Category Archive: 2.) Current Account-Target2

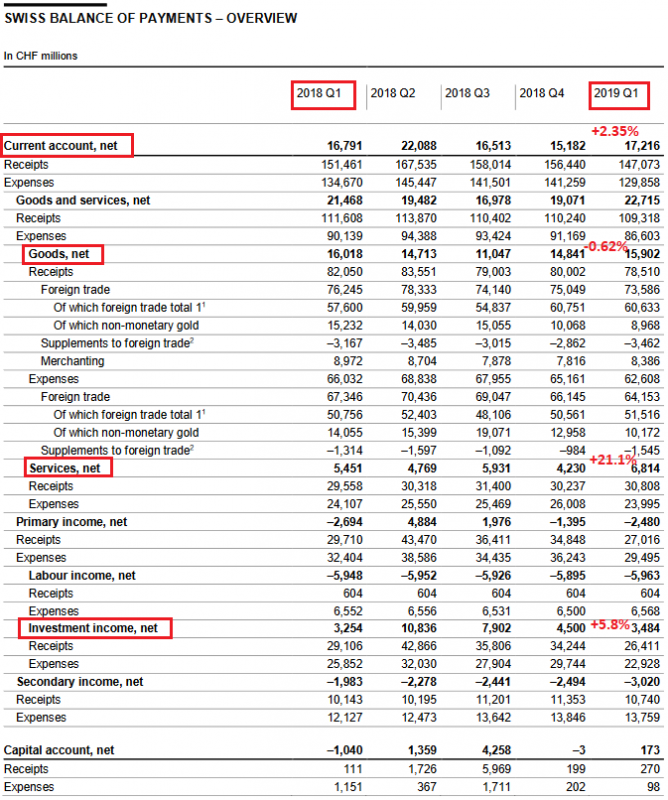

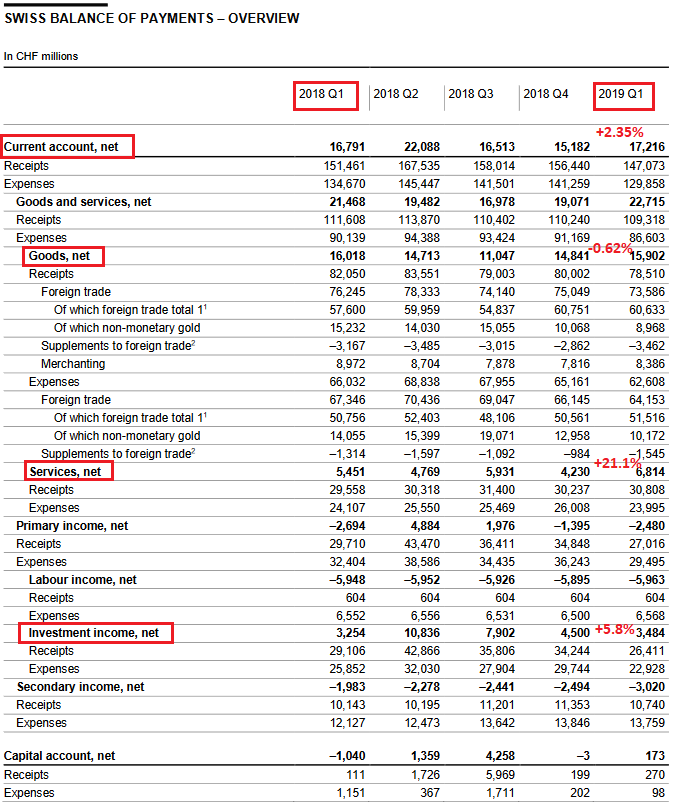

Swiss Balance of Payments and International Investment Position: Q1 2019

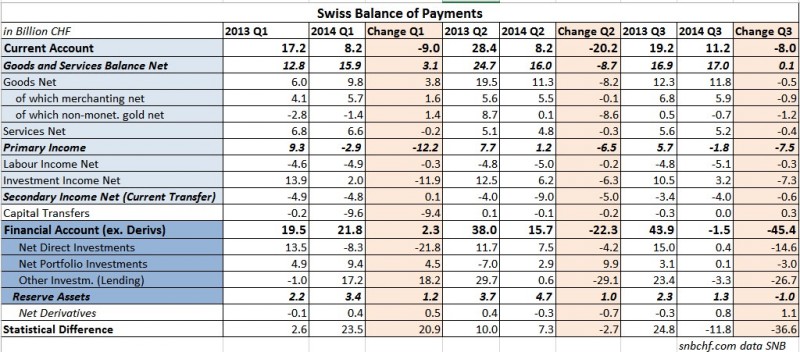

In the first quarter of 2019, the current account surplus amounted to CHF 17 billion, on a par with the same quarter of 2018. Trade in services recorded a higher receipts surplus compared with the year-back quarter, whereas secondary income registered a higher expenses surplus. The balances of trade in goods and primary income barely changed.

Read More »

Read More »

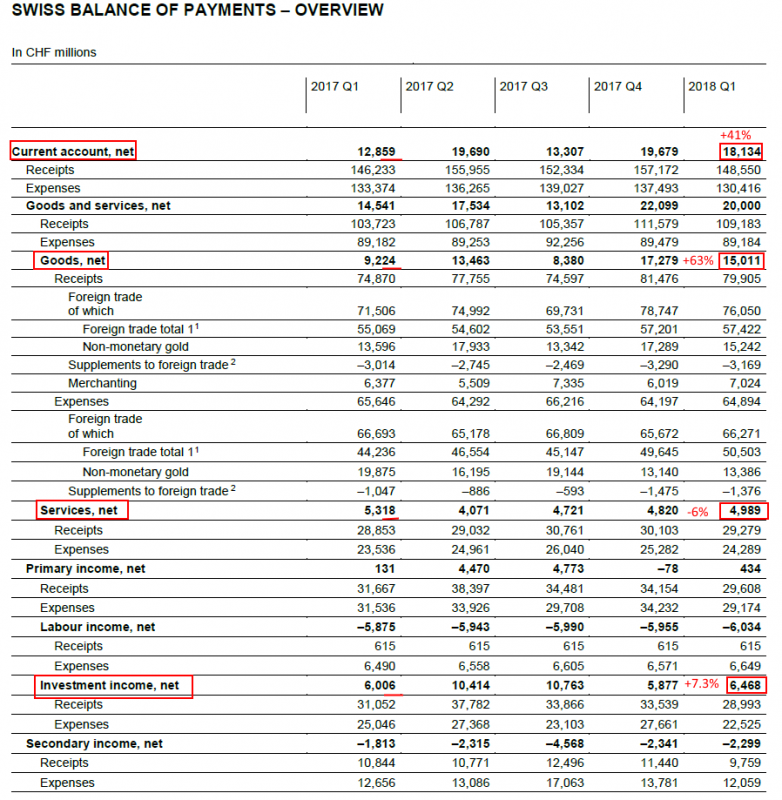

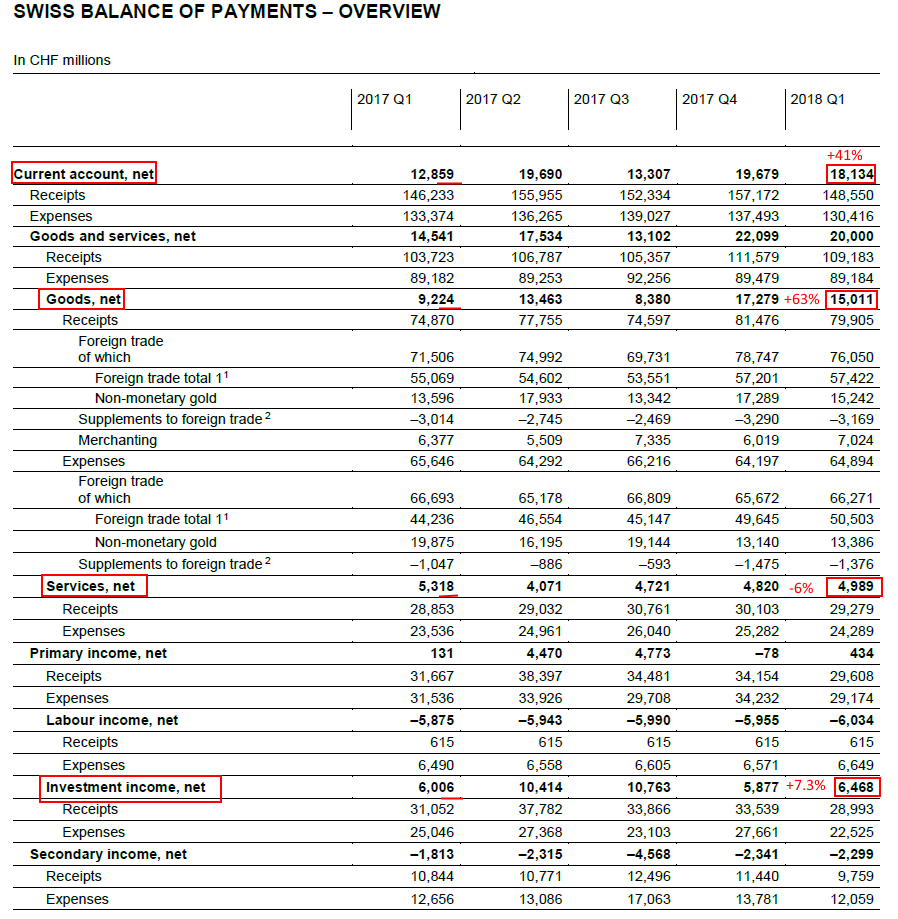

Swiss Balance of Payments and International Investment Position: Q1 2018

The current account surplus amounted to CHF 18 billion in the first quarter of 2018, an increase of CHF 5 billion over the same quarter of 2017. This rise was attributable to the higher receipts surplus on trading in non-monetary gold, which is recorded under trade in goods. In the case of services as well as primary and secondary income, the balances remained stable.

Read More »

Read More »

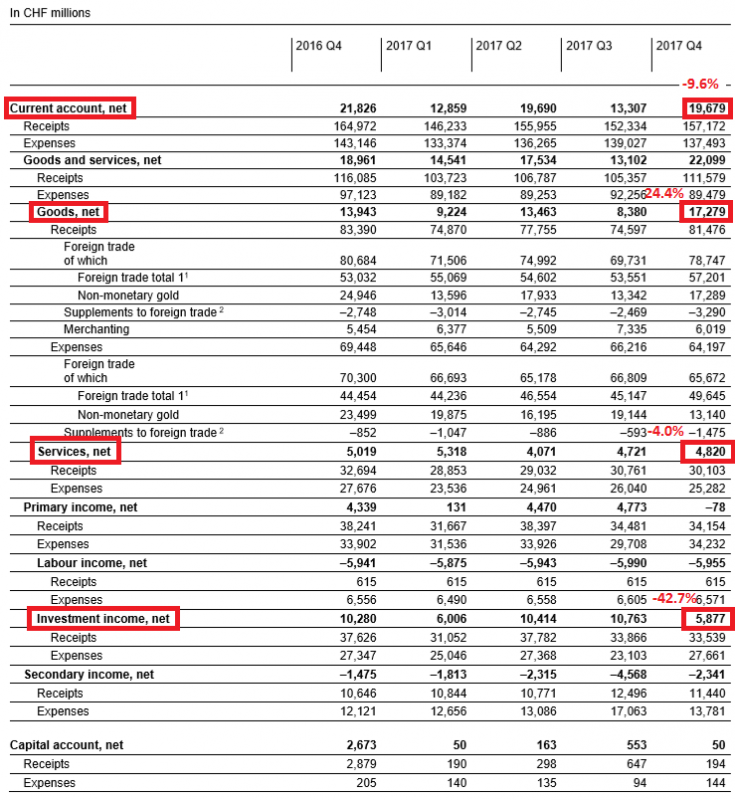

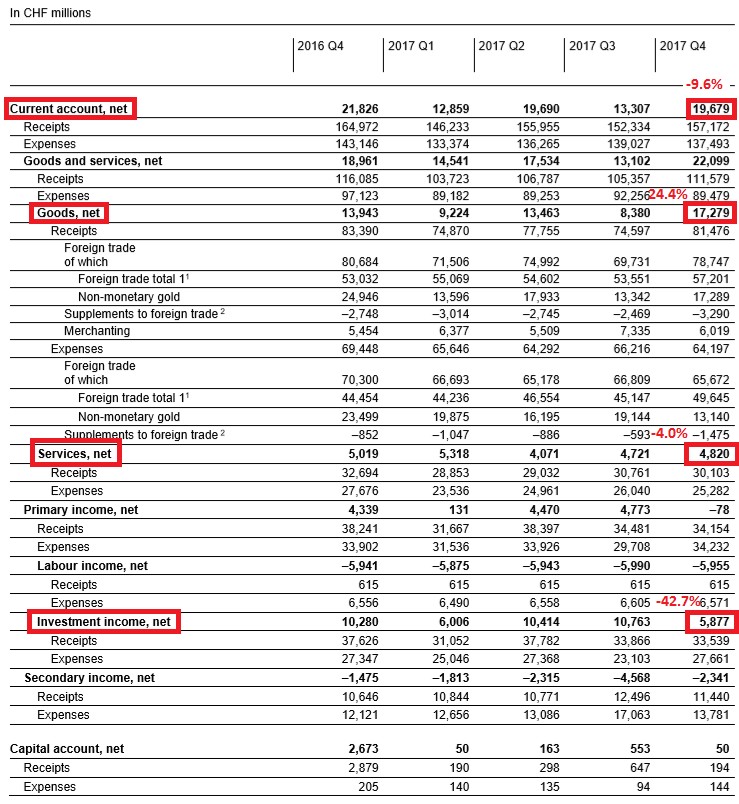

Swiss Balance of Payments and International Investment Position: Q4 2017 and review of the year 2017

Key figures: Current Account: -9.6% against Q4/2016 to 19,679 bn. CHF, Record High Trade Surplus in Goods: +24.4% to 17,279 bn., Services Surplus : -4.0% to 4,820 bn., but Investment Income: down 42.7% to 5,877 bn.

Read More »

Read More »

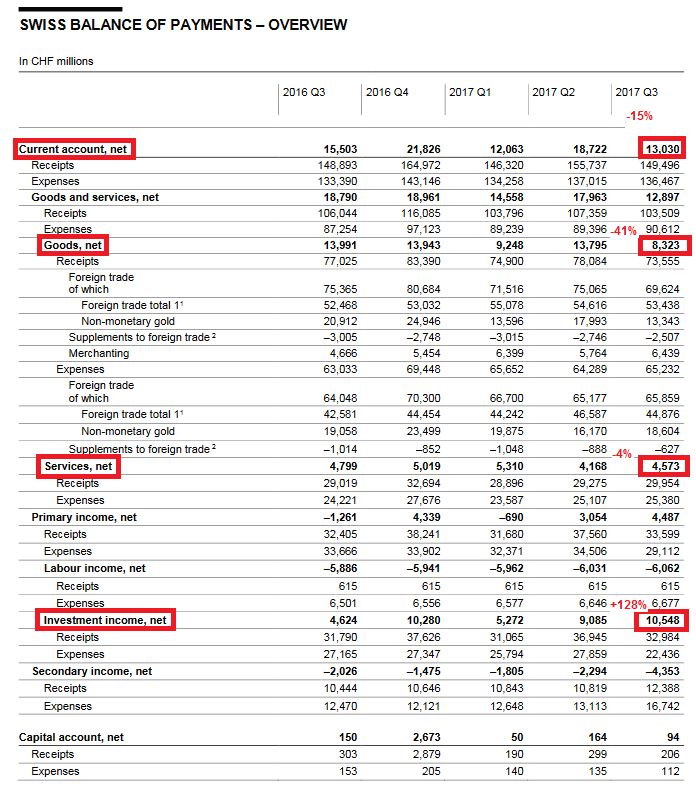

Q3/2017: Swiss Current Account Surplus significantly down

The Swiss current account surplus went down by 15% against the same quarter in 2016. In the third quarter of 2015. The current account surplus was still at 22 bn. CHF.

It seems to be a change in the usual movement that sees a higher Q3 surplus compared to the other quarters.

Read More »

Read More »

Swiss and Eurozone Trade Anomalies

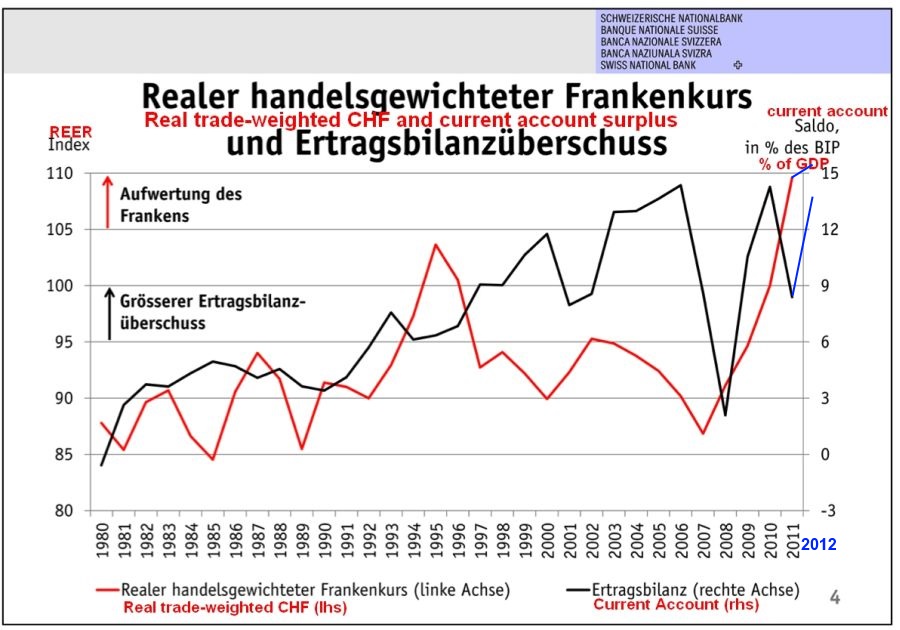

Marc Chandler emphasises the discrepancies between overvalued franc and - despite being overvalued - the massive Swiss trade surplus. Will it continue like that?

Read More »

Read More »

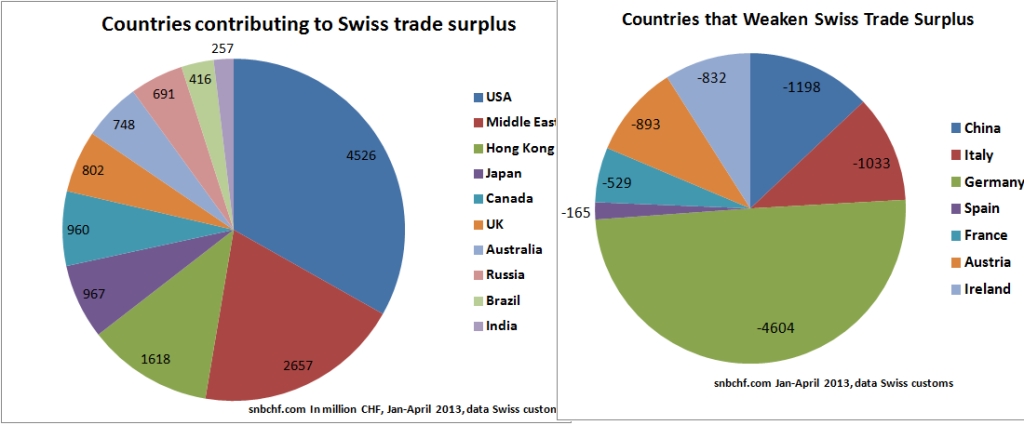

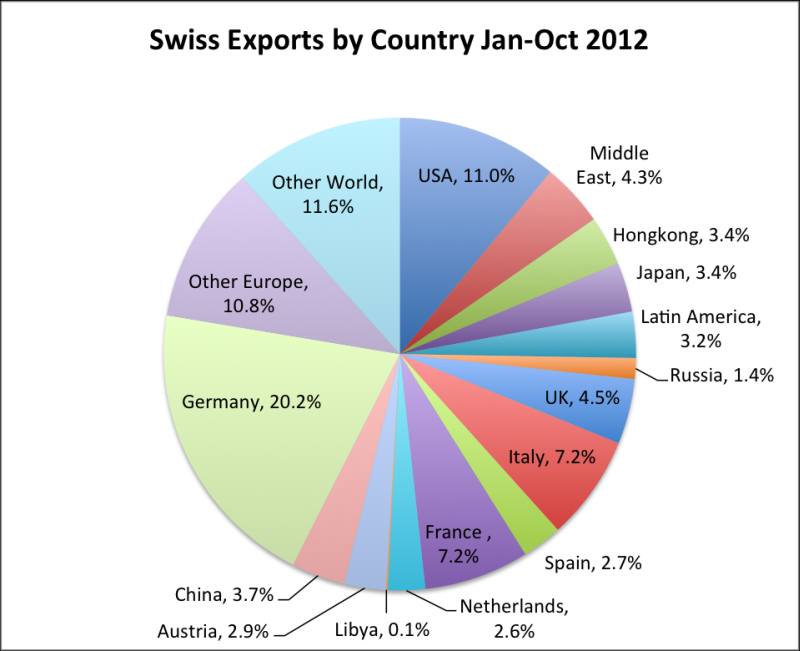

The Swiss Trade Surplus: A Really Global Economy

The Swiss trade balance for goods clearly indicates its global orientation. Switzerland has a trade surplus with the US, Canada, the UK and many emerging markets. Swiss exports are mostly luxury products and pharmaceuticals. The total surplus for the 4 first months in 2013 was 7.7 billion CHF, about 1.2% of GDP, annualized around …

Read More »

Read More »

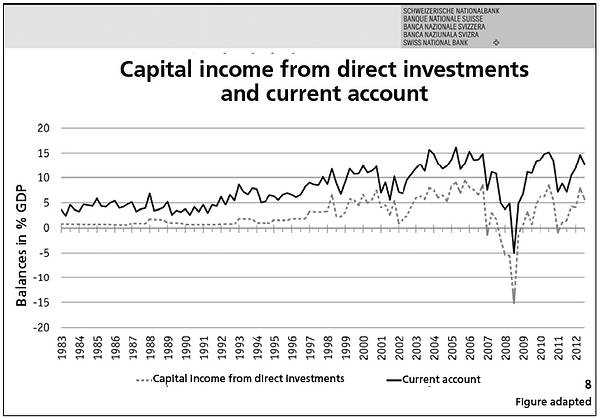

Swiss Current Account Surplus Rises from 8.5 percent to 13.5 percent of GDP

According to latest IMF data the Swiss current account surplus rose from 49 billion CHF in 2011 to 80 billion in 2012, this is from 8.5% of GDP to 13.5%. Details

Read More »

Read More »

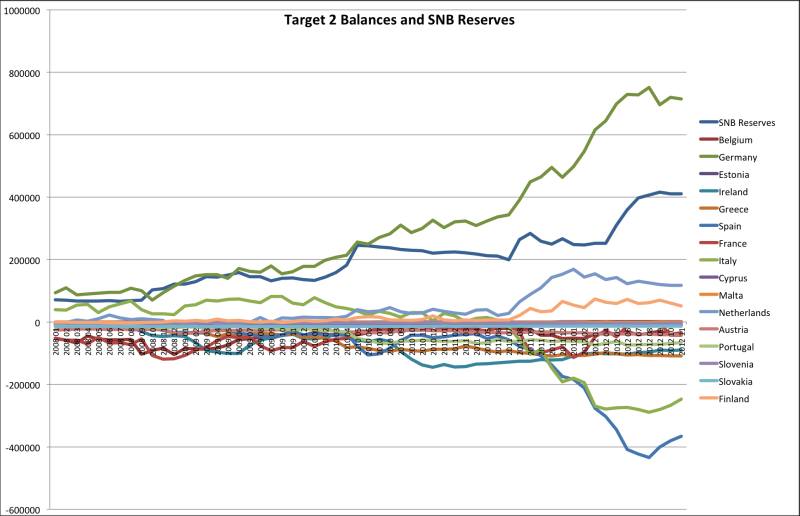

Target2 Balances and SNB Currency Reserves: Same Concept, Update February 2013

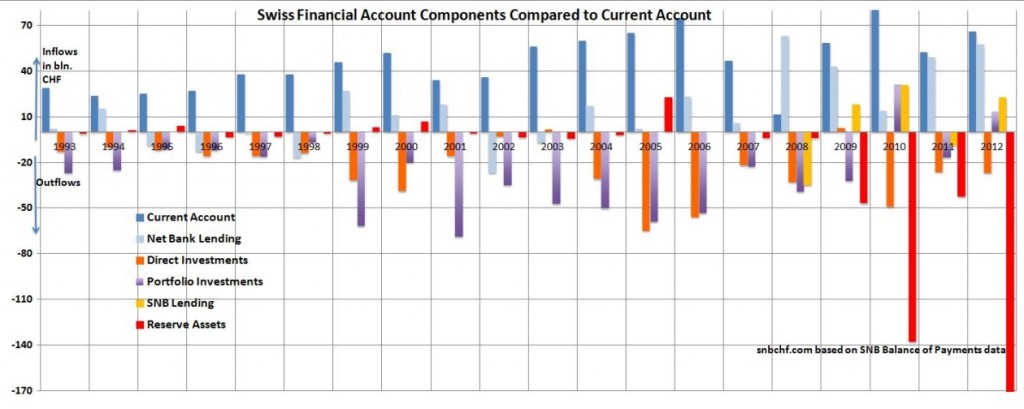

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

Bad News for SNB: While Target2 Imbalances Diminish, SNB Reserves Remain the Same

As we explain here, , Target2 balances and SNB currency reserves represent the same concept, namely capital flight (in a positive and negative sense) and current account imbalances. While Target2 numbers for Germany and Northern Europe go down, SNB reserves remain the same, only 3 billion CHF away from record highs.

Read More »

Read More »

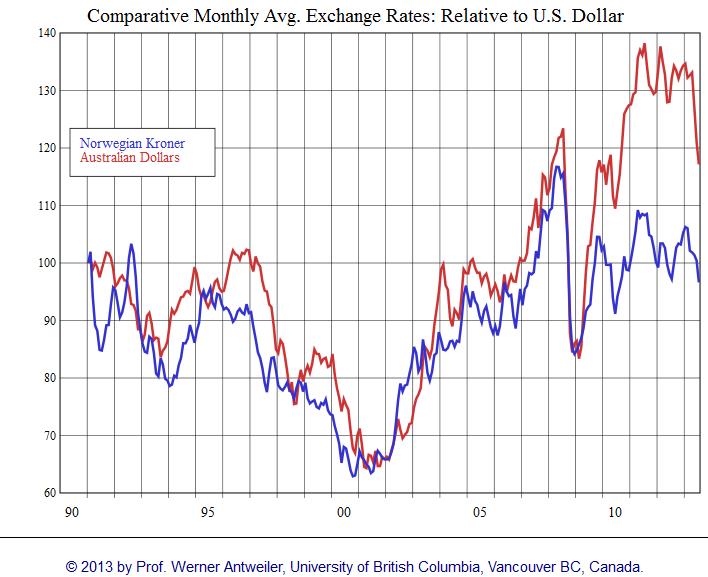

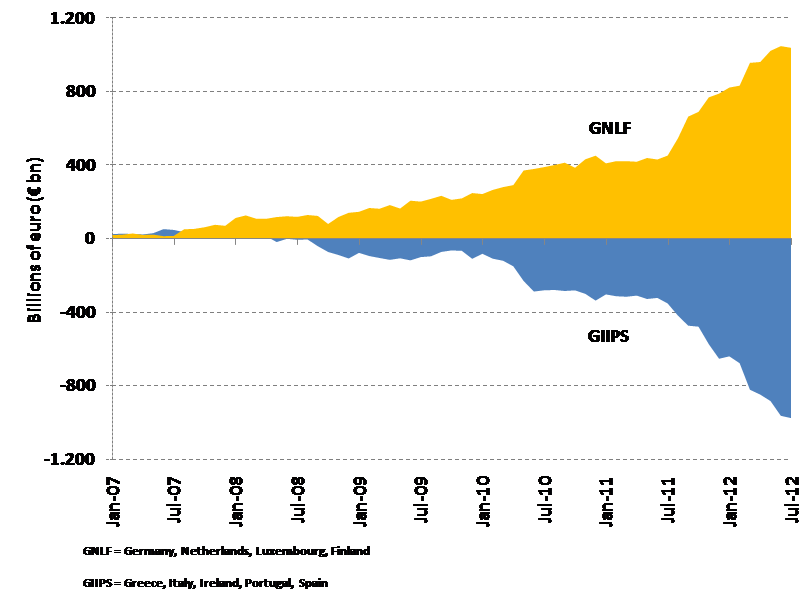

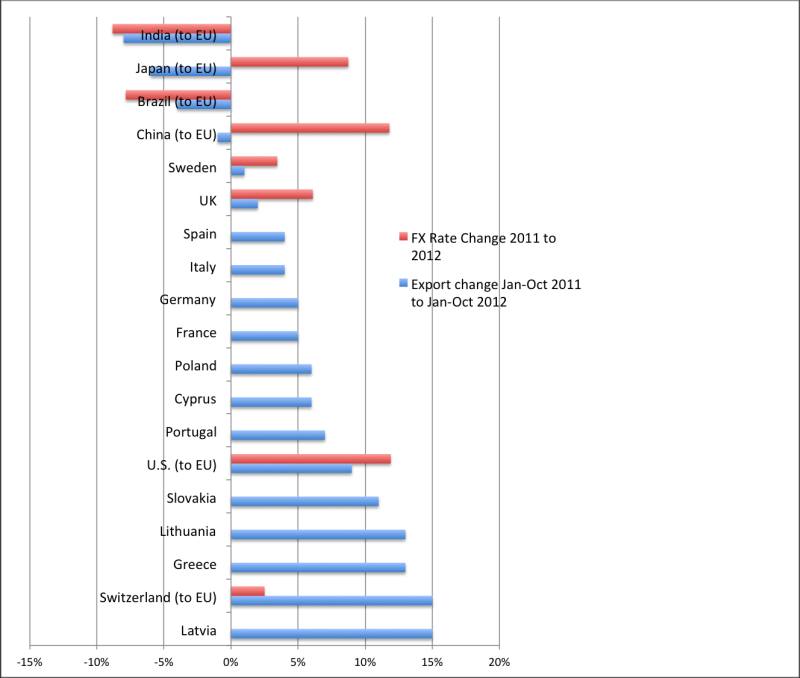

Comparing Trade Balances with FX Rates: Will the European Miracle End?

Eurostat recently published the European exports, imports and trade balance for the first ten months of 2012 compared to 2011. These show heavy improvements for the Southern member states but also a strong dependency on a weak euro.

Read More »

Read More »

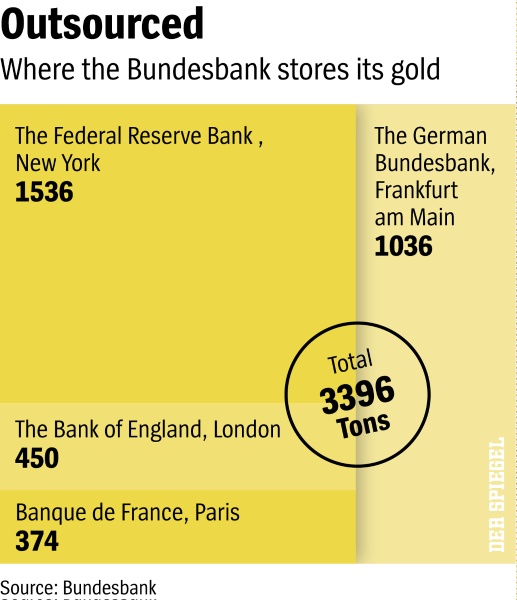

German Currency and Gold Reserves and the German Trade Surplus

During the Bretton Woods system, Germany managed to obtain current account surpluses. They converted these surpluses into gold. At the time they bought it at 35$ per ounce at a relatively cheap price – at the end of the 1960s the price was augmented to 42$. At the end of the 1960 and with …

Read More »

Read More »

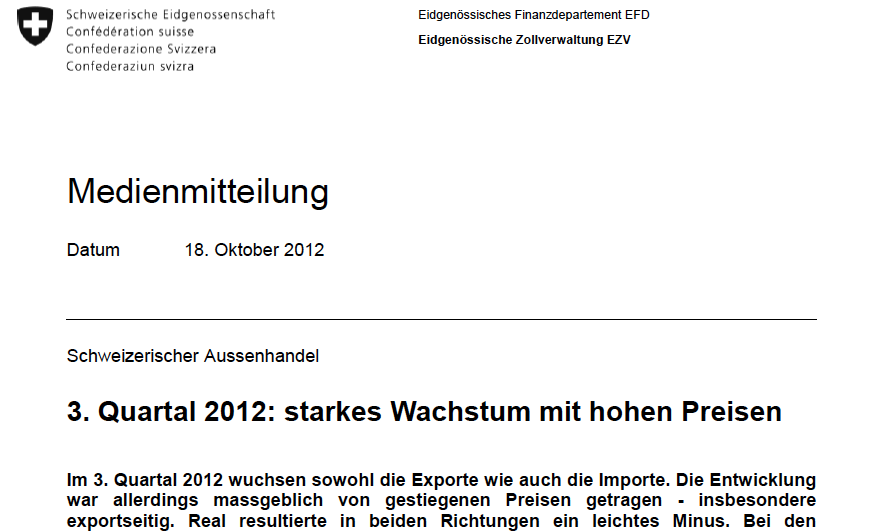

Swiss Exports Rise Thanks to Higher Export Prices. Sorry, What ????

Or how Swiss exporters are able to widen their margins thanks to the SNB currency manipulation Last week the Swiss export data for the third quarter was released. The news agency report was simple: Exports from Switzerland fell by a real 8.0 percent in September to 16.49 billion Swiss francs ($17.87 billion), the Federal …

Read More »

Read More »