Category Archive: 9a) Buy and Hold

Schlechte Geldangewohnheiten #dasgehtbesser

Schlechte Geldangewohnheiten 😡 #dasgehtbesser

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

So krass ist die deutsche Wirtschaft

Deutschland allein = 10 Länder zusammen 😳

📊 Das deutsche Bruttoinlandsprodukt (BIP) lag 2024 bei rund 4.300 Mrd. €

📊 Genauso viel wie die 10 Länder in der Grafik zusammen – darunter z. B. Schweden, Polen, Österreich oder Tschechien.

💡 Deutschland ist wirtschaftlich richtig stark – und das zeigt, wie wichtig es ist, sich mit dem eigenen Geld in dieser Wirtschaft mitzubewegen.

👉 Heißt: Investieren in ETFs mit Deutschland-Anteil = Beteiligung an...

Read More »

Read More »

Das ändert sich 2026 für Verbraucher: Temu, Klarna & Co

Das ändert sich 2026 für Verbraucher: Temu, Klarna & Co 💸

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Zu viel US-Dollar im MSCI World?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_5__sZMbuVTc

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_5__sZMbuVTc

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_5__sZMbuVTc

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_5__sZMbuVTc

Trade...

Read More »

Read More »

So viel kostet eine Immobilie wirklich

Baufinanzierung: Mit Bestzins zur Traumimmobilie

Interhyp ► https://www.finanztip.de/link/interhyp-baufi-text-youtube/yt_4g6ElU43Iwk

Baufi24 ► https://www.finanztip.de/link/ baufi24-baufi-text-youtube/yt_4g6ElU43Iwk

Dr. Klein ► https://www.finanztip.de/link/ drklein-baufi-text-youtube/yt_4g6ElU43Iwk

Hüttig & Rompf

Hypofriend ► https://www.finanztip.de/link/ hypofriend-baufi-text-youtube/yt_4g6ElU43Iwk

📕 Jetzt Sadis Buch bestellen ►...

Read More »

Read More »

So steht Finanztip zu Krypto

Findet Finanztip Krypto schlecht? Nope – aber auch nicht gut. 🟡

💡 Bitcoin & Co. sind spekulative Anlagen. Heißt: Es kann raufgehen – aber auch richtig runter.

📉 Deshalb gilt unsere Faustregel:

👉 Max. 10 % Deines Vermögens in spekulative Anlagen wie Bitcoin oder Einzelaktien

👉 Wenn Krypto, dann nur Bitcoin – keine Altcoins

👉 Und nur mit Geld, das Du zu 100 % verlieren könntest

🟡 Krypto ist auf unserer Finanztip-Ampel gelb – nicht grün, nicht...

Read More »

Read More »

Strom, Gas & CO2: Das ändert sich 2026 beim Wohnen und Tanken

Strom, Gas & CO2: Das ändert sich 2026 beim Wohnen und Tanken 🏡

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Top 3 Wege, um Zeit zu sparen (für ALLE)

Zeit sparen ist kein Luxus der Reichen, es ist eine Strategie für dich HEUTE!

Multimillionäre machen es, aber du kannst es genauso:

👉 Reinigungskraft holen statt selbst schrubben.

👉 Im Restaurant essen, statt Stunden mit einkaufen, kochen und abwaschen verschwenden.

👉 Assistent für Administrative, bevor du im Papierkrieg untergehst.

👉 Wohnung im Zentrum und kein ewiglanges Pendeln aus der Pampa.

Die Mittelschicht verschwendet ihr ganzes...

Read More »

Read More »

Trotz Job arm?

Vollzeit arbeiten – und trotzdem arm? Das ist in Europa Realität. 😔

📊 In vielen EU-Ländern sind über 10 % der Erwerbstätigen armutsgefährdet:

🇩🇪 Deutschland: 6,5 %

🇫🇷 Frankreich: 8,3 %

🇮🇹 Italien: 10,2 %

🇪🇸 Spanien: 11,2 %

🇮🇪 Irland: ganze 13,4 %

💡 Armutsgefährdet heißt: Trotz Job reicht das Geld nicht für ein Leben ohne finanzielle Sorgen – oft wegen Mini-Jobs, schlechter Bezahlung oder zu hoher Lebenshaltungskosten.

💬 Arbeit allein schützt...

Read More »

Read More »

In einer Minute alles erfahren, um fürs Alter vorzusorgen! #vorsorge

In einer Minute alles erfahren, um fürs Alter vorzusorgen! 📈 #vorsorge

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Estate Planning Essentials

Estate Planning Essentials: Protecting Your Legacy Estate planning has a reputation for being complicated, uncomfortable, and easy to delay. That’s a problem; when life moves fast, an outdated estate plan can create confusion, conflict, and unnecessary costs for the family members you care about most. Solid planning replaces guessing with clarity. If you have a …

Read More »

Read More »

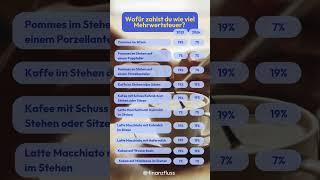

Mehrwertsteuer in der Gastronomie

Ab 2026 sinkt die Mehrwertsteuer in der Gastronomie von 19% auf 7%.🍕🍝 Es gibt allerdings ein paar Ausnahmen. 🍟☕️

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt...

Read More »

Read More »

Der Unterschied zwischen Sparen und Investieren

Sparen ist nicht gleich investieren – und das kostet Dich richtig Geld! 💸

📊 200 € monatlich auf dem Sparkonto (2 % Zinsen):

➡️ Nach 40 Jahren: ca. 146.000 €

📈 200 € monatlich in einen weltweiten ETF (6 % Rendite):

➡️ Nach 40 Jahren: ca. 380.000 €

💡 Und das ist vor Inflation! Bei 2 % Inflation pro Jahr ist Dein Geld in 40 Jahren nur noch halb so viel wert.

👉 Du brauchst Rendite, um Vermögen aufzubauen – und die bekommst Du nur, wenn Du...

Read More »

Read More »

Benefits Of Fee-Only Financial Advisors

Benefits of Fee‑Only Financial Advisors: Why It Matters Navigating your financial future takes more than a few online calculators and a diversified portfolio. For high-net-worth families and business owners, the person you trust to manage your wealth carries significant influence over your outcomes. Yet not all financial advisors operate with the same incentives or responsibilities. …

Read More »

Read More »

MSCI World: USA-lastig aber nicht USA-abhängig

MSCI World: USA-lastig, aber nicht USA-abhängig 🇺🇸🌍

Viele denken: „Im MSCI World sind nur US-Firmen – das ist doch viel zu riskant!“ Aber: Die größten Unternehmen im Index verdienen längst weltweit 👇

📈 Apple macht 64 % seines Umsatzes außerhalb der USA

📈 Alphabet 51 %, Microsoft 49 %, Nvidia 53 %

📈 Sogar Broadcom kommt auf 75 %

💡 Heißt: Auch wenn der MSCI World viele US-Firmen enthält, ist Dein Geld trotzdem international gestreut – weil diese...

Read More »

Read More »

Deal oder kein Deal: Arbeiten zu Weihnachten?

Finanzielle Freiheit kommt nicht vom Christkind!

Geld verdienen während alle Weihnachtslieder singen? Biszum Ende schauen!

Aber ehrlich: Die „Stille Nacht“ gehört der Familie.

👉 Nachdenken, planen, Klarheit schaffen.

#weihnachten

#immobilien

#finanziellefreiheit

Read More »

Read More »

Macht Ordnung reich?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_jJH37V-ThJc

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_jJH37V-ThJc

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_jJH37V-ThJc

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_jJH37V-ThJc

Trade...

Read More »

Read More »

Ihr wollt es, ihr kriegt es: Krypto

Bitcoin? Blockchain? Altcoins? 🤯 Keine Sorge – wir erklären’s Dir!

💰 Krypto klingt spannend, aber Du blickst nicht durch? Dann ist unser neuer Kurs in der Finanztip Academy genau richtig für Dich!

📚 Dort lernst Du:

🔹 Wie Blockchain & Bitcoin funktionieren

🔹 Was Altcoins von Bitcoin unterscheidet

🔹 Wie Du investieren kannst – aber nicht musst

💡 So kannst Du selbst entscheiden, ob Krypto was für Dich ist – ohne Hype, ohne Bullshit.

⬇️ Teil den...

Read More »

Read More »

Wofür geben Deutsche ihr Geld aus? #konsum

Wofür geben Deutsche ihr Geld aus? 💶 #konsum

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Süßigkeiten: Preisexplosion im Advent

Plätzchenpreise auf Rekordhoch 🍪💥

📈 Seit 2020 sind die Preise für Süßes massiv gestiegen – besonders vor Weihnachten!

🍪 Kekse sind Spitzenreiter mit einer Preissteigerung von fast +90 %

🍫 Schokolade und andere Süßwaren liegen deutlich über dem Durchschnitt

🛒 Die allgemeinen Verbraucherpreise sind im Vergleich dazu nur moderat gestiegen

💡 Adventszeit = Hochsaison für Teuerungen. Wer Geld sparen will, sollte Süßes früh einkaufen – oder selbst...

Read More »

Read More »