Category Archive: 5.) Charles Hugh Smith

Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order

Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order http://financialrepressionauthority.com/2020/03/05/the-roundtable-insight-yossi-kaplan-and-charles-hugh-smith-on-the-virus-and-the-new-world-order/

Read More »

Read More »

Did Covid-19 Just Pop All the Global Financial Bubbles?

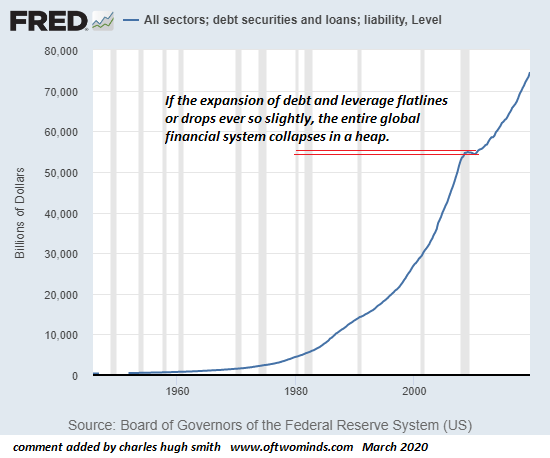

Once confidence and certainty are lost, the willingness to expand debt and leverage collapses. Even though the first-order effects of the Covid-19 pandemic are still impossible to predict, it's already possible to ask: did the pandemic pop all the global financial bubbles? The reason we can ask this question is the entire bull mania of the 21st century has been based on a permanently high rate of expansion of leverage and debt.

Read More »

Read More »

The Limits of Force: A Bayonet in the Back Will Not Restore China’s Economy

Force cannot restore legitimacy, trust or confidence, nor can it magically erase the consequences of a still-unfolding national trauma. The Chinese authorities threatening to punish workers who refuse to return to work are getting a lesson in the limits of force in an unprecedented national trauma: a bayonet in the back will not restore the legitimacy and confidence that have been lost.

Read More »

Read More »

Could the Covid-19 Pandemic Collapse the U.S. Healthcare System?

Disregard these second-order effects at your own peril. A great many systems that are assumed to be robust are actually fragile. Exhibit #1 is the global financial system, of course, but Exhibit #2 may well be the healthcare system globally and in the U.S.

Read More »

Read More »

No, The Fed Will Not “Save the Market”–Here’s Why

The greater the excesses, speculative euphoria and moral hazard, the greater the reversal. A very convenient conviction is rising in the panicked financial netherworld that the Federal Reserve and its fellow dark lords will "save the market" from COVID-19 collapse. They won't. I already explained why in The Fed Has Created a Monster Bubble It Can No Longer Control (February 16, 2020) but it bears repeating.

Read More »

Read More »

When Will We Admit Covid-19 Is Unstoppable and Global Depression Is Inevitable?

Given the exquisite precariousness of the global financial system and economy, hopes for a brief and mild downturn are wildly unrealistic. If we asked a panel of epidemiologists to imagine a virus optimized for rapid spread globally and high lethality, they'd likely include these characteristics: 1. Highly contagious, with an R0 of 3 or higher.

Read More »

Read More »

Covid-19: Global Retrenchment Will Obliterate Sales, Profits and Yes, Big Tech

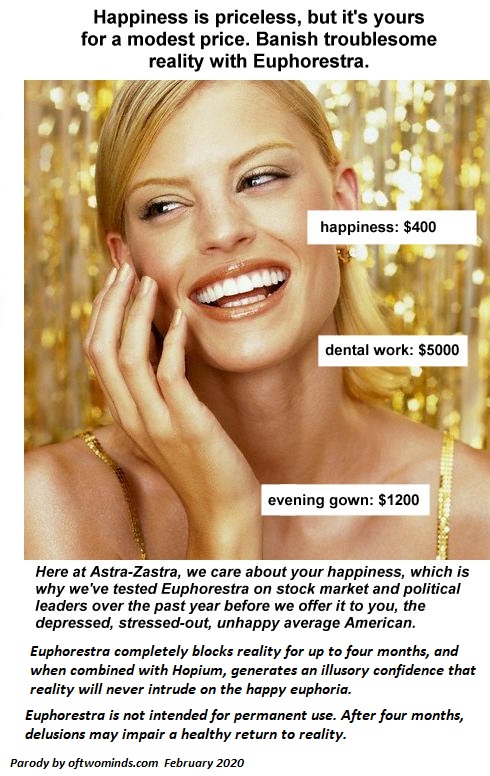

If you think global demand will rebound as global debt and confidence implode, you better not be making consequential decisions based on Euphorestra-addled magical thinking. Even before the Covid-19 pandemic, the global economy was slowing for two reasons: 1) everybody who can afford it already has it and 2) overcapacity. One word captures the end-of-the-cycle stagnation: saturation.

Read More »

Read More »

The World Is Awash in Oil, False Assurances, Magical Thinking and Complacency as Global Demand Careens Toward a Cliff

This collapse of price will manifest in all sorts of markets that are based on debt-funded purchases of desires rather than a warily prudent priority on needs. Since markets are supposed to discover the price of excesses and scarcities, it's a mystery why everything that is in oversupply is still grossly overpriced as global demand slides off a cliff: oil, semiconductors, Uber rides, AirBNB listings and many other risk-on / global growth stories...

Read More »

Read More »

The Fed Has Created a Monster Bubble It Can No Longer Control

The Fed must now accept responsibility for what happens in the end-game of the Moral-Hazard Monster Bubble it created. Contrary to popular opinion, the Federal Reserve didn't set out to create a Monster Bubble that has escaped its control.

Read More »

Read More »

China’s Fatal Dilemma

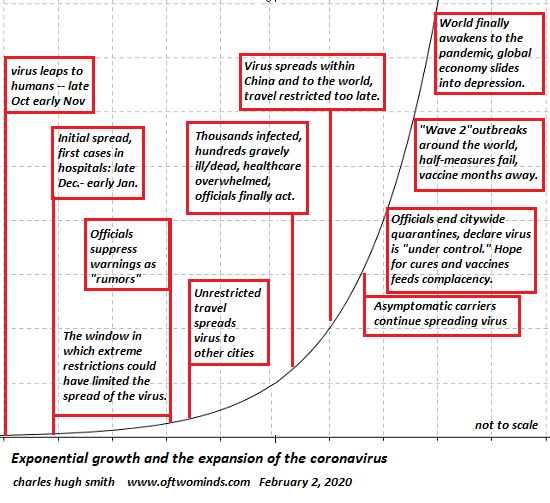

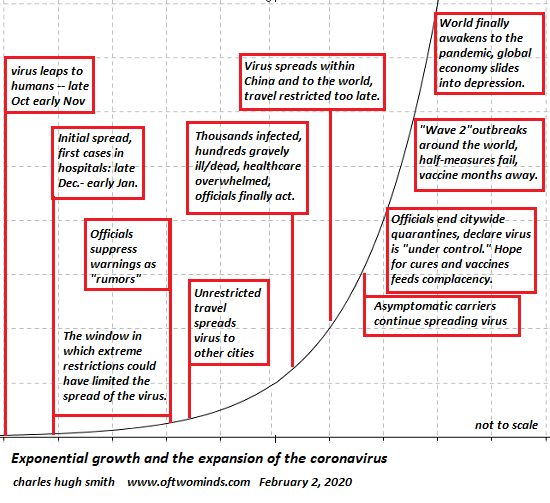

Ending the limited quarantine and falsely proclaiming China safe for visitors and business travelers will only re-introduce the virus to workplaces and infect foreigners. China faces an inescapably fatal dilemma: to save its economy from collapse, China's leadership must end the quarantines soon and declare China "safe for travel and open for business" to the rest of the world.

Read More »

Read More »

Controlling the Narrative Is Not the Same as Controlling the Virus

Are these claims even remotely plausible for a highly contagious virus that spreads easily between humans while carriers show no symptoms? It's clear that the narrative about the coronavirus is being carefully managed globally to minimize the impact on global sentiment and markets.

Read More »

Read More »

Pandemic, Lies and Videos

Will we wonder, what were we thinking? and marvel anew at the madness of crowds? When we look back on this moment from the vantage of history, what will we think? Will we think how obvious it was that the coronavirus deaths in China were in the tens of thousands rather than the hundreds claimed by authorities?

Read More »

Read More »

Brace for Impact: Global Pandemic Already Baked In

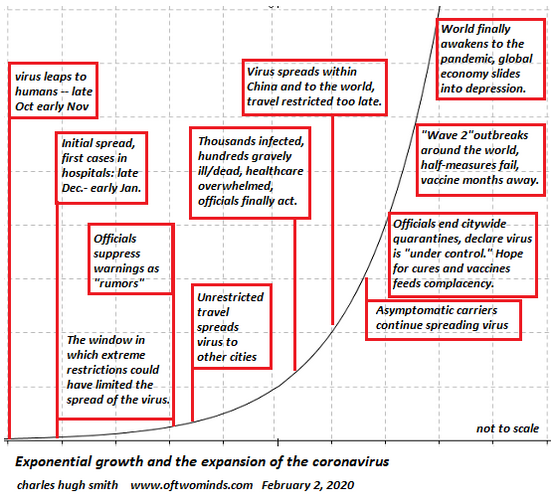

If we accept what is known about the virus, then logic, science and probabilities all suggest we brace for impact. Here's a summary of what is known or credibly estimated about the 2019-nCoV virus as of January 31, 2019: 1. A statistical study from highly credentialed Chinese academics estimates the virus has an RO (R-naught) of slightly over 4, meaning every carrier infects four other people on average.

Read More »

Read More »

Second-Order Effects: The Unexpectedly Slippery Path to Dow 10,000

Dow 30,000 is "unsinkable," just like the Titanic. A recent Barrons cover celebrating the euphoric inevitability of Dow 30,000 captured the mainstream zeitgeist perfectly: Corporate America is firing on all cylinders, the Federal Reserve's god-like powers will push stocks higher regardless of any other reality, blah blah blah.

Read More »

Read More »

Charles Hugh Smith – Real Reason for Record Stock Markets: Front-running the Front-runners

Returning SBTV guest, Charles Hugh Smith, calls the Federal Reserve an evil organization. Their meddling in the economy results in the concentration of wealth to those at the top of the wealth pyramid and is fueling asset bubbles, creating widening wealth inequality. Charles Hugh Smith is the editor of the OfTwoMinds blog: https://www.oftwominds.com Discussed in …

Read More »

Read More »

Could the Coronavirus Epidemic Be the Tipping Point in the Supply Chain Leaving China?

Everyone expecting a quick resolution to the epidemic and a rapid return to pre-epidemic conditions would be well-served by looking beyond first-order effects. While the media naturally focuses on the immediate effects of the coronavirus epidemic, the possible second-order effects receive little attention: first order, every action has a consequence. Second order, every consequence has its own consequence.

Read More »

Read More »

Charles Hugh Smith on the Emerging Repo Crisis

Charles Hugh Smith on the Emerging Repo Crisis http://financialrepressionauthority.com/2020/01/27/the-roundtable-insight-charles-hugh-smith-on-the-emerging-repo-crisis/

Read More »

Read More »

The Future of What’s Called “Capitalism”

The psychotic instability will resolve itself when the illusory officially sanctioned "capitalism" implodes. Whatever definition of capitalism you use, the current system isn't it so let's call it "capitalism" in quotes to indicate it's called "capitalism" but isn't actually classical capitalism.

Read More »

Read More »

Calling Things by Their Real Names

One does not need money to convey one's thoughts, but what money does allow is the drowning out of speech of those without money by those with a lot of money. In last week's explanation of why the Federal Reserve is evil, I invoked the principle of calling things by their real names, a concept that drew an insightful commentary from longtime correspondent Chad D.:

Read More »

Read More »

WTF: What The Fed?! Mike Maloney, Chris Martenson, Grant Williams & Charles Hugh Smith

Get the bonus video here: https://www.peakprosperity.com/wtf-what-the-fed-insights-from-advisers-sign-up “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a free …

Read More »

Read More »