Category Archive: 9a) Buy and Hold

9-12-25 The Essential Hierarchy of Money Goals

Where should your money go first? Too often, people skip ahead to investing or wealth strategies before laying the right foundation. Richard Rosso and Matt Doyle break down the essential hierarchy of money goals—a clear order of priorities to help you stay on track.

From emergency savings and debt reduction to investing, wealth protection, and legacy planning, this framework shows you exactly how to progress step by step.

By focusing on the right...

Read More »

Read More »

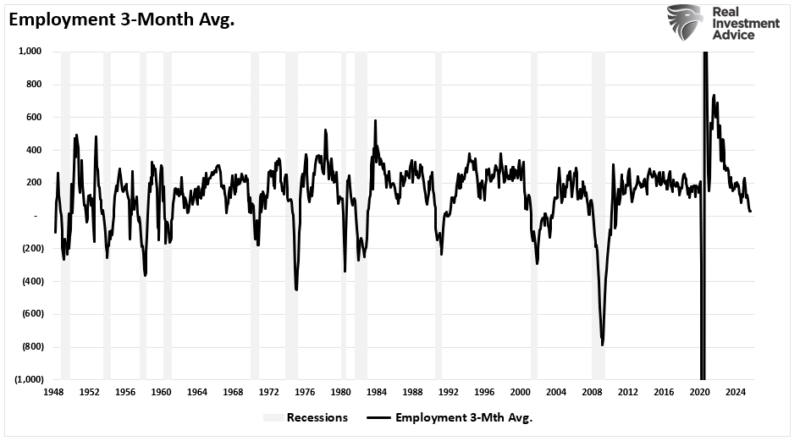

Corporate Earnings Slowdown Signaled By Employment Data

The latest employment data strongly warned of a potential corporate earnings slowdown ahead. This is the first time we have warned about the employment data and its impact on corporate earnings. In May, we penned "Employment Data Confirms Economy Is Slowing." wherein we stated: "Given the importance of consumption in the economy and that employment (production) must come …

Read More »

Read More »

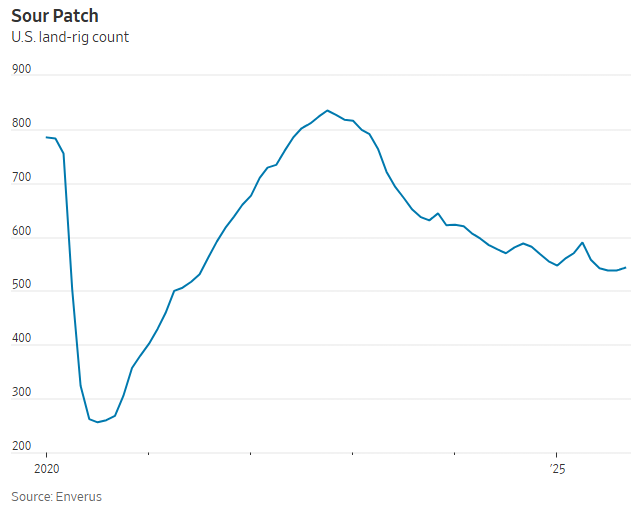

Oilfield Servicers Find New Hope in AI Power Demand

Oilfield service companies are fighting an uphill battle after years of weak demand from traditional energy producers. A relentless multi-year decline in U.S. rig counts has resulted in beaten-down oilfield service companies turning to an unlikely new customer base: technology firms racing to power AI data centers. According to the WSJ, companies such as Solaris …

Read More »

Read More »

9/11/25 When Most Sectors Bullish – Major Correction Risk Low

The Risk Range Report (link below) shows that most sectors have turned bullish. With only a few bearish signals left, the chance of a 20–30% correction is low.

In this short video, I show how this tool can help you spot danger before markets turn.

📉 The Risk Range Report: https://simplevisor.com/risk-range-report

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #MarketCorrection...

Read More »

Read More »

The Truth About the Deficit & Debt – Tom Wheelwright, John Tamny

👉 https://bit.ly/41d3Kmy 👈 CLICK HERE Ready to change your financial future? Join Tom Wheelwright, Robert Kiyosaki's CPA, and apply to the WealthAbility Accelerator today!

How do we solve the deficit? How will it affect you, your business, your taxes, and your investments? Join Tom Wheelwright as he explores the debt, the scandal, and how the federal tax revenue will skyrocket with his guest and author, John Tamny.

John Tamny is president of the...

Read More »

Read More »

1k, 3k, 10k Dividende im Monat kassieren: So viel € musst Du 2025 in ETFs investieren

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_Auw8CWmSw_s

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_Auw8CWmSw_s

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_Auw8CWmSw_s

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_Auw8CWmSw_s

Trade...

Read More »

Read More »

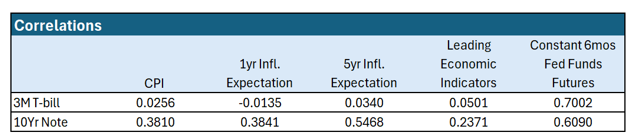

9/11/25 There Ain’t No Inflation

Markets and the Fed keep talking about inflation, but what’s really happening? Lance Roberts previews the upcoming CPI, PPI reports, and real-world data to explain why the official numbers don’t always match what you're feeling. From wages and rents to energy prices--is inflation is truly under control, or just hiding in plain sight.

Discover how “disinflation” differs from “deflation,” why Wall Street’s narrative matters for stocks, and what it...

Read More »

Read More »

Oracle Puts the AI Infrastructure Trade Back in Action

The AI infrastructure trade stagnated through August, with enthusiasm fading even after NVDA beat earnings and raised guidance. Investors shifted their focus to weakening economic data and looming Fed rate cuts, fueling the narrative that the AI boom had run its course. That changed yesterday, when Oracle reignited the trade with a blockbuster earnings call. …

Read More »

Read More »

Finanzfluss Lexikon Bingo: Physisch & synthetisch #bingo #physisch #synthetisch

Finanzfluss Lexikon Bingo: Physisch & synthetisch 🎰 #bingo #physisch #synthetisch

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir...

Read More »

Read More »

9/10/25 This Market Boom Isn’t Backed By The Data

The market’s rally is not supported by underlying economic data. Weak jobs, disinflation, and slowing demand raise real recession risks.

A recession doesn’t necessarily mean a financial crisis or a 50% market crash, but you have to be ready for one.

In this short video, I break down what a recession could actually look like.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #Recession...

Read More »

Read More »

9-9-25 Let’s Talk About A Correction

$SPY / $QQQ remain resilient and supported by strong money flows, underweight positioning, and short covering.

While an ~8% correction is possible due to stretched valuations and the gap from long-term averages, a major downturn looks unlikely this year.

In this short video, Lance Roberts explains what this means for investors.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#MarketCorrection #SPY...

Read More »

Read More »

Diese Finanz-Regeln solltest Du brechen | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_7g3PCO8OV2s

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_7g3PCO8OV2s

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_7g3PCO8OV2s

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_7g3PCO8OV2s

Trade...

Read More »

Read More »

How to Avoid Real Estate Disasters – Robert Kiyosaki

Buying real estate without a plan is a recipe for disaster. In this episode, Robert Kiyosaki shares the proven strategies he uses to avoid costly mistakes—and why most investors fail.

You’ll learn:

-The key planning steps before buying any property

-How to evaluate deals using cashflow, not hype

-Why financial education is the best insurance against losses

-The 4 intelligences every investor needs to master

Robert also explains how to think...

Read More »

Read More »

Was versteht man unter Klumpenrisiko? 🪨 #klumpenrisiko

Was versteht man unter Klumpenrisiko? 🪨 #klumpenrisiko

🎥 Versteckte Gefahren? Klumpenrisiken in deinem Leben erkennen und reduzieren!

?si=Gc4WnOvy7t-zbyaI

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »

9/10/25 Are We On the Edge of Recession?

Are we standing at the edge of a recession? Economic data is showing cracks: slowing job growth, weakening consumer spending, and tightening credit conditions. Meanwhile, the Federal Reserve’s policies continue to weigh on growth.

In this episode, Lance Roberts & Danny Ratliff break down the key signals flashing caution, what they could mean for corporate earnings and market performance, and how investors should think about risk management in...

Read More »

Read More »

Main Street Optimism Ticks Higher Despite Hiring Challenges

Main Street optimism edged higher in August, as the NFIB Small Business Optimism Index rose to 100.8. That reading sits above the long-term average of 98 but missed the consensus estimate of 101. Stronger sales expectations led the improvement, with a net 12% of owners anticipating higher real sales volumes. This represents a six-point jump …

Read More »

Read More »