Category Archive: 9a) Buy and Hold

El secreto MILLONARIO para lograr el ÉXITO EN LOS NEGOCIOS

? https://realmentor.net/rd ? ENTRA AQUÍ ¡Descubre Cómo Alcanzar La LIBERTAD FINANCIERA y Crear INGRESOS PASIVOS Usando El Sistema Que Me Convirtió En Millonario!

=================================

? ¿Estás listo para transformar tu vida y tu negocio?

En este episodio, estamos con Shang Ching, un empresario con más de 40 años de experiencia, quien nos comparte su visión sobre cómo convertir una crisis en una oportunidad y construir bases sólidas...

Read More »

Read More »

Nichtlinearitäten und hyperbolisches Wachstum

#Nichtlinearitäten sind für den Homo sapiens schwer zu erkennen. Dabei lauert nicht nur exponentielles Wachstum in der modernen Zeit. Es gibt auch #hyperbolisches #Wachstum. Ein absoluter Killer.

Read More »

Read More »

12-10-24 Portfolio Rebalancing & High Valuation Risks

Post-election consumer confidence is rocketing higher. Inflation Data is coming: CPI & PPI which will be digested in time for next week's Fed meeting. Inflation numbers are likely to tick up from YOY comparisons.

Read More »

Read More »

Navigating Market Volatility: Tips for Managing Risk and Reward

Keeping our bearish radars on, we're staying cautious and managing risk vs. reward in the market. #riskmanagement #tradingtips #marketanalysis

Read More »

Read More »

Portfolio Rebalancing And Valuations. Two Risks We Are Watching.

While analysts are currently very optimistic about the market, the combined risk of high valuations and the need to rebalance portfolios in the short term may pose an unanticipated threat. This is particularly the case given the current high degree of speculation and leverage in the market.

Read More »

Read More »

Phishing Alarm: Sparkasse

Phishing E-Mails gehören mittlerweile leider zum Alltag. Tina erklärt Dir hier woran Du die gefälschten E-Mails von richtigen E-Mails der Sparkasse unterscheiden kannst.

#Finanztip

Read More »

Read More »

Investiere clever – spare Kosten

Es gibt clevere Wege, wie du deine Kosten minimierst und so mehr aus deinem Geld herausholst. Erfahre, wie du geschickt vorgehst und langfristig deine Rendite maximierst ?

Read More »

Read More »

Political Power Plays: What Hunter’s Pardon Means for America – John MacGregor

In this episode of Full Disclosure, John MacGregor dives into the jaw-dropping unconditional pardon Joe Biden gave Hunter Biden, covering any potential offenses from 2014 to 2024. This move has people talking about influence peddling and financial dealings tied to Ukraine, China, and beyond.

John breaks down how this pardon could shake up federal investigations, impact the economy, and shift the political landscape. Plus, we’ll explore big...

Read More »

Read More »

Die Hochzeit, so heißt es, soll der schönste Tag des Lebens sein. #hochzeit

2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

Read More »

Read More »

Navigating News: Don’t Let Media Control Your Financial Decisions

Don't let current events solely guide your financial decisions! Take a step back, separate yourself, and make informed choices for your wealth #financialwisdom #stayinformed

Read More »

Read More »

12-9-24 Why Earnings Can’t Outgrow The Economy

Lance's Husbands' Christmas shopping warning service; markets are now in second week of sloppy trading. Portfolios out-of-balance will trigger volatility as managers adjust weighting.

Read More »

Read More »

How to Build a Diversified Investment Portfolio for Long-Term Growth

Investing for the long term is a journey that requires careful planning, patience, and, most importantly, diversification. Building a diversified investment portfolio is essential for mitigating risk and ensuring steady growth over time. By spreading your investments across different asset classes, you can weather market fluctuations and achieve your financial goals more effectively. In this …

Read More »

Read More »

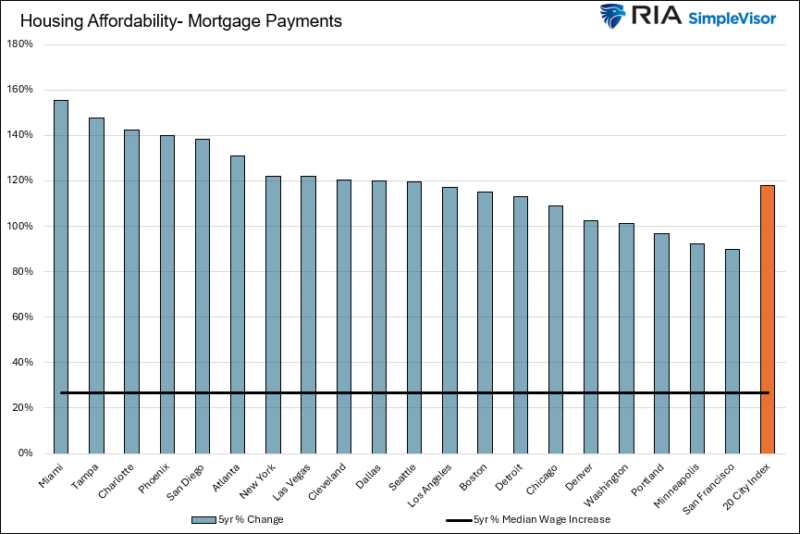

Housing Affordability Brings Market To A Standstill

Housing affordability helps explain why residential real estate transactions have reached a standstill. Over the last five years, housing prices have surged. Per the Case-Shiller 20 City Home Price Index, home prices from 20 of the largest cities have risen between 33% and 80%. Over the same five-year period, mortgage rates jumped from 3.68% to …

Read More »

Read More »

Die lebenswertesten Städte in Deutschland

Wir präsentieren: Die lebenswertesten Städte Deutschlands. Wo es sich am besten leben lässt und nach welchen Kriterien ausgewählt wurde, das erfährst Du hier.

#Finanztip

Read More »

Read More »

The Rich Don’t Work for Money, Here’s What School Won’t Teach You About Money

Join Robert Kiyosaki as he shares powerful life lessons from his journey to success through financial education. This motivational talk explores essential financial literacy concepts that shaped his path from struggling student to successful author. Discover practical business ideas and insights about investing that can help shape your financial future.

Key Takeaways:

Why "living debt-free" is the biggest lie you're told.

How the U.S....

Read More »

Read More »

Hast du schon eine virtuelle Debitkarte?

Debitkarte oder Kreditkarte? ? Die Unterschiede und wie du versteckte Gebühren vermeidest ✅

Read More »

Read More »

Understanding the Impact of Interest Rates on Inflation and the Economy

Inflation concerns are rising, impacting interest rates and the economy. Debt levels are crucial. Keep an eye on the housing market trends! ? #economy #inflation #debtlevels

Watch the entire show here: https://cstu.io/a9c64c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Ryanair vs. easyJet #marketcap

Ryanair vs. easyJet ? #marketcap

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen...

Read More »

Read More »