Category Archive: 9a) Buy and Hold

Beim eigenen Arbeitsplatz solltest du nicht geizig sein 🤕

Beim eigenen Arbeitsplatz solltest du nicht geizig sein 🤕

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #rendite...

Read More »

Read More »

Meta And Microsoft: Great Earnings But Different Results

On the heels of strong fourth-quarter earnings reports, Microsoft is opening down 8%, while Meta is trading up 10%. Microsoft topped expectations for earnings and revenues. However, there is some concern about its total cloud revenue. They reported cloud revenue of 26% versus expectations of 28-29%. That said, their leading cloud computing product, Azure, grew …

Read More »

Read More »

Mainstream Expectations: Hope Vs. Potential Risk

Mainstream expectations, those from Wall Street, economists, and corporate strategists, have congealed around a bullish economic outlook for 2026. Most forecasts project stronger economic growth, with contained inflation, and continued investment in technology and capital expenditure. As such, many institutional investors interpret this as a year of opportunity for markets and corporate earnings.That was a …

Read More »

Read More »

Wie viel Grönland ist in deinem ETF?

Wie viel Grönland steckt in Deinem ETF? Spoiler: so gut wie nix 🌍

💡 In Deinem MSCI World ETF sind null grönländische Aktien. Auch dänische Unternehmen machen nur einen Mini-Anteil aus – z. B. Novo Nordisk mit unter 1 %.

🇬🇱 Das BIP von Grönland liegt bei nur 3 Mrd. US-Dollar – fast alles davon stammt von staatlichen Unternehmen. Ausländische Firmen? Kaum vorhanden.

🤔 Was passiert, wenn die USA Grönland kaufen oder übernehmen? Schwer zu sagen –...

Read More »

Read More »

1-29-26 What The Fed Really Said & What To Expect Next

The Fed sees inflation easing and believes policy is already restrictive, making rate hikes very unlikely and keeping cuts as the more probable next move.

In this short video, @michaellebowitz and I break down what Powell actually said, what the Fed is signaling on growth and labor, and what to expect next for markets.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Video_7_Deal oder kein deal europa

Europa ist in einer schwierigen Phase. In der großen Masse geht es bergab ...

Aber das heißt nicht, dass du hier nicht gut leben und sehr gut Geld verdienen kannst.

Die Wahrheit:

👉 Es gibt nicht viele, die wirklich Gas geben wollen.

Europa ist kein Paradies.

Aber für Macher ist es immer noch ein verdammt gutes Spielfeld.

#investmentpunk

#mindset

#finanziellefreiheit

Read More »

Read More »

Deutsche Bahn Chefin Palla wirft ein Drittel ihrer Führung raus und kündigt Superbaujahr an

🚆 Deutsche Bahn Chefin Palla wirft ein Drittel ihrer Führung raus und kündigt Superbaujahr an

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage...

Read More »

Read More »

Fällst Du auf unsere Geld-Fallen rein?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_fgxWmWXjv9E

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_fgxWmWXjv9E

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_fgxWmWXjv9E

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_fgxWmWXjv9E

Trade...

Read More »

Read More »

Die wichtigsten Änderungen für Deine Finanzen 2026

Krankenkassenvergleich 01/2026 - Finde die beste GKV

HKK* ► https://www.finanztip.de/link/hkk-gkv-text-youtube/yt_ebEGJqwqa1c

TK* ► https://www.finanztip.de/link/tk-gkv-text-youtube/yt_ebEGJqwqa1c

BKK Firmus* ► https://www.finanztip.de/link/bkkfirmus-gkv-text-youtube/yt_ebEGJqwqa1c

Audi BKK* ► https://www.finanztip.de/audibkk-gkv-text-youtube/yt_ebEGJqwqa1c

DAK* ► https://www.finanztip.de/link/dak-gkv-text-youtube/yt_ebEGJqwqa1c

Steuerprogramm...

Read More »

Read More »

1-29-26 Market Risks Behind Powell’s “Nonrestrictive” Stance

The Federal Reserve is holding interest rates steady, keeping policy in a 3.5%–3.75% range.

Lance Roberts and Michael Lebowitz examine how markets are reacting to Chair Jerome Powell’s message, and break down what the Fed is signaling—and why it could fuel market volatility ahead.

0:00 - INTRO

0:19 - Mega Reports & Fed Fallout

4:31 - Markets Struggle after 7,000

9:33 - Inflation, Truflation, & Labor

14:14 - Chances of Rate Changes Higher...

Read More »

Read More »

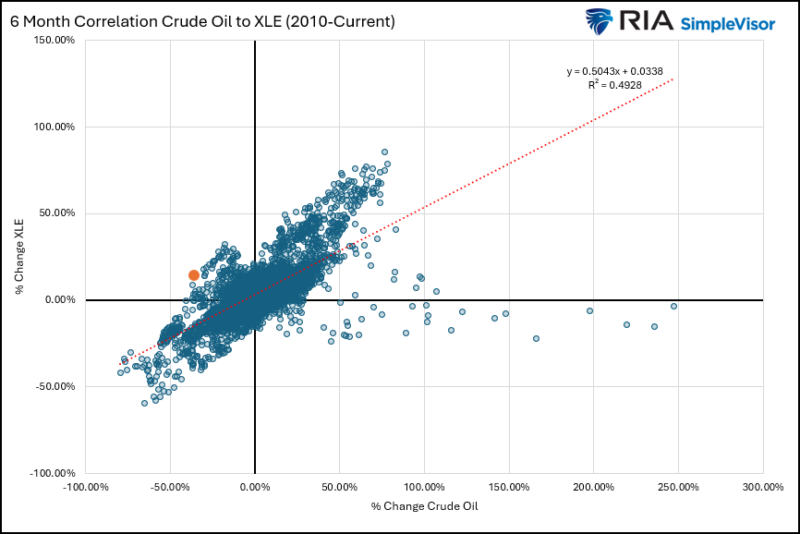

The Energy Sector Is Outpacing Energy Prices

Over the last year, energy stocks have traded well despite crude oil prices languishing. For instance, over the last six months, XLE, the energy ETF, has risen 14%, while crude oil prices have fallen by 12%. The two largest components of XLE, Exxon and Chevron, which account for 40% of the ETF, are up 30% … Continue reading...

Read More »

Read More »

Die Handelsbilanz mit den USA 🇺🇸

Die Handelsbilanz mit den USA 🇺🇸

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #rendite #finanzbildung #ökonomie...

Read More »

Read More »

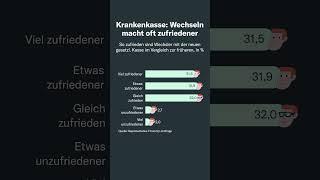

Krankenkasse: Wechseln macht oft zufriedener

Krankenkasse wechseln? Das bringt was! 🏥

🔄 Laut Finanztip-Umfrage sind über 63 % der Menschen nach dem Wechsel ihrer gesetzlichen Krankenkasse zufriedener als vorher.

😊 31,5 % sagen sogar: viel zufriedener! Und nur knapp 5 % bereuen den Wechsel.

💡 Heißt für Dich: Wenn Du mit Service, Leistungen oder Zusatzangeboten unzufrieden bist – ein Wechsel kann sich lohnen. Und ist einfacher, als viele denken!

📊 Wer gleich zufrieden bleibt oder...

Read More »

Read More »

Warum der Euro stärker ist, als die meisten Anleger glauben

Ist der Euro tot? Diese Frage taucht aktuell immer häufiger auf. Viele Anleger glauben, Europa stehe vor dem Abgrund und der US-Dollar sei alternativlos. Doch ein genauer Blick auf die aktuellen Entwicklungen zeigt ein deutlich differenzierteres Bild.

In diesem Video analysiert Investmentpunk Gerald Hörhan, warum der Euro deutlich stärker ist, als viele erwarten – und warum eine weitere Aufwertung gegenüber dem US-Dollar durchaus realistisch sein...

Read More »

Read More »

Wie umgehen mit Trump?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_En-HedE6aNY

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_En-HedE6aNY

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_En-HedE6aNY

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_En-HedE6aNY

Trade...

Read More »

Read More »

1-28-26 The Narrative Trap: How Investors Justify Buying Silver Higher

$SLV rally is fueled by narrative and retail chasing.

Historically, it ended with painful mean reversion.

In this short video, I discuss why investors justify buying #silver higher, how psychology overrides fundamentals, and why parabolic moves in industrial metals rarely last. $GLD

📺Full episode: -IGAw

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

TikToker Khaby Lame schließt 900-Millionen-Dollar-Deal ab

TikToker Khaby Lame schließt 900-Millionen-Dollar-Deal ab 💸

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #rendite...

Read More »

Read More »

Deal oder kein Deal: Gold statt Sparen

Sparen? Dein Geld verbrennt dir auf der Bank oder in deiner Matratze!

Inflation frisst dein Geld still und leise. Gold dagegen ist ein Inflationsschutz.

Kein Zins, kein Versprechen echter Wert.

Aber wichtig: Cost-Average nicht vergessen.

Perfekt ist es nicht. Aber in Zeiten von Geldentwertung gilt:

👉 (Fast) alles, was glänzt, ist gut. 😎

#investmentpunk

#gold

#inflationsschutz

Read More »

Read More »

1-28-26 Q&A Wednesday, the YouTube Chat Free-for-all

Welcome to Q&A Wednesday: The YouTube Chat Free-for-All — our most interactive show of the week.

Lance Roberts & Danny Ratliff answer real-time questions straight from the YouTube live chat. No scripts. No pre-selected topics. Just timely, unfiltered discussion on the issues investors are wrestling with right now.

#QAWednesday #InvestorQuestions #MarketVolatility #FinancialEducation #RiskManagement

Read More »

Read More »