Category Archive: 9a) Buy and Hold

Pullback or Not? & Time to Trim Gold

A weak jobs report has traders betting on a Fed rate cut – but don’t rule out a pullback in $SPY / $QQQ in September.

Gold $GLD, meanwhile, looks overbought – a good spot to take profits.

In this short video, I break it all down.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #FedRateCut #SPY #QQQ #GoldInvesting #MarketOutlook

Read More »

Read More »

Welche ETFs sind die besten für Anfänger? #reddit

Welche ETFs sind die besten für Anfänger? 💬 #reddit

Thomas beantwortet EURE Fragen! | Reddit AMA:

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff...

Read More »

Read More »

9/5/25 Financial Planning Secrets: Why Your Advisor Should Do More Than Pick Stocks

Too many people think financial planning is just about picking investments—but it’s much more than that. A great plan is a living, breathing roadmap that evolves as your life changes.

Richard Rosso & Jonathan McCarty uncover what makes the perfect financial planning experience—from getting your head straight, to gathering the right documents, to partnering with a fiduciary advisor who looks beyond just returns.

You’ll learn:

• Why real...

Read More »

Read More »

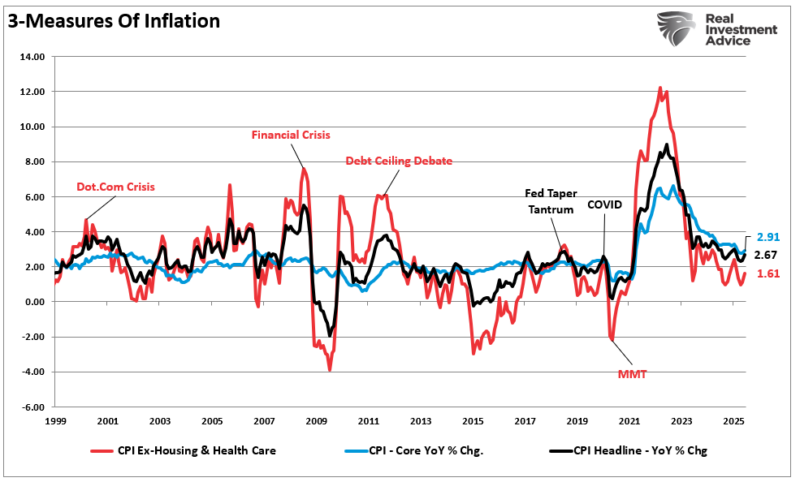

Fed Policy Is More Restrictive Since Rate Cuts

The Fed has cut the Fed Funds rate by 1% since late 2024, and the presumption from many market participants is that the Fed has made policy less restrictive. Technically, they are somewhat correct. Banks and other financial institutions that borrow over very short periods have seen their borrowing costs decline due to the Fed’s …

Read More »

Read More »

Why Keynes’ Economic Theories Failed In Reality

A recent post from Daniel Lacalle, “How Keynesians Got The US Economy Wrong Again,” exposed the widening gap between John Maynard Keynes' economic theory and reality. Despite the confident forecasts of leading Keynesian economists, the U.S. economy in 2025 continues to defy expectations. The Federal Reserve’s tightening cycle failed to trigger the widely predicted “hard …

Read More »

Read More »

Polen reformiert sein Rentensystem 🇵🇱 #rente

Polen reformiert sein Rentensystem 🇵🇱 #rente

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Bad Jobs Report = Good News For Markets?

A weak jobs print with sharp negative revisions could become bullish fuel, lifting hopes of a 50 bps Fed rate cut.

In this short video, I break down why bad news might be good news for $SPY / $QQQ.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/...

Read More »

Read More »

Teurer Irrtum: Gasheizung kostet das Dreifache

Energieberater - Hier bekommst Du Deinen Sanierungsfahrplan

Enwendo* ► https://www.finanztip.de/link/enwendo-energieberatung-text-youtube/yt_lGAkxlEvCdM

Enter* ► https://www.finanztip.de/link/enter-energieberatung-text-youtube/yt_lGAkxlEvCdM

Fuchs & Eule* ► https://www.finanztip.de/link/fuchseule-energieberatung-text-youtube/yt_lGAkxlEvCdM

Novo* ► https://www.finanztip.de/link/novo-energieberatung-text-youtube/yt_lGAkxlEvCdM

Senercon

🧡...

Read More »

Read More »

Finde die Balance zwischen sparen und leben! 🧘 #sparen

Finde die Balance zwischen sparen und leben! 🧘 #sparen

9 Anzeichen, dass du ZU VIEL sparst!:

?feature=shared

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in...

Read More »

Read More »

9/4/25 Stock Market Bubble? Extreme Valuations & What Investors Should Do Now

Stock valuations are at extreme levels — some call it a bubble, while others argue the bull market has more room to run. So, who’s right? And more importantly, what should YOU do as an investor?

Lance Roberts & Michael Lebowitz expose the conflicting market narratives and explain why selling everything may not be the smartest move. Instead, they’ll explore how active investing, technical signals, and disciplined risk management can help you...

Read More »

Read More »

Robots Are Tesla’s Future: EVs No Longer The Value Proposition

Tesla is the leading manufacturer of electric vehicles (EVs) in the US and second, behind BYD, in the world. Despite its strong position in the EV market, Tesla is only the fourteenth largest auto manufacturer. Despite its low ranking, it has a market capitalization that is almost four times that of Toyota, the second-largest auto …

Read More »

Read More »

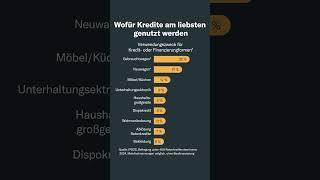

Wofür Kredite am liebsten genutzt werden

Ratenkredite werden am häufigsten für den Kauf eines Autos abgeschlossen – besonders oft für Gebrauchtwagen: Mehr als jede:r vierte Ratenkreditnutzer:in finanziert damit einen solchen Wagen.

Kredite können vieles ermöglichen: das neue Auto für den Arbeitsweg, die Traumhochzeit mit Flitterwochen in der Karibik, den neuesten Fernseher – oder auch ganz pragmatisch die Umschuldung eines teureren Kredits.

Bevor Du jedoch mit solchen Wünschen zur Bank...

Read More »

Read More »

9-3-25 Why Most People Fail at Day Trading

It's an interesting conundrum that some retirees go into day trading as a "side gig," which in turn becomes another full time job, monitoring all of the data and news. Just because you have access to information doesn't mean you have to act upon it. Sometimes it's better to let the dust settle before making a move.

RIS Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisors, Danny Ratliff, CFP

Produced by...

Read More »

Read More »

Werde reich – erklärt in 60 Sekunden!

Gerald erklärt dir in nur 60 Sekunden, wie du reich wirst.

Wer ist Gerald Hörhan?

Der österreichische Selfmade Multi-Millionär mit Lederjacke und 60+ Millionen EUR Immobilienportfolio, Gerald Hörhan, erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich.

Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich...

Read More »

Read More »

Steuerbescheid falsch? Das musst du jetzt tun! | Steuerbescheid lesen und prüfen

Fehler im Steuerbescheid: Das kannst du tun!

Steuersoftware-Vergleich: ►► https://www.finanzfluss.de/vergleich/steuerprogramm/ ⚖️

Unsere Empfehlung: ►► https://steuer.check24.de/ul/?ts=aff&tc=finanzfluss * ✅

ℹ️ Weitere Infos zum Video:

Selbst das Finanzamt macht hin und wieder Fehler, deswegen sollte man den Steuerbescheid immer genau auf seine Korrektheit prüfen. Bei größeren Abweichungen macht es außerdem Sinn, gegen den Steuerbescheid...

Read More »

Read More »

Irgendwann ist auch mal gut! #sparen

Irgendwann ist auch mal gut! 📉 #sparen

9 Anzeichen, dass du ZU VIEL sparst!:

?feature=shared

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff...

Read More »

Read More »

9/3/25 10 Reasons You Shouldn’t Retire (but what to do if you do)…

Thinking about retirement? Think again.

Lance Roberts & Danny Ratliff present 10 powerful reasons you shouldn’t retire too soon—from financial stability to maintaining purpose and health. But if you do decide to retire, they’ll also show you exactly what steps to take to protect your money, lifestyle, and long-term security.

0:19 - How ChatGPT Saved Google in Anti-trust Court

2:49 - Why the 50-DMA is Key

8:18 - Looking Ahead to Employment...

Read More »

Read More »