Category Archive: 9a) Buy and Hold

4-29-24 Sucker Rally Or The Return Of The Bulls?

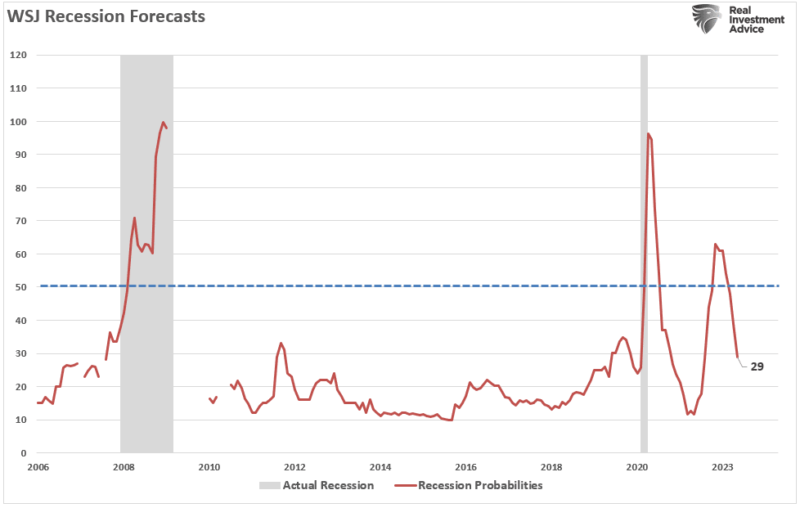

Market performance in election years is marked by investor anxiety over the outcome, and the potential for outlying risk. The FOMC Meeting this week: will the Fed halt plans for cuts, and possibily even hike rates? Expectations for strong employment numbers. Markets rally on PCE report, beginning to build a new, bullish trend. This will be a busy earnings week. When the correction comes, how you will play? The liquidity boost from tax receipts in...

Read More »

Read More »

Boeing vs. Airbus #fliegen

Boeing vs. Airbus ? #fliegen

? Marktkapitalisierung seit 1999, logarithmisch skaliert

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir...

Read More »

Read More »

Elster Online in <10 Min: Steuererklärung für 2023 selber machen! | Mein Elster Portal 2024

Steuererklärung mit Elster Online Portal einfach erklärt!

Zum Steuersoftware-Vergleich: https://www.finanzfluss.de/vergleich/steuerprogramm/ ?

Unser Steuersoftware Testsieger: ►► https://link.finanzfluss.de/go/wiso-steuererklaerung *?

Vermögen tracken mit Finanzfluss Copilot: ►► https://www.finanzfluss.de/copilot/ ?

ℹ️ Weitere Infos zum Video:

Im heutigen Video führt euch Markus Schritt für Schritt durch die Steuererklärung mit Elster.

•...

Read More »

Read More »

Wird Homeoffice uns unseren Wohlstand kosten?

? https://betongoldwebinar.com/yt ?Jetzt Gratis Immobilien-Webinar ansehen!

Keyvan Rastegar ist einer der führenden Rechtsanwälte in Österreich, Spezialist für Gesellschaftsrecht und Gründer der neuen Gesellschaftsform FlexCo. #HomeOffice, flexiblere Arbeitszeiten und Remote Arbeiten – ein Trend vor allem der jüngeren Generation seit der Pandemie. Doch ist mehr Flexibilität immer besser? Welche Auswirkungen hat die #Work-Life-Balance auf unsere...

Read More »

Read More »

Die teuersten Spritpreise Europas #tanken #auto #shorts

Im europaweiten Vergleich schneidet Deutschland bei den Spritpreisen nicht am besten ab. In welchen Ländern Du am besten mit dem öffentlichen Nahverkehr fährst zeigen wir Dir hier.

Quelle: Europäische Kommission / Destatis https://www.destatis.de/Europa/DE/Thema/Verkehr/kraftstoffpreise.html

#Finanztip

Read More »

Read More »

Fliegen wird teurer! #Luftverkeherssteuer

Fliegen wird teurer! ? #Luftverkeherssteuer

? Unter anderem aufgrund einer Erhöhung der Luftverkehrssteuer zum 1. Mai 2024. Die Steuer gilt für alle Fluggesellschaften, die aus Deutschland fliegen, und variiert je nach Flugdistanz. Es handelt sich um prozentual geringe Preissteigerungen.

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos,...

Read More »

Read More »

NEU im Finanzfluss Copilot: 2FA, Import für Bison, Parqet, CSV + PDFs & viele weitere Features!

Finanzfluss Copilot: Dein Gesamtvermögen im Überblick!

Kostenlosen Account erstellen ►► https://www.finanzfluss.de/copilot/ ?

Der Finanzfluss Copilot hat einige neue Features und andere Updates bekommen. In diesem Video schauen wir uns die genauer an.

• Finanzfluss Copilot: https://www.finanzfluss.de/copilot/

• Copilot Tutorials: https://www.youtube.com/@FinanzflussCopilot

• 2FA aktivieren:

• Generischer CSV Import:

• Scalable Capital CSV...

Read More »

Read More »

Zu viel USA im ETF? #shorts

Du bist auf der Suche nach dem richtigen ETF-Sparplan und wunderst dich, warum 71% des MSCI World aus den USA sind? Saidi erklärt Dir wie dieser hohe Anteil zu Stande kommt.

#Finanztip

Read More »

Read More »

Warum Deutschland wirklich versagt – Geschichte – Hintergründe

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Alle jammern über die schlechteste #Regierung, die wir je hatten, einen #Bundeskanzler, der im Ranking der westlichen Staaten den letzten Platz einnimmt. Doch woran liegt es wirklich, dass wir seit sieben Jahren einen wirtschaftlichen #Verfall sehen und es...

Read More »

Read More »

Special Episode: Unpacking the Trump Legal Saga – Kim Kiyosaki, Mike Davis

In this special episode of the Rich Dad Radio Show, host Kim Kiyosaki and guest attorney Mike Davis discuss the court case surrounding President Trump in New York City. They dive into the facts behind these events, highlighting the blurred lines in the nation's laws and the increasing politicization within the court system.

Mike Davis, the former Chief Counsel for Nominations to Senate Judiciary Chairman Chuck Grassley, is the founder and...

Read More »

Read More »

In diesen Städten sind die #Mieten am stärksten gestiegen #wohnen #shorts

Die Mieten steigen fast überall. Aber wo am stärksten? Leo hat die Liste der Städte dabei, wo Wohnen sich am schnellsten verteuert.

Quelle: Immowelt

Read More »

Read More »

Upcoming Tax Changes: What Happens When the Current Code Expires?

Potential tax changes looming! ? What could this mean for you? Find out more in this video. #taxes #financialplanning #changesahead

Join us as we delve into the imminent changes coming to the tax code. Understand what these adjustments mean for you and how they might impact your finances.

- Overview of the current tax code and its expiration.

- What happens if no changes are made to the tax code.

- Implications for personal tax brackets.

-...

Read More »

Read More »

#491 ETFs mit 65 – ist das zu spät? #zualtzuminvestieren?

#491 ETFs mit 65 – ist das zu spät? ?? #zualtzuminvestieren?

Beim Geld anlegen heißt es immer: Man kann nicht früh genug damit anfangen. Klar, ein langfristiger Anlagezeitraum ist hilfreich, um Vermögen aufzubauen – aber, wenn man doch erst später damit beginnt?

Kann man selbst oder seinen Eltern oder Großeltern empfehlen, auch noch jenseits der 50, 60 oder 70 in den Aktienmarkt einzusteigen oder ruiniert man sich so möglicherweise sogar die...

Read More »

Read More »

5 Entscheidungen, von denen Dein Wohlstand abhängt

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_ujUsw_T04X4

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_ujUsw_T04X4

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_ujUsw_T04X4

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_ujUsw_T04X4

Justtrade

Traders Place* ►...

Read More »

Read More »

4-26-24 Are You Prepared for Higher Taxes?

Markets & Earnings Recap, PCE Preview: What is the Fed going to do? Tesla takes it on the chin; Mortgage rates and home prices are on the rise; are homeowners feeling trapped? How far will your money go in retiremetn? Higher taxes are coming; who'll pay the most? Training for Retirement: How to flip the switch from accumulation to de-cumulation; living without that paycheck. Budgeting and spending planning: Where does the money go? Compounding...

Read More »

Read More »

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

Understanding Real GDP: The Critical Role of Inflation and PCE

Understanding the impact of inflation on GDP and data calculations is crucial. The right inflation number remains uncertain, affecting various economic indicators. #inflation #gdp

Explore the intricate relationship between real GDP and inflation in our latest video with guest expert Michael Lebowitz. Dive deep into the economic indicators that affect your daily life and understand their real impact.

- The significant role of Personal...

Read More »

Read More »

Hier ist Wohnen günstiger geworden

Nicht überall steigen die Mieten: An manchen Orten sind sie in den letzten Jahren gesunken. Für dieselbe Miete bekommst Du dort jetzt mehr Fläche. Welche Orte das sind, verrät Dir Saidi.

Read More »

Read More »

Bestellst du häufig bei Amazon? #amazon

Bestellst du häufig bei Amazon? ? #amazon

? Diese neue Einschränkung gilt ab Ende April für alle: Ab dem 25.04.müssen Kunden schneller entscheiden, ob sie ihre Waren behalten wollen.

Denn Amazon verkürzt die Rückgabefrist von 30 auf 14 Tage. Diese Änderung betrifft vor allem Elektronik, Kameras, Bürobedarf, Musik, Filme und Videospiele. Amazon-Geräte und erneuerte Produkte sind von dieser Neuregelung noch ausgenommen. Der Versandriese betont, dass...

Read More »

Read More »

Schlechte Geldanlagen loswerden | Geld ganz einfach

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_j_PKxOCvSmI

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_j_PKxOCvSmI

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_j_PKxOCvSmI

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_j_PKxOCvSmI

Justtrade

Traders Place* ►...

Read More »

Read More »