Category Archive: 9a) Buy and Hold

A Daily Dose Of Charts & Graphs October 22, 2025

In this Short video, I cover leverage, $GLD key support, the seasonality tailwind, liquidity and sentiment trends, Fed policy context, and valuation vs. narrative — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

📺Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

🤑 Glücksspiel = Konsumausgaben

🤑 Glücksspiel... oder Geldwäsche? Die einen suchen im Casino die Glückssträhne, andere versuchen, ihr Geld zu waschen.

📺 TV-Tipp: Thomas ist als Experte Teil der Dokumentation „Dirty Money: Geldwäsche-Paradies Deutschland“ – jetzt in der ARD Mediathek.

🎯 Seit 2025 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu...

Read More »

Read More »

10-29-25 Bitcoin: Speculation, Blockchain, & the Future of Money

Why has Bitcoin captured the attention of investors and innovators alike?

Lance Roberts & Vinay Gupta break down what makes Bitcoin unique — from its blockchain backbone to its role as currency, commodity, and speculative asset. We’ll explore how to think about Bitcoin in a diversified portfolio, what risks investors need to understand, and why blockchain may reshape how business is done in the future.

#BitcoinInvesting #BlockchainTechnology...

Read More »

Read More »

Leveraged ETFs: Yet Another Sign Of Rampant Speculation

Not only is the market chasing the most speculative of assets, but it is employing record amounts of leverage to do so. Traditionally, investors use margin loans to gain leverage. More recently, however, leveraged ETFs allow investors to get leverage in one package. To wit, the graph below, courtesy of BofA, shows that there are …

Read More »

Read More »

Dollar Debasement: Reality Or A Dangerous Narrative?

Gold prices are soaring. And with each tick higher, more and more market pundits and investors are coming out of the woodwork, asserting that dollar debasement is the reason. Is that the correct reason, or might gold be in a momentum-fueled speculative bubble like many other assets? The answer has significant implications for the price …

Read More »

Read More »

Top-Branchen für Milliardäre #vermögen

Top-Branchen für Milliardäre 📈 #vermögen

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

La pobreza no es un accidente (De la crisis a Dueño de Negocio) – Víctor Chávez & Fernando González

👉 https://realmentor.net/rd 👈 ENTRA AQUÍ y descubre el SISTEMA de PADRE RICO que te enseña a construir activos, crear ingresos que no dependan de tu tiempo y acelerar tu libertad financiera con Fernando González-Ganoza, mentor hispano y representante oficial de Robert Kiyosaki por más de 30 años.

¿Sientes que trabajas sin parar y aun así el dinero nunca alcanza?

En este episodio, Fernando conversa con Víctor Chávez, un emprendedor que convirtió...

Read More »

Read More »

10-21-25 5x ETFs & Margin Debt: The Hidden Risk BehindThe Year-End Rally Narrative

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »

Warum Gold und Silber gerade hoch im Kurs stehen #debasement

Warum Gold und Silber gerade hoch im Kurs stehen 📈 #debasement

Marktgeflüster Podcast #170: ETF-Blase gibt es doch & Crash im Februar

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände...

Read More »

Read More »

10-21-25 Cash Value Life Insurance: Smart Strategy or Costly Mistake?

Cash value life insurance often sparks debate — is it a smart financial tool or an expensive way to mix insurance with investing? Lance Roberts & Jonathan Penn break down how cash value life insurance actually works and where it may (or may not) fit into your overall financial picture.

0:18 - Preview - Life Insurance & BYOB, Earnings Season Continues

6:00 - Markets Confirm Bullish Trend

10:55 - Private Credit Fund Warning - Subprime Credit...

Read More »

Read More »

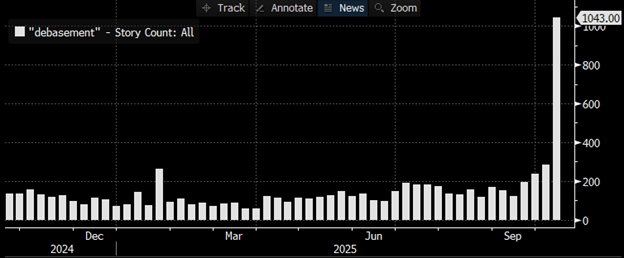

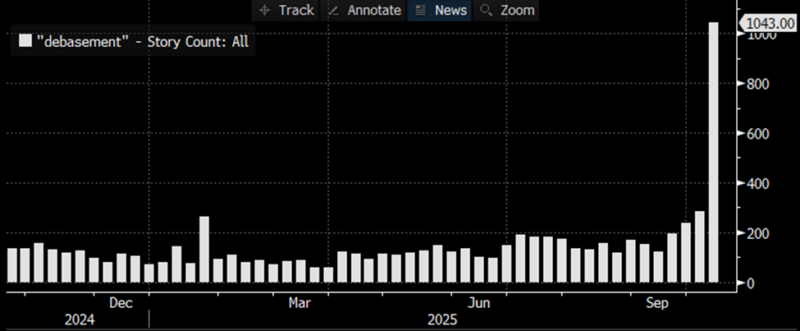

Joe Weisenthal’s Take Down Of The ‘Debasement’ Trade

Bloomberg's Joe Weisenthal wrote an interesting article (Maybe 'Debasement' Isn't The Best Way To Put it), sharing his opinion on the rising popularity of the so-called debasement trade. The debasement trade logic that Joe generally debunks is growing very popular in the media, per the Bloomberg graph below. While Joe thinks the debasement trade logic …

Read More »

Read More »

So wenig bringen Zinsen | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_mznieIE3eSs

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_mznieIE3eSs

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_mznieIE3eSs

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_mznieIE3eSs

Trade...

Read More »

Read More »

The #1 Investing Mistake That Destroys Wealth – Andy Tanner, Del Denney

🎯 Ready to take control of your financial future? Visit https://bit.ly/3JsRdmj for access to FREE investing tools, including Andy’s “Power of 6” ebook.

Every investor loses money at some point — but what separates the wealthy from everyone else is how they respond. In this episode of Stockcast, Andy Tanner and Del Denney break down the emotional side of investing and how to turn painful losses into powerful lessons.

You’ll learn how the best...

Read More »

Read More »

Auf jeden Fall kommt irgendwann ein Crash. #korrektur

Auf jeden Fall kommt irgendwann ein Crash. 📉 #korrektur

Marktgeflüster Podcast #170: ETF-Blase gibt es doch & Crash im Februar

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu...

Read More »

Read More »

10-20-25 The Illusion Of Zero Risk: When Volatility Returns, This Market Will Break

Years of easy money trained investors to believe markets have no risk. Buying every dip still works because volatility is low, but this illusion of safety won’t last.

In this Short video, I argue that when volatility returns, this “zero-risk” market will break.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-20-25 Invest Like a Bull…Think Like a Bear

IInvest like a bull. Think like a bear.

Lance Roberts dives into the mindset of successful investors: staying bullish on opportunity, but thinking like a bear when it comes to risk.

Learn how to stay optimistic without losing discipline, why emotional control outperforms market hype, and how blending bullish conviction with bearish caution can help you thrive through any cycle.

* How to stay invested while protecting capital

* Recognizing when...

Read More »

Read More »

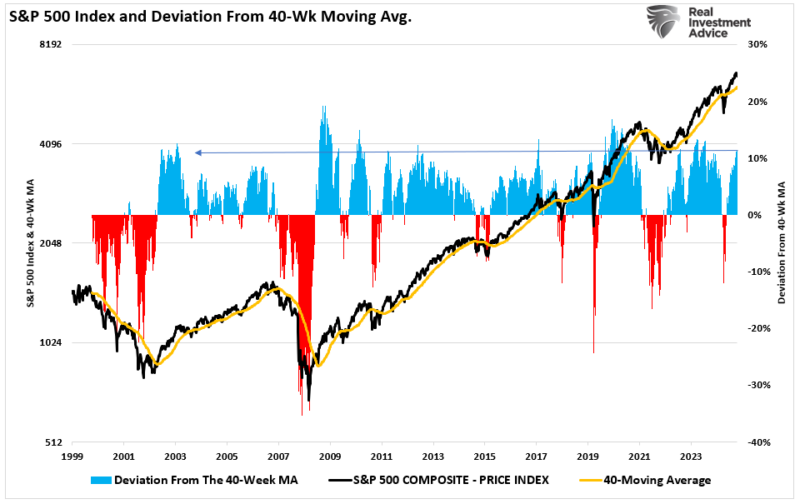

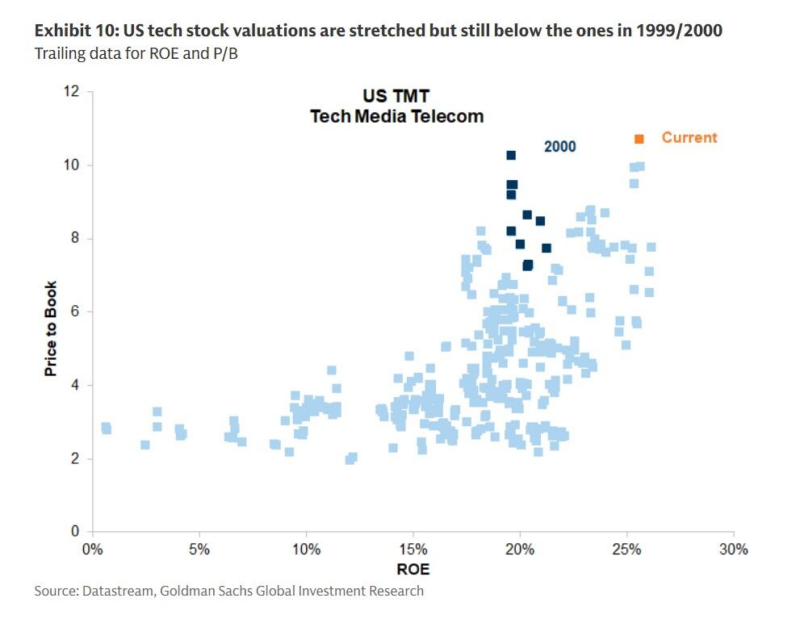

Speculative Bull Runs And The Value Of A Bearish Tilt

The recent market crack certainly woke up the more complacent bullish investors. Of course, the complacency was warranted, given the recent market surge, conversations about “TINA” (There Is No Alternative), and how “this time is different.” But that is what a speculative bull run looks and feels like. However, deep inside, you know there are …

Read More »

Read More »

SRF: The Fed’s Newest Liquidity Backstop In Action

In July of 2021, after the pandemic and the liquidity issues that arose in 2019, the Fed established a new liquidity backstop. This program, the Standing Repo Facility (SRF), allows financial institutions to borrow on a collateralized basis from the Fed. Unlike the Overnight Reverse Repurchase facility (ON RRP), which allows financial institutions to park …

Read More »

Read More »