Category Archive: 9a) Buy and Hold

Dealmaking Masterclass macht dich reicher

Kurze Antwort: Ja. Sonst würden sich Millionäre nicht anmelden.

Wir nennen es nicht umsonst das „Multimillionär-Studium“.

9 Monate Mentoring.

Direkt von Profi-Investoren, Multimillionären und Ultra High Net Worth Individuals.

👉 Nur 30 Teilnehmer pro Masterclass.

Kein Massenkurs, kein Gelaber. Sondern persönliches Coaching von mir und meinem Team, echte Deals, echtes Netzwerk.

Wenn du mitarbeitest, Fragen stellst, umsetzt und das Netzwerk nutzt,...

Read More »

Read More »

Userfrage: Geldanlage 2026, Vermögensaufbau, Diversifikation, Crash

Ein Zuseher (21J) fragt mich, warum man überhaupt zwischen verschiedenen #Anlageklassen diversifizieren soll. Die höchste #Wertsteigerung ist ja mit Aktien zu erwarten und eine breite #Streuung in Aktien via #ETF sei ja wohl ausreichend.

-

✘ Werbung:

Mein Buch Politik für Wähler ► https://amazon.de/dp/B0F92V8BDW/

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch...

Read More »

Read More »

Doppelte Rendite durch Hebel?

🚀 Doppelte Rendite mit Hebel-ETFs? Klingt gut – hat aber einen Haken!

📈 Hebel-ETFs (z. B. mit Faktor 2) verdoppeln die Bewegung des Index – nach oben und nach unten.

💥 Problem: Volatility Drag – bei Schwankungen kommt der ETF oft nicht mehr ganz auf seinen alten Wert zurück.

📉 Beispiel: Markt erholt sich, Hebel-ETF hinkt hinterher.

💸 Dazu kommen: höhere Zinskosten seit 2022, weil sich Hebel-ETFs Geld leihen müssen.

💡 Hebel-ETFs sind kein Tool für...

Read More »

Read More »

Krankenkasse wird 2026 richtig teuer? Das solltest Du tun

Deine Krankenkasse erhöht 2026 die Beiträge? Damit bist Du nicht allein! Was Du jetzt tun solltest

Read More »

Read More »

Gerd Kommer, wann kommt der Crash?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_1zMMVJCwkcc

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_1zMMVJCwkcc

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_1zMMVJCwkcc

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_1zMMVJCwkcc

Trade...

Read More »

Read More »

Die Pendlerpauschale steigt in 2026

Pendeln nervt – aber jetzt gibt’s mehr Geld zurück 🚗💸

📅 Ab 1. Januar 2026 steigt die Pendlerpauschale auf 38 Cent – ab dem 1. Kilometer!

📉 Bisher galt: 30 Cent bis 20 km, 38 Cent erst ab dem 21.

📊 Beispiel: Bei 10 km einfacher Arbeitsweg an 220 Tagen im Jahr = 176 € mehr Werbungskosten

🚲 Gilt für alle Verkehrsmittel – egal ob Auto, Bahn oder Fahrrad!

💡 Wichtig: Du musst mit allen Werbungskosten über 1.230 € kommen, sonst greift nur die...

Read More »

Read More »

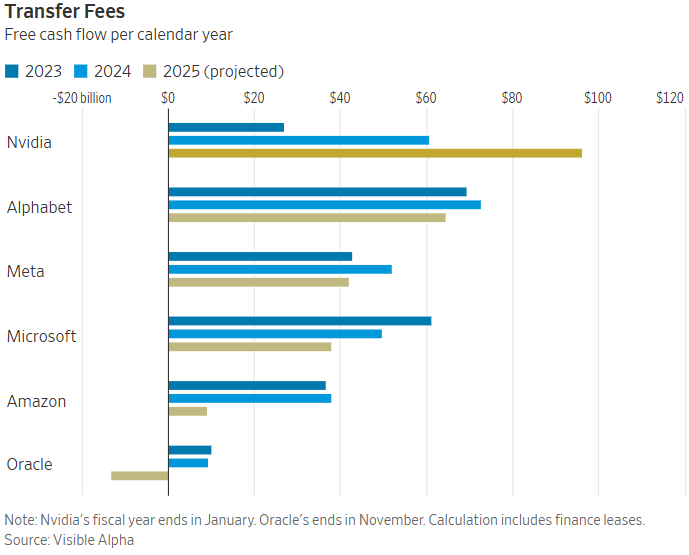

Nvidia’s Cash Strategy Reflects Regulatory Landscape

Nvidia’s explosive growth has created a new challenge: how to deploy an unprecedented amount of cash in a world where scale itself has become a regulatory constraint. The chart below, from The Wall Street Journal, illustrates Nvidia’s massive free cash flow growth. However, traditional uses of its cash, such as large acquisitions, are increasingly difficult …

Read More »

Read More »

Die 9 beliebtesten Reiseländer der Deutschen in 2025

🛫 Die 9 beliebtesten Reiseländer der Deutschen in 2025

👉 Welches Reiseziel habt ihr für 2026 im Visier? Schreibt es in die Kommentare.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine...

Read More »

Read More »

Welche Finanzgeschenke kannst Du dieses Jahr verschenken?

Diese 3 Finanz-Geschenke würde ich sofort noch mal verschenken 🎁💸

1️⃣ ETF-Sparplan: Das perfekte Geschenk für Kinder, Nichten, Neffen & Co. Wer früh investiert, profitiert vom Zinseszinseffekt.

2️⃣ Steuersoftware-Abo: Klingt trocken, bringt aber im Schnitt über 1.000 € Rückzahlung. Praktisch und extrem nützlich!

3️⃣ "Finanzen ganz einfach" von Saidi: Ein Buch, das Finanzen endlich verständlich macht – für alle, die sich sonst nie...

Read More »

Read More »

Das 1. Mal Privatjet geflogen

✈️ Denkst du, war ich sehr jung damals? Mein erstes Mal Privatjet: Mitte 30. Zeit ist das Einzige, was du nicht vermehren kannst. Deshalb hab ich früh gelernt: Zeit kaufen, statt stundenlang am Gate verschwenden. #investmentpunk#zeitistgeld #finanziellefreiheit

Read More »

Read More »

Market Volatility Strategies For Investors

Navigating Market Volatility: Strategies for Confident Investing Market volatility has a way of feeling personal. One week your investment portfolio looks steady; the next it’s down, headlines are loud, and every conversation sounds like a prediction. That emotional whiplash is normal. Panic selling is what turns temporary price volatility into permanent damage. For high-net-worth families …

Read More »

Read More »

Sobald du dein Gehalt bekommst, solltest du diese Dinge tun! #todos

Sobald du dein Gehalt bekommst, solltest du diese Dinge tun! 💸 #todos

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Mehr Netto vom Brutto? Die Freibeträge werden angepasst. 🧮

Mehr Netto vom Brutto? Die Freibeträge werden angepasst. 🧮

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Sind Dividenden ein kostenloser Money Hack?

Dividenden-Hack? Leider nein 💸

🎯 Die Idee: Aktie kurz vor Dividende kaufen, kassieren, verkaufen – klingt wie geschenktes Geld.

📉 Die Realität: Am Ex-Dividenden-Tag fällt der Kurs in der Regel genau um die Dividendenhöhe.

💰 Dazu kommen: Transaktionskosten & Abgeltungssteuer – das kann Deine Rendite fressen.

💡 Dividenden sind kein Trick, sondern ein Teil Deiner langfristigen Rendite. Den Zinseszinseffekt nutzt Du nur, wenn Du investiert...

Read More »

Read More »

Die Beitragsbemessungsgrenzen steigen – was das für dich heißt

Die Beitragsbemessungsgrenzen steigen - was das für dich heißt 📈

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Diese Branchen streichen die meisten Arbeitsplätze

In diesen Branchen wackeln gerade die Jobs 💼📉

📊 Die Industriebranche steckt unter Druck: Viele Unternehmen bauen massiv Stellen ab.

🚗 Autobranche ist Spitzenreiter mit -6,3 % weniger Beschäftigten in nur einem Jahr!

🔧 Auch Metall, Maschinenbau und Elektronik trifft es hart.

🥫 Nur eine Branche legt zu: die Nahrungsmittelindustrie mit +1,8 % neuen Jobs.

💡 Für Deine Karriere heißt das: Umschauen lohnt sich – manche Branchen schrumpfen, andere...

Read More »

Read More »

Kleine Depots investieren am stärksten in Einzelaktien 🇩🇪 #depot

Kleine Depots investieren am stärksten in Einzelaktien 🇩🇪 #depot

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Emil rankt Finanz-Fails aus der Community

Blindranking zu den größten Finanz-Fails 😬

📉 Wir haben euch nach euren schlimmsten Geldfehlern gefragt – und ich, Emil von Finanztip, hab sie für euch gerankt! Von harmlos bis richtig bitter:

1️⃣ Glücksspiel (ganz klar)

2️⃣ Schneeballsystem + Liebesbetrug 😵💫

3️⃣ Heiraten (no offense!)

4️⃣ Geld auf dem Sparbuch (geht besser)

5️⃣ Zu spät mit dem Investieren angefangen

Und Emils persönlicher Fail?

💸 Motorradführerschein und Motorrad statt...

Read More »

Read More »