Category Archive: 9a) Buy and Hold

Gehirn Kaugummi Gedankenkontrolle Gedankenhygiene – Reupload 2015

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Eins kann unser #Hirn nicht - nicht denken. Das kann auch sehr negativ sein. Man kann in seinen #Gedanken #gefangen sein. Denken Sie darüber nach worüber Sie denken wollen, wenn Sie nicht denken müssen ... ;-)

Read More »

Read More »

Beck im Fragenhagel! Mieten vs. Kaufen? Meinung zu Bitcoin? Zukunft der EU? Interview 3/3

Andreas Beck im Fragenhagel! Interview Teil 3/3

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=559&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=559&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️ Weitere Infos...

Read More »

Read More »

Setting Expectations for 2023 | Before the Bell

(1/4/23) Welcome to 2023 and a new format for our pre-market reports! A popular market axiom states, 'as go the first five days of January, so goes the rest of the year.' There was no Santa Claus Rally during the last five trading days of 2022, and the first trading day of January didn't go so well, either. Market lows were set back in October, and we said then to look for a tradable rally. We cautioned against volatility during the first two weeks...

Read More »

Read More »

Die guten Zeiten sind vorbei! ?#shorts

? https://betongoldwebinar.com/yts ?Jetzt Gratis Immobilien-Webinar ansehen!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell...

Read More »

Read More »

Part 2: Economic Disasters in 2023 – Robert Kiyosaki, @JamesRickardsProject

The U.S. is the world’s largest economy, the dollar is the world’s reserve currency, and today’s guest explains “what happens here, doesn’t stay here.”

James Rickards, author of “Sold Out: How Broken Supply Chains, Surging Inflation, and Political Instability will Sink The Global Economy” says, “We’re heading for a very severe recession.” Rickards explains how Jerome Powell and the Fed’s rate hikes will throw the economy into a recession and by...

Read More »

Read More »

Financial Resolutions that Actually Stick

(1/3/23) The watchword for 2023: "Muck." Predictions for the markets: A tough year ahead; making financial resolutions: What can you control in your household? There will be new taxes this year. Where have all the go-getters gone? Act your wage; not finding worth in work. some families can collect six-figure incomes by staying home; waking up early & making your bed; setting up an emergency fund; Secure Act 2-0: Incentivizing savings;...

Read More »

Read More »

10 Crypto Prognosen für 2023Depot update, Mindset mit Andreas Beck und Rainer Zitelmann. Bitcoin

In diesem Video mache ich 10 Prognosen für das Jahr 2023 und Crypto, in einem Jahr schauen wir was eingetroffen ist. Ich zeige auch mein derzeitiges Portfolio. Wir werden auch noch ein bisschen Mindset mit Andreas Beck und Rainer Zitelmann machen.

? Kostenlos Abonnieren: https://bit.ly/3EKCWwz

Timestamps:

0:00 Einleitung

0:27 Rainer Zitelmann

4:56 Andreas Beck

16:00 10 Prognosen für 2023

20:44 Depot Update

22:12 Mindset

27:48 Verabschiedung...

Read More »

Read More »

40 Stunden sind ein Halbtagsjob! #shorts

? https://betongoldwebinar.com/yts ?Jetzt Gratis Immobilien-Webinar ansehen!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell...

Read More »

Read More »

Andreas Beck: Macht, Renditen, Geschäftsmodelle – was Anleger jetzt über Tech-Aktien wissen müssen

Tech-Unternehmen waren die großen Verlierer 2022. Nach jahrelangem Boom ging es heftig nach unten. Dafür sind sie jetzt wieder halbwegs bezahlbar. Aber wird es an den Börsen einen neuen Tech-Boom geben? Darüber habe ich mit dem Portfolio-Manager Andreas Beck gesprochen.

» Hier meinen Newsletter bestellen: https://rene-will-rendite.com/

Read More »

Read More »

Andreas Beck – bei Immobilien ist die Hölle los #shorts

Andreas Beck - bei Immobilien ist die Hölle los #shorts #immobilien #zinsen #mietrendite

https://youtube.com/@Finanzfluss

Read More »

Read More »

Scalable Capital vs. Trade Republic: Was ist besser? Kosten, Angebot und Unterschiede im Vergleich!

Scalable Capital oder Trade Republic? Welcher Broker ist besser?

Scalable Capital Depot eröffnen: ►► https://link.finanzfluss.de/go/scalable-capital-broker *?

Trade Republic Depot eröffnen: ►► https://link.finanzfluss.de/go/trade-republic *?

ℹ️ Weitere Infos zum Video:

Wir haben für euch das Wertpapierangebot von Scalable Capital und Trade Republic miteinander verglichen. Ob es dabei einen klaren Sieger gibt und wo die Stärken des jeweiligen...

Read More »

Read More »

Deutschland im Winter 2023 – Danke für 2022

✘ Werbung:

Mein ch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Mein vierteljährliches Rundumschlag-Video fasst bisherige Entwicklungen zusammen und gibt einen dystopischen Ausblick auf die Zukunft. Nicht alles wird eintreten, aber wenn es eintritt, wird es gravierende Folgen haben.

Ich wünsche Ihnen das Beste und viel Glück für das Jahr 2023

-

Anleihekrise ► -LM6eX5TI

ifo Prof. Fuest ►

Interview Mario Lochner 1 ►

Interview Mario Lochner 2...

Read More »

Read More »

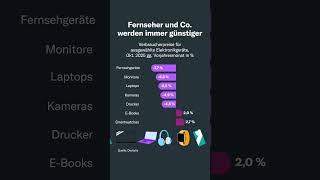

Was ändert sich 2023?

Was ändert sich 2023 aus finanzieller Sicht? Saidi geht es im heutigen Video mit Euch durch.

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Hier gehts zu den erwähnten Ratgebern:

Ratgeber Bürgergeld 2023 ►...

Read More »

Read More »

Hörbuch Allgemeinbildung: Kapitel 12/22 – Kapitalismus und Globalisierung

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

In den vergangenen Jahren macht sich in unserer #Gesellschaft eine verstärkte Kritik am Kapitalismus und der Globalisierung bemerkbar. Doch die meisten Bürger haben sich noch niemals Gedanken darüber gemacht, was ein #Rückgang der Globalisierung und dem damit verbundenen Kapitalismus für unser aller #Wohlstand bedeuten.

Fußnoten

►...

Read More »

Read More »

Jahresrückblick 2022 & Ausblick 2023 des Investmentpunk

? https://betongoldwebinar.com/yt ?Jetzt Gratis Immobilien-Webinar ansehen!

HALLO LEUTE! DANKE FÜR EIN WEITERES TOLLES JAHR MIT EUCH!

Schöne Feiertage und einen guten Rutsch, wünscht das ganze Investmentpunk-Team!

IHR SEID DIE BESTEN! ??

Hinterlasst uns einen Kommentar und erzählt uns, wovon ihr 2023 noch mehr sehen möchtet!

Wir sehen uns 2023! ??

Das Jahr 2022 neigt sich dem Ende zu. Viel ist geschehen, die Pandemie scheint auszuklingen,...

Read More »

Read More »

ChatGPT, OpenAI und unsere Zukunft, Userdiskussion

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Vergangene Woche habe ich mich bei OpenAI angemeldet und ChatGPT angewendet. Erster Eindruck: Wirklich beeindruckend. Zweiter Eindruck … viele Fehler, Abstürze und unglaublich geschwätzig. Eigentlich noch unbrauchbar, weil man sich ohne Querchecks nicht darauf verlassen kann. Ist die KI #böse?

Heute gibt es erst drei #Beispiele und dann kommentiere ich eine #Diskussion...

Read More »

Read More »

In 6 Monaten wieder günstig in Immobilien einsteigen? Immobilienentwickler vor einer Insolvenzwelle?

Andreas Beck über die Lage des Immobilienmarktes! Teil 2/3

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=557&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=557&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️...

Read More »

Read More »

Wie Du mit der Strompreisbremse ungeahnt viel sparen kannst

Ab Januar 2023 gelten die Energiepreisbremsen. Wie viel Ihr Euch damit sparen könnt und warum Energiesparen sich erst recht lohnt, rechnet, Saidi im heutigen Video mit Euch durch.

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Ratgeber Preisbremsen & Rechner ►...

Read More »

Read More »

Economic Disasters in 2023 – Robert Kiyosaki and @JamesRickardsProject

The weight of high inflation rates and quick monetary tightening have worsened the US economy's prognosis in 2023. Robert Kiyosaki invited his good friend, and financial expert to discuss what he sees for 2023. Today’s guest says his “list” is different than other experts out there as his list combines geopolitics and economics to provide a complete picture of the outlook in 2023.

James Rickards, author of “Sold Out: How Broken Supply Chains,...

Read More »

Read More »