Category Archive: 9a) Buy and Hold

Where Does Money Come From?

All money is lent into existence. The Federal Reserve or the government does not print money. Those two facts are vital to understanding our lead question: where does money come from? Furthermore, knowing who does and doesn't print money and the incentives and disincentives that change the money supply are critical to inflation forecasting. …

Read More »

Read More »

Wahlprogramm-Analyse: Mehr oder weniger Steuern?

Wie stehen die Parteien bei der anstehenden Bundestagswahlen zum Thema Soli und Spitzensteuersatz? Wir zeigen es Dir hier.

#Finanztip

Read More »

Read More »

Rich Dad Radio Show LIVE! with Jaren Sustar

Join Rich Dad Real Estate Expert, Jaren Sustar, Tuesday, February 11th LIVE at 10am Eastern as he breaks down the BEST type of real estate to buy in 2025.

Read More »

Read More »

Cómo Construir Riqueza Desde Cero: Estrategias de Alejandro Cardona

? https://realmentor.net/rd ? ENTRA AQUÍ ¡Descubre Cómo Alcanzar La LIBERTAD FINANCIERA y Crear INGRESOS PASIVOS Usando El Sistema Que Me Convirtió En Millonario!

?https://www.seminariocreandoriqueza.com/ ? ENTRA AQUÍ ¡Aprende a invertir y generar ingresos en la bolsa de valores con el Economista Alejandro Cardona!

=================================

? ¿Sabías que el verdadero éxito financiero no está en cuánto dinero ganas, sino en cómo lo...

Read More »

Read More »

Live: Wie wird 2025 für Deinen ETF?

Wie wird das Aktienjahr 2025? Solltet Ihr optimistisch oder eher vorsichtig sein? Saidi und Emil beantworten Eure Fragen und schauen in die Glaskugel.

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_GKJJh7zHjdM

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-yt/yt_GKJJh7zHjdM

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_GKJJh7zHjdM...

Read More »

Read More »

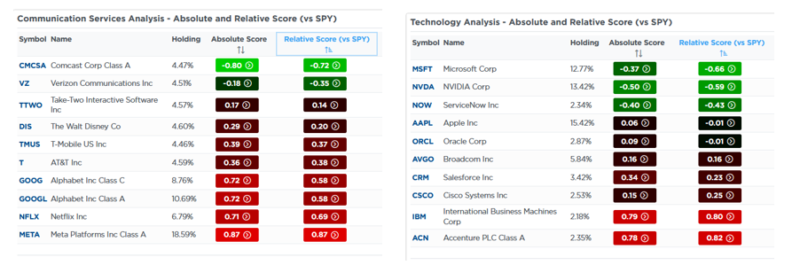

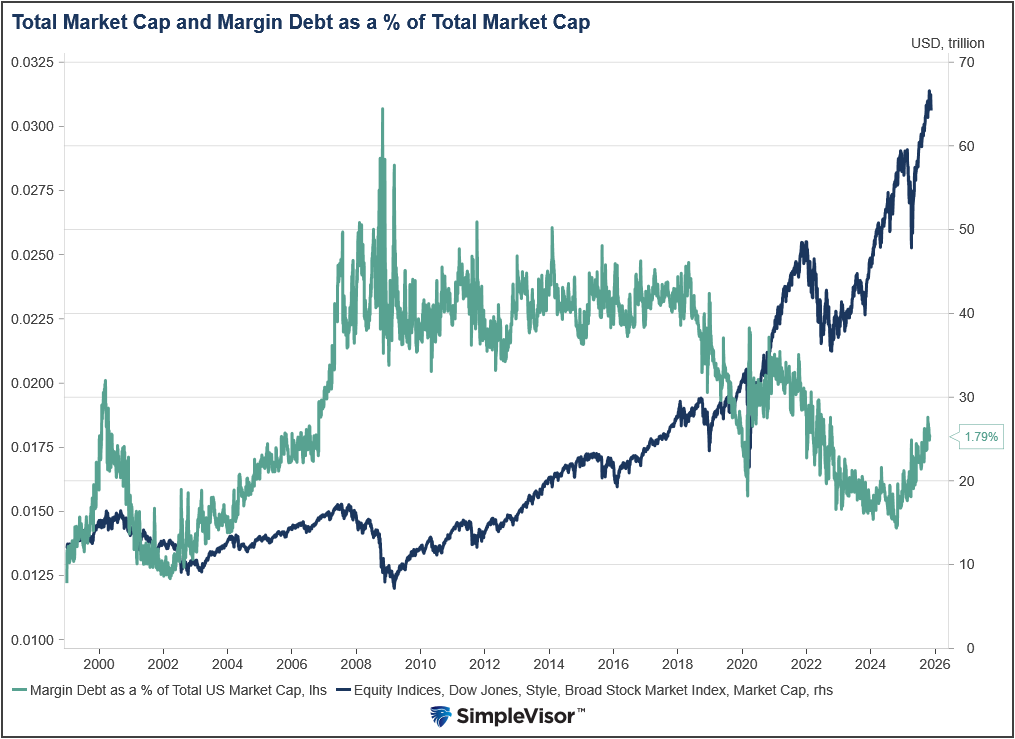

Stay Balanced and Monitor Market Trends for Optimal Investment Performance

Don't let fear of a bear market hold you back! Stay informed with Simple Visor's tools to analyze the market trends. ? #InvestingTips #MarketAnalysis

Watch the entire show here: https://cstu.io/d4f84b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

$2 Gas? NEVER Happening! (The Energy Crisis Explained) – Mike Mauceli

Gas prices, oil production, and energy policies—how do they really work? In this episode of The Energy Show, we dive deep into the complexities of the energy market, exploring why oil producers don’t want prices to drop, how Trump’s policies aimed to increase production, and why Biden’s recent LNG pause could change everything.

Energy expert Robert Rapier breaks down the real cost of drilling, revealing that a single oil well can cost between $9...

Read More »

Read More »

Börsenwert je Mitarbeiter #börse

Börsenwert je Mitarbeiter ? #börse

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen...

Read More »

Read More »

Die Industrie verliert rasend Arbeitsplätze | Kosteneinsparungen

Ein Zuseher sieht in seinem #Großunternehmen die #hochwertigen technischen #Arbeitsplätze immer schneller #wegbrechen. Wird das bald aufhören? Oder hat es gerade erst begonnen?

-

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W/

-

Autoindustrie 2025 ►

Werkschließungen bei VW ►

Kostenrechnung...

Read More »

Read More »

The Untold Truth About Commercial Real Estate! – Brent Daniels, Hanifah Brown

? Visit https://richdadpro.com/ to join our real estate community!

Everyone talks about flipping houses, but what if the real money is in commercial real estate? In this episode of Rich Dad Radio, we dive deep into big-money real estate deals with expert Hanifah Brown. From multifamily properties (5+ units) to industrial warehouses and office spaces, commercial real estate offers massive opportunities—but most investors don’t know where to start....

Read More »

Read More »

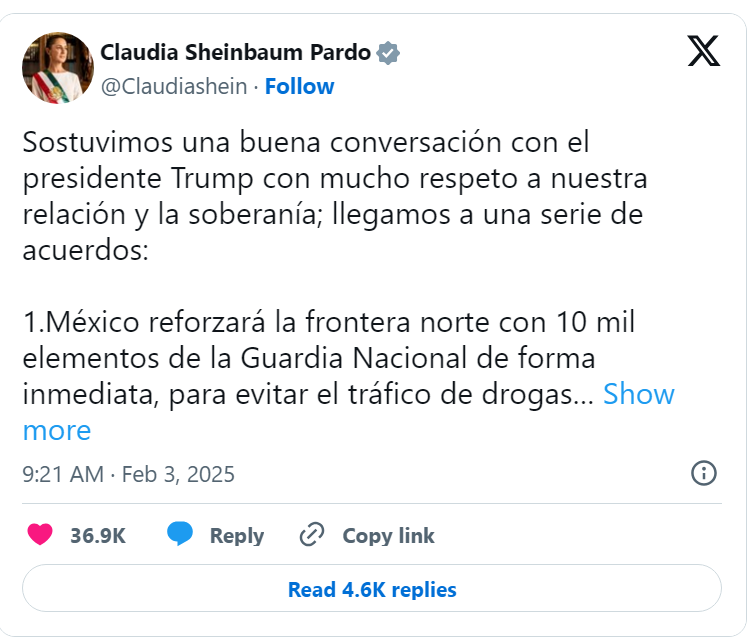

2-4-25 Trade War Over!

Well that was fast.

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. The announcement of tariffs set the market on its heels Monday morning as media writers quickly pushed narratives about the potential impacts. However, as suggested on the “Real Investment Show” before the market opened on Monday, the best thing to do would be “nothing.” We stated the market’s opening would...

Read More »

Read More »

Wo bekomme ich diese Prozente…? – So fängst du 2025 mit dem Investieren an #investments

Wo bekomme ich diese Prozente...? - So fängst du 2025 mit dem Investieren an ?? #investments

? -Y

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff...

Read More »

Read More »

Tariffs Roil Markets

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. Such was not unexpected, as contained in the Trump tariff Executive Order {SEE HERE}. Specifically, that order stated: "[Sec 2, SubSection (h)]: Sec. 2. (a) All articles that are products of Canada as defined …

Read More »

Read More »

New Tariffs Torpedo Global Markets

Investors woke up Monday morning to a sea of red. On Friday, after the markets had closed for the weekend, President Trump announced a new series of tariffs levied against Mexico, Canada, and China. Moreover, he threatened that those tariffs could increase and that new tariffs would be announced for the Euro-region. Cryptocurrencies, technology, and …

Read More »

Read More »

So stark sind Menschen in DE überschuldet

Wie sieht eigentlich die Verschuldung in Deutschland aus? Welche Altersgruppe ist am stärksten Betroffen? Wir haben das für Dich hier mal analysiert.

#Finanztip

Read More »

Read More »

Is This the Start of a Market Correction? Traders Watch Key Support Levels

Watch how the markets respond to support levels. Holding them = no big deal. Breaking them = potential for a larger corrective cycle. ? #MarketAnalysis

Watch the entire show here: https://cstu.io/242abd

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Tariffs Affect Corporate Profitability and Consumer Prices

Consumer reactions to tariffs impact companies' profitability. Watch how prices may increase due to tariffs affecting both earnings and consumer wallets. #EconomicImpact

Watch the entire show here: https://cstu.io/19c7dc

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Impact of Trade Tariffs and Border Policies

Colombia and Panama react differently to tariffs. Leaders need to understand the impact. #TradeWars #Tariffs #Leadership

Watch the entire show here: https://cstu.io/90d4ff

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The SHOCKING Truth About 401(k)s (Most People Have No Idea!) – Andy Tanner, Del Denney

? FREE eBook "Power of 6" - https://bit.ly/3JsRdmj

Are you counting on your 401(k) for retirement? You might want to think again. In this eye-opening episode of Rich Dad Stockcast, we break down the hidden truths behind the 401(k)—and why it might be the biggest retirement scam in history.

Joining us is Rich Dad expert Andy Tanner, who isn’t holding back. He exposes the flaws, hidden fees, and tax traps that Wall Street and the...

Read More »

Read More »

2-3-25 SPECIAL REPORT: Tariff Talk

President Trump's 25% tariffs on Canada and Mexico may be short-lived (indeed, following this morning's show, Mexico blinked, promising to send troops to the border, and Trump's tariff was suspended for 30-days). The difference between the 2017 Tariffs and now: No tax cuts in place this time around. Watch for more market volatility in the wake of tariff talks. Lance reviews the ins, outs, and possibilities of the Trump Tariffs: What is the...

Read More »

Read More »