Category Archive: 9a) Buy and Hold

Hohe Zinsen reichen nicht aus #inflation

Hohe Zinsen reichen nicht aus 📉 #inflation

Das gesamte Video findest du auf unserem Youtube-Kanal: 🎥 Warum es ein fataler Fehler ist, mehr als DIESEN Betrag auf dem Konto zu haben...

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

Rechnest du noch mit der gesetzlichen Rente? 🤔 #rente

Rechnest du noch mit der gesetzlichen Rente? 🤔 #rente

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Jeder Investoren-Typ in 17 Min. erklärt!

Von Value Investor bis Meme-Trader: Die wichtigsten Anlegertypen erklärt!

Black Week: -44% auf Finanzfluss Copilot PLUS bis 1.12. ►► https://link.finanzfluss.de/r/black-week-youtube-ff 📱

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=890&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

ℹ️ Weitere Infos zum Video:

Jeder Anleger verfolgt seine eigene...

Read More »

Read More »

Sparplan mit 2x-Hebel: Doppelte Rendite mit Amundis Glomumbo?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_Ahq0jus7Mf4

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_Ahq0jus7Mf4

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_Ahq0jus7Mf4

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_Ahq0jus7Mf4

Trade...

Read More »

Read More »

Welche Farbe hat dein Aston Martin?

Das beste Auto? Hängt davon ab ...

👉 Technologisch: asiatische Hersteller 👉 Image & Werthaltigkeit: Europa.👉 Fun-Factor: Amerikaner und Europäer.

Ich liebe Technik, Stil und Power und hab mir genau deswegen ein paar echte Traumstücke gegönnt.

Kennst du den Mercedes SLS Gullwing? Schon mal gefahren? 😎

#luxus

#autos

#investmentpunk

Read More »

Read More »

Ukraine – Frieden und Gasmangellage | 28-Punkte Friedensplan

Der #28-Punkteplan zum #Frieden in der #Ukraine enthält oberflächlich gute aber auch unpopuläre bis merkwürdige Lösungsansätze. Blickt man tiefer in die Problematik, so erkennt man, dass die im Hintergrund Beteiligten alle ihre speziellen Vorteile mit dieser Lösung erhalten. Heute benenne ich Nutznießer und Verlierer. Es sollte Sie nicht überraschen, wer zu den Verlierern gehört, falls Sie es noch nicht selbst gemerkt haben.

-

✘ Werbung:

Mein Buch...

Read More »

Read More »

11-22-25 How the Fed Controls Every Asset You Trade

The Fed is now the single most important source of liquidity in every major market.

In this short video, Michael Lebowitz and I break down the key signals that reveal when liquidity stress is building and why they matter for every asset you trade.

📺Full episode: _r_I

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Black Friday: Spart man wirklich? ◼️ #blackfriday

Black Friday: Spart man wirklich? ◼️ #blackfriday

Das gesamte Video findest du auf unserem Youtube-Kanal: 🎥 NEU im November 2025: Trade Republic, Spotify Preise, Black Friday & mehr!

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

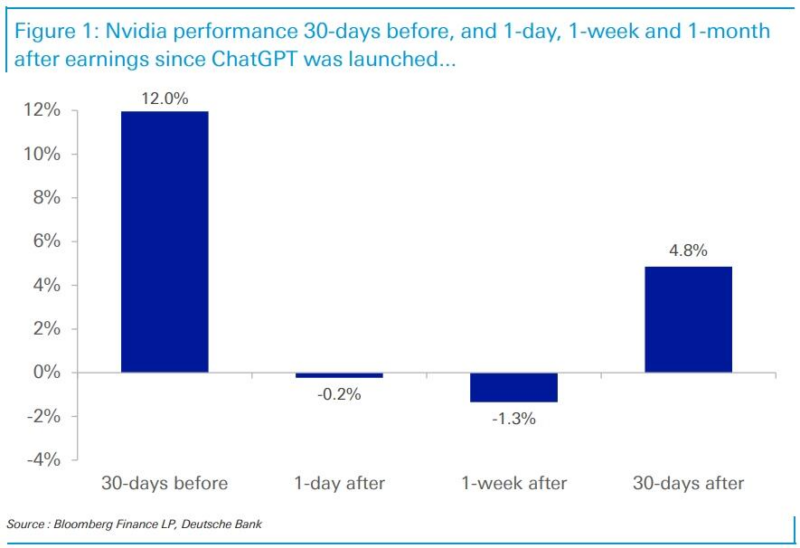

The AI Trade: Opportunity Or Warning?

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

Preiserhöhung von Amazon Prime unzulässig ️

Preiserhöhung von Amazon Prime unzulässig 👨⚖️

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

11-21-25 Why Narratives Break & Markets Correct

$SPY / $QQQ correct even in strong uptrends, but it feels worse because media panic amplifies every dip.

In this short video, I explain why big narratives like rate cuts, AI or #Bitcoin liquidity always break and why this pullback is still normal for a bull market.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Diese Jobs wird die KI erstzen

Basisberufe, repetitive Aufgaben? KI macht es besser, schneller, günstiger.

Analysten, die nur Daten auswerten, werden es schwer haben. 📉

Aber: Top-Fachkräfte, die offline agieren, strategisch denken oder dir Sicherheit geben,wird es immer geben. 💡

KI ist ein Tool, kein Grund, sich zurückzulehnen.

Wer vorbereitet ist, profitiert. Wer ignoriert, verliert.

#ki

#zukunftderarbeit

#mindset

Read More »

Read More »

11-28-25 Black Friday Special Edition

It's a cornucopia of content for this Friday following Thanksgiving, and Richard Rosso and Jonathan McCarty bemoan the demise of the U.S. Penny, the fallacy of risk tolerance questionnaires, Rich's Financial Fitness Garage and creating Retirement income; plus Rich's salutation for Thanksgiving.

0:00 - INTRO

0:44 - The Demise of the U.S. Penny

4:54 - Financial Risk Surveys - Rich & Jonathan's Scores

11:05 - Rich's Fitness Garage - Creating...

Read More »

Read More »

Userfrage: Job im Ausland, Heimkehr, Jobsuche, Familie

Ein langjähriger #Expat kommt aus dem #Ausland zurück und verliert hier bald darauf seinen hochwertigen #Job und steht mir seiner größeren Familien vor großen Herausforderungen. Ich diskutiere seine Gedanken.

-

✘ Werbung:

Mein Buch Politik für Wähler ► https://amazon.de/dp/B0F92V8BDW/

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ►...

Read More »

Read More »

Was ist eigentlich hier passiert? Der Dotcom-Crash

Emil erzählt Euch was vom Dotcom Crash der vielen Depots zwischen 2000 und 2003 richtig weh getan hat.

Read More »

Read More »

Bereust Du Deinen Sparplan? | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_wr6ohZMKPrM

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_wr6ohZMKPrM

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_wr6ohZMKPrM

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_wr6ohZMKPrM

Trade...

Read More »

Read More »

Warum du Prognosen ignorieren kannst

Warum du Prognosen ignorieren kannst 🙉

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

11-21-25 Roth Conversion Strategy: What Actually Works

Not all Roth conversions are created equal — and new research shows a clear winner.

Richard Rosso breaks down a study that modeled hundreds of thousands of retirement scenarios to determine which Roth conversion strategy performs best over a 10-year period:

• Staying in a traditional IRA/401(k) and taking RMDs

• A one-time Roth conversion

• A gradual, multi-year conversion strategy

We examine how taxes, RMDs, longevity, and investment returns...

Read More »

Read More »