Category Archive: 9a) Buy and Hold

Ehegattensplitting vs. Steuerklasse 3/5: Unterschied? Wie viel Steuern durch heiraten sparen?

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_bJjVCt799ss

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_bJjVCt799ss

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_bJjVCt799ss

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_bJjVCt799ss

Justtrade

Traders Place* ►...

Read More »

Read More »

Escaping the 9-to-5 with Real Estate – Tyler Jorgenson, Deyl Kearin

In this episode of the Rich Dad Radio Show, guest host Tyler Jorgenson interviews Deyl Kearin, a successful real estate investor who has applied the principles from Robert Kiyosaki's 'Rich Dad Poor Dad' to build a robust portfolio. Deyl discusses his investments ranging from multifamily properties to spec houses, his entrepreneurial journey, the importance of financial literacy, and balancing career with family life. Tune in to learn his strategies...

Read More »

Read More »

Krise bei Varta spitzt sich zu! ? #varta

Krise bei Varta spitzt sich zu! ? #varta

? Mit diesem Tool kannst du Haushaltsgeräte und ihren Stromverbrauch vergleichen. Denn ein günstiger Anschaffungspreis bei Neugeräten heißt nicht immer, dass man wirklich spart.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen und eigene, fundierte, finanzielle Entscheidungen zu treffen. Folge uns, um keine Videos mehr zu verpassen!...

Read More »

Read More »

7-24-24 How to Invest, or not, in a Presidential Election

Trump Hasn’t Won the Election Yet. The Stock Market Is Acting Like He Already Has. Lance Roberts & Danny Ratliff discuss what-if's and which sectors to watch...either way. Plus, which strategy wins the Retirement Spending smack-down, and why you need to plan to spend-down your retirement nest egg.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Planner, Danny Ratliff, CFP

Produced by Brent Clanton,...

Read More »

Read More »

Günstig Urlaub machen – Preise in Hotels und Gaststätten im Vergleich zu Deutschland ️ #urlaub

Günstig Urlaub machen - Preise in Hotels und Gaststätten im Vergleich zu Deutschland ?️ #urlaub

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff...

Read More »

Read More »

39 Cent mehr beim Tanken zahlen?

Gerade bei längeren Road-Trips, ist Tanken an der Autobahn-Tankstelle die bequemste Lösung. Einfach kurz von der Autobahn, Tanken und weiter gehts. Warum Du an Autobahn-Tankstellen aber oft mehr Geld ausgibst, erfährst Du von Xenia.

#Finanztip

Read More »

Read More »

Why Wall Street’s Earnings Predictions Often Miss the Mark

Wall Street's expectations for earnings growth are historically overly optimistic. With the economy slowing down, companies making money now may not make sense. #WallStreet #EarningsGrowth

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Challenges and Opportunities in the Future of Oil and Gas – Mike Mauceli, Karr Ingham

Join Mike Mauceli on the Energy Show with REI Energy as he discusses the economic outlook for oil and gas investors with Karr Ingham, the newly appointed President and Petroleum Economist of the Texas Alliance of Energy Producers. They delve into the impact of politics, including the Biden administration's stance on fossil fuels and Trump's recent speech on energy, on the oil and gas industry. Karr Ingham shares insights on the importance of...

Read More »

Read More »

Stell dir vor du hast im Lotto gewonnen! #lotto

Stell dir vor du hast im Lotto gewonnen! ? #lotto

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Software auf meinem Linux-PC

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Was braucht man täglich für #Software auf seinem #Linux Rechner und was kommt mit den #Distributionen mit? Ich stelle die von mir verwendete Software auf meinen Linux-Rechner vor.

-

Mein Schnitt PC ► -mmBhzk

Meine Linux Distro ► https://youtu.be/-k3YPAlETQM...

Read More »

Read More »

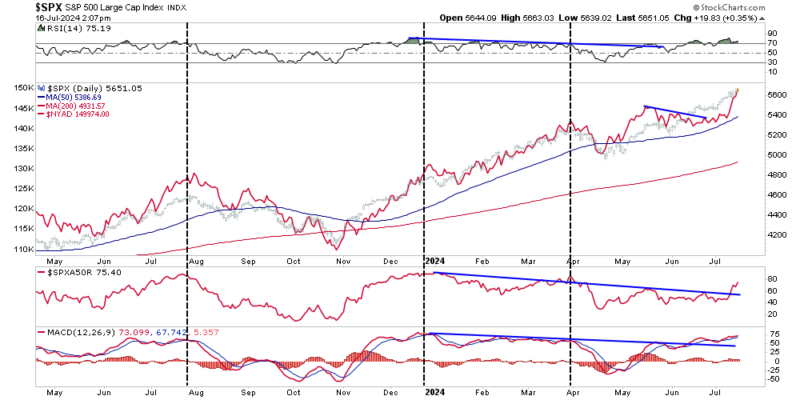

7-23-24 Is the Bull Market Just Getting Started?

Since the beginning of this year, the “bad breadth” issue has been a concern for the current bull market rally. Historically speaking, periods of narrow market advances typically precede short-term corrections and bear markets. However, as the Federal Reserve prepares to cut rates for the first time since 2020, there seems to be a change afoot.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisot,...

Read More »

Read More »

Wie viel Einkommen macht glücklich? Wie viel maximal sparen? Eure Meinungen & Erfahrungen

Wie viel Geld macht eigentlich glücklich? Dazu gibt es zwar viele Studien, aber für alle allgemeingültig gelten die natürlich nicht. Deshalb wollen Xenia und Saidi von Euch wissen: Was ist für Euch der Betrag zum Glück? Wie viel Geld habt Ihr, seid Ihr damit glücklich – und warum?

Tragt Eure Meinung dazu vorab hier ein: https://finanztip.typeform.com/to/mIu53bFm?utm_source=lsdescription

Depot-Vergleich 2024: Die besten Broker & Aktiendepots...

Read More »

Read More »

The Bull Market – Could It Just Be Getting Started?

We noted last Friday that over the previous few years, a handful of “Mega-Capitalization” (mega-market capitalization) stocks have dominated market returns and driven the bull market. In that article, we questioned whether the dominance of just a handful of stocks can continue to drive the bull market. Furthermore, the breadth of the bull market rally has remained a vital concern of the bulls.

Read More »

Read More »

Tricks der Vermieter

Die Mietpreisbremse soll uns vor ungerechtfertigt hohen Mieten schützen. Es gibt aber Wege, über die Vermieter:innen diese umgehen. Xenia erklärt Dir wie.

#Finanztip

Read More »

Read More »

How AI Will Impact Your Investment Strategy – Andy Tanner, Del Denney

In this episode, host Del Denney and Rich Dad Wealth Expert Andy Tanner explore the rise of artificial intelligence in investment strategies. Del and Andy discuss how AI is transforming trading, the limitations and potential of AI-driven tools, and the importance of solid financial education.

They also address future trends, regulations, and how investors can leverage AI by owning technology stocks. Tune in to gain valuable insights on navigating...

Read More »

Read More »

7-22-24 Analyzing the Potential Impact of a Kamala Harris Presidency

Lance discusses the markets' potential reaction to Biden's exit from Presidential race, and whether markets' rotation out of mega-cap stocks is sustainable; a rewind to February market conditions compared to now: A correction is expected before the election. Commentary on keeping market corrections into context; the mega-cap rotation and fewer medium- and small-cap companies from which to choose: 40% of these are unprofitable companies. As...

Read More »

Read More »

Analyzing the Potential Impact of a Kamala Harris Presidency

What does the market anticipate with a potential Kamala Harris presidency? ?? #Election2024 #KamalaHarris #MarketTrends

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Häuser und Wohnungen sind teuer… ️ #immobilien

Häuser und Wohnungen sind teuer... ?️ #immobilien

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »

Sind Aktien wie ein Casino? #casino

Sind Aktien wie ein Casino? ? #casino

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Diese 10€ solltest Du diesen Sommer unbedingt investieren

Du willst bei Deinem Urlaub böse Überraschungen vermeiden? Dann ist eine Auslandsreisekrankenversicherung ein absolutes Muss. Warum das so ist, erfährst Du in diesem Video.

#Finanztip

Read More »

Read More »