Category Archive: 9a) Buy and Hold

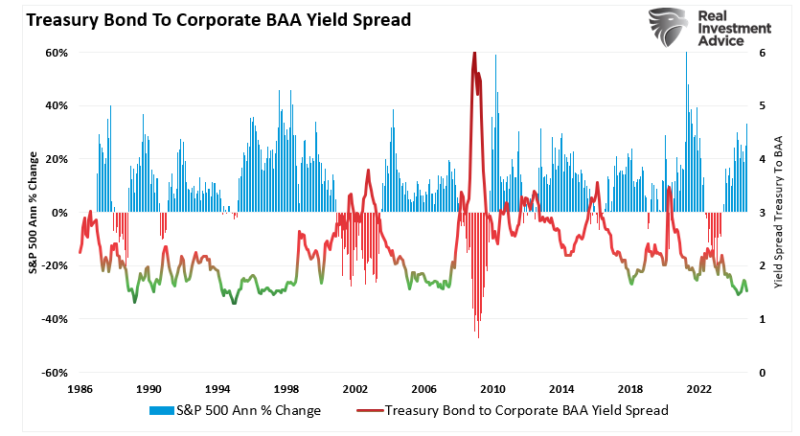

11-26-24 Why Credit Spreads Matter

Credit spreads can greatly assist in determining the risk of a correction or bear market by reflecting the perceived risk of corporate bonds compared to government bonds. The spread between risky corporate bonds and safer Treasury bonds remains narrow when the economy performs well. This is because investors are confident in corporate profitability and are willing to accept lower yields for higher risks. Conversely, during economic uncertainty or...

Read More »

Read More »

The 3-3-3 Rule

Donald Trump nominated seasoned hedge fund manager Scott Bessent as the next Treasury Secretary. While the Treasury Secretary has many responsibilities, debt management is one of the most important. Therefore, given the recent scrutiny the bond market has been paying to high deficits and associated debt, Scott Bessent appears to be a timely appointment. Bessent …

Read More »

Read More »

Credit Spreads: The Markets Early Warning Indicators

Credit spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often involves Treasury bonds (considered risk-free) and corporate bonds (which carry default risk). By observing these spreads, investors can gauge …

Read More »

Read More »

Sind ELTIFS eine gute Idee? #shorts

Seit Anfang des Jahres sind ELTIFs auch bei Privatanlegern im Gespräch - aber lohnt es sich, sich über sie Infrastrukturprojekte & Co. ins Depot zu holen?

Read More »

Read More »

Government Waste EXPOSED: Pentagon Audits, Deficit Woes & Financial Survival Tips – John MacGregor

In this episode of Full Disclosure, host John MacGregor tackles the urgent issue of government waste and mismanagement, focusing on the Pentagon's repeated audit failures and the federal deficit. MacGregor provides a deep dive into the 401k retirement plan, debunking myths and emphasizing its value, especially in comparison to pensions. He also critiques President Biden's financial decisions, including funds allocated to Ukraine, and addresses the...

Read More »

Read More »

The Detachment of Democrats from Working Class Issues

?️ Democrats lost support from the working class in the election. This article highlights their detachment from working class issues. Check it out! ? #ElectionAnalysis #WorkingClassIssues

Watch the entire show here: https://cstu.io/5bb2b5

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

11-25-24 Markets Look for a Holiday Rally

Thanksgiving week is spread out before us like a serving table laden with food: Markets will trade in a holiday-shortened week with moods of expectation for high consumer spending. Lance reveals his strategy for Christina's Christmas present. Markets' goal is to generate 50-points, targeting S&P 6,000, despite limited downside. Bond Yields are dropping with Scott Bessent's nomination as Treasury Secretary. The Dollar and Bitcoin are...

Read More »

Read More »

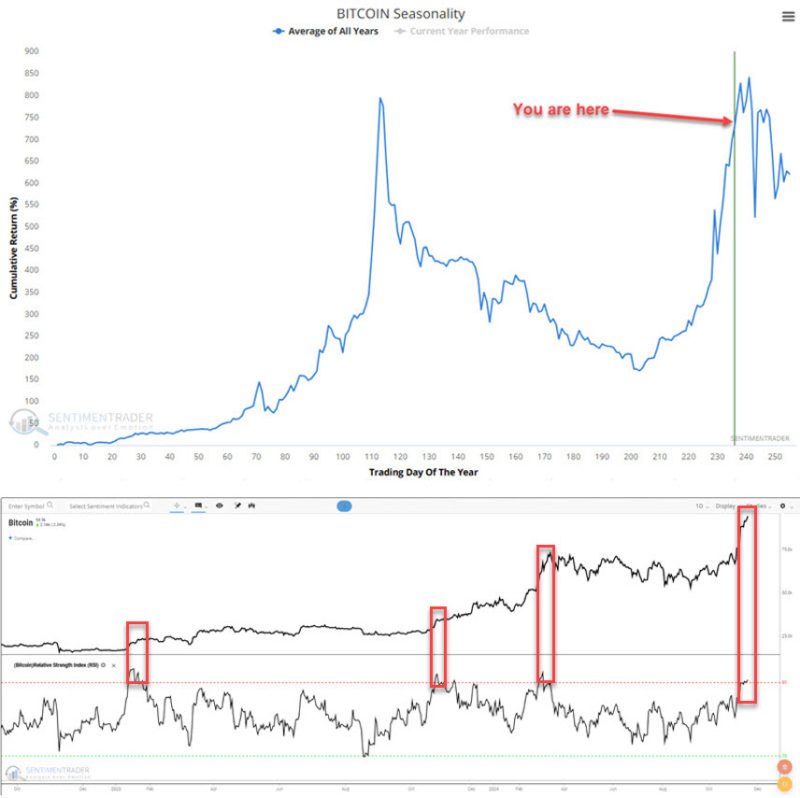

Bitcoin Is Entering Volatility Season

Since the election, Bitcoin has risen nearly 50%. While Bitcoin investors are licking their chops, believing the magnificent rally will continue, they need to realize that Bitcoin is entering a period of pronounced seasonal volatility. The graph below from Sentimentrader shows that the recent performance has tracked the typical performance for the time of year. …

Read More »

Read More »

Real Estate Insider Reveals Truth About the Housing Market

Real estate investing might seem like an easy way to make money—buy a property, fix it up, and sell or rent it—but the truth is far more complicated.

Read More »

Read More »

The Real Impact of Trump’s Tariffs: What Investors Should Know

Uncertainty ahead! ?? Trump's tariffs may not cause the chaos some predict. Stay cautious with your investments and avoid hasty decisions. #FinanceTips

Watch the entire show here: https://cstu.io/8bb550

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Warum Deutschland (fast) KEINE Schulden machen darf: Die Schuldenbremse

Fluch oder Segen für die Wirtschaft? Die Schuldenbremse erklärt!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=817&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Vermögen tracken mit Finanzfluss Copilot: ►► https://www.finanzfluss.de/copilot/ ?

ℹ️ Weitere Infos zum Video:

Nachdem die Ampelkoalition unter anderem am Streit um die Schuldenbremse...

Read More »

Read More »

ETFs verstehen & kaufen: Dein Start mit Depot, ETF-Auswahl, Sparplan

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_PTJ0tFzUdR0

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-yt/yt_PTJ0tFzUdR0

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_PTJ0tFzUdR0

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_PTJ0tFzUdR0

Trade Republic

Justtrade

Flatex* ►...

Read More »

Read More »

Ist Festgeld völlig unnötig? #shorts

Lohnt sich ein Festgeldkonto überhaupt noch? Oder solltest Du Dein Geld lieber auf ein gut verzinstes Tagesgeldkonto schieben? Saidi klärt Dich hier darüber auf.

#Finanztip

Read More »

Read More »

Robert Kennedy Targets Big Pharma: Vaccine Makers Under Fire

? New administration targeting specific areas like big pharmaceutical companies! ? Exciting times ahead in the healthcare sector! #InvestingInsights #HealthcareRevolution ?

Watch the entire show here: https://cstu.io/b7cd6b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »