Category Archive: 9a) Buy and Hold

Deal oder kein Deal: Business schließen, weil es keinen Spaß macht

👉 Absolut KEIN Deal. Und schau bis zum Ende.

Das ist das Dümmste, was du machen kannst.

Du hast Zeit, Geld und Ressourcen investiert und dann einfach zusperren ist idiotisch.

Wenn du nicht mehr daran arbeiten willst:

👉 Verkaufe es.

👉 Hole dir, was dir zusteht.

Business ist kein Hobby.

Es ist ein Asset.

Und Assets wirft man nicht weg, man monetarisiert sie.

#investmentpunk

#business

#mindset

Read More »

Read More »

Gas Mangellage | Neue Daten | Ausblick

Am Montag 12.1.2026 unterschritten unsere #Gasspeicher nach einer Woche Frost die Marke von 47%. Starker #Schneefall über ganz Deutschland stoppte die #Photovoltaik und die großen Schneeflächen halten die Luft kühl. Kann uns LNG aus den USA retten? Hält der Winter an, werden wir die Gasmangellage ausrufen müssen. Kommt LNG aus USA und wird der Winter mild, dann kann es knapp reichen.

-

✘ Werbung:

Mein Buch Politik für Wähler ►...

Read More »

Read More »

Was ist dein Börsen-Unwort des Jahres?

Was ist dein Börsen-Unwort des Jahres? 🙊

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu...

Read More »

Read More »

1-13-26 The Economic Reflation Narrative Is Back

The economic reflation narrative is back—but is it durable or just another market storyline driven by optimism and liquidity?

Lance Roberts explains what investors mean by “economic reflation,” why markets are once again pricing in stronger growth, and which data points are reinforcing the bullish case. We examine the role of monetary policy shifts, fiscal spending, labor market dynamics, and commodity trends that are supporting expectations for...

Read More »

Read More »

DOJ Investigates Powell: Implications For Fed Policy?

Over the weekend, Jerome Powell revealed that the Department of Justice (DOJ) has opened a criminal investigation into his June testimony to Congress regarding the roughly $2.5 billion renovation of Federal Reserve headquarters. The DOJ has served subpoenas to the Fed and threatened a criminal indictment relating to that testimony. Such action by the DOJ …

Read More »

Read More »

Bußgelder für Autofahrer im Winter

Im Winter gibt es für Autofahrer so einiges zu beachten. Wer dagegen verstößt, kann mit diesen Bußgeldern rechnen. 🚗🌨️

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt...

Read More »

Read More »

So viel kostet Dich Skifahren in Deutschland

So teuer ist Skifahren in Deutschland 🎿

💡 Ein Tag Skifahren kann ordentlich ins Geld gehen – je nach Skigebiet unterscheidet sich der Preis für einen Tagespass stark.

📍 Am teuersten ist es auf der Zugspitze mit 66 € pro Tag.

📍 Günstiger kommst Du am Feldberg weg: Hier zahlst Du nur 41 €.

📍 Zwischen diesen Extremen liegen bekannte Gebiete wie Garmisch-Classic (64 €) oder Winterberg (49 €).

💸 Tipp: Wenn Du öfter fährst, kann sich ein Mehrtages-...

Read More »

Read More »

1-12-25 How Market Narratives Push Investors Into Bad Trades

Market narratives don’t move prices—buyers and sellers do.

In this Short video, Lance Roberts explains why following headlines instead of data creates emotional bias and consistently pushes investors into bad trades.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Millionäre treffen Entscheidungen schnell!

👉 Du triffst Entscheidungen schnell und für dich selbst.

Keine endlosen Diskussionen, kein Zögern, kein Zeit verschwenden.

Entschlossenheit. Zielstrebigkeit. Umsetzung.

Also wenn du mit mir im Restaurant bist: Du weißt, was zu tun ist! 😎

#mindset

#erfolg

#investmentpunk

Read More »

Read More »

So einfach kann man die Krankenkasse wechseln

So einfach kann man die Krankenkasse wechseln 🔄

🔎 Google "krankenkassenvergleich finanzfluss" oder nutze den Link in der Bio.

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments...

Read More »

Read More »

1-12-26 Investor Lessons From 2025 for 2026

Markets opened 2026 with early gains, improving breadth, and a rotation toward value—but mixed fundamentals and elevated expectations remain beneath the surface.

Lance Roberts break down the key investor lessons from 2025 that matter most as we head into 2026. We review what worked, what failed, and why market narratives once again misled investors. Topics include value versus growth, volatility versus risk, the role of cash, earnings-driven...

Read More »

Read More »

2026 Earnings Outlook: Another Year Of Optimism

The Wall Street consensus forecast for 2026 earnings growth is strong by historical standards. Analysts are giddy and projecting another year of double-digit growth in S&P 500 earnings per share (EPS). FactSet’s most recent data showed an expected 2026 earnings growth rate for the S&P 500 of about 15 percent. That is well above the …

Read More »

Read More »

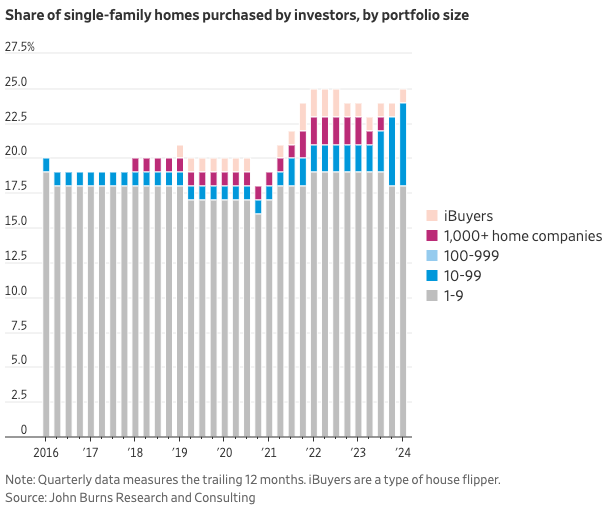

Fannie And Freddie To The Rescue

President Trump is using Fannie Mae and Freddie Mac to help make housing more affordable. According to a TruthSocial post, the President claims Fannie and Freddie have a combined $200 billion in cash. Accordingly: I am instructing my Representatives (Fannie and Freddie) to buy $200 billion dollars In mortgage bonds. The hope is that increased …

Read More »

Read More »

Unser Krankenkassenvergleich

Unser Krankenkassenvergleich 📊

🔎 Google "krankenkassenvergleich finanzfluss" oder nutze den Link in der Bio.

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt...

Read More »

Read More »

Millionäre bekommen kein Burnout!

Ein Burnout kannst du dir niemals leisten!

Die gute Nachricht:

👉 Wenn du viel Geld verdienst, Vermögen aufbaust und nicht von Monat zu Monat lebst, bekommst du kein Burnout.

Burnout entsteht, wenn

👉 dir deine Arbeit keine Freude macht

👉 du kaum über die Runden kommst

👉 und jeden Monat Angst hast, die Miete nicht zahlen zu können.

Freiheit schützt dich.

Armut macht krank.

#mindset

#finanziellefreiheit

#investmentpunk

Read More »

Read More »

Für diese Dinge solltest du kein Geld ausgeben! #finanzen

Für diese Dinge solltest du kein Geld ausgeben! 🙅 #finanzen

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

12 Dinge, bei denen du NIEMALS sparen solltest!

Zu viel Geiz? An diesen 12 Dingen solltest du niemals sparen!

Kostenloses Depot eröffnen (+25€ Bonus): ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=898&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

Finanzfluss Copilot: App für dein Vermögen ►► https://link.finanzfluss.de/r/copilot-app-yt 📱

ℹ️ Weitere Infos zum Video:

Woran würdest du niemals sparen? Genau das haben wir die...

Read More »

Read More »

Die richtige Krankenkasse finden 🧐

Die richtige Krankenkasse finden 🧐

🔎 Google "krankenkassenvergleich finanzfluss" oder nutze den Link in der Bio.

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt...

Read More »

Read More »

10.000 EUR, wie anlegen?

Mit 10k ist dein größter Hebel noch nicht der Markt, sondern du selbst.

Frag dich zuerst:

👉 Wie kann ich mit meiner jetzigen Arbeit mehr verdienen?

👉 Welche Skills bringen mir mehr Einkommen?

👉 Wie erhöhe ich meinen Cashflow?

Erst wenn du mehr Geld verdienst (30k - 50k), macht Anlegen wirklich Sinn.

#mindset

#erfolg

#finanziellefreiheit

Read More »

Read More »

1-10-26 How to Rotate Sectors Without Blowing Up Your Portfolio

Sector rotation isn’t about picking the next winner. It’s about managing risk as conditions change.

In this Short video, Michael Lebowitz & Lance Roberts discuss how to rotate gradually, rebalance winners, and adapt portfolios as market leadership changes.

📺Full episode:

Catch Lance

daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

entadvice/

#Markets #Money #Investment_Advice

Read More »

Read More »