Category Archive: 9a) Buy and Hold

Das ändert sich bei Payback zum Jahreswechsel

Auch bei Payback ändern sich ab 2025 ein paar Dinge. Wer kommt neu dazu und welche Unternehmen steigen zum Jahreswechsel bei Payback Pay aus? Leo hat hier die wichtigsten News, die dann ab Anfang nächsten Jahres gelten.

#Finanztip

Read More »

Read More »

20 Jahre nur Verluste möglich?

? Würdest du auch bei jahrelang ausbleibenden Renditen ruhig bleiben? Kommentiere.

Ausschnitt aus:

?Gründer Stories & Interviews von @robertheineke

Read More »

Read More »

How This Election Will Reshape America’s Economy – John MacGregor

In this episode of Full Disclosure, host John MacGregor addresses the sweeping changes following the recent election, highlighting Donald Trump's historic political comeback and Kamala Harris' defeat. MacGregor discusses the economic implications of the election, including a renewed emphasis on capitalism, the Constitution, and the rule of law.

00:00 Introduction

00:46 Turning the Page: A New Era

02:18 Election Aftermath: Economic Outcomes

02:47...

Read More »

Read More »

? Mehr Hubraum statt Wohnraum

Warum wirken andere reicher, obwohl ihr Gehalt ähnlich ist? ? Es könnte an etwas liegen, das du bisher übersehen hast ...

Read More »

Read More »

Super Micro Is Not So Super Anymore

Super Micro Computer Inc. (SMCI) was the market's darling only six months ago. Amazingly, Its stock, had risen 3x in just the first three months of 2024. Consequently, S&P Global announced its addition to the S&P 500 Index. The announcement is annotated below with a box in early March. Furthermore, the circle, which coincides with …

Read More »

Read More »

Arbeiten wir in Deutschland zu wenig? ⏰ #arbeitszeit

Arbeiten wir in Deutschland zu wenig? ⏰ #arbeitszeit

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

How to Protect Your Investments & Spot Market Opportunities – Andy Tanner, Del Denney

In this episode of Rich Dad's Stockcast, host Del Denney and guest Andy Tanner dive into the powerful ARMOR framework (Advanced Risk Management and Opportunity Readiness). They explore how investors can manage risks and spot key opportunities in the market. Key topics include understanding market crashes, maintaining temperament during volatile times, and the importance of financial education.

Free Training with Andy Tanner:...

Read More »

Read More »

Strategies to Pocket Gains and Reduce Investment Risk in Any Market

Wouldn't you rather put some money in your pocket after tax? ?? #TaxTips #FinancialPlanning #MoneyMatters

Watch the entire show here: https://cstu.io/c19f49

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

So zahlt Dir der Staat einen Teil Deiner Miete

Hast Du schon mal von Wohngeld gehört? Ob Du Wohngeld beantragen kannst und was Du dafür tun musst, das erfährst Du hier von Leo.

#Finanztip

Read More »

Read More »

Understanding Market Peaks: Why Broad Participation Could Be a Red Flag

? Wise words from Sam Stovall at S&P ? When everyone's bought in, who's left to buy? Broad participation can be bullish but also a warning sign. #InvestingTips

Watch the entire show here: https://cstu.io/993271

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Assessing Debt Reduction Strategies in Today’s Economic Climate

Discussing the current economic environment and future predictions. Where are we headed? No other option? Demographics play a big role! ?? #EconomyTalks

Watch the entire show here: https://cstu.io/0dc8d7

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Nebenberuflich zum Erfolg

Viele träumen davon, den Job zu kündigen und selbst zu gründen – doch ist das wirklich der beste Weg? ?

Ausschnitt aus:

?Gründer Stories & Interviews von @robertheineke

Read More »

Read More »

Social Media vs. Realität

Fühlst du dich oft so, als hätten andere mehr Geld, mehr Erfolg und ein aufregenderes Leben? Social Media zeigt oft nur die besten Momente – was wir sehen, ist eine geschönte Version der Realität. ✨ Lass dich nicht von dieser Illusion täuschen und bleib auf deinem eigenen Weg!

Read More »

Read More »

AstraZeneca vs. Pfizer #marketcap

AstraZeneca vs. Pfizer ? #marketcap

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen...

Read More »

Read More »

ETF-Wechsel: So SPARST du Geld und maximierst deine Erträge!

Lohnt es sich, den ETF zu wechseln trotz Steuern und Gebühren?

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=815&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Vermögen tracken mit Finanzfluss Copilot: ►► https://www.finanzfluss.de/copilot/ ?

ℹ️ Weitere Infos zum Video:

In diesem Video überprüfen wir, unter welchen Umständen es sich lohnt, den ETF zu...

Read More »

Read More »

Saidis Fails & Tipps aus 25 Jahren Börse

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_NaHEYrUbcyk

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_NaHEYrUbcyk

Trade Republic

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_NaHEYrUbcyk

Justtrade

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-yt/yt_NaHEYrUbcyk

Flatex* ►...

Read More »

Read More »

Eigenheim oder Miete: Wann lohnt sich was? ?

Der Immobilienmarkt ist voller Optionen – aber was passt wirklich zu dir? Erfahre, wie du die richtige Wahl für deine Lebenssituation triffst! ??

Read More »

Read More »

Election Over. Now What For The Market.

Inside This Week's Bull Bear Report S&P 6000...Already? Last week, we discussed the expected derisking heading into an uncertain election. "There is an important lesson in this week's action. Over the last several weeks, we have warned about the weakening of momentum and relative strength and the triggering of the MACD 'sell signal.' However, many …

Read More »

Read More »

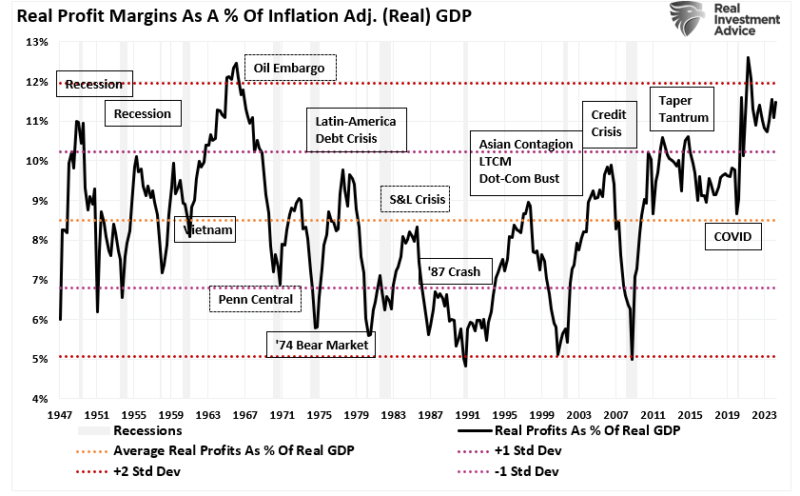

Drohen bald magere Börsenjahre?

? Wie sieht die Zukunft der Renditen wirklich aus? Während 7 % Rendite in der Vergangenheit oft erreichbar waren, könnten die Aussichten heute anders aussehen ?

Read More »

Read More »

Effective Strategies for Managing Risk in Stock Trading

Focus on smart risk management when trading stocks. It's not about capturing every bit of upside, but creating wealth along the way. ? #StockMarket

Watch the entire show here: https://cstu.io/d206e1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »