Category Archive: 3) Swiss Markets and News

Medical funding from big pharma continues apace

An investigative report by a group of Swiss newspapers has revealed the extent to which pharmaceutical companies are funding hospitals, doctors, and medical centres in the country. CHF458 million ($456.5 million): this was the amount paid by the 60 pharma companies based in Switzerland to various arms of the medical profession between 2015 and 2017, according to a report by the Beobachter, Handelszeitung, Blick, and Le Temps newspapers.

Read More »

Read More »

More Swiss bankruptcies in 2018 than ever before

Last year saw a record number of bankruptcy procedures opened in Switzerland, with almost 14,000 cases involving bust businesses and individuals. The record numbers, released on Thursday by the Federal Statistical Office, mark a 5.4% increase on 2017 and translate to overall financial losses of some CHF2 billion ($2 billion).

Read More »

Read More »

Ailing fintech Monetas goes into liquidation again

Bankruptcy proceedings have been reignited against troubled Swiss digital payments company Monetas more than a year after the enterprise hit serious financial difficulties. Efforts to find a new buyer appear to have come to nothing as the firm goes into liquidation.

Read More »

Read More »

Foreign Investors Own 60 percent of Swiss Corporations

Global financial institutions are increasingly dominating the shareholders of major Swiss companies, according to the Sunday editionexternal link of the Neue Zürcher Zeitung (NZZ). The German-language newspaper points to Swiss banking giant Credit Swiss as a prime example of a financial institution where traditional shareholder democracy is eroding fast.

Read More »

Read More »

Income inequality declines in Switzerland

In 2016, before the effects of taxes and welfare, the highest earning 20% of Swiss households made on average 40.8 times what an average household in the bottom 20 percent made, an inequality measure known as the S80/S20. However, after taxes and welfare, including low income support, health insurance subsidies, pensions and disability benefits, the same income ratio fell to 4.4.

Read More »

Read More »

Swiss regulator fires warning over buy-to-let property lending

The Swiss financial regulator has warned banks that rules on mortgage lending may be further tightened if they fail to control their appetite for dishing out real estate credit. Loans tipped the one trillion franc mark in 2017 and continue to swell, particularly in the buy-to-let market.

Read More »

Read More »

Switzerland continues to lure foreign companies

Switzerland attracted 282 foreign firms to set up shop in the alpine state, creating 899 jobs last year, according to cantonal economic chiefs. That’s an increase of 37 companies from 2017. Switzerland is in the throes of revamping its corporate tax system to keep it line with the competition rules of the European Union and Organisation for Economic Cooperation and Development (OECD).

Read More »

Read More »

Raiffeisen Switzerland bank to cut 200 jobs

Switzerland’s third-largest bank says it will cut up to 200 jobs to save CHF100 million ($100 million) this year. Raiffeisen is reorganising and undertaking a cost-cutting programme. This follows a recent fraud allegation scandal involving its former chief executive.

Read More »

Read More »

Steep drop in thefts in Switzerland

Comparing 2018 to 2012, thefts in Switzerland fell by nearly half, according to the Federal Statistical Office. In 2012, there were a record 219,000 thefts recorded in Switzerland. By 2018, the figure had fallen to 112,000, a drop of 49%.

Read More »

Read More »

Swiss likely to vote on capital tax reform plan

The leftwing Young Socialist group has handed in the necessary signatures to force a nationwide vote on its proposal to increase tax on capital revenue in Switzerland. The initiative intends to tax dividends and interest on wealth by a factor of 1.5 compared with regular income tax.

Read More »

Read More »

IMF predicts Swiss growth to slow to 1.1percent in 2019

The Swiss economy is likely to slow in 2019, with gross domestic product growth expected to hit 1.1%, followed by a “moderate” recovery in 2020, the International Monetary Fund said on Monday. The IMF said in a concluding statement, published on Monday following a mission to Switzerland and an annual evaluation, that a “sustained regional slowdown, intensification of global trade tensions and a disruptive Brexit” would adversely affect the Swiss...

Read More »

Read More »

Stadler lands $600 million order in the US

Swiss railway vehicle manufacturer Stadler Rail has won a $600 million (CHF597 million) order in the United States. The Metropolitan Atlanta Rapid Transit Authority (MARTAexternal link) on Friday announced its decision to award Stadlerexternal link the contract for 127 Metro (underground) trains with two options of 25 additional trains each.

Read More »

Read More »

Million franc salaries cause friction in Bern

Switzerland’s government recently voted for a ceiling on the salaries of those managing public companies such as Swisscom, Swiss Post, Skyguide and Swiss Rail. In response, the board of Swiss Rail wrote to the Federal Council requesting it to soften its position. From 2020, the company wants to pay its nine senior managers CHF 5.89 million, including a salary of more than CHF 1 million to Andreas Meyer, the boss of the company.

Read More »

Read More »

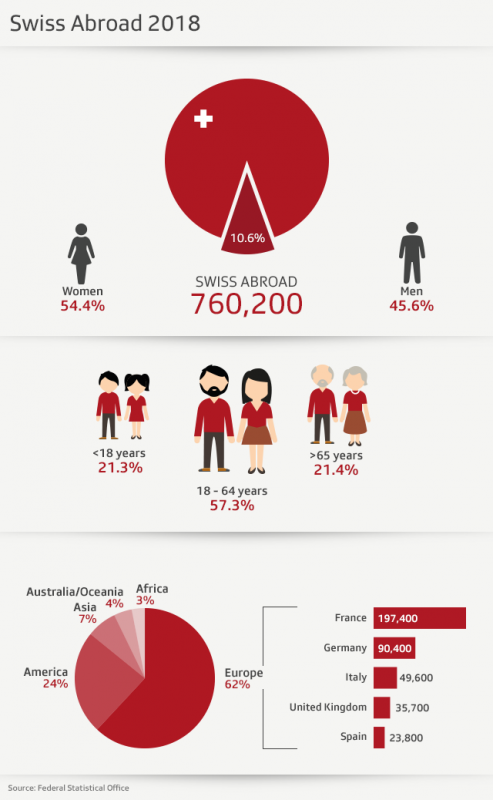

Swiss expat community hits 760,000

The number of Swiss Abroad citizens grew by 1.1% to reach 760,200 at the end of last year. Most live in neighbouring countries and in the United States.The expatriate community accounts for 10.6% of the total number of Swiss nationals, according to official statistics published on Thursday. Nearly three-quarters of the Swiss Abroad have dual nationality.

Read More »

Read More »

Almost 60,000 Swiss dwellings unoccupied last year

A significant increase in vacant homes is predicted by Zurich Cantonal Bank. Suburbs are particularly prone to lower occupancy levels. The problem of empty housing, particularly in the urban periphery, is likely to worsen, with construction activity concentrated in areas with already high vacancy rates. Last year around 59,700 homes did not have any tenants.

Read More »

Read More »

Growth forecast lowered for Swiss economy

Worsening international conditions will have a negative impact on Switzerland’s export-driven economy, prompting the Swiss Economic Institute (KOF) to lower its forecast for this year. KOF on Wednesday announced it had revised its growth forecast down from 1.6% to 1% for Switzerland’s gross domestic product. However, the latest outlook for 2020 remains virtually unchanged with growth of 2.1%.

Read More »

Read More »

Facebook rejects most information requests from Swiss authorities

Over the first three months of 2018 Switzerland’s authorities made 80 requests for Facebook user data, however two thirds of them were rejected, according to the newspaper SonntagsBlick as reported in 20 Minutes. When the requests were urgent the response rate rose to two thirds of requests.

Read More »

Read More »

Public transport enjoys another record year among tourists

Foreign visitors spent 6.4% more on Swiss Travel System tickets in 2018 than in the previous year. Sales rose to over CHF130 million ($131 million). 2018 is thus the sixth record year in a row, the Swiss Federal Railways said on Tuesday. Chinese guests were the top foreign users of public transport, with sales of CHF20.3 million, an increase of 14.9%.

Read More »

Read More »

Swiss Rail shares bumper profits with passengers

In 2018, Swiss Rail made a profit of CHF 568 million, 42.5% more than in 2017. Part of the rise was due to higher than average spending on maintenance in 2017. It is worth noting that Swiss Rail receives a large sum from taxpayers every year. In 2018, the company received CHF 3.5 billion of public funding, CHF 2.7 billion of it booked as income.

Read More »

Read More »

Swiss chocolate consumption slides

In 2018, Switzerland’s population consumed around 87,000 tonnes of chocolate. However, average chocolate consumption dropped from 10.5 kg per person in 2017 to 10.3 kg in 2018, a decline of roughly 2%. This decline reflects last year’s longer hotter summer, according to the industry association Chocosuisse.

Read More »

Read More »