Category Archive: 1.) Zerohedge on SNB

We Know How This Ends – Part 2

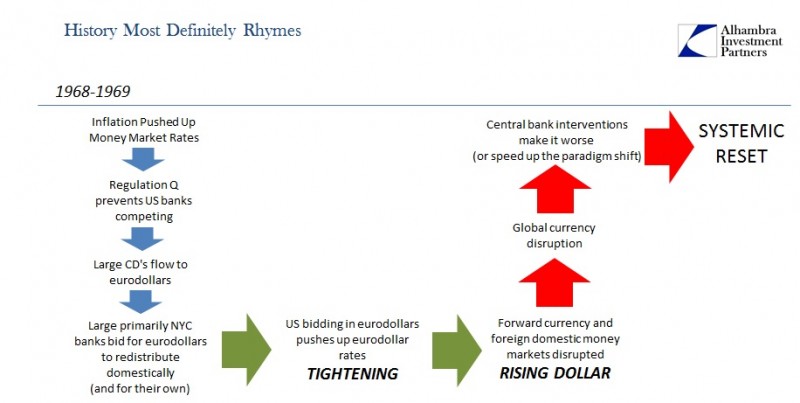

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

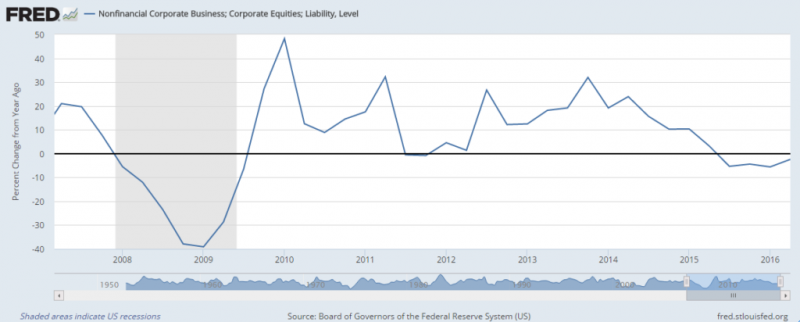

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

Jim Grant Puzzled by the actions of the SNB

James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold.

Read More »

Read More »

Is Someone Trying To Buy The Swiss National Bank?

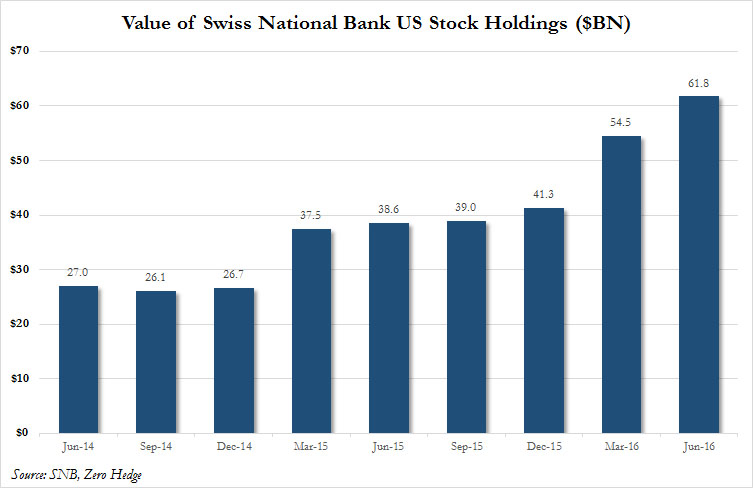

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank... However, it is far less known that not only is the Swiss National Bank also a publicly traded stock, but is also one of the best performing stocks in the world this year.

Read More »

Read More »

666: The Number Of Rate Cuts Since Lehman

BofA's Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, "global central banks have now cut rates 666 times since Lehman."

Read More »

Read More »

“Mystery” Buyer Revealed: Swiss National Bank’s US Stock Holdings Rose 50 percent In First Half, To Record $62BN

In a month, quarter and year, in which many have scratched their heads trying to answer just who is buying stocks, as both retail and smart money investors have been aggressively selling, yesterday we got the answer.

Read More »

Read More »

Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. Some hope for the Swiss National Bank or will Berkshire shares sink together with Apple and the SNB?

Read More »

Read More »

As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

We hope for the sake of Swiss residents that equity markets never suffer a dramatic drop. The SNB has “invested” 20% of Swiss GDP in stocks. When will the ivory tower economists ultimately lose control of the most manipulated, centrally-planned market in history?

Read More »

Read More »

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »