Category Archive: 6a) Gold & Monetary Metals

Take Advantage of the Dips – Precious Metals Projections – May ’22

The dollar is up, and silver is way down since Easter. And the stock market? Yikes. Host Craig Hemke and analyst Chris Vermeulen of the Technical Traders break down all the charts you need to navigate the coming bear market.

Have questions for us? Send them to [email protected] or simply leave a comment here.

Check out https://www.sprottmoney.com, or to learn more about Chris Vermeulen: https://www.thetechnicaltraders.com.

Read More »

Read More »

#Shorts – Wollen wir wirklich einen Atomkrieg riskieren? Max Otte

#Shorts - Wollen wir wirklich einen Atomkrieg riskieren? Viele Nato-Staaten, besonders auch Deutschland, unterstützen die Ukraine bei der Abwehr der russischen Angriffe durch Waffen aller Art. Dabei besteht die Gefahr, ebenfalls als Gegner eingeschätzt zu werden und Putin hat ja auch schon offen mit dem Einsatz von Atomwaffen gedroht.

Wohin soll das noch führen?

Diese Frage versucht Max Otte, der bekannte deutsche Ökonom neben anderen Fragen in...

Read More »

Read More »

Wollen wir wirklich einen Atomkrieg riskieren? Max Otte Handyversion

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3v46eTD

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3v46eTD

Wollen wir wirklich einen Atomkrieg riskieren? Viele Nato-Staaten, besonders auch Deutschland, unterstützen die Ukraine bei der Abwehr der russischen Angriffe durch Waffen aller Art. Dabei...

Read More »

Read More »

Alasdair Macleod: News for the Dollar, regaining growth// $$$

Why should day traders focus on only one side of the market? Why is it necessary to research and learn carefully about investment objects?

Read More »

Read More »

Wollen wir wirklich einen Atomkrieg riskieren? Max Otte

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3v46eTD

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3v46eTD

Wollen wir wirklich einen Atomkrieg riskieren? Viele Nato-Staaten, besonders auch Deutschland, unterstützen die Ukraine bei der Abwehr der russischen Angriffe durch Waffen aller Art. Dabei...

Read More »

Read More »

The Federal Reserve is being far from “hawkish!” Marc Faber Trading Interview

Marc Faber, publisher of the Gloom Boom Doom report, sits down with Blake Morrow to discuss the moves from the #FOMC this week and talk about how current #monetarypolicy will shape the markets for years to come.

Inflationary pressures, brought on by the Federal Reserve, can have parallels drawn to the 1970’s as Marc Faber points out.

Marc discusses the real estate market, how generations have been prices out of the market. And how currencies...

Read More »

Read More »

*FINANCIAL BUBBLE WARNING!!!** Only SILVER Can Save You In RECESSION – Alasdair MacLeod

*FINANCIAL BUBBLE WARNING!!!** Only SILVER Can Save You In RECESSION - Alasdair MacLeod

In today’s video, Alasdair Macleod who is the Head of Research for GoldMoney and a popular investor updates about the current silver and gold markets, with a detailed insight on his concept of the end of financialization, control of central banks over precious metal prices, chances of a global recession and whether the entire asset class will go to zero if...

Read More »

Read More »

This Is How China’s Stockpiling Of Gold Will Impact GOLD PRICES | Andrew Maguire & Alasdair MacLeod

This Is How China's Stockpiling Of Gold Will Impact GOLD PRICES | Andrew Maguire & Alasdair MacLeod

#gold #goldprice #goldratetoday

Subscribe To Our Channel ➤➤➤➤ shorturl.at/vBYZ9

Welcome to Investors Hub, an exclusive community of finance enthusiasts that are interested in understanding the ins and outs of the investment space.

At Investors Hub, we are constantly on the lookout for great opportunities to buy Silver, Gold, crypto and other...

Read More »

Read More »

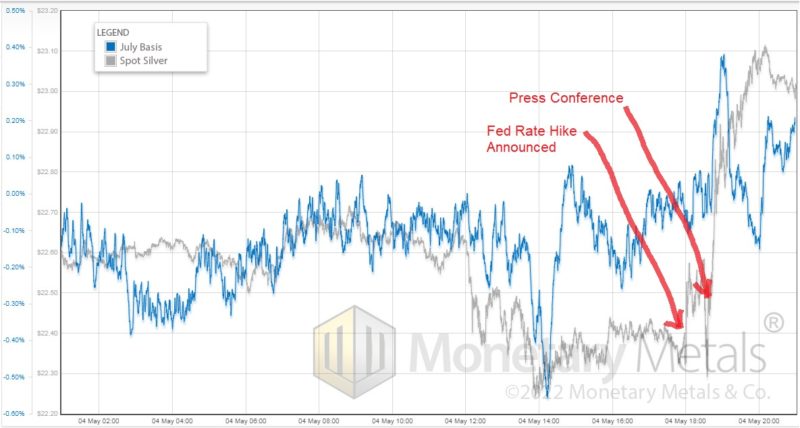

Stock Market Swoons on Fed Hikes and Economic Contraction

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As turmoil in financial markets unnerves investors, a larger economic crisis may be starting to unfold.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2022/05/06/stagflation-drags-down-stock-market-002525

Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan...

Read More »

Read More »

This Is Why GOLD Will Play An Important Role In The New Monetary System | Alasdair Macleod

This Is Why GOLD Will Play An Important Role In The New Monetary System | Alasdair Macleod

#gold #goldprice #goldratetoday

Subscribe To Our Channel ➤➤➤➤ shorturl.at/vBYZ9

Welcome to Investors Hub, an exclusive community of finance enthusiasts that are interested in understanding the ins and outs of the investment space.

At Investors Hub, we are constantly on the lookout for great opportunities to buy Silver, Gold, crypto and other financial...

Read More »

Read More »

A Horrific Financial Crisis IS HERE!! Market Meltdown? Crash? Something Else? — Alasdair MacLeod

A Horrific Financial Crisis IS HERE!! Market Meltdown? Crash? Something Else? — Alasdair MacLeod

------------------------------------------------

? SUBSCRIBE for New Videos - Daily Uploads! https://bit.ly/3vjtEq2

? CONTENT:

Our Channel Mainly Covers Broad Range of Topics Like Current Economy, Financial Literacy, Housing Market, Financial Crisis, Market Crash, Inflation, Deflation, Stock Market, Stocks, Bonds, Gold, Silver, Crypto, Bitcoin,...

Read More »

Read More »

Jetzt droht ein Kalter Krieg… (Prof. Max Otte)

✅ Jetzt kostenlosen Ratgeber herunterladen: https://kettner.shop/Prepare_for_Weltsystemcrash_4O

Prof. Dr. Max Otte sieht drei mögliche Szenarien, die nach dem Ukraine-Konflikt am wahrscheinlichsten sind...

⭐ GOLD KAUFEN

↪︎ Münzen: https://kettner.shop/gold-m_4OG9

↪︎ Barren: https://kettner.shop/gold-b_4OG9

? SILBER KAUFEN

↪︎ Münzen: https://kettner.shop/silber-m_4OG9

↪︎ Barren: https://kettner.shop/silber-b_4OG9

✅ EDELMETALL-EINSTEIGER

↪︎...

Read More »

Read More »

Inflation is Accelerating Due to Russian Sanctions | Alasdair MacLeod

Alasdair MacLeod in latest interview about inflation tells tat currencies collapse by russian sanctions. Businesses could collapse, and many stocks, bonds, and ETFs could fall to zero, says Alasdair MacLeod.

Alasdair MacLeod, former bank director and current ead of researc at Gold Money. Alasdair doesn’t see muc cance of a sudden economic recovery, and te markets are beginning to understand inflation is coming. In an inflationary environment,...

Read More »

Read More »

Gold: A use case for the modern era

Part II of II

The big picture here is clear and it is essential to understand that it represents a very significant paradigm shift. Whether it is online or offline, whether it is through a mobile app, an exchange or even through physical contracts, ownership titles to gold holdings keep changing hands. And thus, no matter the vehicle that is used to facilitate these transactions, the fact of the matter is that it acts as a gold-backed...

Read More »

Read More »

Recession risks rise as central banks move slowly on interest rates, Marc Faber warns | ABC News

Contrarian investor Marc Faber says central banks have waited too long to act. He believes a recession is inevitable and it will hurt ordinary people.

Subscribe: http://ab.co/1svxLVE

ABC News provides around the clock coverage of news events as they break in Australia and abroad, including the latest coronavirus pandemic updates. It's news when you want it, from Australia's most trusted news organisation.

For more from ABC News, click here:...

Read More »

Read More »

States Are Opting Back Into Gold & Silver w/ Jp Cortez

Today Jp Cortez, Policy Director at Sound Money Defense League, joins us to share his thoughts on the global economy and the recent uptick of states pushing for sound money policy. Jp shares details of the fight as more politicians aim to reinstate gold and silver as legal tender minus taxation.

Read More »

Read More »