Category Archive: 9a) Buy and Hold

De $0 a Portafolio Millonario (El Secreto Real) – Alejandro Cardona & Fernando Gonzalez

👉 https://realmentor.net/rd 👈 ¡ENTRA AQUÍ Y Descubre el SISTEMA de PADRE RICO que me hizo MILLONARIO! Construye INGRESOS PASIVOS y alcanza la LIBERTAD FINANCIERA con Fernando González-Ganoza, mentor de habla hispana y representante oficial de Robert Kiyosaki por más de 30 años.

👉 https://www.seminariocreandoriqueza.com/richdad 👈 Aprende a invertir y generar ingresos en la bolsa de valores con el Economista Alejandro Cardona.

¿Sigues trabajando...

Read More »

Read More »

Kommt jetzt der “Uptober”?

Kommt jetzt der "Uptober"? 🍂

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur...

Read More »

Read More »

10-7-25 7 Midlife Money Traps That Destroy Wealth

In your 30s, 40s, or 50s, life gets busy—and money decisions get complicated. Many professionals fall into the same midlife financial traps that quietly erode their future wealth. Lance Roberts & Jon Penn unpack seven common midlife money mistakes that can derail your long-term goals—from lifestyle creep and poor diversification to credit card debt and get-rich-quick schemes. Learn how to stay focused, protect your growing assets, and build...

Read More »

Read More »

AMD Surges: Nvidia Competition Heats Up

Advanced Micro Devices (AMD) stock opened up by nearly 35% on Monday morning, following reports that OpenAI is acquiring a 10% stake in AMD. As part of the agreement, AMD will supply OpenAI with 6 gigawatts of AMD's Instinct GPUs.

Read More »

Read More »

AI, Automation & The End of the Rat Race: What Investors Must Know

🎯 Ready to take control of your financial future? Visit https://bit.ly/3JsRdmj for access to FREE investing tools, including Andy’s “Power of 6” ebook.

AI isn’t coming — it’s already here. And it’s not just changing jobs; it’s transforming who owns the future. In this episode of Stockcast, Andy Tanner reveals how artificial intelligence is creating the biggest wealth transfer in history — and why most people will miss it.

You’ll learn:

-Why AI...

Read More »

Read More »

Ist die 10€-Frühstart-Rente nur ein Ablenkungsmanöver?

Ist die 10€-Frühstart-Rente nur ein Ablenkungsmanöver?

Abonniere @imLoop-c2g, um keine wichtigen News mehr zu verpassen!

Welche Nachrichten sind heute für Deutschland und unsere Wirtschaft relevant? Das erfährst du bei uns. Wir informieren dich über News aus dem In- und Ausland. Wichtige Themen vom Tag – kompakt und verständlich aufbereitet. Für ausgewählte Nachrichten gehen wir dabei in den Deep Dive. Wir zeigen dir unterschiedliche Perspektiven...

Read More »

Read More »

10-6-25 The Hidden Math Wall St. Doesn’t Tell You About Buy & Hold

Most investors think market drops are just “blips,” but the math tells a different story — a 50% decline cuts total dollar gains in half, not by a small “blip.”

In this short video, I explain why legendary investors like Warren Buffett & Paul Tudor Jones focus on limiting losses, not blindly holding — and why right now, protecting capital beats chasing the rally.

Full episode: https://www.youtube.com/live/Oo1Ny37IaEs?si=5vnlpbRLq_FaAHQL...

Read More »

Read More »

Wie viel kostet dein Girokonto?

Wie viel bezahlst du für dein Girokonto? 💶

Ein neues Girokonto sorgt gerade für frischen Wind im Markt – mit 3% Zinsen aufs Guthaben und 3% Cashback auf deine Einkäufe. 💸

Da stellt sich natürlich die Frage: Was sind aktuell eigentlich die besten Girokonto-Angebote? Und vor allem: Wie schneidet dein Konto im Vergleich ab?

Die Antwort gibt es in unserem großen Finanzfluss-Girokonto-Vergleich. Wir haben 58 Konten getestet – bewertet nach den...

Read More »

Read More »

Sollten Bürger mehr für private Altersvorsorge zahlen?

Friedrich Merz stimmt die Deutschen auf höhere Kosten für die Beteiligung an Sozialsystemen ein. Sollten Bürger mehr für private Altersvorsorge zahlen?

Abonniere @imLoop-c2g, um keine wichtigen News mehr zu verpassen!

Welche Nachrichten sind heute für Deutschland und unsere Wirtschaft relevant? Das erfährst du bei uns. Wir informieren dich über News aus dem In- und Ausland. Wichtige Themen vom Tag – kompakt und verständlich aufbereitet. Für...

Read More »

Read More »

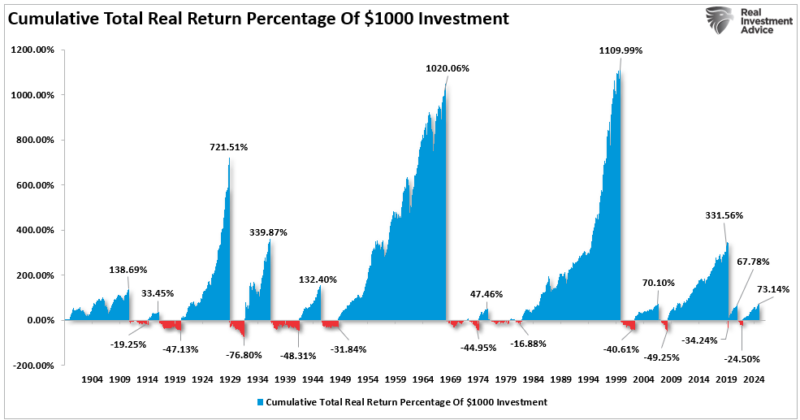

10-6-25 Bear Market Losses: The Dangerous Illusion Investors Fall For

Investors often believe that when markets “recover,” their portfolios do too — but that’s a dangerous illusion. In this episode, Lance Roberts breaks down why percentage losses and gains are not symmetrical, and how a 50% loss requires a 100% gain just to break even.

We’ll discuss why bear market math destroys long-term returns, how emotional investors get trapped in the “illusion of recovery,” and why managing risk during drawdowns matters more...

Read More »

Read More »

Bear Market Losses – A Dangerous Illusion

When bear market losses occur, headlines talk in percentages: “The market dropped 20 %.” Investors nod. A 20 % decline sounds manageable, historical, and expected. As Ben Carlson recently penned: "Bear markets have some symmetry to them, at least in the short-term. In the long term, bull markets versus bear markets are asymmetric. Things are not balanced. Look at …

Read More »

Read More »

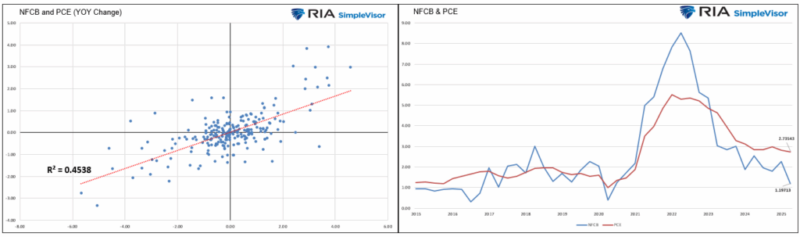

Corporate Prices Lead Consumer Prices

The following discussion is courtesy of Paul Mortimer Lee, as provided by Albert Edwards of Societe Generale. Paul makes an interesting case that PCE prices, the Fed’s primary gauge of inflation, are likely to decline. Supporting his view is a relatively wide and growing gap between the prices witnessed by the non-financial corporate business sector, …

Read More »

Read More »

Finanzfluss Lexikon Bingo: KGV #bingo #kgv

Finanzfluss Lexikon Bingo: KGV 🎰 #bingo #kgv

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Girokonto-Vergleich 2025: Neue Bank mit 3% Zinsen & 3% Cashback! | Bestes kostenloses Konto

Zum Girokonto Vergleich: ►► https://www.finanzfluss.de/vergleich/girokonto/ ⚖️

Testsieger (+75€ Bonus): ►► https://link.finanzfluss.de/go/girokonto-testsieger *

Consorsbank! Girokonto (+200€ Prämie): ►► https://link.finanzfluss.de/go/consorsbank-girokonto *

Finanzfluss Copilot: App für dein Vermögen ►► https://link.finanzfluss.de/r/copilot-app-yt 📱

ℹ️ Weitere Infos zum Video:

Ob Zinsen auf dem Girokonto, kostenlose Bargeldabhebungen oder...

Read More »

Read More »

5 Eckpunkte für eine Reform der Altersvorsorge

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_jFinl5DB0bw

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_jFinl5DB0bw

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_jFinl5DB0bw

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_jFinl5DB0bw

Trade...

Read More »

Read More »

Why Saving Dollars Won’t Save YOU – Robert Kiyosaki, Doug Casey

The U.S. dollar is losing value faster than most people realize. Inflation, debt, and reckless money printing are destroying retirement accounts and savings. In this episode, Robert Kiyosaki explains why saving in dollars is financial suicide and how to protect your wealth before it’s too late. Learn why real assets like gold, silver, and real estate are the only true stores of value. Don’t let your 401(k) and savings evaporate—discover how the...

Read More »

Read More »