Category Archive: 1.) FXStreet on SNB&CHF

AUD/CHF Technical Analysis: Bears seeking a break to channel bottoms, below 61.8 percent Fibo

Bulls target risk back to the top of the channel and recent highs of 0.6750. Bears seek a break of trendline support and a resumption of the downside within the bearish channel. AUD/CHF has been resilient against the odds, considering the risk-off tone in markets were otherwise, the CHF usually performs.

Read More »

Read More »

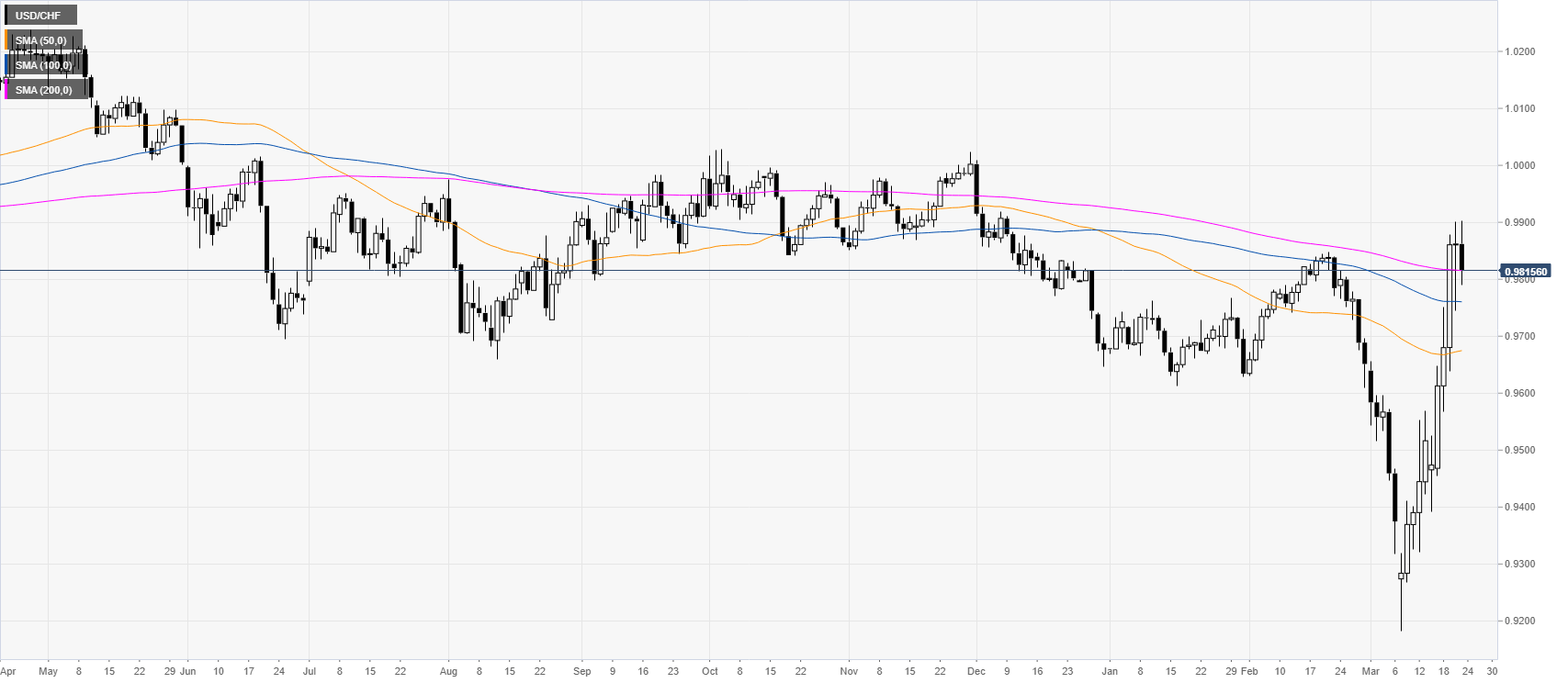

USD/CHF capped again by 1.0025, retreats below parity

Swiss Franc flat versus US Dollar, down against its European rivals. Another weak economic report from the US keeps the Greenback and markets under pressure. The USD/CHF pair again was capped by the 1.0025/30 area and pulled back. Near the end of the session it is hovering around 0.9980/85 after falling to 0.9950.

Read More »

Read More »

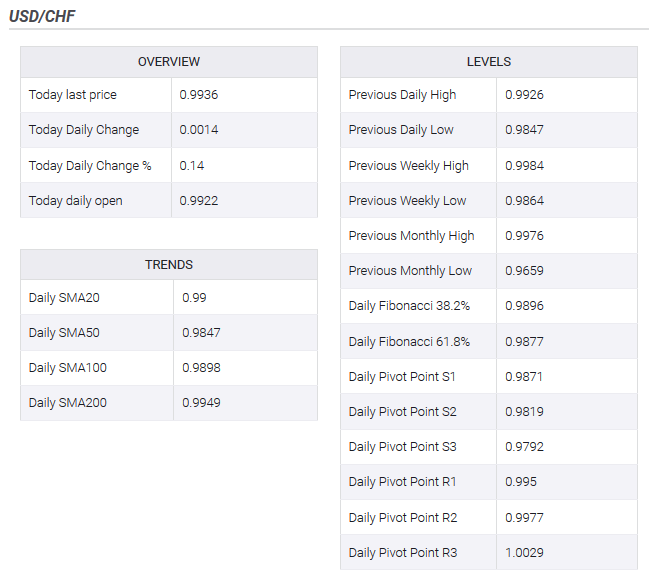

USD/CHF technical analysis: Bulls trying to defend multi-week old ascending trend-channel

Fading safe-haven demand undermined the CHF demand and extended some support. Bears await a sustained weakness below short-term ascending channel support. The USD/CHF pair struggled to register any meaningful recovery and remained well within the striking distance of near three-week lows set in the previous session, coinciding with the lower end of a multi-week-old ascending trend-channel.

Read More »

Read More »

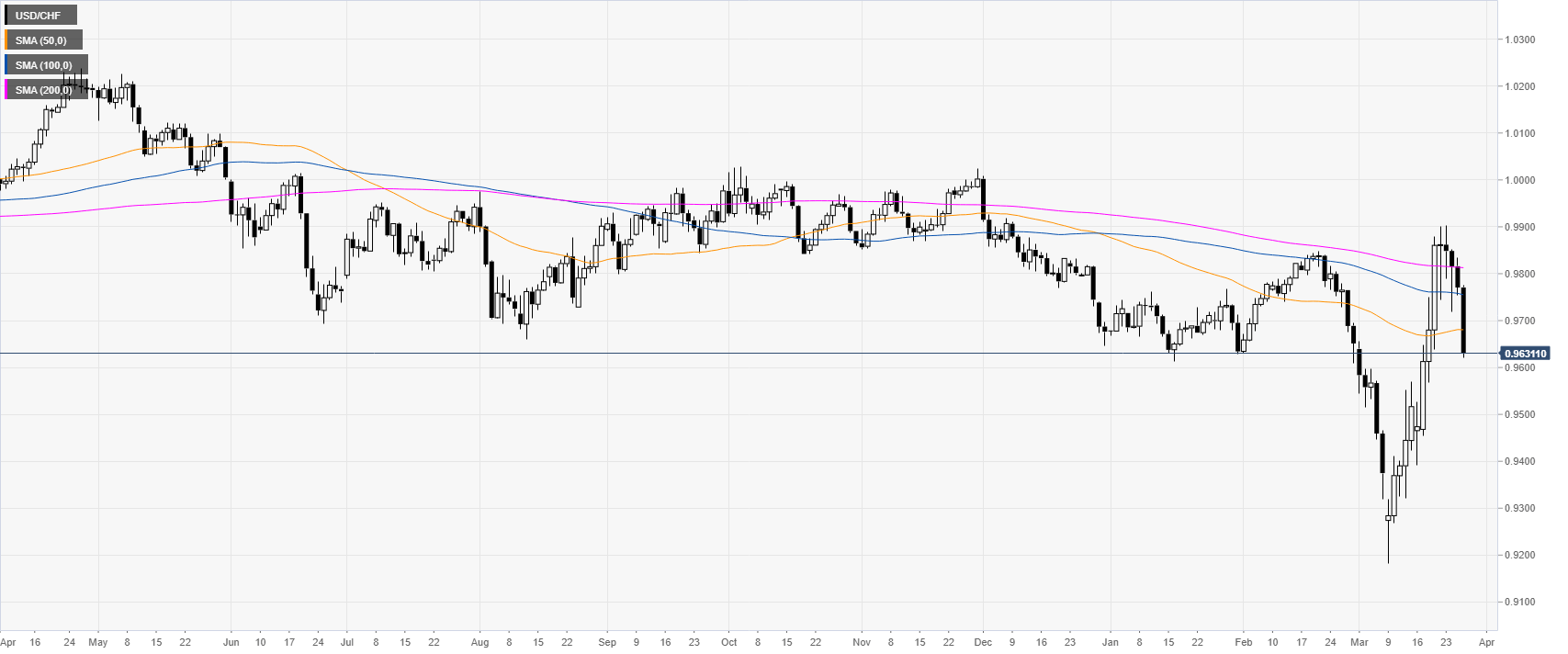

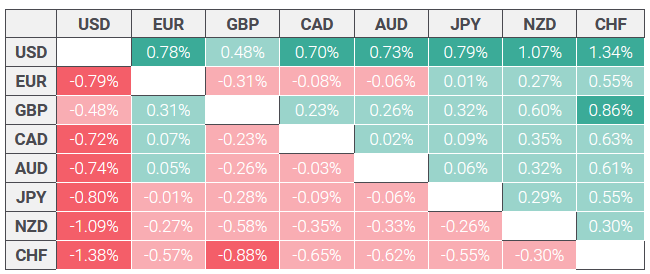

USD/CHF consolidates gains above 0.9900, limited by 0.9950

US Dollar rises versus Swiss Franc for the second-day in-a-row. USD/CHF testing key 200-day simple moving average and 0.9950. The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930.

Read More »

Read More »

CHF: Possible reversal? – Deutsche Bank

Deutsche bank analysts suggest that at current spot levels, risk-reward favours longs in EUR/CHF. “While Brexit and trade war outcomes look like coin tosses, the impact is likely to be asymmetric as the SNB caps the left tail. While a relief rally would be fully accommodated, they would likely intervene heavily and cut the policy rate in the event of no deal.”

Read More »

Read More »

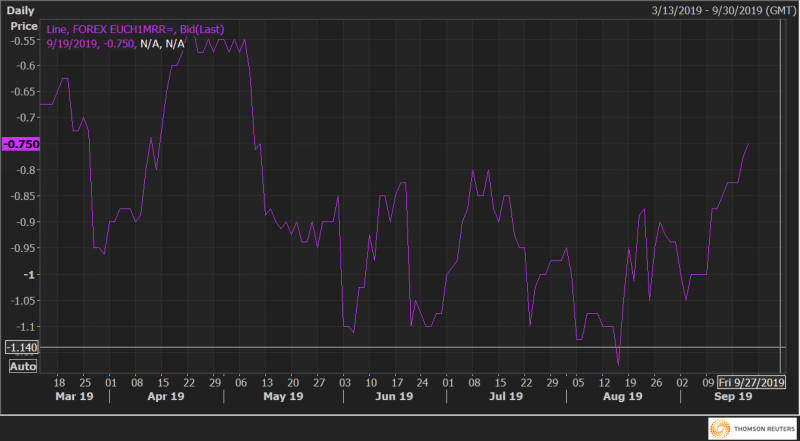

EUR/CHF risk reversals hit highest since May on call demand

EUR/CHF risk reversals have jumped to the levels last seen in May. Risk reversals indicate the demand for call options is rising. Risk reversals on EUR/CHF (EURCHF1MRR), a gauge of calls to put, jumped to the highest level since May on Friday, indicating the investors are adding bets to position for a rally in the common currency.

Read More »

Read More »

AUD/CHF technical analysis: Bears looking for a run to a 50 percent mean reversion

AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement for a 50% reversion. A subsequent pull-back, however, to the resistance and another sell-off will likely make for a high probability set up. AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement of the August lows to September highs, located at 0.6715, and target the 50% retracement at 0.6674 (meeting the 2019 lows) should the markets...

Read More »

Read More »

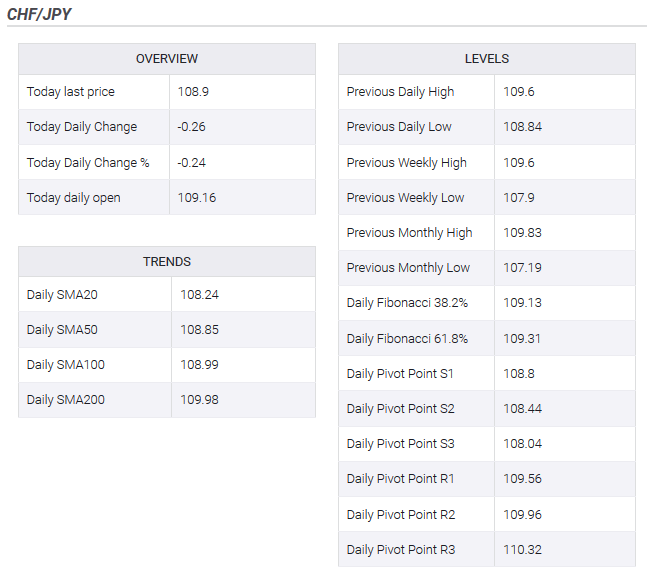

CHF/JPY: Eyes on central banks and geopolitics

This week the BoJ will hold its regular policy meeting. Global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc and Yen. CHF/JPY is struggling to maintain the upside as the Yen picks up a safe haven bid, anchored on geopolitical developments following a textbook risk-off response in global financial markets following the strike on Saudi Arabia’s oil facilities over the weekend.

Read More »

Read More »

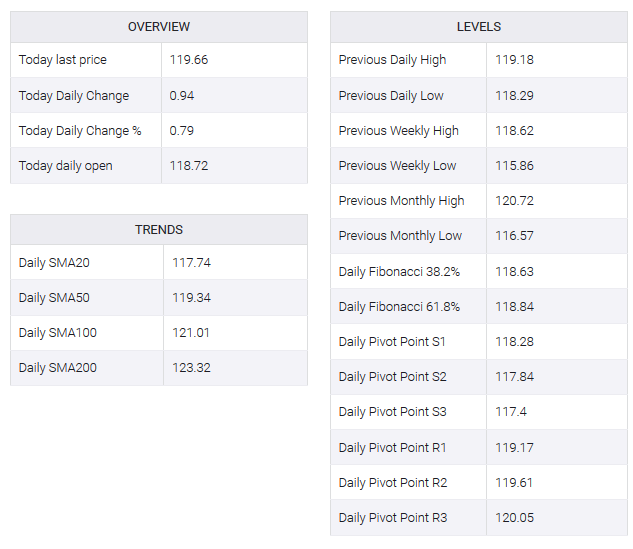

EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today.

Read More »

Read More »

EUR/CHF technical analysis: Break out or fake out?

The cross needs to hold above the 1.0970s and beyond the 25th July swing lows. To the downside, a break back below the prior descending resistance will spell bad news for the bulls. EUR/CHF has been running higher of late, despite the onset of the European Central Bank - a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed.

Read More »

Read More »

USD/CHF bounces from trend-line support on trade news

US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October. USD/CHF is currently trading 0.26% higher and bouning of trend-line support.

Read More »

Read More »

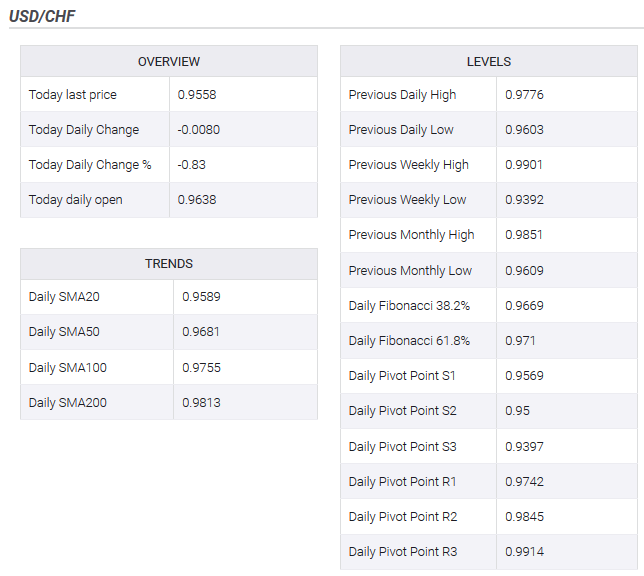

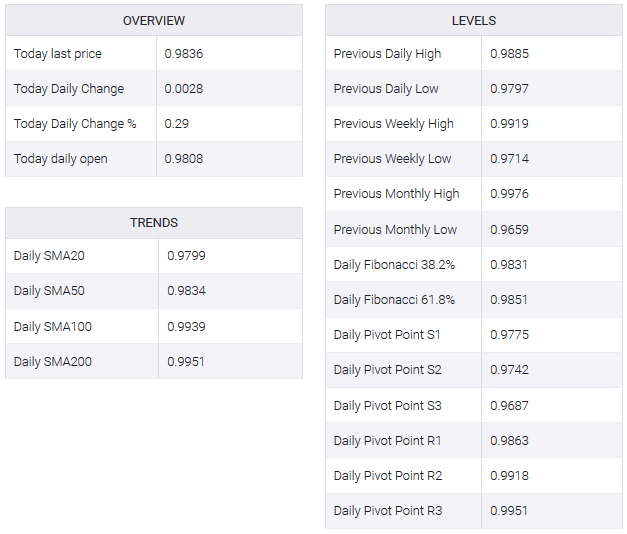

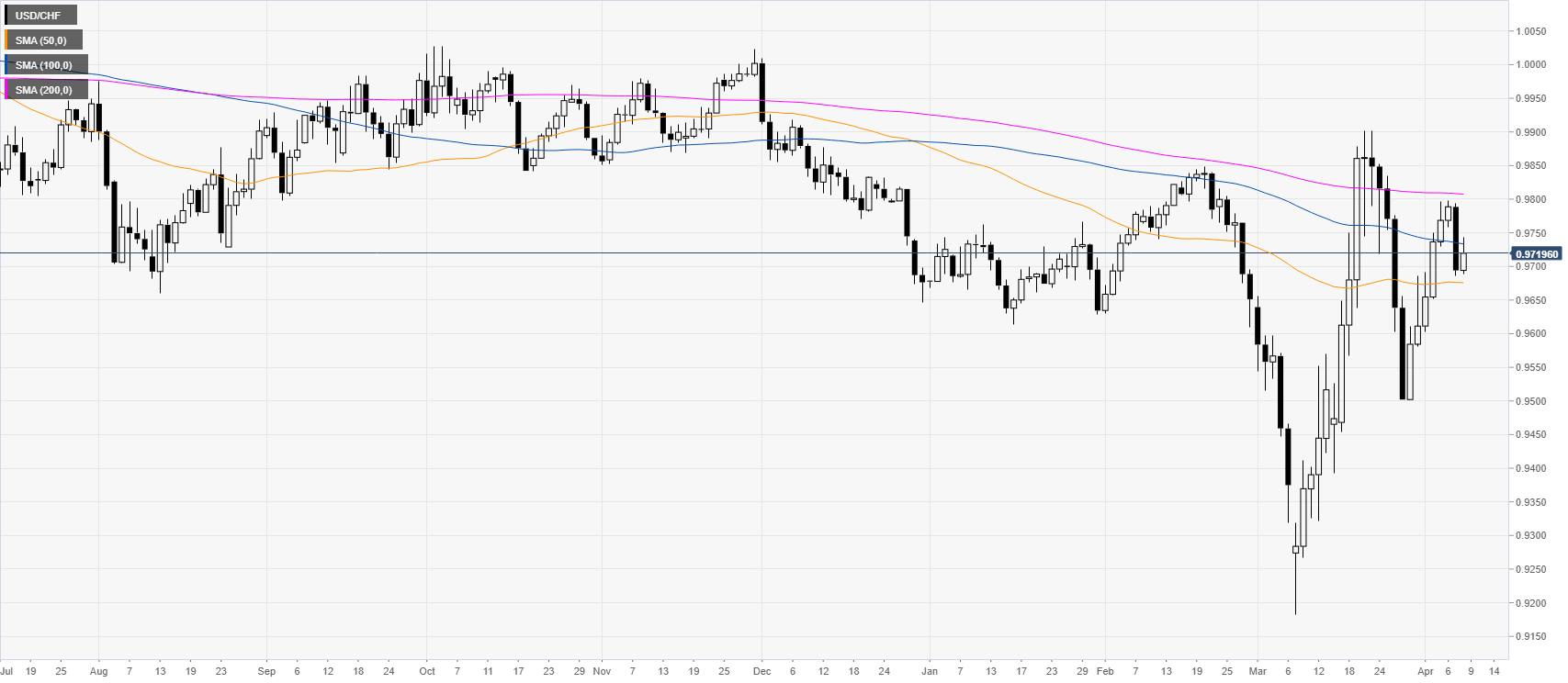

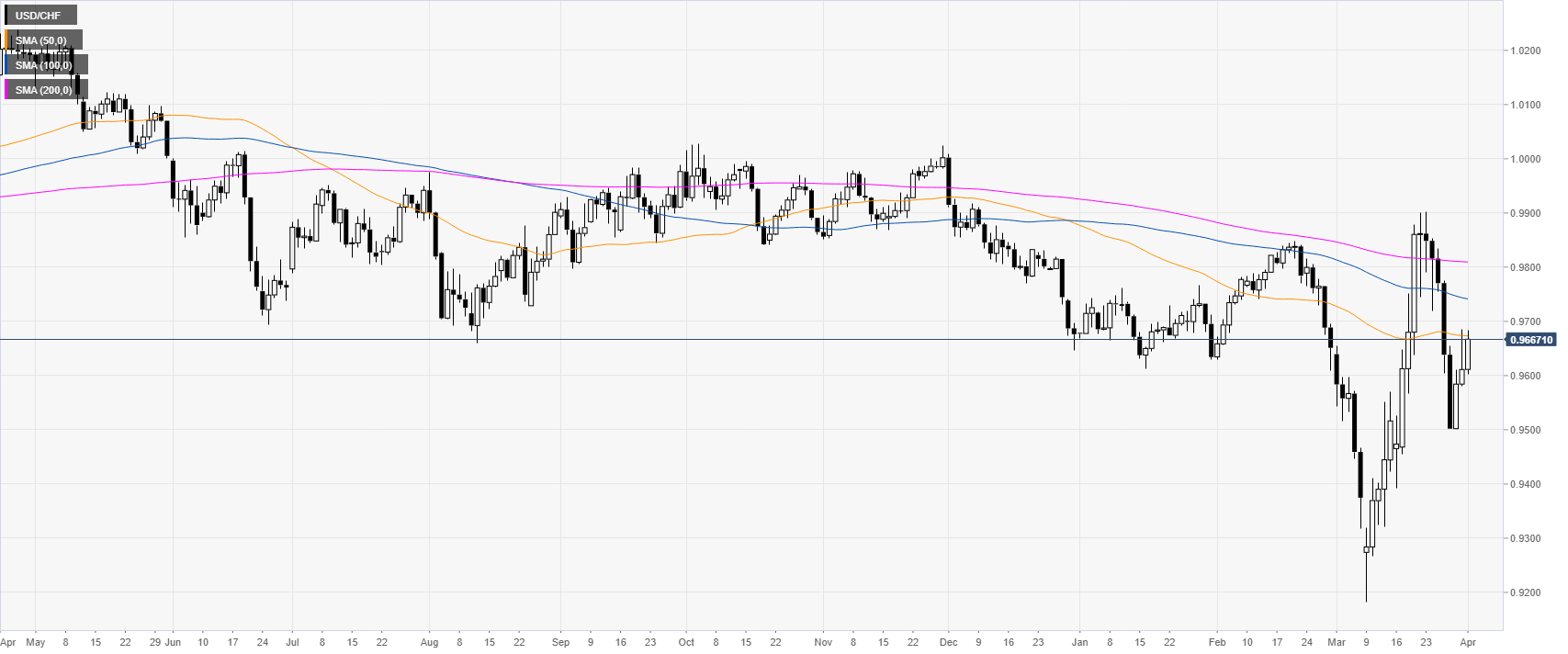

USD/CHF Technical Analysis: The ongoing corrective slide challenges 200-hour SMA support, around mid-0.9800s

Extends overnight retracement slide from an ascending trend-channel resistance. A follow-through selling has the potential to drag the pair towards channel support. The USD/CHF pair remained under some selling pressure for the second consecutive session on Wednesday and retreated farther from over one-month tops set in the previous session.

Read More »

Read More »

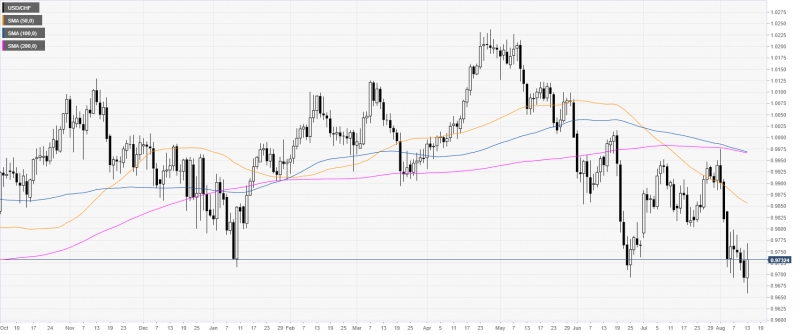

USD/CHF technical analysis: Manages to hold above 0.9800 handle, 200-hour SMA

The USD/CHF pair struggled to sustain above 61.8% Fibo. level of the 0.9879-0.9714 recent slump and seems to have stalled this week's recovery move from the 0.9700 neighbourhood. The intraday downtick remained cushioned near the 0.9800 handle, which coincides with 100/200-hour SMA confluence region and should act as a key pivotal point for intraday traders.

Read More »

Read More »

USD/CHF: Value of CHF calls hits highest since March 2018

Risk reversals on Swiss Franc (CHF1MRR), a gauge of calls to puts, dropped to the lowest level in 17-months, indicating the investors are adding bets to position for a rise in the Swiss currency. The USD/CHF one-month 25 delta risk reversals fell to -1.41 – a level last seen in March 2018.

Read More »

Read More »

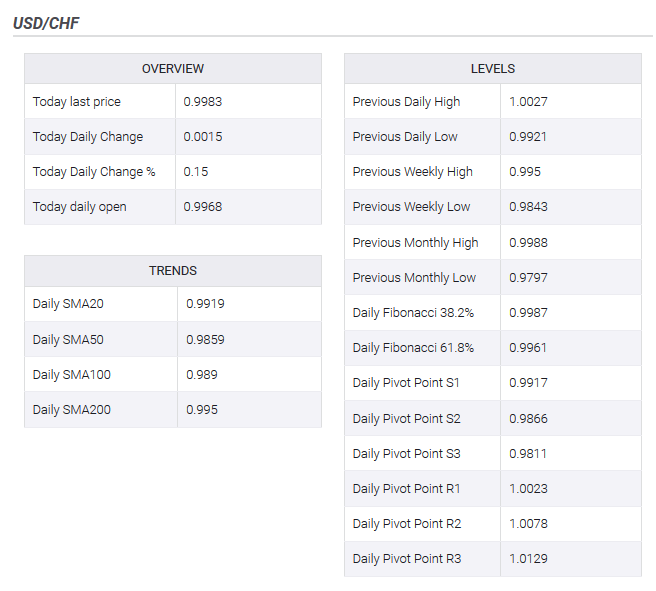

USD/CHF technical analysis: Greenback jumps and settles above 0.9726 as tariffs gets delayed

USD/CHF is trading off 2-month lows below the main daily simple moving averages (DSMAs). US equity markets are rising sharply as US tariffs are to be delayed to December 15. The news was perceived as risk-on, sending safe-haven CHF, JPY and gold down.

Read More »

Read More »

USD/CHF technical analysis: Greenback under pressure below 0.9700 as sellers challenge June lows

CHF is up as Wall Street indices start the week in the red. The level to beat for bears are at the 0.9675 and 0.9660 levels.

Read More »

Read More »

USD/CHF technical analysis: Greenback stable near 0.9755 as US stocks recover

The demand for the Swiss franc decreases as Wall Street indices are gaining strength. The level to beat for bulls are at 0.9790 and 0.9815 level.

Read More »

Read More »

Matías Salord: Trading USDCOP, USDMXN y USDCLP

Fecha de emisión: 03 agosto 2017. Ponente: Matías Salord. En esta sesión semanal, nuestro analista Matías Salord les hablará del panorama económico y del mercado de las principales divisas. SHARE AND SUBSCRIBE FOR MORE VIDEO– –Подпишись на канал– police fail / ДТП / cops crash / polizei unfall Street Race in Russia, Moscow [Уличные . … Continue reading »

Read More »

Read More »

Matías Salord: Trading USDCOP, USDMXN y USDCLP

Fecha de emisión: 03 agosto 2015. Ponente: Matías Salord. En esta sesión semanal, nuestro analista Matías Salord les hablará del panorama económico y del mercado de las principales divisas de Latinoamérica, haciendo especial hincapié en el análisis de cotizaciones, indicadores económicos y contexto.

Read More »

Read More »

-637049959004970218-800x353.png)

-637031895419073883-800x353.png)

-637025933982178300-800x353.png)

-638453232816314704.png)

-638351136132631444.png)

-637217795705356366.png)

-637211742211799359.png)