Category Archive: 5.) Charles Hugh Smith

Curveballs in the Housing Bubble Bust

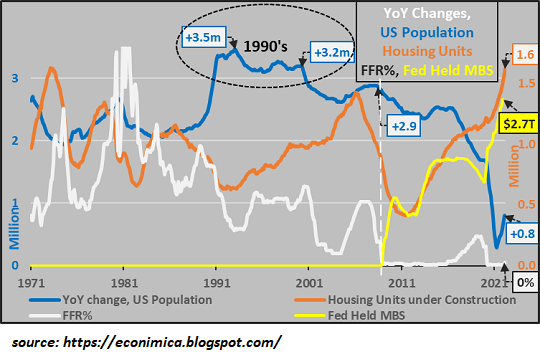

All these curveballs will further fragment the housing market. Oh for the good old days of a nice, clean housing bubble and bust as in 2004-2011: subprime lending expanded the pool of buyers, liar loans and loose credit created speculative leverage, the Federal Reserve provided excessive liquidity and the watchdogs of the industry were either induced (ahem) to look away or dozed off in a haze of gross incompetence.

Read More »

Read More »

Herd on the Street

The casino has become complex and there are no easy answers or predictable paths.

The Wall Street herd had it easy from 2009 to 2021. Life was simple and life was good: markets were easy to predict.

Read More »

Read More »

What Happens When Complexity Unravels?

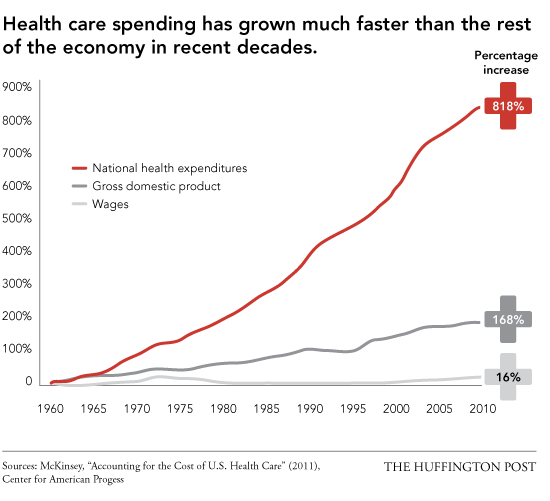

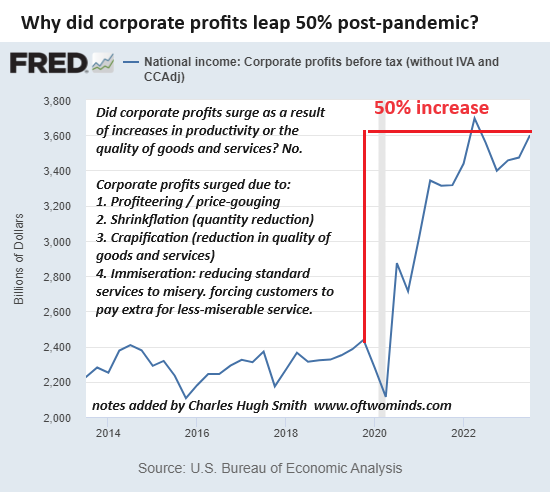

Those glancing at the appearances will be assured all is well and it will all sort itself out. Those who look behind the screen will move away as fast as they can. When finances tighten, there are two choices: cut expenses or increase revenues. Monopolies, cartels and governments can increase revenues by increasing taxes or the price of goods and services because users /customers / taxpayers have no alternative.

Read More »

Read More »

Not the 1970s or the 1920s: We’re in Uncharted Territory

All of these similarities and differences are setting up a sea-change revaluation of capital, resources and labor that will be on the same scale as the extraordinary transitions of the 1920s and 1970s.

Read More »

Read More »

The Contrarian Curse

What if all the new consensus memes are as wrong as the ones they replaced? I have the Contrarian Curse, and I have it bad. The Contrarian Curse is: as soon as the herd adopts your previously contrarian view, you start questioning the new consensus, just as you questioned the previous consensus.

Read More »

Read More »

Is Housing a Bubble That’s About to Crash?

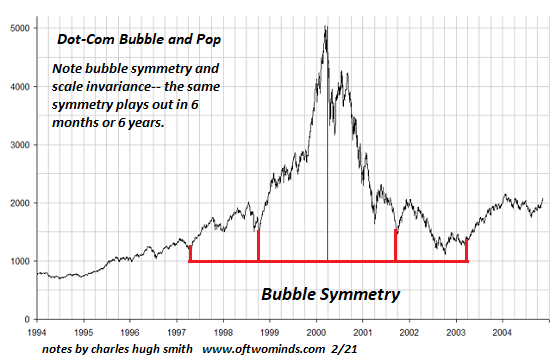

We are all prone to believing the recent past is a reliable guide to the future. But in times of dynamic reversals, the past is an anchor thwarting our progress, not a forecast. Are we heading into another real estate bubble / crash?

Read More »

Read More »

Doom Porn and Empty Optimism

If we can't discern the difference between doom-porn and investing in self-reliance, then solutions will continue to be out of reach. I'm often accused of calling 783 of the last two bubble pops (or was it 789? Forgive the imprecision). Like many others who have publicly explored the notion that the status quo isn't actually sustainable despite its remarkable tenaciousness, I am pilloried as a doom-and-gloomer (among other things, ahem).

Read More »

Read More »

Crash Is King

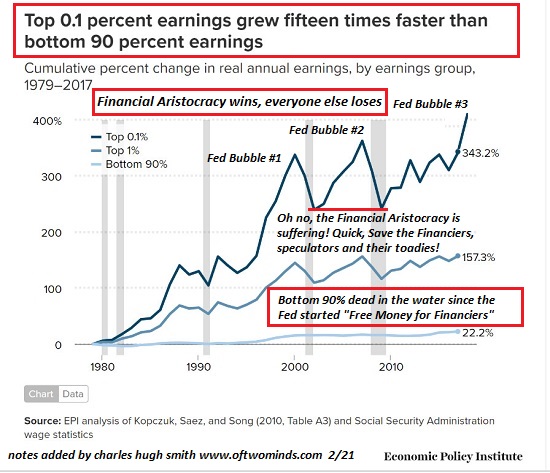

This may be one of many revaluations of capital vis a vis labor and resources and core vis a vis periphery. You've heard the expression "cash is king." Very true. But it's equally true that "crash is king:" when speculative excesses collapse under their own extremes, the crash crushes all other narratives and becomes the dominant dynamic.

Read More »

Read More »

What’s Your Plan A, B and C?

Nothing unravels quite as dramatically as systems which are presumed to be rock-solid and forever.

Here's the default Bullish case for stocks and the economy: let's call it Plan Zero.

1. The economy and equities can grow forever (a.k.a. infinite growth on a finite planet in a waste-is-growth Landfill Economy)

Read More »

Read More »

A Couple of Thoughts on Big Numbers

Let's ask "cui bono" of the $33 trillion in added debt and the $9 trillion added to GDP: to whose

benefit?

I've been thinking about how hard it is to get our heads around big numbers.

Read More »

Read More »

Debt Saturation: Off the Cliff We Go

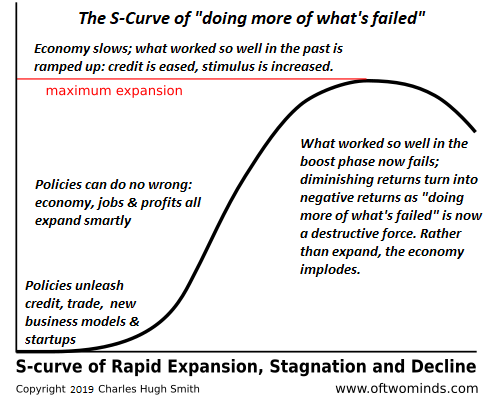

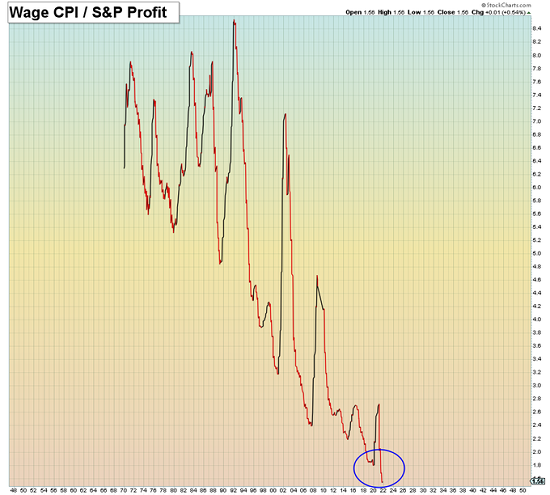

When the system can't borrow more and distribute the insolvency, it implodes. I started writing about debt saturation back in 2011. The basic idea is we can continue to borrow and spend as long as one of two conditions hold: 1) real (inflation-adjusted) income is rising, so there's more income to service additional debt, or 2) the cost of borrowing declines so the same income can support more debt.

Read More »

Read More »

Yes, It Is Different This Time

Most people would be horrified by a 40% decline in their "investments." When bubbles pop, speculative assets don't drop 40%, they drop 90% or even 98%.

Read More »

Read More »

For Freak’s Sake, People, Even the Crash Test Dummies Are Nervous

Those trusting the Fed to be visibly weak, corrupt and incompetent forever might be in for an unwelcome surprise. When even the crash test dummies are nervous, it pays to pay attention. Being in a mild crash isn't too bad if all the protective devices inflate as intended. But in a horrific crash where nothing goes as planned, it's like speeding in a ready-to-explode Pinto and being side-swiped by a semi on Dead Man's Curve.

Read More »

Read More »

It’s All the Aliens’ Fault

As for our central banks' defaulting on their lines of credit with the Martian Central Bank--that's another

alien intervention we'll live to regret.

I hope this won't shock the more sensitive readers too greatly, but I've discovered undeniable evidence that all

our planet's problems are the result of alien intervention. Yes, aliens exist and are actively intervening

in humanity's activities, to our great detriment.

Wars, plagues, The...

Read More »

Read More »

Calm Before the Storm?

Stocks don't vanish when sold; somebody owns the shares all the way to the bottom. These owners who refuse to sell because they have convinced themselves the next dip will be the hoped-for resumption of the bullish trend are called "bagholders."

Read More »

Read More »

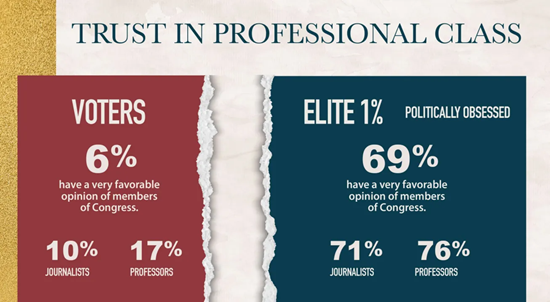

Autocracy’s Fatal Weakness

This desire for compliance and consensus dooms the autocracy to failure and collapse because dissent is the essence of evolutionary churn and adaptation. The various flavors of autocracy (theocracy, kleptocracy, dictatorship, etc.) look remarkably successful at first blush but they all share a fatal flaw.

Read More »

Read More »

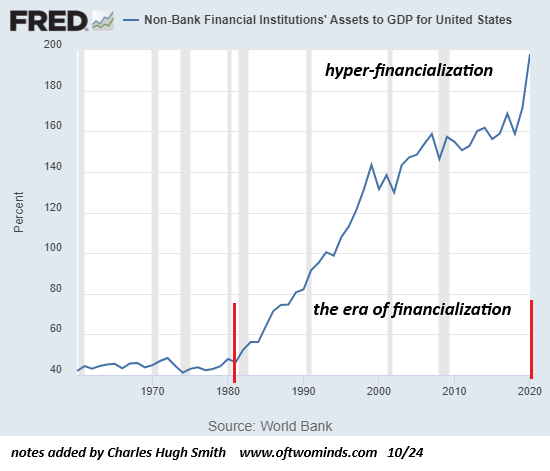

How Healthcare Became Sickcare

The financialization of healthcare started two generations ago and is now in a run-to-fail feedback loop of insolvency. Long-time readers know I have been critical of U.S. healthcare for over a decade. When I use the term sickcare this is not a reflection on the hard work of frontline caregivers--it is a reflection of the financialization incentives that have distorted the system's priorities and put it on a path to insolvency.

Read More »

Read More »

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy by: Charles Hugh Smith

National Security is not just military force. In an age of scarcity, security is a degrowth economy of energy independence, social cohesion and civic virtue.

All nations, including the United States, face systemic crises that are reinforcing each other at an explosive point in history.

Read More »

Read More »

The Roundtable Insight with Charles Hugh Smith on The Great Awakening Vision

Http://financialrepressionauthority.com/2022/03/17/the-roundtable-insight-charles-hugh-smith-on-the-great-awakening-vision/

Link to the Article on the alternative Great Reset - http://financialrepressionauthority.com/2022/03/08/the-great-awakening-an-alternative-great-reset-based-on-the-principles-of-the-austrian-school-of-economics

Read More »

Read More »

Risk Accumulates Where No One Is Looking For It

All this decay is so incremental that nobody thinks it possible that it could ever accumulate into a risk that threatens the entire system. The funny thing about risk is the risk that everyone sees isn't the risk that blows up the system. The mere

fact that everyone is paying attention to the risk tends to defang it as everyone rushes to hedge or reduce the risk.

Read More »

Read More »