Category Archive: 9a) Buy and Hold

Why Schools Never Taught You THIS About Money – Andy Tanner, Del Denney

🎯 Ready to take control of your financial future? Visit https://bit.ly/3JsRdmj for access to FREE investing tools, including Andy’s “Power of 6” ebook.

Most people were taught how to earn money… but not how to keep it, grow it, or use it to buy freedom. In this episode of Rich Dad StockCast, host Del Denney and Rich Dad expert Andy Tanner break down what financial literacy really means — and why most of us never learned it in school.

👉 Why aren’t...

Read More »

Read More »

Ab wie viel Geld müssen andere nie wieder arbeiten? | Livestream

Die besten Tagesgeld-Angebote 04/25: https://www.finanztip.de/tagesgeld/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=2-FUxW5G63U

Die besten Festgeld-Angebote 04/25: https://www.finanztip.de/festgeld/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=2-FUxW5G63U

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_2-FUxW5G63U

Traders Place* ►...

Read More »

Read More »

6-2-25 Why Buying Stocks is Always Hard

Why does the stock market test our patience and nerve?

Lance Roberts looks at the psychology of investing, how to master long-term strategies, and ways to navigate market volatility with confidence! Today is National Leave Work Early day...but before you do, make sure to tackle Lance's Monday Mandatory Reading list (links are provided below); Lance shares another tender moment from the Roberts' kitchen, and his essay on why buying stocks is hard...

Read More »

Read More »

Mehr oder weniger Rendite: Covered Call ETFs #coveredcalletf

Mehr oder weniger Rendite: Covered Call ETFs 📊#coveredcalletf

🎥 12% Rendite erzielen mit diesem ETF? Monatliche Einnahmen mit Covered Call ETFs erklärt!:

-BY6nRjDc?si=ZpeBJpUaQpxvYXku

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

Bond Market Paradigm Shift?

Some bearish bond investors in Japan and the US appear to believe that a paradigm shift is underway in the sovereign bond markets. To wit, consider the following statement from Jim Bianco on Thoughtful Money: “If these deficits are really going to kick in and cause problems, these rates are going to go much higher than … Continue...

Read More »

Read More »

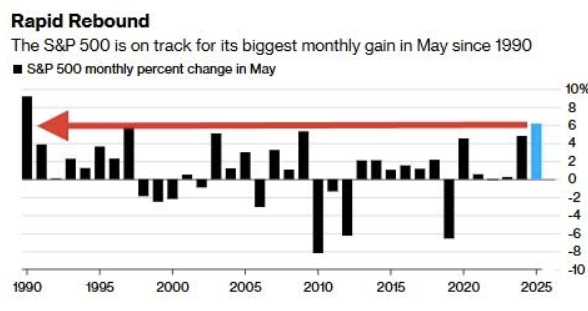

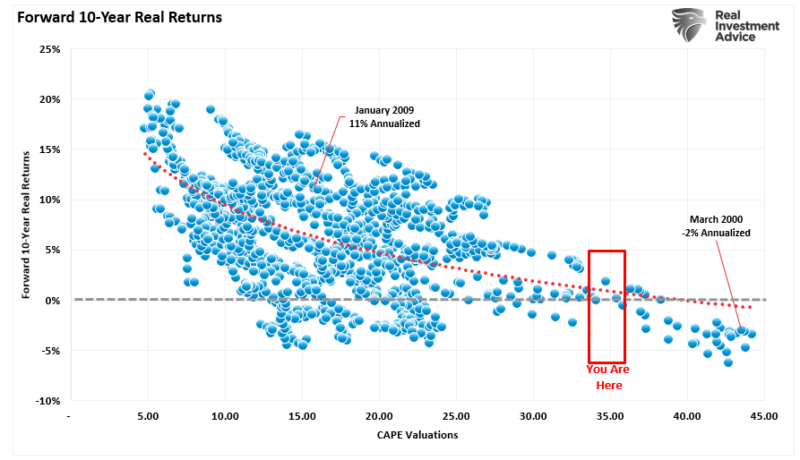

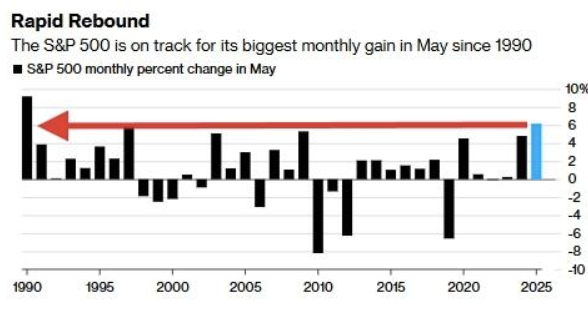

Buying Stocks Is Always Hard

Buying stocks is always hard. Particularly during corrections. Or, near market peaks. Or, when stocks are falling. And when they are rising. Oh, buying stocks is also tricky when valuations are high. And when they are low. You get the point. There is never the right time when it comes to buying stocks. I recently … Continue reading »

Read More »

Read More »

So bezahlt Deutschland an der Kasse

Bar oder doch lieber mit Karte? Womit zahlen wir in Deutschland, wenn wir unseren Wocheneinkauf machen?

Mehr als 44% der Einkäufe bezahlt die Kundschaft mittlerweile mit Karte – entweder direkt mit einer physischen Karte oder als digitale Variante im Smartphone hinterlegt. In nur fünf Jahren hat sich der Anteil damit verdoppelt.

5,7% aller Bezahlvorgänge im stationären Einzelhandel sind mittlerweile mobil z.B. mit Apple Pay oder Google Pay, im...

Read More »

Read More »

Die größten Geldfresser #sparen

Die größten Geldfresser 👹 #sparen

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen...

Read More »

Read More »

12% Rendite – Was steckt hinter Covered Call ETFs? #coveredcalletf

12% Rendite - Was steckt hinter Covered Call ETFs? 📊 #coveredcalletf

🎥 12% Rendite erzielen mit diesem ETF? Monatliche Einnahmen mit Covered Call ETFs erklärt!:

-BY6nRjDc?si=ZpeBJpUaQpxvYXku

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

Mit ETF-Nettopolice Tausende € an Steuern sparen? ETF-Rentenversicherung vs. ETF Sparplan

ETF-Nettopolicen-Vergleich: ►► https://www.finanzfluss.de/vergleich/etf-rentenversicherung/ 🏆

Nettopolice vs. Sparplan Rechner: https://www.finanzfluss.de/rechner/rentenversicherung/

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=848&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

Finanzfluss Copilot: App für dein Vermögen ►►...

Read More »

Read More »

Ist das die härteste Steuererklärung? Check24 Steuer im Härtetest

Steuerprogramm & App: Wiso, Taxfix, Smartsteuer

Wiso Steuer* ► https://www.finanztip.de/link/buhlwisosteuer-steuersoftware-text-youtube/yt_DfMrbg0mSao

Check24 Steuer* ► https://www.finanztip.de/link/check24-steuersoftware-text-youtube/yt_DfMrbg0mSao

Steuerbot* ► https://www.finanztip.de/link/steuerbot-steuersoftware-text-youtube/yt_DfMrbg0mSao

Taxfix

Smartsteuer* ►...

Read More »

Read More »

Wie viel verdient Donald Trump als US-Präsident?

Wie viel verdient Donald Trump als US-Präsident eigentlich? 🤔

Wie hoch das tatsächliche Einkommen des US-Präsidenten ist,

zum Beispiel durch Zinsen oder Einkünfte aus Kapitalanlagen,

das lässt sich erst nach der jeweiligen Steuererklärung sagen,

die der US-Präsident freiwillig offenlegen kann.

Joe Biden hat das gemacht und lag 2023 bei einem Einkommen von insgesamt 620.000 US-Dollar. Trump dagegen hat zuletzt seine Einnahmen nicht offengelegt,...

Read More »

Read More »

Buch: Politik für Wähler im Druck erschienen

Endlich hat es mit der Veröffentlichung des #Buchs "Politik für Wähler - Vom Stimmvieh zum freien Bürger" auf Amazon geklappt. Ab sofort ist es als #Taschenbuch und #Hardcover verfügbar.

Mein Buch Politik für Wähler ► https://amazon.de/dp/B0F92V8BDW/

-

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ►...

Read More »

Read More »

Das sind die größten ETF-Anbieter #etfs

Das sind die größten ETF-Anbieter 📈 #etfs

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Das Prinzip hinter Covered Call ETFs – Call-Put #coveredcalletf

Das Prinzip hinter Covered Call ETFs - Call-Put 📊 #coveredcalletf

🎥 12% Rendite erzielen mit diesem ETF? Monatliche Einnahmen mit Covered Call ETFs erklärt!:

-BY6nRjDc?si=ZpeBJpUaQpxvYXku

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

The Narratives Change. Markets Don’t.

Inside This Week's Bull Bear Report A Successful Test Last week, we discussed how this seems to be an "unstoppable" bull market. However, that doesn't mean markets won't pause before attempting to move higher. As we noted last week, the consolidation was expected. "Even with Bessent's comments, that market remains overbought in the short term, …

Read More »

Read More »

So viel verdienen DAX-Vorstände

Einmal so viel verdienen, wie ein DAX-Manager 😮💨

*Die Gehälter beziehen sich auf die gewährte und geschuldete Vergütung gemäß §162 des Aktiengesetzes, inklusive Dienstzeit- und Versorgungsaufwand sowie einmaliger Zahlungen. Unternehmen mit einem CEO-Wechsel 2024 sind hier nicht berücksichtigt.

Die HRI-Studie basiert auf den Vergütungsberichten von 38 der 40 Dax-Konzerne. Der Flugzeugbauer Airbus und der Diagnostikkonzern Qiagen sind nicht...

Read More »

Read More »

Was hältst du von einem Ende der Bonpflicht? 🤔 #quittung

Was hältst du von einem Ende der Bonpflicht? 🤔 #quittung

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »