Category Archive: 6a) Gold & Monetary Metals

Silver! The Other Bull Market

All eyes have been on gold as the yellow metal has hit record high after record high. But there is another bull market that is somewhat in the shadows.

Silver.

In this episode of the Midweek Memo, host Mike Maharrey highlights the silver market, covers the dynamics driving the price up, and explains why there are solid reasons to think silver has plenty of room to run even higher.

Read More »

Read More »

Silver Ratio Out Of Whack #silver #investing #preciousmetals #commodities

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Analyst and reporter Mike Maharrey of Money Metals Exchange explains why the gold-silver ratio is out of whack, what that means for silver, and what that means for YOU!

Buy Silver - Money Metals Exchange

https://www.moneymetals.com/buy/silver

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

📘 Facebook ➤ https://www.facebook.com/MoneyMetals

📸...

Read More »

Read More »

The Silver Crisis No One Sees Coming

#Silver has surged past $40 to a fourteen-year high while gold has set fresh records. But the White House has exempted gold bars from tariffs and left silver without parallel assurance. That gap has turned a rally into a market-structure stress test.

This video unpacks:

Why New York trades rich to London and why London lease rates spiked above 5%

How #gold’s #tariff clarity redirected Swiss and European flows away from silver

The strain in the...

Read More »

Read More »

Is This a Perfect Storm for Silver?

Money Metals CEO Stefan Gleason is interviewed on the popular Investing News YouTube channel. Stefan mentions a bunch of topics and also reveals what metals and items folks ARE buying these days, and a whole lot more.

Don’t forget to also follow us on social media for more important precious metals updates!

https://www.youtube.com/@Moneymetals | https://www.facebook.com/MoneyMetals | https://instagram.com/moneymetals/ |...

Read More »

Read More »

Gold Bull Just Starting #gold #investing #preciousmetals

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Mike Maharrey of Money Metals explains why the Gold Bull is Just Starting.

https://www.moneymetals.com/buy/gold

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

📘 Facebook ➤ https://www.facebook.com/MoneyMetals

📸 Instagram ➤ https://instagram.com/moneymetals/

🐦 Twitter/X ➤ https://twitter.com/MoneyMetals

📌 Pinterest ➤...

Read More »

Read More »

This Is Bigger Than a Market Shift. It’s a Global Reset.

#Gold made new highs. Silver followed. The headline is simple, the drivers are not. In this short briefing, Jan Skoyles explains why the long end of bond markets weakened, how policy credibility entered the price, and what Beijing’s choreography signalled for risk premia. The focus is practical. How to think about duration risk today. Why a measured allocation to bullion can still improve portfolio resilience.

Key points

Real yields firmed while...

Read More »

Read More »

Gold and Silver Rally as Fiat Falters

Gold is at new record highs and silver is surging.

Meanwhile, the dollar is fading.

In this episode of the Midweek Memo podcast, host Mike Maharrey talks about the dynamics driving this latest leg up in the precious metals bull run, focusing specifically on ongoing de-dollarization, the reasons behind it, and the ramifications.

As the dollar loses ground, gold and silver are seizing its territory.

Read More »

Read More »

David Hunter- Why Gold Could Explode to $4,000 This Year

These aren’t wild guesses, they’re the contrarian forecasts of macro strategist #DavidHunter.

In this GoldCore TV interview, Hunter explains why:

#Gold could hit $4,000 in the coming months and surge to $20,000 by the 2030s

Silver could leap to $75 near-term and ultimately $500

A weakening #dollar and massive money printing will fuel asset inflation across stocks, bonds, and metals

Investors who think gold only rises when stocks fall may be...

Read More »

Read More »

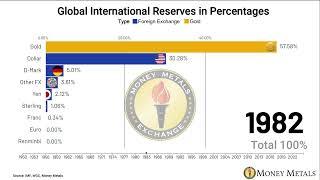

Massive Surge in Gold’s Share of International Q1 2025

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Global shock: Jan Nieuwenhuijs of Money Metals shows gold’s share of international reserves soared to 24.16% in Q1 2025.

Central banks worldwide are dumping currencies and Treasuries, de-dollarizing as the U.S. dollar slips to 43.79%.

Gold’s rise signals a shift in the world’s reserve currency balance.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE...

Read More »

Read More »

Greg Weldon Exclusive: Unstoppable Forces Driving Metals Prices Higher

Coming up don’t miss another incredible interview with Greg Weldon of Weldon Financial. Greg weighs in on the slumping dollar and what he sees there as more and more countries shift away from U.S. Treasuries and alternatively increase their gold holdings. He also chimes in on why he believes that even despite central bank and large players constantly meddling in the markets the underlying forces that have been driving metals prices higher simply...

Read More »

Read More »