Category Archive: 6a) Gold & Monetary Metals

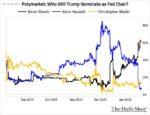

Trump vs The Fed: Inside Trump’s Plan for Dollar Reset

Sit up and pay attention. The Trump administration is rumoured to be moving to take control of the Federal Reserve’s regional banks, signaling that the price of money itself may soon be dictated from the White House.

In this video, we’ll cover:

Why $9 trillion of U.S. debt refinancing makes #Fed “independence” impossible

The attempted purge of Fed governors and what it really means

The “Mar-a-Lago Accord”: a blueprint to weaken the dollar and...

Read More »

Read More »

I Owe! I Owe! The Debt Bubble

The U.S. economy is a massive debt bubble.

And what happens to bubbles?

They pop.

On this episode of the Midweek Memo podcast, host Mike Maharrey provides an overview of government, corporate, and consumer debt, explaining how we got into this situation, the ramifications, the potential for stagflation, and how you can shield yourself from the consequences.

Read More »

Read More »

Fed Firing Offense – Mike Maharrey – Money Metals Exchange #federalreserve

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Mike Maharrey of Money Metals Exchange discusses firing offenses of the Federal Reserve in this short clip!

Visit MoneyMetals.com/News to stay on top of other offenses committed by the Federal Reserve.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

📘 Facebook ➤ https://www.facebook.com/MoneyMetals

📸 Instagram ➤...

Read More »

Read More »

Silver: Here’s Why The US Government Just Announced It’s Critical

For the first time in history, the U.S. government has reclassified silver as a critical mineral placing it alongside copper, lithium, and rare earths as essential to modern life.

This single designation could change how investors, governments, and billionaires view the metal forever. From energy security to national defence, solar panels to sovereign wealth funds #silver is no longer a “forgotten” asset, but a strategic resource.

H/T to...

Read More »

Read More »

Jerome Powell Gives “All-Clear” Signal for Gold & Silver to Rally

David Morgan of The Morgan Report (https://www.themorganreport.com/) , joins us this week. While many precious metals bulls may be frustrated with the recent sideways action in the prices of gold and silver, David tells us why he believes the recent consolidation should be viewed as a very good thing and much more.

Don’t forget to also follow us on social media for more important precious metals updates!

https://www.youtube.com/@Moneymetals |...

Read More »

Read More »

Inflation Is On Purpose – #inflation #money #endthefed #federalreserve #economy #preciousmetals

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Mike Maharrey of Money Metals says Inflation Is On Purpose!

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

📘 Facebook ➤ https://www.facebook.com/MoneyMetals

📸 Instagram ➤ https://instagram.com/moneymetals/

🐦 Twitter/X ➤ https://twitter.com/MoneyMetals

📌 Pinterest ➤ https://www.pinterest.com/moneymetals/

💼 LinkedIn ➤...

Read More »

Read More »

Nothing Makes Sense Anymore (Here’s Why)

What is going on?! Bolivia is literally printing money with #gold. The U.S. national #debt just hit $37 TRILLION five years ahead of schedule. Subprime borrowers are defaulting faster than in 2008. Retail investors are piling into stocks while institutions quietly sell. And peace talks are branded as “failures” because leaders didn’t escalate war.

In this episode, we break down:

Why Bolivia’s gold strategy could signal a new world order

The...

Read More »

Read More »

What’s Up With Inflation?

If you believe the CPI, inflation is at least close to being under control. But the PPI tells a different story.

So, what's up with inflation?

In this episode of the Midweek Memo Podcast, host Mike Maharrey breaks down the inflation data. He explains why tariffs couldn't be the sole factor driving the recent spike in producer prices and reveals the real culprit.

It's government doing what government has done throughout history - devaluing...

Read More »

Read More »

Gold Confiscation Risk: The Real Truth

Could governments really confiscate gold again like in 1933? In this video, we uncover the history of U.S. #goldconfiscation, why it happened, and whether it could happen in 2025.

Learn why FDR forced #Americans to surrender their gold

How revaluation robbed savers overnight

Why confiscation today is unlikely but taxation, surveillance, and revaluation risks are real

How investors can protect their wealth with offshore #storage,...

Read More »

Read More »

Oklahoma State Goldbacks are HERE!

Oklahoma Goldbacks are ✨ HERE ✨ 1/2, 1, 2, 5, 10, 25, 50, and 100 denominations available. 💵 These new designs have such crisp, incredible detail that will have you desiring the whole set! Give us a call or order them here: https://www.moneymetals.com/search?q=oklahoma+goldback

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

📘 Facebook ➤...

Read More »

Read More »