Up to Wednesday, the S&P 500 rose to a 10-month high of 2119.12 points, less than 1% below its all-time high of 2130.82 of 12 May last year. But stocks pulled back on Thursday and more decisively on Friday, as bond yields around the world reached or neared record lows amid looming gloomy political and economic headwinds.

Read More »

Category Archive: Grail Securities

Will the U.S. Stock Market give birth to its own Black Swan?

At 2099.06 points the S&P 500 is now in a confirmed uptrend and on the cusp of attacking the 19 April high of 2100.80. But uncertainty of the “we will - we won’t” vacillation of the Federal Reserve, remains.

Read More »

Read More »

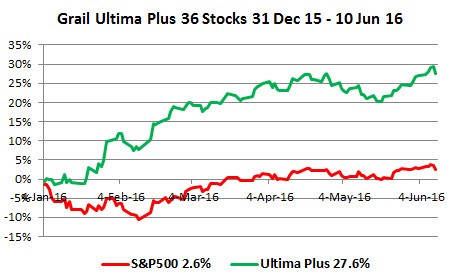

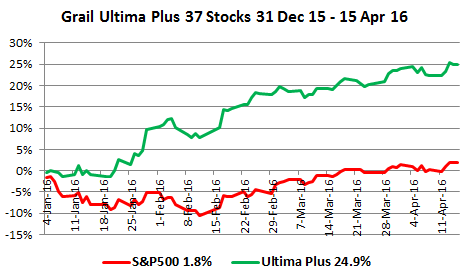

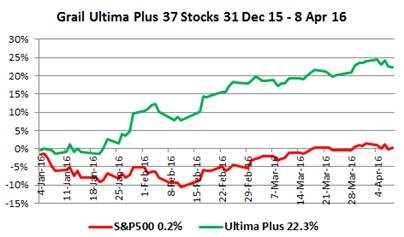

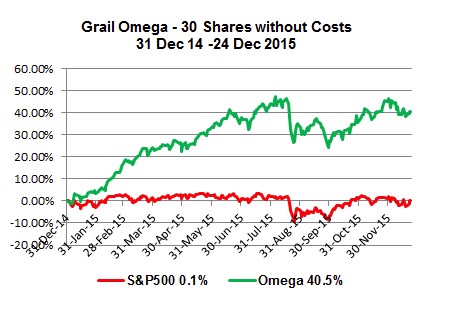

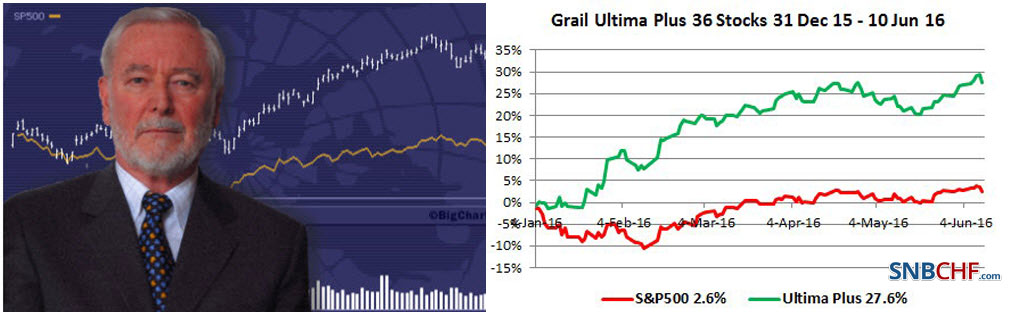

Stunning results achieved by Grail’s Free Portfolio in just two Months!

I am very pleased to report that the free portfolio in its deadline week exceeded my target of 15%, having reached a return of 16.84%, helped by a gain of 2.7%!

The purpose of the portfolio was to give readers irrefutable evidence of the unique power of the Grail Equity Management System (GEMS) to generate high returns with no more risk than the S&P 500. The first graph shows that the mother portfolio has a margin of safety vis-à-vis the index of...

Read More »

Read More »

The Free Portfolio and the Age of the Alpha Stock

This free portfolio is offered to help investors understand that what they may have learnt about risk and return do not correspond to the realities of investing today.

Read More »

Read More »

Nicolas Darvas: Follow the Price Action and Set Stop-Losses

Of the many rules prescribed for investment success, the most golden of all is to cut your losses before they get too big. You may have also witnessed the peaking and catastrophic falls of such market favorites as Weight Watchers (WTW). The speculator and dancer (!) Nicolas Darvas gave us ideas how to set the stop-loss.

Read More »

Read More »

How you see the Stock Market determines your Profit or Loss!

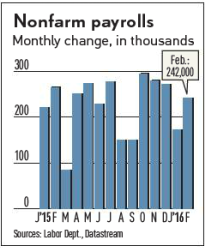

The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target. Wages however fell back by 0.1% from February’s gain of 0.5%. The workforce participation rate moved up to 62.9%. The excellent news on Friday was however received mutely by the market. Interest rates may rise.

Read More »

Read More »

The stock market’s siamese twin oiled Friday’s rally

Because the stock market is currently strongly correlated to the energy sector, Friday’s rally responded in kind on the news of a surge of 12.3% in the NYMEX WTI sweet crude market after a report had suggested that OPEC may finally agree to cut its production to reduce the world glut. The news instantly oiled the S&P 500’s rise of 1.95%. However despite the strong daily gain, oil prices still ended the week down in spite of being the best one-day...

Read More »

Read More »

The Age of the Alpha Stock

Alpha-stock denominated portfolios establish large margins of safety, strong profits, and provide outstanding client retention and marketing advantages, which mediocre and passive strategies are unable to generate. As we have entered a new normal, those asset managers who do more of the same are likely to face client frustration and profit recession.

Read More »

Read More »

Beware the Ides of the Earnings Season!

It is critical for an investor to be very vigilant during the earnings season, which already began on January 11 with Alcoa (AA) reporting its results. Not only do companies report their financials, but they also make other significant announcements, such as either raising or lowering its earnings guidance for the coming months.

Given the importance of this information, it is no surprise that a company's stock can often soar or plunge on these...

Read More »

Read More »

With the eyes of the chameleon the market turns deep red!

The S&P 500 now stands at 1880.33 points, only 31.97 points from its 2015 opening price of 1848.36; for the broad market, a year’s meager gains almost wiped clean. The index’s P/E ratio now stands at 19.81, and is still well above its historic average of 15.57.

Read More »

Read More »

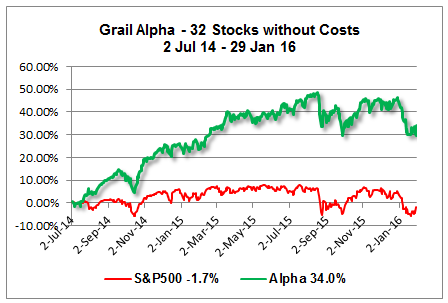

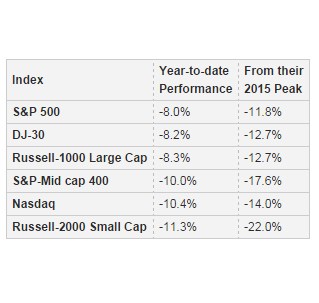

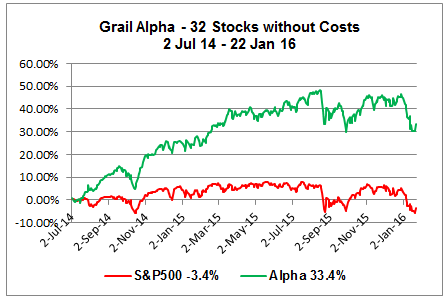

That was the week that was!

Week January 17-22 : This was the first winning week of 2016 and of some relief to ordinary investors. The question is whether it is sustainable, or just a short-covering bounce, as is frequently the case when the market is undergoing a correction. Currently the S&P 500 has sunk 10.5%, the DJ-30 12.1%, and the NASDAQ 12.0%, since mid-2015. Calling a bottom, or a top, is a challenge even for professional investors. I would cite three short-term...

Read More »

Read More »

The Market’s Bad Omens mount as the Black Swan population grows!

Last week’s market action confirmed clearly its corrective trend. I cannot say more than that, because when systematic risk kicks in the good, the bad, and the ugly all suffer the same slippery fate.

Read More »

Read More »

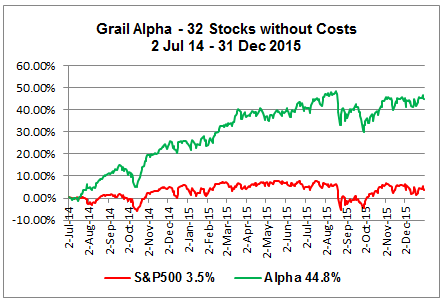

Miserable week that ended a miserable year

it was the S&P 500’s worst since the start of the bull market in 2009, ending the year down 0.73% at 2043.94 points. 56% of the stocks posted losses

Read More »

Read More »

Only high-Alpha Investing in 2016 will be profitable!

Russ Koesterich of Blackrock believes that the market is experiencing a profit recession. If so, equity markets will experience more of the same pain next year. The global economy will be even worse off as it moves through its recessionary cycle. However, in contrast, Grail portfolios will continue to show very attractive earnings growth, since their average earnings surprise over 5 quarters is $0.06

Read More »

Read More »

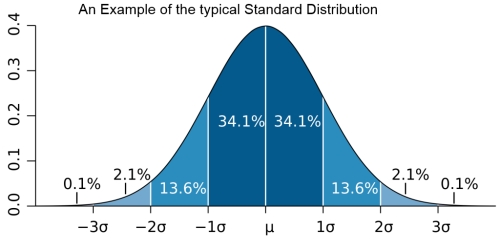

The Fallacies of Portfolio Volatility Measurements

John Henry Smith introduces the base concepts of portfolio volatility: Standard deviation, linearity, normal distribution and the Gaussian bell curve, skewness, value-at-risk and the alpha premium. He explains why they are often misinterpreted.

Read More »

Read More »

The Low Volatility Anomaly and the Failures of Your Asset Manager

According to John Henry Smith, fund managers are too much focused on bench-marking their performance to a market index, over-emphasizing the importance of "alpha". But asset managers should abstract from alpha and construct portfolios that have lower risk and higher return than the market. Impossible?

Read More »

Read More »

Mark of a true investor: He disregards instincts

John Henry Smith Grail Securities Switzerland explains why instincts and greed are counter-productive in the world of investing. Instead you should train yourself against them.

Read More »

Read More »

Listen to the Sirens of the Stock Market at your Peril!

John Henry Smith of Grail Securities (Switzerland) shows that the financial markets have always been awash with its own brand of Sirens, who dolefully prophesy the complete collapse of whole economic systems. For him Pericles gave the best advice: “The key is not to predict the future, but to be prepared for it!”

Read More »

Read More »

Adjust Your Sales in today’s Choppy Market!

Dumping stocks is one of the hardest things to do. The best way to do this is to examine each stock’s earnings growth projections for significant damage. A planned 20% or 25% return might now no longer realistic, in particular when the sink even below their 200-day moving average

Read More »

Read More »

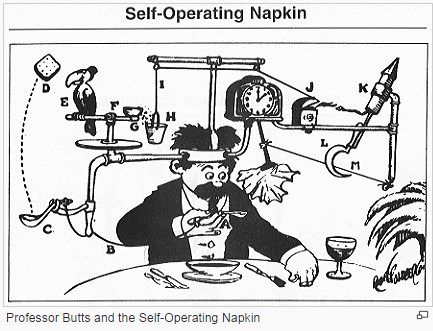

Don’t Over-Complicate Investment!

John Henry Smith of Grail Securities explains the five most simple rules of investment. Don't build a Rube Goldberg machine! Don't over-complicate things!

1. As a bull, ensure an up-trending market

2. Find a stock with superior fundamentals

3. Wait for a support base

4. Buy the stock when it breaks out

5. Cut your losses quickly if the stock fails

Read More »

Read More »