Category Archive: 9a) Buy and Hold

Understanding Technical Analysis: Your Market Navigation Tool

Technical analysis is like a roadmap for navigating the market in real-time. It helps us understand market trends and make informed decisions. ? #StockMarket #Investing

Watch the entire show here: https://cstu.io/ebfef4

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

In Kuwait ist Benzin billiger als Cola ?#billig

In Kuwait ist Benzin billiger als Cola ?#billig

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

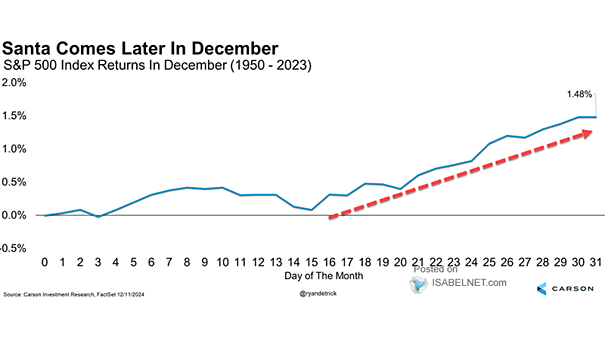

Trump Election Sends NFIB Optimism Surging

Inside This Week's Bull Bear Report First Comes The Fed, Then Santa Last week, we discussed that the risk to the markets was the annual portfolio rebalancing process. To wit: "With the year-end approaching, portfolio managers need to rebalance their holdings due to tax considerations, distributions, and annual reporting. For example, as of this writing, …

Read More »

Read More »

Welches Depot ist das Beste? #shorts

Welches Depot ist das Richtige für Dich? Wenn Du Dich das fragst, dann hat Saidi hier einen Tipp für Dich, wie Du das ganz einfach herausfinden kannst.

#Finanztip

Read More »

Read More »

Neu: Finanztip Academy – Saidi zeigt Dir den Finanz-Masterplan

? Zur Finanztip Academy ► https://www.finanztip.de/academy/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=5-WVKwJXmRM

Mit der neuen Academy von Finanztip stellst Du gemeinsam mit Saidi Schritt für Schritt Deinen Finanz-Masterplan auf.

Alle Kanäle von Finanztip:

Die Finanztip Academy ► https://www.finanztip.de/academy/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=5-WVKwJXmRM

Der Finanztip Newsletter...

Read More »

Read More »

So steigerst du dein Gehalt als Angestellter

Wie planst du deine Gehaltssteigerung? ?? Bleibst du auf deiner Position oder strebst du eine Karriere an?

Read More »

Read More »

#557 Fürs Ja-Wort in den Dispo: Das kostet Heiraten 2024

#557 Fürs Ja-Wort in den Dispo: Das kostet Heiraten 2024

Was kostet eigentlich eine Hochzeit und wie viel zahlen Paare laut einer Umfrage für ihre Party? Den Kosten sind nach oben keine Grenzen gesetzt, aber genauso gibt es auch einige Maßnahmen, mit denen man Kosten einsparen kann. Außerdem diskutieren wir die Frage: kann man mit einem Hochzeitsplaner Geld sparen?

Read More »

Read More »

Zuseherfrage: Lebensziele – Glück, Wohlstand und Gesundheit

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Heute geht es um die #Lebensziele, die der Mensch hat. Und ich lege die meinen dar. Und sie sind recht einfach strukturiert. Man kommt von ganz alleine darauf, wenn man einmal feste nachdenkt. Naja – ganz schön lange nachdenkt. Und es bedarf glasklarer...

Read More »

Read More »

The Truth About Supplements: Choose Wisely or Risk Your Health – Dr. Nicole Srednicki

In this episode of Ultra Healthy Now, Dr. Nicole Srednicki, the host and founder of Ultra Healthy Human, discusses supplement consumer awareness. She emphasizes the importance of selecting high-quality supplements and avoiding those that may be ineffective or harmful. Dr. Nicole highlights the alarming health statistics in the U.S. and the growing supplement market. She provides practical tips on evaluating supplement ingredients, brand reputation,...

Read More »

Read More »

Understanding Market Corrections and Bear Markets with Lance Roberts

Market correction vs crash explained! A 50% decline doesn't mean a bear market. Stay informed to navigate the stock market like a pro! ?? #investingtips

Watch the entire show here: https://cstu.io/0621ba

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

12-13-24 Looking Ahead to 2025: Realize Gains or Change Exposure?

Everyone has a forecast for 2025. What does that really mean for you and your money? Should you realize gains or change exposure? Danny and Matt also explore what happens at age 73, proper RMD strategies and Inherited IRA uncertainties, and whether you should work with a Donor Advised Fund or private charitable foundation? Danny and Matt will share some investment strategies for 2025 and the implications of realizing capital gains, plus Portfolio...

Read More »

Read More »

Auch Scalable gibt die Zinsen jetzt komplett an die Kunden weiter! #leitzins

Auch Scalable gibt die Zinsen jetzt komplett an die Kunden weiter! ? #leitzins

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen...

Read More »

Read More »

Is Canada A Canary In The Economic Coalmine?

On Wednesday, the Bank of Canada cut its key benchmark rate by 50bps. They have now cut by 150 bps in 2024, compared to what will likely be 100 bps for the Fed after next week's meeting. Unlike the Fed, Canada’s central bank is fighting off a recession. Canadian real GDP for the last four … Continue reading »

Read More »

Read More »

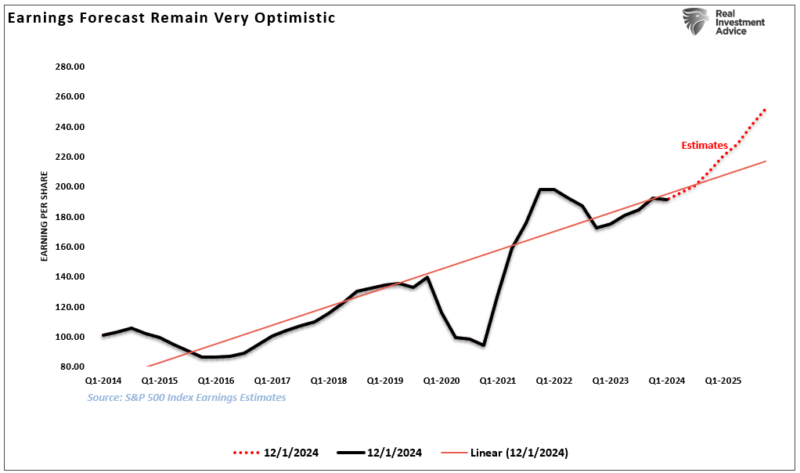

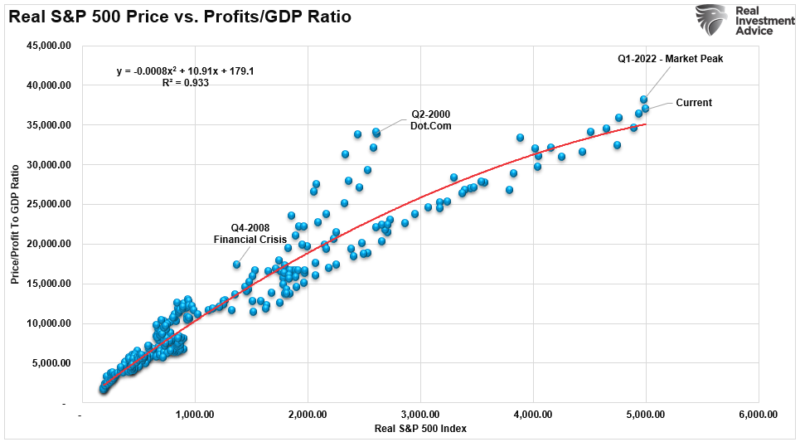

Economic Indicators And The Trajectory Of Earnings

Understanding the trajectory of corporate earnings is crucial for investors, as these earnings significantly influence stock valuations and market performance. Economic indicators such as Gross Domestic Product (GDP), the Institute for Supply Management (ISM) Manufacturing Index, and the Chicago Fed National Activity Index (CFNAI) provide valuable insights into the economic environment that shapes company profitability. …

Read More »

Read More »

Diese Finanzdinge solltest Du 2024 noch erledigen

Auch wenn Du Dich wahrscheinlich schon voll im Weihnachtsstress befindest, diese 3 Dinge solltest Du noch vor Jahresende erledigen.

#Finanztip

Read More »

Read More »

“If You Want To Get Rich, DO THIS”

Roberts's advice for young people going from being an employee or self-employed to achieving financial freedom in the B (Business Owner) and I (Investor) quadrants. Robert shares his insights on financial literacy, building a team, creating systems, and understanding the importance of mission-driven work.

We also discuss:

Why schools fail to teach financial literacy.

The difference between focusing on income vs. building a balance sheet.

The key...

Read More »

Read More »