Category Archive: 5.) Alhambra Investments

Six Point Nine Times Two Equals What It Had In Twenty Fourteen

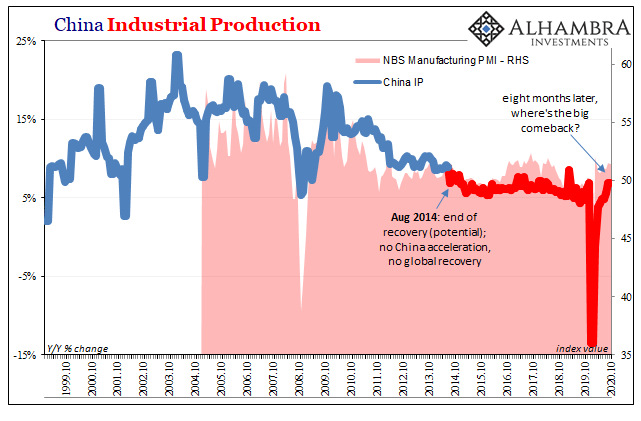

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.”

Read More »

Read More »

Where Is It, Chairman Powell?

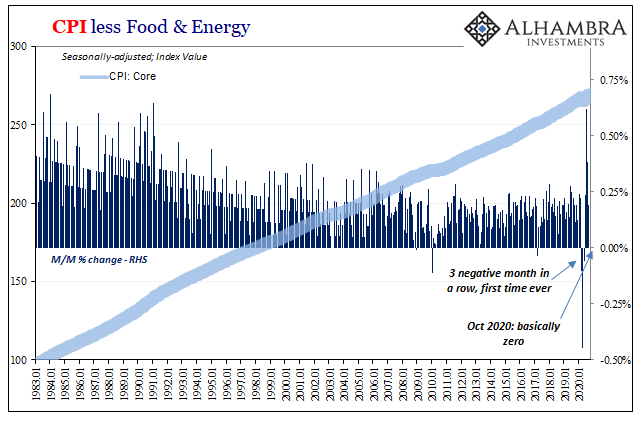

Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance.

Read More »

Read More »

The Prices And Costs Of What Xi Believes He’s Got To Do

It does seem, at first, a huge contradiction. On the one hand, what we know so far of China’s 14th 5-year plan apparently will lean heavily on new technologies not-yet invented to rescue the country’s economy from the pit of de-globalization the eurodollar system had thrown it into years ago.

Read More »

Read More »

How Much Taxes Will Retirees Owe on Their Retirement Income

Planning for retirement. We spend most of our working career preparing for it, saving for it, covering every contingency. When you finally wave goodbye to the company, you’re ready for all that planning to take over. But does your planning take into account the taxes you’ll have to pay on your retirement income? It’s one of the biggest retirement planning mistakes people make.

Read More »

Read More »

Good Payrolls Still Say Slowdown

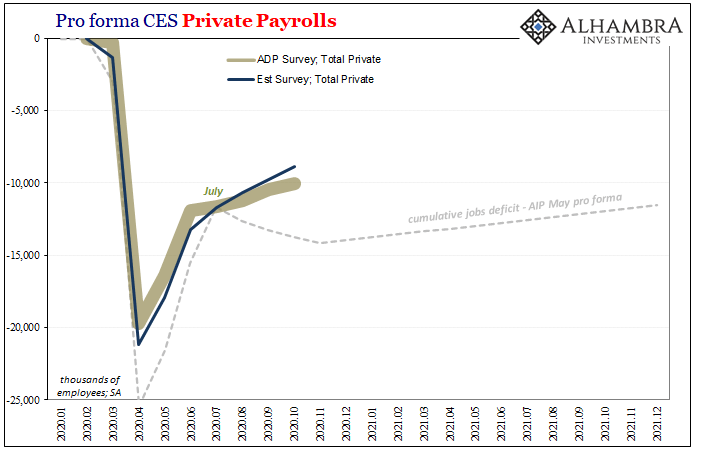

The payroll report for the month of October 2020 was a very good one. This shouldn’t be surprising, perfect BLS publications appear with regularity even during the most challenging of circumstances. Headlines and underneath, everything looked fine last month.

Read More »

Read More »

Inflation Fairy Tale: Why It’s Deflation We Should Worry About (w/ Steven Van Metre & Jeff Snider)

Is inflation on the horizon? Should bank reserve balances stored with the Federal Reserve count as "money"? According to Jeffrey Snider, head of global research at Alhambra Investment Partners, and Steven Van Metre, macro fund manager and founder of Portfolio Shield, the answer to these questions is a resounding "no." Drawing upon a data ranging from Treasury auction sales to Eurodollar futures curves, van Metre and Snider...

Read More »

Read More »

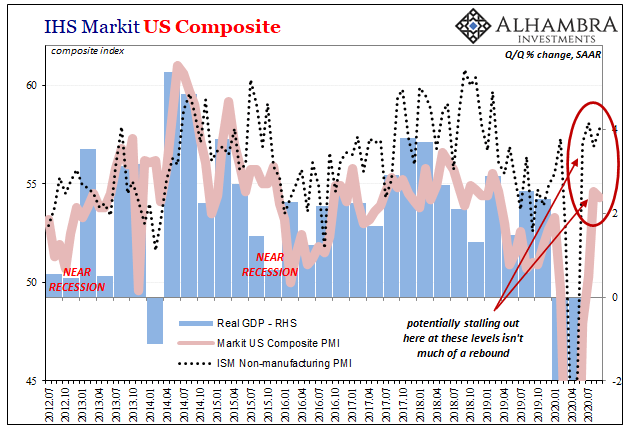

Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too.

Read More »

Read More »

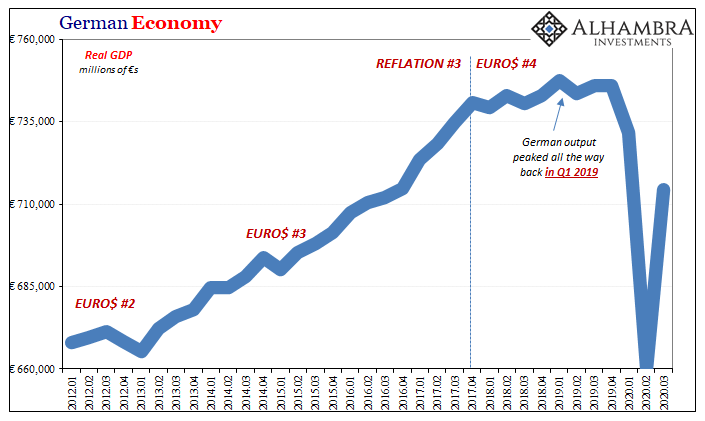

Meanwhile, Outside Today’s DC

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

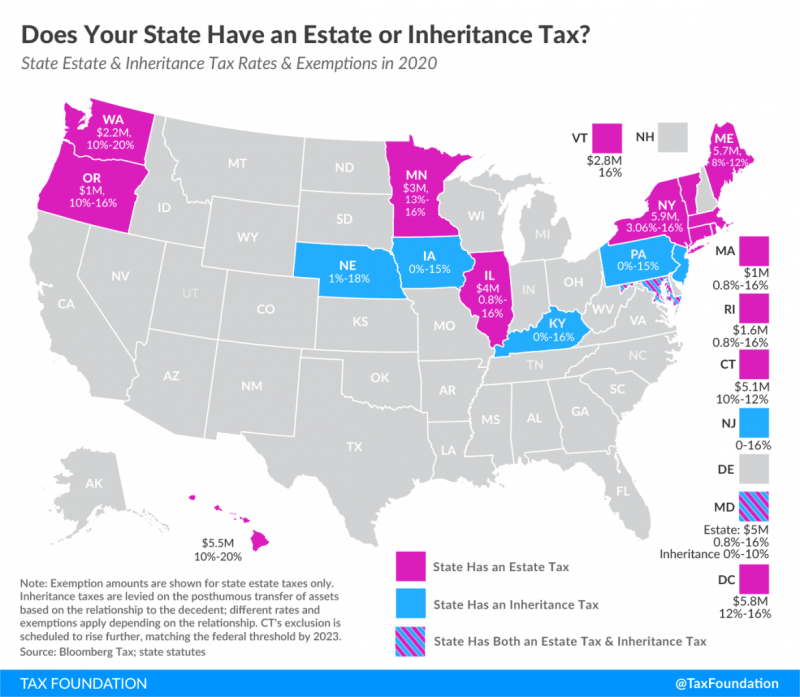

17 States that Charge Estate or Inheritance Taxes

Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise.

Read More »

Read More »

What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »

Charitable Remainder Trusts

Alhambra's' Bob Williams describes Charitable Remainder Trusts and how they can be used as a planning tool to create a win-win for you and charities.

Read More »

Read More »

Yep, There’s A New ‘V’ In Town And The Locals…Don’t Seem To Much Care For It

They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage.

Read More »

Read More »

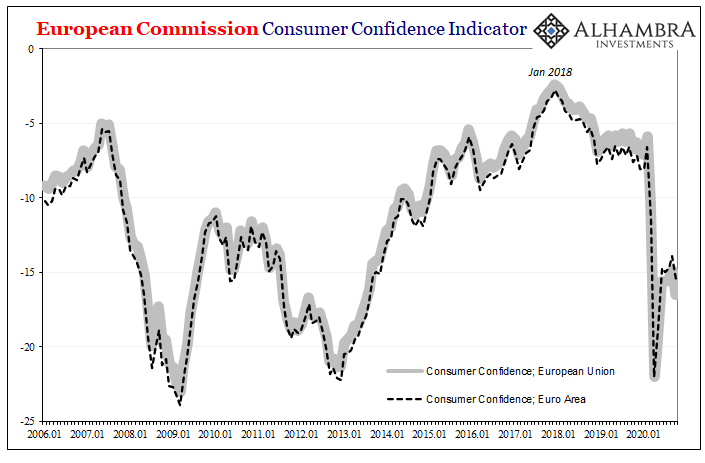

Consumer Confidence Indicator: Anesthesia

Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom.

Read More »

Read More »

5 Estate Planning Myths That Can Derail Your Estate Plan

You spend a lifetime earning, saving, acquiring. But the old adage is true—you can’t take it with you. So, what do you do with your assets when you’re gone? How do you want them distributed? That’s where a good estate plan comes in.

Read More »

Read More »

A Deflationary Mindset That Isnt In Our Minds: Jeff Snider

The timing could not have been worse, though in the grand scheme of things it is just perfect. It was barely two weeks ago when Jay Powell was announcing what he and others were claiming was a huge, massive deal. No longer a specific inflation target, but one that would be averaged high against low.

Read More »

Read More »

Inflation Conditions Absent, Someone Call Jay

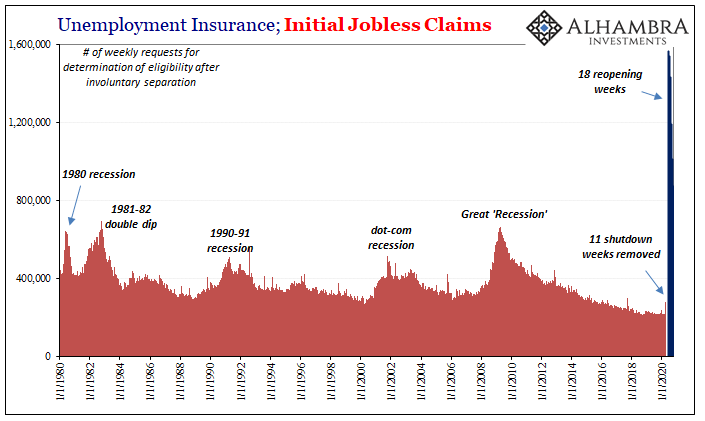

Wednesday, October 7, 2020 5:45 AM EDT Not just payroll data, either. The JOLTS data also keeps backing up this idea of a slowdown forming in the trajectory of both the CES and CPS series. More and more it looks like the economy is running out of momentum well short of the finish line.

Read More »

Read More »

It Just Isn’t Enough

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state.

Read More »

Read More »

Is There Enough?

It’s just not fast enough. And with the labor market spitting out numbers across a broad economic cross-section that look increasingly tired suggesting an economy running out of momentum, there’s the added urgency of time.

Read More »

Read More »

Who’s Negative? The Marginal American Worker

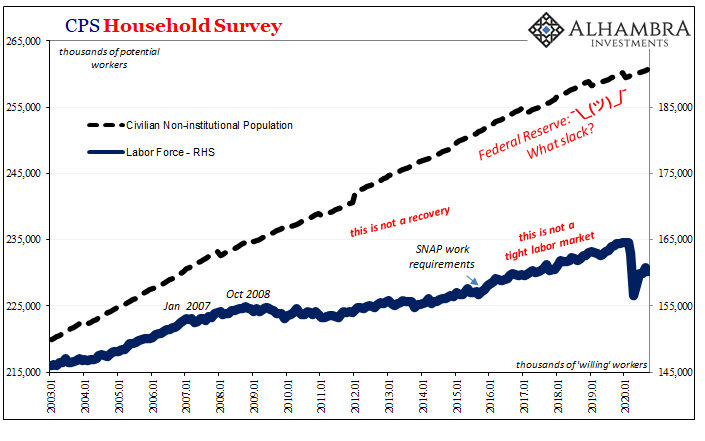

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments.

Read More »

Read More »

Monthly Macro Monitor – September (VIDEO)

Alhambra CEO Joe Calhoun and Alhambra's Bob Williams look at data from the past month and discuss what it means for the economy.

Read More »

Read More »