Category Archive: 3) Swiss Markets and News

Swiss National Bank expects profit of CHF49 billion for 2019

The Swiss National Bank (SNB) expects to post an annual profit of CHF49 billion ($50.29 billion) for 2019, it said on Thursday, citing big gains from foreign bonds and stocks bought to dampen the value of the safe-haven Swiss franc. The profit, following a loss of CHF15 billion in 2018, means the central bank will pay out CHF2 billion to the Swiss government and cantons for last year and will hold discussions with the finance ministry on a possible...

Read More »

Read More »

Swiss rents fall but property prices increase in 2019

Rents in Switzerland fell by an average of 0.5% last year but some regions bucked the trend. Last year was a good one for tenants, according to the Swiss Real Estate Offer Indexexternal link, which was published on Tuesday. December alone saw rents dropping 0.4% on average. The most significant drops were in central Switzerland (-1.7%), the Lake Geneva region (-1.1%) and northwestern Switzerland (-0.9%).

Read More »

Read More »

The S&P’s Biggest Bear Capitulates

First it was Dennis Gartman shutting down his newsletter after more than three decades, lamenting a market that no longer made any sense (a lament shared by Deutsche Bank's Aleksanda Kocic), and now the market's QE4-driven meltup has forced Wall Street's biggest sellside bear to capitulate on his November call that the market will drop in 2020; instead UBS' head of US equity strategy, Francois Trahan, has joined the bullish herd hiking his year-end...

Read More »

Read More »

Swatch offers compromise in watch movements deadlock

Switzerland’s largest watch maker, Swatch, says it will limit the number of movements it makes for the industry in a bid to end a long-running stand-off with the anti-trust regulator. At the end of last year, the Competition Commission (Comco) temporarily suspended deliveries of watch movements from Swatch’s ETA unit to big rivals from January 1, 2020.

Read More »

Read More »

Facebook’s Libra has failed, says Switzerland’s president

Facebook’s plan to launch its digital currency Libra is unlikely to succeed Ueli Maurer, Switzerland’s president, told SRF. Maurer doesn’t think central banks will accept the basket of currencies underpinning the cryptocurrency. “The project, in this form, has thus failed” he said.

Read More »

Read More »

Revolutionary idea to store green power for the grid

Stacking blocks of concrete with a crane to store energy and use the force of gravity to keep producing electricity when renewable sources are lacking: simple but revolutionary, the battery solution proposed by the Ticino start-up Energy Vault is attracting investors and customers from around the world.

Read More »

Read More »

Swiss government makes it easier to get paid for work done on the train

From 1 January 2020, it will be much easier for Switzerland’s 38,000 federal government employees to get paid for working on the train, according to the newspaper Tages-Anzeiger. Until the beginning of this year, working on the train on the way to and from work was only rewarded in exceptional instances and even then it was only partially counted.

Read More »

Read More »

Running a Swiss business – changes in 2020

Every year brings changes for business owners and managers. In May 2019, a majority of Swiss voters accepted a package of changes to the way companies are taxed known as The Federal Act on Tax Reform and AHV Financing (TRAF). Many of the changes flowing from this begin on 1 January 2020.

Read More »

Read More »

Unemployment in Geneva higher than neighbouring France

In December last year, the Observatoire statistique transfrontalier published unemployment figures for the French region surrounding Geneva. French unemployment calculations follow the method used by the International Labour Organisation (ILO), which include all job seekers, according to Tribune de Genève.

Read More »

Read More »

Mnuchin to head US delegation to Davos

The US delegation at the upcoming World Economic Forum (WEF) gathering in Davos will be led by Treasury Secretary Steven Mnuchin. It is unclear whether President Donald Trump will again attend the annual event.

Read More »

Read More »

Technical problem shuts down Swiss nuclear power station

The Leibstadt nuclear power station in northern Switzerland has been disconnected from the power grid and shut down because of a technical fault. Once the cause has been clarified, the plant will be put back into operation as soon as possible, the operator said. It is not clear when that will be.

Read More »

Read More »

Signs Swirl All Around Us – The Monetary Reset Is At Hand

For most of this decade owning gold and gold-related investments has required the patience of Job, and the sector is so obscure that it is hard to be sure of anything. But for months now the unusual developments have been piling up so much that it may be possible to regain some optimism.

Read More »

Read More »

Facebook’s Libra has failed in current form, says Swiss president

Facebook’s Libra project needs reworking to be approved, according to the president of Switzerland, where the cryptocurrency is seeking regulatory consent. “I don’t think [Libra has a chance in its current form], because central banks will not accept the basket of currencies underpinning it,” Finance Minister Ueli Maurer, who held the rotating presidency in 2019, told Swiss public radio, SRF.

Read More »

Read More »

Swiss parliament approves new 6 billion franc fighter jet purchase

Before Christmas, Switzerland’s parliament approved the purchase of a new fleet of fighter jets costing CHF 6 billion, according to RTS. The plan, which aims to defend Swiss airspace beyond 2030, has now been approved by both Switzerland’s upper and lower houses.

Read More »

Read More »

Number on welfare in Switzerland falls for first time in 10 years

In 2018, the number of people receiving social welfare in Switzerland fell from 278,300, or 3.3% of the population, to 272,700, 3.2% of the population. The last time the number fell was in 2008 when it dropped from 3.1% (233,500) to 2.9% (222,600) of the population.

Read More »

Read More »

Xi To Skip Davos, Collapsing Hopes Of Phase One Deal Signing Event With Trump

If it was The Wall Street Journal or other US financial media outlets, for the last several weeks, pumping headlines via "people familiar with the discussions," about how President Trump and Chinese President Xi Jinping could have a phase one trade deal signing event at the World Economic Forum in Davos, Switzerland, in January.

Read More »

Read More »

Credit Suisse: FINMA appoints independent investigator

The Swiss Financial Market Supervisory Authority FINMA says it will have an independent auditor investigate Swiss bank Credit Suisse “in the context of observation activities”. “The observation activities carried out by Credit Suisse raise various compliance issues,” FINMA said in a statement on Friday evening.

Read More »

Read More »

Credit Suisse Ex-Employee Says “Striking Tall Blonde” Spy Followed Her In Manhattan And Long Island

When Colleen Graham heard a story of investigators looking into Credit Suisse for spying on its recently departed head of wealth management, something sounded familiar. She had recalled, years prior, when she was working on a JV between the bank and Palantir Technologies, a "striking tall blonde" had followed her in Manhattan after she refused to sign off on how revenue from the JV would be booked.

Read More »

Read More »

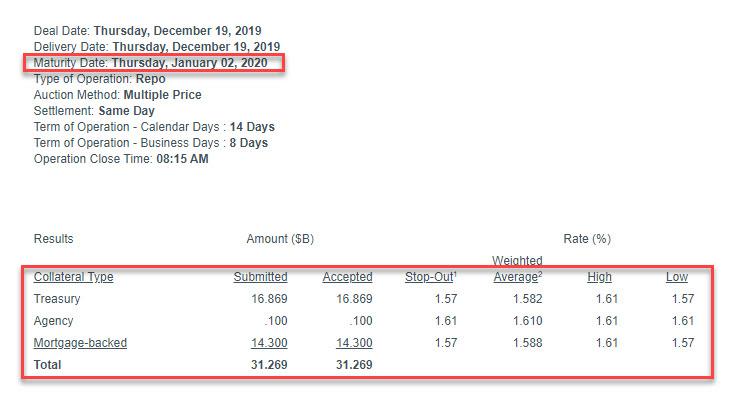

Repo Crisis Fades Away: For The First Time, A “Turn” Repo Is Not Oversubscribed

It looks like the year-end repocalypse that was predicted by Credit Suisse strategist Zoltan Pozsar is taking a raincheck. Today's Term Repo saw $26.25BN in security submissions ($15.75BN in TSYs, $10.5BN in MBS), below the $35BN in total availability. This was the first "turn" repo that was not fully subscribed (on Monday, there was $54.25BN in demand for $50BN in repos maturing on Jan 17).

Read More »

Read More »

Switzerland’s high prices – a European comparison

Recently published data shows how prices compare across Europe. The data, collected by Eurostat, compares prices across a number of categories of spending in 2018. Average prices across the EU-28 are used as a base.

Read More »

Read More »