Category Archive: 5.) Charles Hugh Smith

What’s Behind the Global Erosion of Civil Liberties, Privacy and Property Rights?

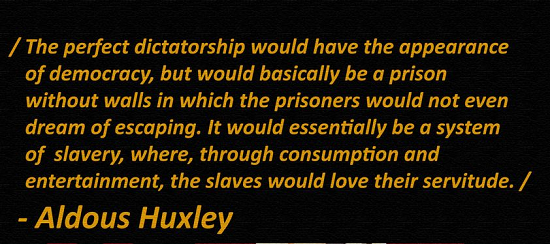

The second essential step is to recognize how the spectacles of "news" and entertainment distract our attention from this erosion of basic rights. Hierarchical power structures like city-states arose as problem-solving solutions, not just for the elites who benefited from the concentration of wealth and power but for the citizenry.

Read More »

Read More »

What if the "Black Swan" of 2023 Is the Fed Succeeds?

If the Fed succeeding is a "Black Swan," bring it on. What if the "Black Swan" of 2023 is the Federal Reserve succeeds? Two stipulations here: 1. "Black Swan" is in quotes because the common usage has widened to include events that don't match Nassim Taleb's original criteria / definition of black swan; the term now includes events considered unlikely or that are off the radar screens of both the media and the...

Read More »

Read More »

The Roundtable Insight – Charles Hugh Smith on Eroding Civil Liberties and Property Rights

Support us on Patreon - https://www.patreon.com/roundtableinsight

http://financialrepressionauthority.com/2023/01/06/the-roundtable-insight-charles-hugh-smith-on-eroding-civil-liberties-and-property-rights/

Read More »

Read More »

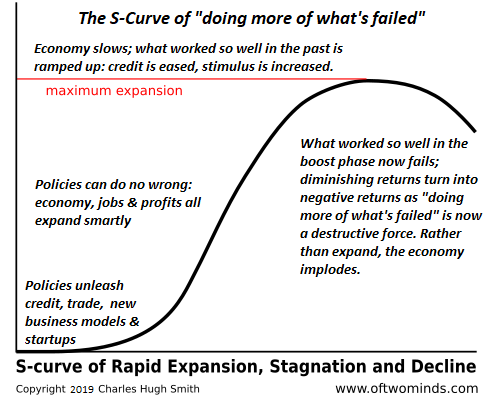

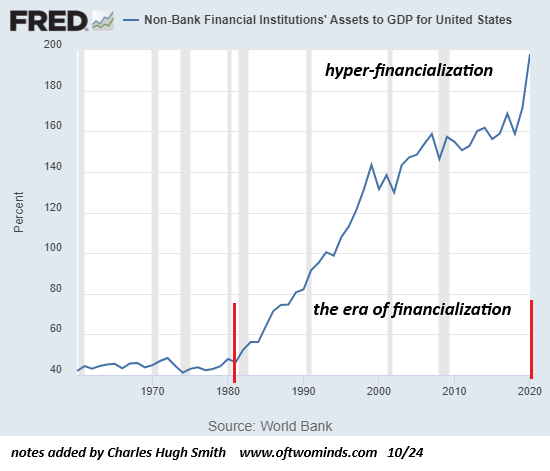

It’s a New Era

This dynamic--making problems much worse by forcing more of whatever worked in the previous era into a saturated, increasing unstable new era--receives little attention or understanding. Eras may last decades, and only those who've lived long enough to recall previous eras have experienced the transition from one era to the next.

Read More »

Read More »

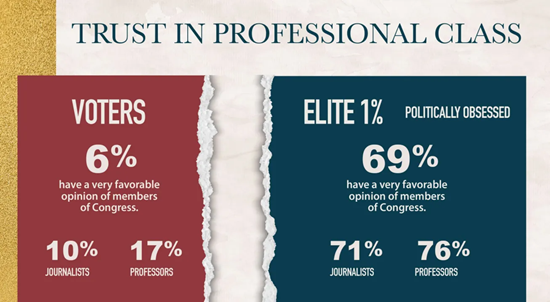

Misunderstanding War, Money and Prosperity

If the consensus of experts misunderstand money, credit and prosperity, how are we going to advance? Describing all the ways experts got it wrong is a thriving cottage industry. Expertise is itself contentious, as conventional expertise legitimized by credentials, prestigious institutional positions, scholarship, prizes, etc. can be wielded to promote the interests of the expert or whomever is funding the expert.

Read More »

Read More »

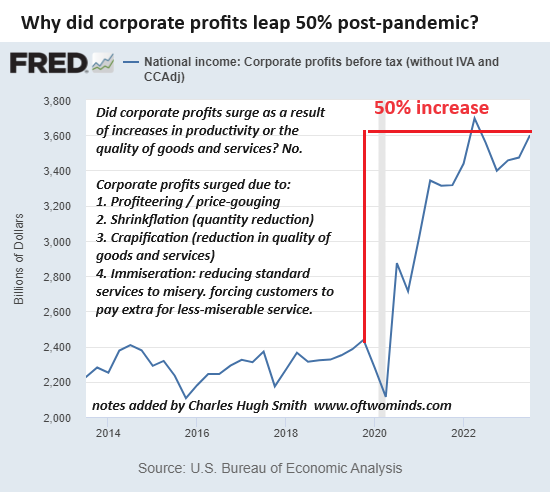

What’s Your Line in the Sand? The $25 Burger?

The gag reflex kicks in at some point and we walk away because it is no longer worth the price. Everyone has a line in the sand when it comes to inflated prices they refuse to pay. For one Walmart shopper I observed, it was a carton of eggs for close to $10. She announced her line in the sand verbally, with great force and sincerity.

Read More »

Read More »

A Great Madness Sweeps the Land

Those who see the madness for what it is have only one escape: go to ground, fade from public view, become self-reliant and weather the coming storm in the nooks and crannies. A great madness sweeps the land. There are no limits on extremes in greed, credulity, convictions, inequality, bombast, recklessness, fraud, corruption, arrogance, hubris, pride, over-reach, self-righteousness and confidence in the rightness of one's opinions.

Read More »

Read More »

Monopolies and Cartels Are "Communism for the Rich"

What's unfettered in America is "Communism for the Rich" and the normalization of corruption that results from the auctioning of political power to protect monopolies and cartels. The irony of constantly being accused of being a communist is rather rich.

Read More »

Read More »

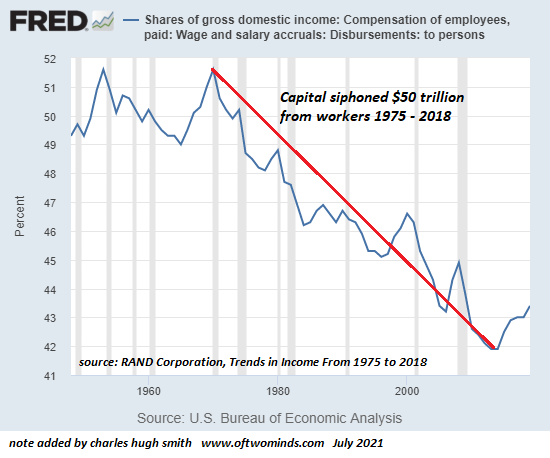

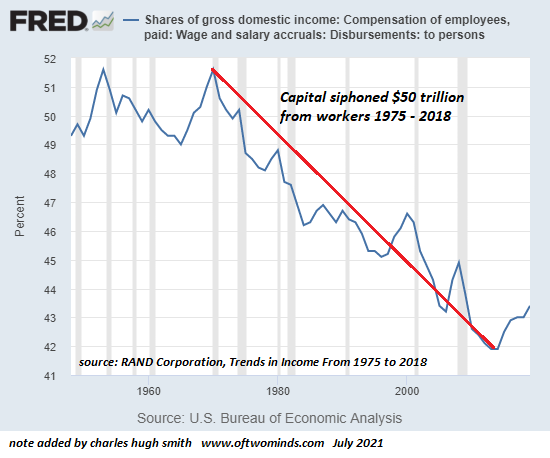

The Blowback from Stripmining Labor for 45 Years Is Just Beginning

The clueless technocrats are about to discover that unfairness and exploitation can't be measured like revenues and profits, but that doesn't mean they're not real. Economists and financial pundits tend to make a catastrophically flawed assumption.

Read More »

Read More »

How Things Fall Apart

That's how things fall apart: insiders know but keep their mouths shut, outsiders are clueless, and the decay that started slowly gathers momentum as the last of the experienced and competent workforce burns out, quits or retires. Outsiders are shocked when things fall apart. Insiders are amazed the duct-tape held this long.

Read More »

Read More »

The Monopoly – Labor "Let It Rot" Death Spiral

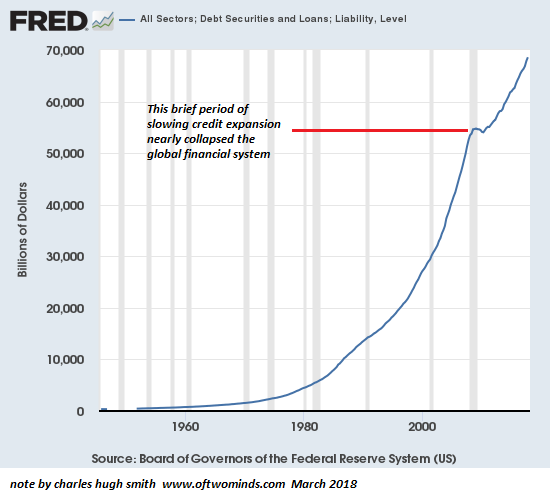

The only rational response to this reality is to opt out, lay flat and let it rot. In my previous post, The Bubble Economy's Credit-Asset Death Spiral, I described the self-reinforcing feedback of expanding credit and soaring asset valuations and how the only possible result of this financial perpetual motion machine was a death spiral of collapsing debt service, collateral and credit impulse.

Read More »

Read More »

Die “Titanic”-Analogie, die Sie noch nicht gehört haben | Von Charles Hugh Smith

Den vollständigen Tagesdosis-Text (inkl. ggf. Quellenhinweisen und Links) finden Sie hier: https://apolut.net/die-titanic-analogie-die-sie-noch-nicht-gehoert-haben-von-charles-hugh-smith

Read More »

Read More »

Die “Titanic”-Analogie, die Sie noch nicht gehört haben | Von Charles Hugh Smith

Den vollständigen Tagesdosis-Text (inkl. ggf. Quellenhinweisen und Links) finden Sie hier: https://apolut.net/die-titanic-analogie-die-sie-noch-nicht-gehoert-haben-von-charles-hugh-smith

Ein Kommentar von Charles Hugh Smith.

Passive Akzeptanz des Verleugnens

Ob wir uns dessen bewusst sind oder nicht, wir reagieren mit passiver Akzeptanz des Verleugnens.

Sie haben zweifellos gehört, dass die Neuanordnung der Liegestühle auf der Titanic eine...

Read More »

Read More »

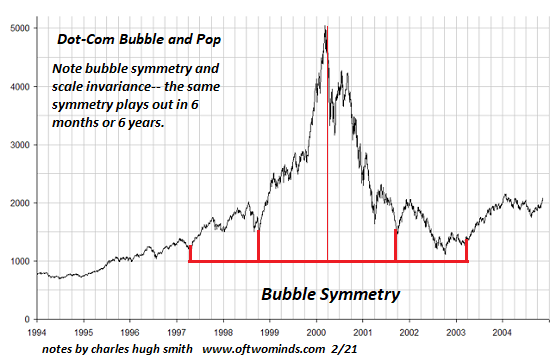

The Bubble Economy’s Credit-Asset Death Spiral

Who believed that central banks' financial perpetual motion machine was anything more than trickery designed to generate phantom wealth? Central banks seem to have perfected the ideal financial perpetual motion machine: as credit expands, money pours into risk assets, which shoot higher under the pressure of expanding demand for assets that yield either hefty returns (junk bonds) or hefty capital gains as the soaring assets suck in more capital...

Read More »

Read More »

This Is of Course Insane

Greed is a powerful motivation to be an ardent believer in the central banking cult. The ideal cult convinces its followers that it isn't a cult, it's simply the natural order of things.In current terms, this normalizes insane behaviors and beliefs. Sacrificing youth to appease the gods isn't a cult; it's simply the natural order of things.

Read More »

Read More »

The "Oil Curse" and Splashy PR Announcements of Oil Production Cuts

It's not just the price of oil that matters: how much disposable income consumers have left to buy more goods and services matters, too. The Oil Curse (a.k.a. The Resource Curse) refers to the compelling ease of those blessed with an abundance of oil/resources to depend on that gift for the majority of state/national revenues.

Read More »

Read More »

The Uncertainty in China Is Kryptonite to Global Markets

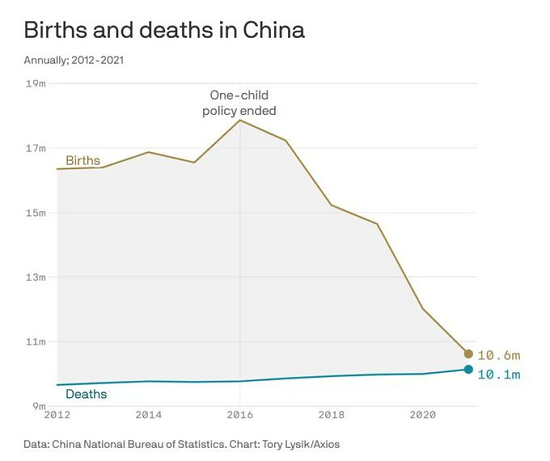

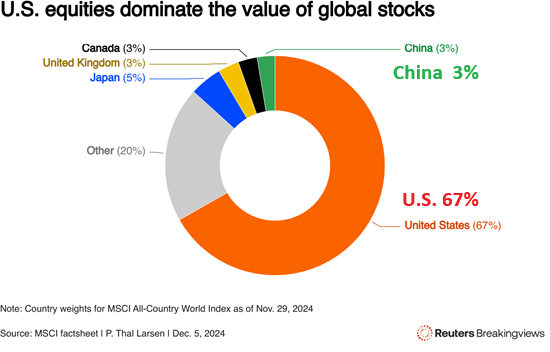

Few seem alive to the potentially consequential financial risks arising from uncertainties evolving in China. One thing we know rather definitively is that markets don't like uncertainty: uncertainty is Kryptonite to markets. Another thing we know is that the events unfolding in China are generating uncertainty on multiple levels.

Read More »

Read More »

There’s No Bottom Until Frenzied Speculation Turns to Dust

Only when speculative sizzle attracts no buyers / marks will the bottom be in. There hasn't been a truly organic bottom in stocks in decades. Fifteen years of relentless central bank manipulation since the 2008-09 Global Financial Meltdown has persuaded punters that central banks will always save us should the market turn down because relentless central bank suppression of interest rates and expansion of liquidity (a.k.a. free money for financiers)...

Read More »

Read More »

FTX: The Dominoes of Financial Fraud Have Yet to Fall

Once assets are revealed as worth far less than claimed, insolvency is the inevitable result. If you haven't plowed through dozens of post-collapse commentaries on FTX, I'm saving you the trouble: here's a distillation of what matters going forward. If you're seeking a forensic accounting of FTX, others have done this work already.

Read More »

Read More »

Where Crypto Went Wrong

You want to fix the world with finance? Then fix this: wages' share of a financialized, globalized, speculative-bubble dependent economy have been falling for decades. Fix this and you really will change the world. Anything less changes nothing.

Read More »

Read More »