Category Archive: 5.) Charles Hugh Smith

Charles Hugh Smith – The Financial System is Headed for Collapse

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »

Read More »

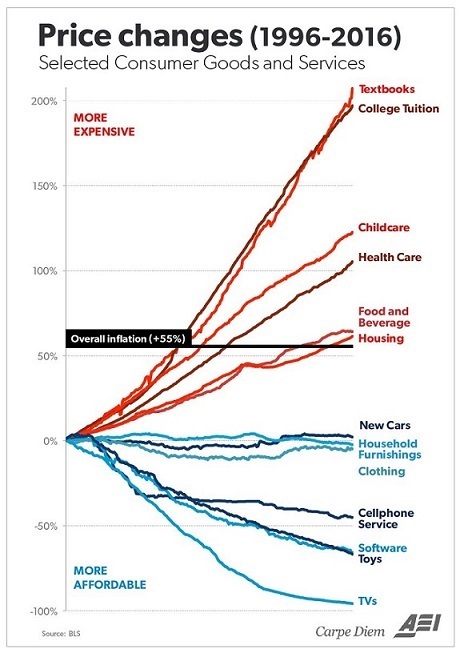

What We’ve Lost

This is only a partial list of what we've lost to globalism, cheap credit and the Tyranny of Price which generates the Landfill Economy. A documentary on the decline of small farms and the rural economy in France highlights what we've lost in the decades-long rush to globalize and financialize everything on the planet-- what we call Neoliberalism, the ideology of turning everything into a global market controlled by The Tyranny of Price and cheap...

Read More »

Read More »

Welcome to the USSR: the United States of Suppression and Repression

We're all against "fake news," right? Until your content is deemed "fake news" in a "fake news" indictment without any evidence, trial or recourse. When propaganda is cleverly engineered, people don't even recognize it as propaganda: welcome to the USSR, the United States of Suppression and Repression.

Read More »

Read More »

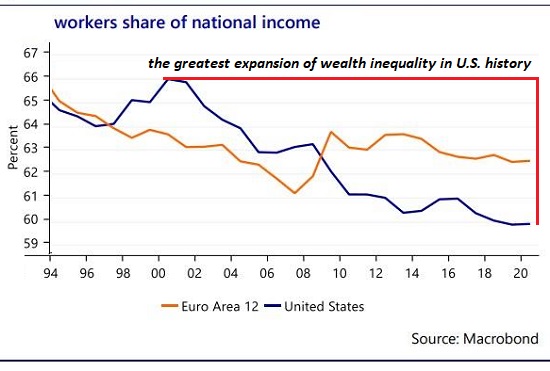

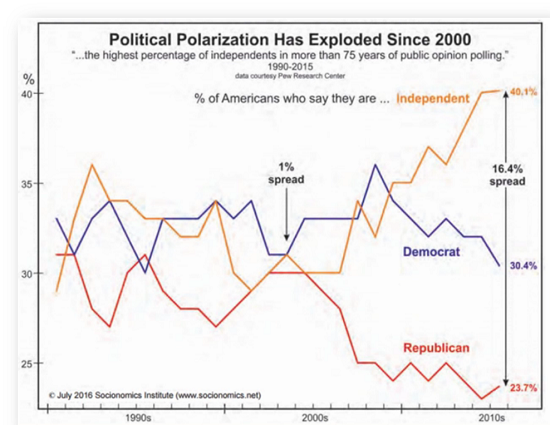

Economic Decay Leads to Social and Political Decay

If we want to make real progress, we have to properly diagnose the structural sources of the rot that is spreading quickly into every nook and cranny of the society and culture. It seems my rant yesterday (Let Me Know When It's Over) upset a lot of people, many of whom felt I trivialized the differences between the parties and all the reforms that people believe will right wrongs and reduce suffering.

Read More »

Read More »

Let Me Know When It’s Over

Maybe it's my cheap seat or my general exhaustion, but the whole staged spectacle is beyond tiresome; I've had my fill. Let me me know when it's over: yes, all of it: the impeachment, the trade dispute with China, U.S. involvement in Syria, the manic stock market rally and the 2020 election.

Read More »

Read More »

Charles Hugh Smith: Will You Be Richer or Poorer?

Much of what we truly value is at risk. Full description and comments at: https://www.peakprosperity.com/charles-hugh-smith-will-you-be-richer-or-poorer/ Prolific and exceptionally perceptive author Charles Hugh Smith returns to discuss the insights in his just-launched book Will You Be Richer Or Poorer? Profit, Power & AI in a Traumatized World (the first chapter of which can be read for …

Read More »

Read More »

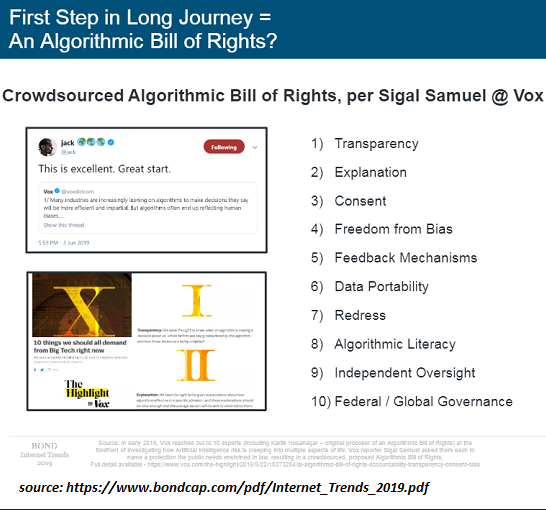

The Ultimate Heresy: Technology Can’t Fix What’s Broken

Technology can't fix what's broken, because what's broken is our entire system.. The ultimate heresy in today's world isn't religious or political: it's refusing to believe that technology can not only solve all our problems, it will do so painlessly and without any sacrifice. Anyone who dares to question this orthodoxy is instantly declared an anti-progress (gasp!) Luddite, i.e. a heretic in league with the Devil.

Read More »

Read More »

Will the Clintons Destroy the Democratic Party?

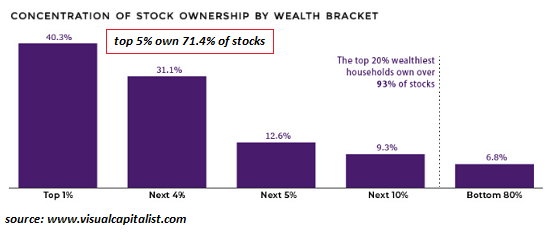

History is full of ironies, and perhaps it will suit the irony gods for The Donald to take down the Republican Party and the Clinton dynasty to destroy the Democratic Party. Let's start by stipulating my bias: I would cheer the collapse of both self-serving, venal political parties, which have stood by for decades as the rich have become immeasurably richer and the politically powerful few have disempowered the many.

Read More »

Read More »

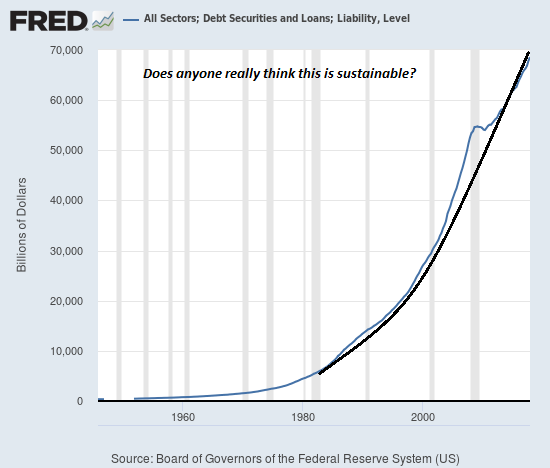

Our Time/Labor Is Finite, But Money Is Infinite

Once we understand this mechanism, we understand that labor can never get ahead. I've been pondering a comment longtime correspondent Drew P. emailed me in response to my post, What's Holding Up the Market?: Our time/labor is finite, but money is infinite. Drew explained that creating new fiat currency and injecting it into a closed system (our financial system) controls and restrains the value of our time and labor, past, present and future.

Read More »

Read More »

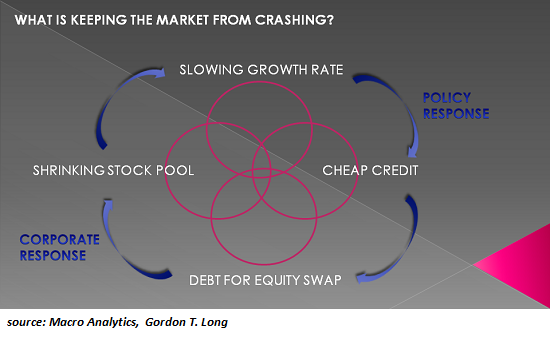

What’s Holding Up the Market?

The Fed's nearly free money for financiers policies in support of the Super-Rich do not exist in a vacuum--the disastrous consequences are already baked in. What's holding up the U.S. stock market? The facile answer is the Federal Reserve but this doesn't actually describe the mechanisms in play or the consequences of a market that levitates ever higher on the promise of more Fed money-for-nothing injected into the diseased veins of the financial...

Read More »

Read More »

MACRO ANALYTICS – 10-03-19 – What’s Holding The Market Up? w/ Charles Hugh Smith

NOTE: THIS IS NOT AN INTERVIEW BUT RATHER AN ONGOING MONTHLY EXCHANGE BETWEEN CHARLES AND GORDON WHICH IS MADE AVAILABLE TO THE PUBLIC AS A PUBLIC SERVICE. VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up VIDEO ABSTRACT: http://charleshughsmith.blogspot.com/2019/10/whats-holding-up-market.html Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, …

Read More »

Read More »

Could Pricey Urban Meccas become Crime-Ridden Ghost Towns?

As the exodus gathers momentum, all the reasons people clung so rabidly to urban meccas decay. If there is any trend that's viewed as permanent, it's the enduring attraction of coastal urban meccas: despite the insane rents and housing costs, that's where the jobs, the opportunities and the desirable urban culture are.

Read More »

Read More »

Pets Are Now as Unaffordable As College, Housing and Healthcare

Like so many other things that were once affordable, owning pets is increasingly pricey. One of the few joys still available to the average household is a pet. At least this is what I thought until I read 5 money-saving tips people hate, which included the lifetime costs of caring for a pet. It turns out Poochie and Kittie are as unaffordable as college, housing and healthcare (and pretty much everything else).

Read More »

Read More »

Here’s How We Are Silenced by Big Tech

This is how they silence us: your content has been secretly flagged as being "unsafe," i.e. "guilty of anti-Soviet thoughts;" poof, you're gone. Big Tech claims it isn't silencing skeptics, dissenters and critics of the status quo, but it is silencing us. Here's how it's done. Let's start with Twitter.

Read More »

Read More »

Charles Hugh Smith Part 2 Millennial Advice on Jobs and Affordable Housing

Charles Hugh Smith Part 2 Millennial Advice on Jobs and Affordable Housing Click here for the full transcript: http://financialrepressionauthority.com/2019/09/26/the-roundtable-insight-charles-hugh-smith-part-2-millennial-advice-on-jobs-and-affordable-housing/

Read More »

Read More »

ALERT?U.S. Economy Recession Inevitable On October 3, 2019!! (Charles Hugh Smith)

#Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver #Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill Holter #Bo Polny # economic collapse #dollar …

Read More »

Read More »

Financial Storm Clouds Gather

The price of this "solution"--the undermining of the financial system--will eventually be paid in full. The financial storm clouds are gathering, and no, I'm not talking about impeachment or the Fed and repo troubles--I'm talking about much more serious structural issues, issues that cannot possibly be fixed within the existing financial system.

Read More »

Read More »

Charles Hugh Smith: AMERICA IS UNPREPARED: TRILLIONS AT STAKE – WHOLE PENSIONS COULD VANISH!

EDUCATE YOURSELF IMMEDIATELY: LP(S) – Enemy LP(S) – Dead LP(S) – Ratio LP(L) – Top PREPARE FOR THE BEAR MARKET: LP(S) – Bear This Can Crack the USD Hegemony! GO IMMEDIATELY TO: https://www.WealthResearchGroup.com/Calicoin Lior Gantz Is Giving Access To His PERSONAL Treasure Trove, His Own Trades AT: https://www.wealthresearchgroup.com/mypicks/ Warren Buffett, Ray Dalio, Charlie Munger And …

Read More »

Read More »

Confirm? U.S Economic Collapse On October 3, 2019 (Charles Hugh Smith)

#Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver #Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill Holter #Bo Polny # economic collapse #dollar …

Read More »

Read More »

? Warning About An Unstoppable Economic Collapse On October 3, 2019 (Charles Hugh Smith)

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/ Contact advertising :[email protected]

Read More »

Read More »