Category Archive: 9a) Buy and Hold

Ab 30 sind sie im Hamsterrad gefangen

Was denkt ihr, wie viel kann man eigentlich einen Grabplatz vermieten? (Bis zum Ende schauen 😅)

Frau, Eigenheim auf Kredit, Leasing-Auto, Kind.Alle um 22:00 brav im Bett, weil morgen wieder Hamsterrad.

Keine Energie, kein Feuer, kein Leben mehr, aber Hauptsache der Rasen ist gemäht.

Bei manchen hilft nicht mehr der Lebensberater, sondern gleich der Friedhofsdirektor!

Was sie wirklich brauchen, ihnen aber niemand sagt: finanzielle Freiheit!...

Read More »

Read More »

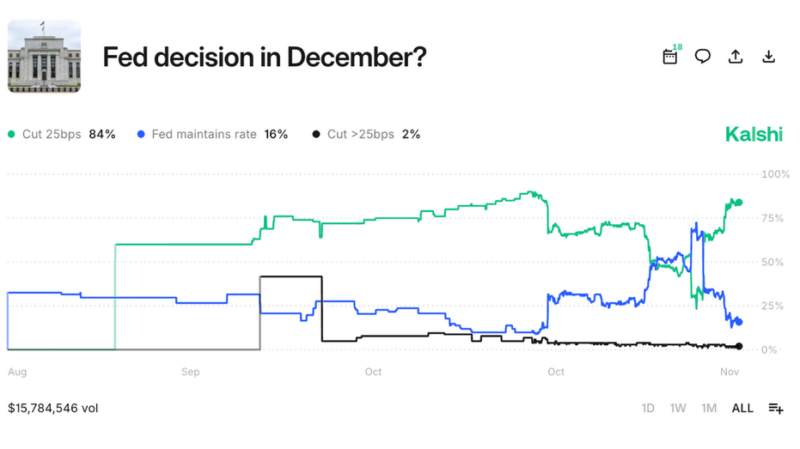

Year-End Rally Begins

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue reading...

Read More »

Read More »

Achtung diese Bußgelder gelten für Autofahrer im Winter ️

🚘 Achtung, diese Bußgelder gelten für Autofahrer im Winter ❄️

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Was ist das KISS-Prinzip?

🧠 ETFs sind dumm – und genau deshalb genial!

💡 Das KISS-Prinzip („Keep it simple, stupid“) passt perfekt zu Aktien-ETFs: Sie folgen einfach stumpf einem Index wie dem DAX oder MSCI World – ohne zu raten, welche Aktie bald durch die Decke geht.

📉 Studien zeigen: 83 % der aktiven Fonds schneiden nach 10 Jahren schlechter ab als ETFs. Nach 15 Jahren sogar 92 % weltweit!

💸 Der Grund? Aktive Fonds sind teuer und liegen oft falsch. ETFs sind dagegen:...

Read More »

Read More »

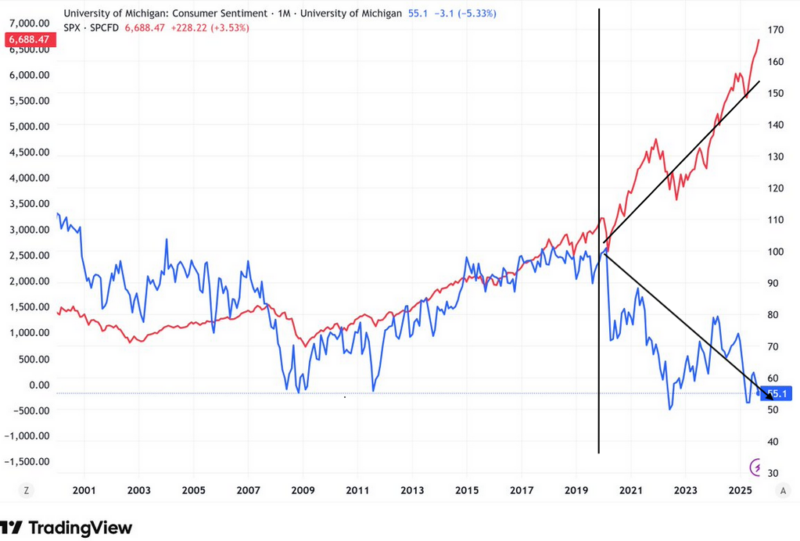

From Secular Bull To Secular Flat: The Next Likely Market Regime

We’re nearing the end of a remarkably long secular bull market.

In this short video, I explain why the next phase is usually a long period of sideways, volatile returns as valuations reset and the market shifts into a secular flat regime.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

30.000 € – Harvard

💸 Teuerste Weiterbildung: 30.000 € - Harvard.

Selbst erarbeitet. Kein Geschenk, kein Zufall. Weiterbildung ist kein Luxus. Sie ist Pflicht, wenn du dorthin willst, wo andere nur träumen hinzukommen. 👉 Lerne von denen, die schon da sind oder zahl mit deinen eigenen Fehlern den viel höheren Preis.

#mindset #finanziellefreiheit #weiterbildung

Read More »

Read More »

Probewohnen in der Schweiz – Gründe, Gedanken, Strategien – Basisinformationen für Auswanderer

Ich mache mir Gedanken, die weit über die normalen #Phantasien fürs #Auswandern hinausgehen. Mancher mag das als Angstmacherei ansehen. Doch alle #Katastrophen sind für Wissende zuvor im Ansatz erkennbar. So auch die, in die Deutschland gerade hineinschlittert bzw. hineingeschubst wird. Es wird erkennbar, dass für die Deutschen der Staat zum Gefängnis werden kann.

-

✘ Werbung:

Mein Buch Politik für Wähler ► https://amazon.de/dp/B0F92V8BDW/

Mein...

Read More »

Read More »

ETF-Steuer im Januar: Das musst Du jetzt tun – Vorabpauschale 2026

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_u2rZibfN0r8

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_u2rZibfN0r8

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_u2rZibfN0r8

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_u2rZibfN0r8

Trade...

Read More »

Read More »

“Mein Job kotzt mich an!” – aber wie gefährlich ist kündigen jetzt?

Viele von Euch kennen das Gefühl: Der aktuelle Job passt nicht mehr, Ihr seid unterfordert, verdient zu wenig oder merkt einfach, dass Euch die Arbeit nicht mehr erfüllt. Gleichzeitig macht die wirtschaftliche Lage Euch unsicher. In diesem Video ordnet Saidi ein, worauf Ihr bei Jobwechsel-Gedanken achten solltet, welche Risiken real sind und warum der Arbeitsmarkt – trotz Flaute – strukturell oft für Euch spricht.

Ihr erfahrt, wie Ihr Eure eigenen...

Read More »

Read More »

Meta verdient Milliarden mit Scams

Meta verdient Milliarden mit Scams 💰

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen...

Read More »

Read More »

Black Friday Deal: Finanzfluss Copilot PLUS 44% günstiger

Black Friday Deal: Finanzfluss Copilot PLUS 44% günstiger 🔥

Sichere dir 44% Rabatt auf Copilot PLUS, wenn du eine Jahresmitgliedschaft über unsere Website abschließt. So zahlst du im Schnitt nur 4,99€ / Monat, statt 8,99€ im regulären Monatsabo. Dieser Preis ist auch für zukünftige Verlängerungen gültig und umfasst alle kommenden PLUS Features. Nur bis zum 01.12.2025, Link in Bio!

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für...

Read More »

Read More »

The K Shaped Economy In One Graph

Tuesday's weak Consumer Confidence report was a good reminder of why some economists are calling our economy the K shaped economy. The Conference Board Consumer Confidence Index fell 6.8 points to 88.7 in November, below expectations of 93. Moreover, it sits at levels similar to those of early 2020, when the pandemic shuttered the economy. …

Read More »

Read More »

Diese ETFs sind bis zu 80% günstiger geworden

Die laufenden Kosten für ETFs werden immer günstiger. Eine Auswahl an ETFs die Finanztip empfiehlt seht Ihr hier.

Read More »

Read More »

Why Peak Confidence Is At Market Peaks

When investors feel certain and in control, risk is actually at its peak.

In this short video, @Peter_Atwater and I discuss how this “comfort zone” blinds investors to uncertainty and inflates market optimism.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Hast du schon mal von der Thanksgiving-Rally gehört?

🦃 Hast du schon mal von der Thanksgiving-Rally gehört? 📈

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #sp500 #thanksgiving...

Read More »

Read More »

So entstehen Luschen in unserer Gesellschaft

⚠️ Und 30 Jahre später machen sie den Staat dafür verantwortlich, wieso sie arm sind.

Es ist keine Schande, Schmerzen zu haben oder zu struggeln. Aber wenn du nie lernst, selbst wieder aufzustehen, wirst du erwachsen und trotzdem noch “Hilfe” schreien.

Schuld ist dann natürlich die Politik, die Steuern, das System.

= Luschen💥

#mindset

#selbstverantwortung

#investmentpunk

Read More »

Read More »

Warum wir C24 nicht mehr empfehlen

🚨 C24 Bank fliegt erstmal aus unseren Empfehlungen!

💡 Die deutsche Finanzaufsicht BaFin hat gravierende Mängel bei der C24 Bank festgestellt – vor allem bei der Geldwäscheprävention. Es gab laut BaFin sogar Verstöße gegen gesetzliche Pflichten.

🔍 Zusätzlich sieht die BaFin auch Lücken bei der Betrugsprävention – und das betrifft am Ende auch Dich: Z. B. könnten Überweisungen bei C24 strenger geprüft oder Nachweise verlangt werden.

🏦 Unsere...

Read More »

Read More »

🤧 Wie krank war Deutschland? Krankenstände nach Bundesland

Wie krank war Deutschland 2025 bisher? 🤧 Die Krankenstände im Bundesland-Vergleich.

👉 Aus welchem Bundesland kommst du? Bist du überrascht über die Quote?

Quelle: BBK Dachverband

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

Die meistverkauften Bücher Deutschlands: Platz 1 geht an…

Der Spiegel ermittelt wöchentlich die aktuellen Bestseller Deutschlands. Und diese Woche auf Platz 1 ist.... Finanztip! Mit Saidis neuem Buch "Finanzen ganz einfach". Danke für Euren Support - wir freuen uns riesig!

Read More »

Read More »

Nutella mit oder ohne Butter? 🤔

Nutella mit oder ohne Butter? 🤔

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen und...

Read More »

Read More »