Category Archive: 5.) The United States

What Caused the Recession of 2019-2021?

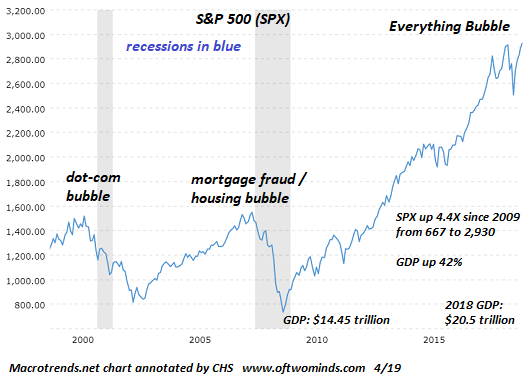

As I discussed in We're Overdue for a Sell-Everything/No-Fed-Rescue Recession, recessions have a proximate cause and a structural cause. The proximate cause is often a spike in energy costs (1973, 1990) or a financial crisis triggered by excesses of speculation and debt (2000 and 2008) or inflation (1980).

Read More »

Read More »

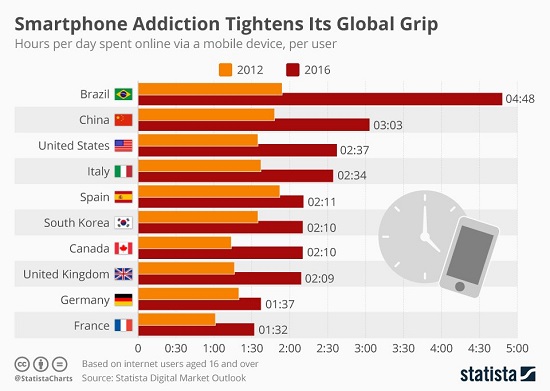

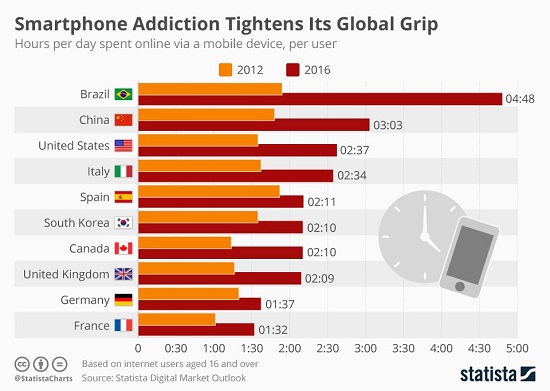

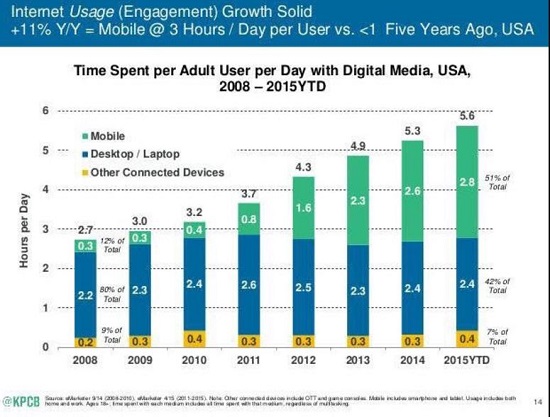

The Corporate Lemmings Who Rushed into Mobile/Social Media Ads Are Running off the Cliff

Given that corporations are run by people, and people are social animals that run in herds, it shouldn't surprise us that corporations follow the herd, too. Take the herd move to forming conglomerates in the go-go late 1960s: corporations suddenly started buying companies in completely different sectors in businesses they knew nothing about, because the herd was forming conglomerates--not because it made any business sense but because it was the...

Read More »

Read More »

We’re Overdue for a Sell-Everything/No-Fed-Rescue Recession

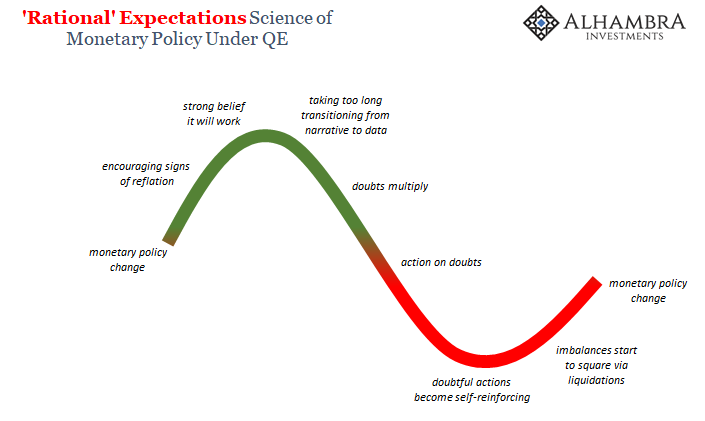

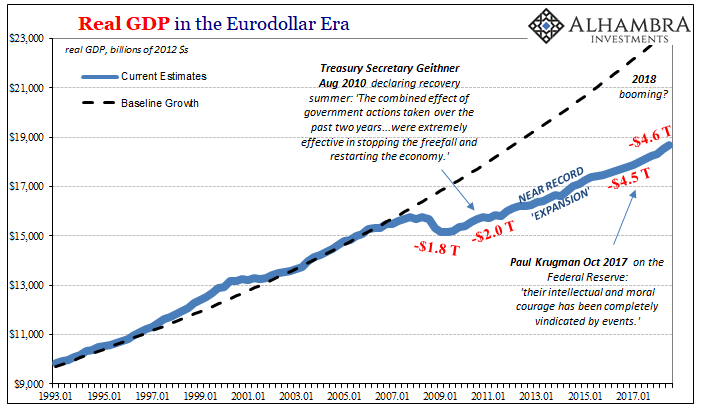

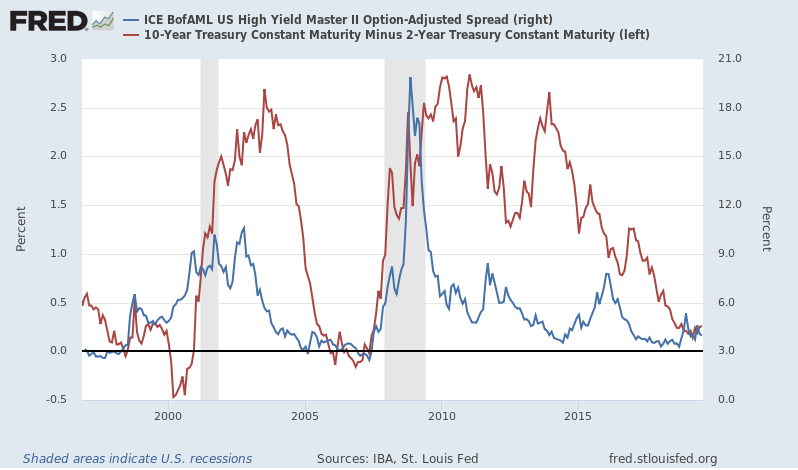

We're way overdue for a sell-everything recession, one that the Fed will only make worse by pursuing its usual policies of lowering interest rates and goosing easy money. As I noted last week, central banks, like generals, always fight the last war--until the war is lost.

Read More »

Read More »

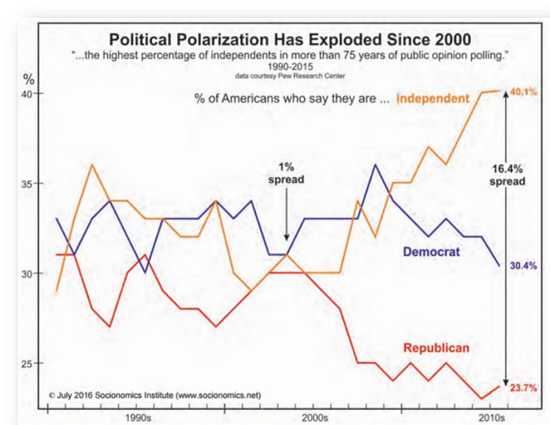

2019: The Three Trends That Matter

Look no further than Brexit in Britain, the yellow vests in France and the Deplorables in the U.S. for manifestations of a broken social contract and decaying social order. Among the many trends currently in play, Gordon Long and I discuss three that will matter as 2019 progresses: 2019 Themes (56 minutes).

Read More »

Read More »

Brace for Impact

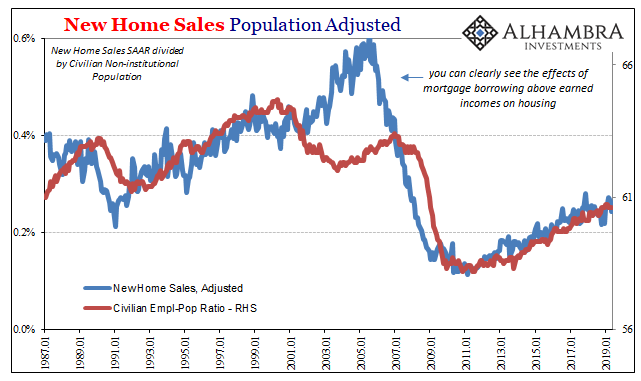

As credit-asset bubbles pop, the dominoes start falling. The economy is far more precarious than the surface boom/bubble suggests. A great many households, enterprises and municipalities are in overloaded boats whose gunwales are just a few inches above the water; the slightest wave will swamp and sink them.

Read More »

Read More »

More Of What Was Behind December, And Not Just December

As more and more data rolls in even in this delayed fashion, the more what happened to end last year makes sense. The Census Bureau updated today its statistics for US trade in November 2018. Heading into the crucial month of December, these new figures suggest a big setback in the global economy that is almost certainly the reason markets became so chaotic.

Read More »

Read More »

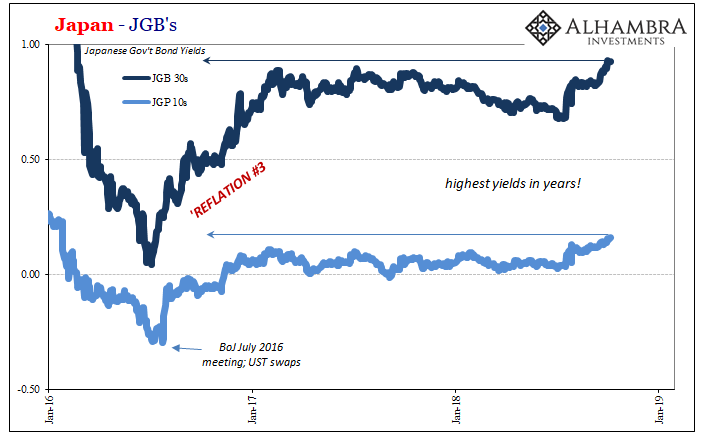

Lost In Translation

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish.

Read More »

Read More »

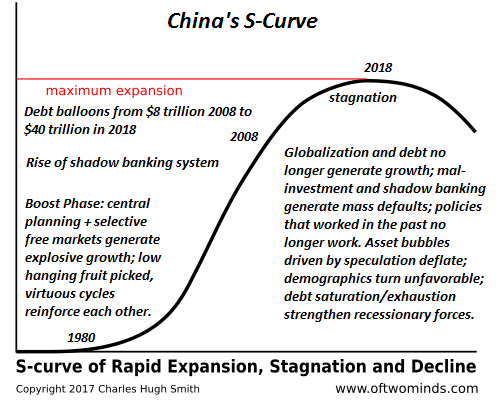

China’s S-Curve of Expansion, Stagnation and Decline

All the policies that worked in the Boost Phase no longer work. Natural and human systems tend to go through stages of expansion, stagnation and decline that follow what's known as the S-Curve. The dynamic isn't difficult to understand: an unfilled ecological niche is suddenly open due to a new adaptation; a bacteria evolves to exploit a new host, etc.

Read More »

Read More »

US Manufacturing Questions

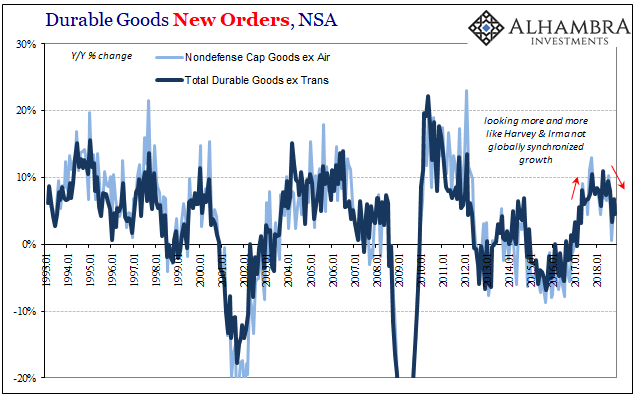

The US economic data begins to trickle in slowly. Today, the reopened Census Bureau reports on orders and shipments to and from US factories dating back to last November. New orders for durable goods rose just 4.5% year-over-year in that month, while shipments gained 4.7%. The 6-month average for new orders was in November pulled down to just 6.6%, the lowest since September 2017 (hurricanes).

Read More »

Read More »

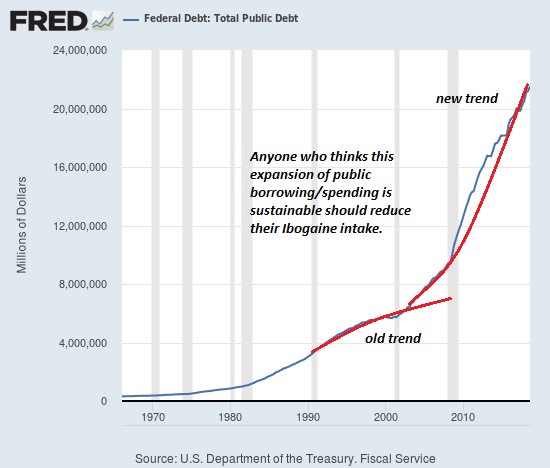

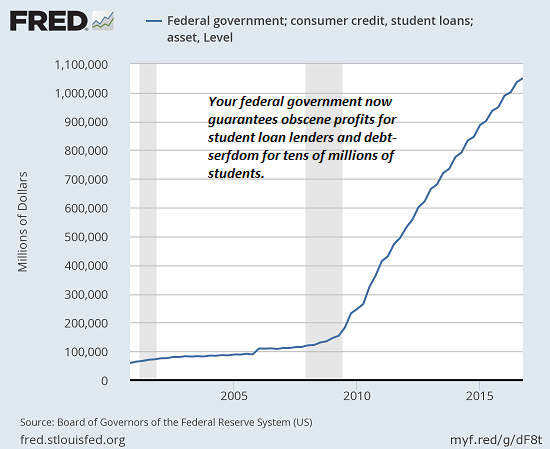

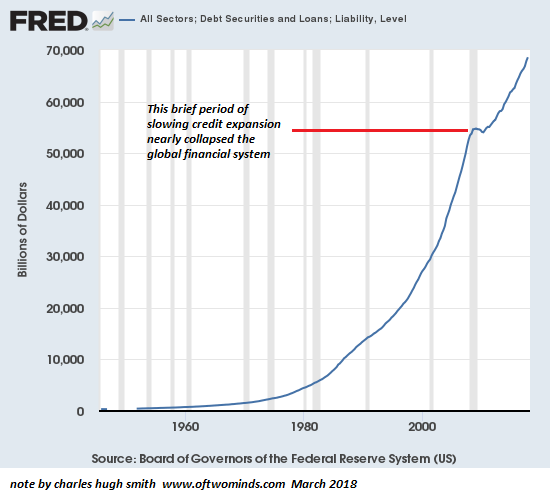

The Coming Global Financial Crisis: Debt Exhaustion

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion. Just as generals fight the last war, central banks always fight the last financial crisis. The Global Financial Crisis (GFC) of 2008-09 was primarily one of liquidity as markets froze up as a result of the collapse of the highly leveraged subprime mortgage sector that had commoditized fraud (hat tip to Manoj S.) via liar loans and...

Read More »

Read More »

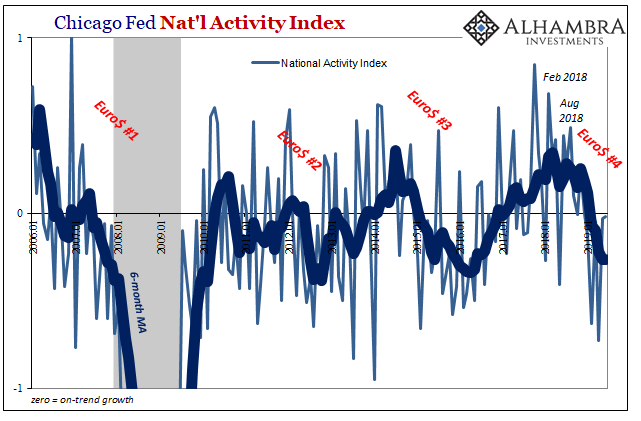

Bond Curves Right All Along, But It Won’t Matter (Yet)

Men have long dreamed of optimal outcomes. There has to be a better way, a person will say every generation. Freedom is far too messy and unpredictable. Everybody hates the fat tails, unless and until they realize it is outlier outcomes that actually mark progress. The idea was born in the eighties that Economics had become sufficiently advanced that the business cycle was no longer a valid assumption.

Read More »

Read More »

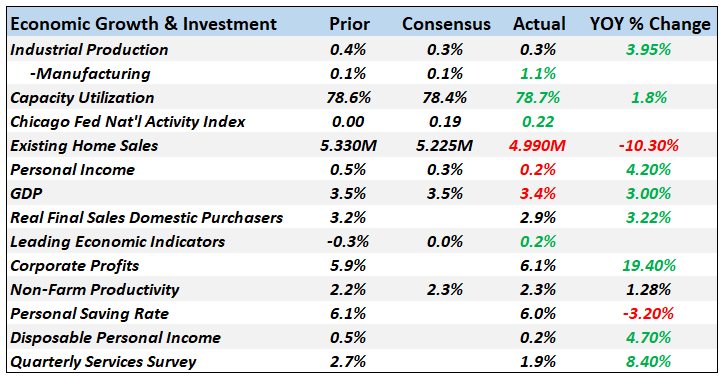

Monthly Macro Monitor – February (VIDEO)

Alhambra Investments CEO Joe Calhoun discusses the latest information about markets, specific categories affecting the economy.

Read More »

Read More »

It’s Not That There Might Be One, It’s That There Might Be Another One

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality.

Read More »

Read More »

So If Half of Facebook Accounts Are Fake… What Is Facebook Worth?

The social media space is absolutely ripe for a new entrant who demands arduous verification and constantly monitors its user base to eliminate cloned and fake accounts. How many accounts on Facebook are fake? Recent estimates of half could be low. Here's an experiment: open a Facebook account with a name that cannot possibly be anyone else's real name, for example, Johns XQR Citizenry.

Read More »

Read More »

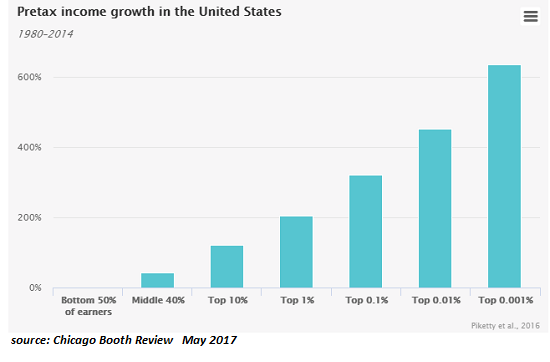

So You Want to Get Rich: Focus on Human Capital

Wealth is flowing to those who earn money from their human capital and enterprise. So you want to get rich: OK, what's the plan? If you ask youngsters how to get rich, many will respond by listing the professions the media focuses on: entertainment, actors/actresses, pro athletes, and maybe a few lionized inventors or CEOs.

Read More »

Read More »

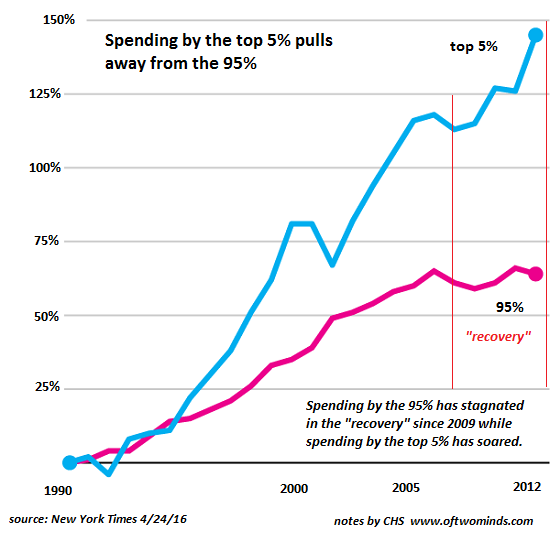

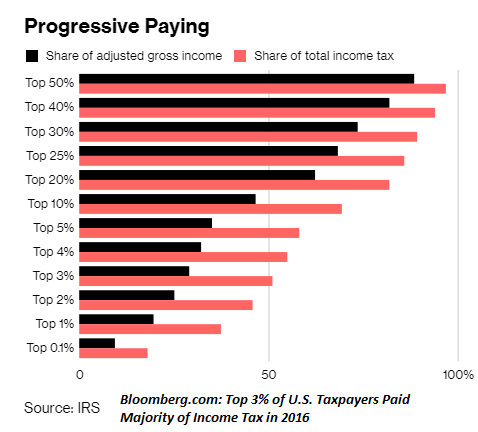

The “Working Rich” Are Not Like You and Me-or the Oligarchs

Rising income inequality may be a reflection of the changing nature of work. F. Scott Fitzgerald's story The Rich Boy included this famous line: "Let me tell you about the very rich. They are different from you and me." According to a recent paper published by the National Bureau of Economic Research (NBER),Capitalists in the Twenty-First Century (abstract only), the "working rich" are different from you and me, and from the Oligarchs above them...

Read More »

Read More »

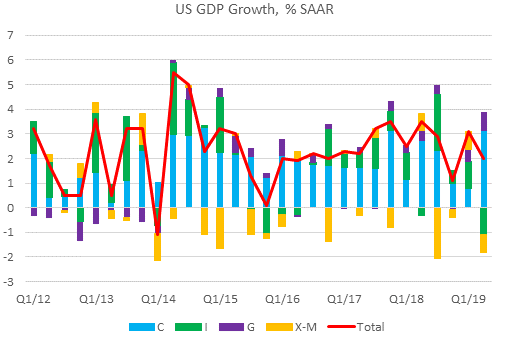

Monthly Macro Monitor – January 2019

A Return To Normalcy. In the first two years after a newly elected President takes office he enacts a major tax cut that primarily benefits the wealthy and significantly raises tariffs on imports. His foreign policy is erratic but generally pulls the country back from foreign commitments. He also works to reduce immigration and roll back regulations enacted by his predecessor.

Read More »

Read More »

The Ruling Elites Love How Easily We’re Distracted and Turned Against Each Other

No wonder the ruling elites love how easily we're distracted and divided against ourselves: it's so easy to dominate a distracted, divided, blinded-by-propaganda and negative emotions populace. Let's say you're one of the ruling elites operating the nation for the benefit of the oligarchy.

Read More »

Read More »

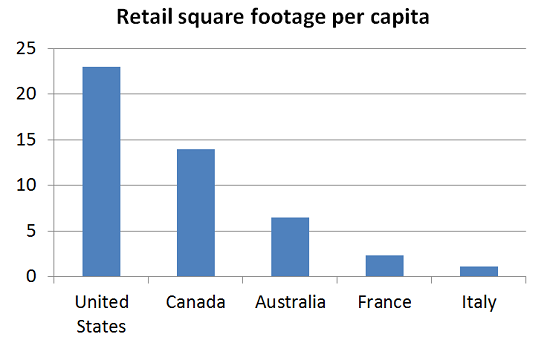

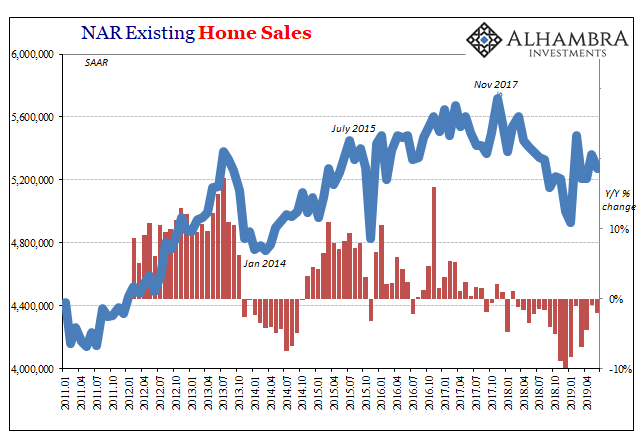

Gentrified Urban America Will Be Hit Hard by the Recession

Combine sky-high commercial rents in homogenized, gentrified urban areas and sharp declines in the incomes of the limited populace who can afford gentrified urban areas and what do you get? A number of macro dynamics have set up gentrified urban America for a big fall in the coming recession.

Read More »

Read More »

Want to Heal the Internet? Ban All Collection of User Data

The social media/search giants have mastered the dark arts of obfuscating how they're reaping billions of dollars in profits from monetizing user data, and lobbying technologically naive politicos to leave their vast skimming operations untouched.

Read More »

Read More »