Category Archive: 5.) Alhambra Investments

Weekly Market Pulse: As Clear As Mud

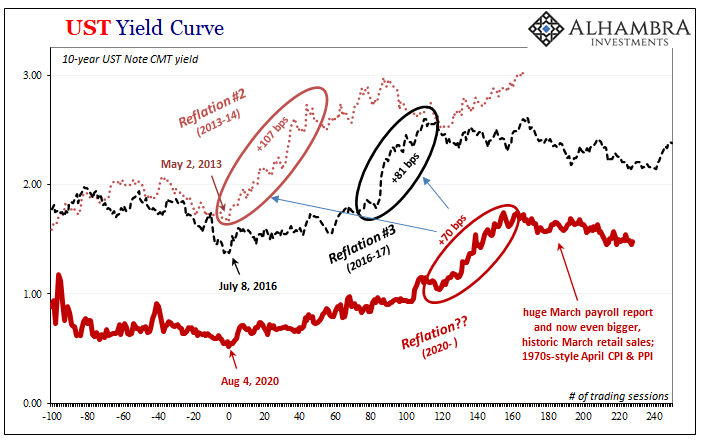

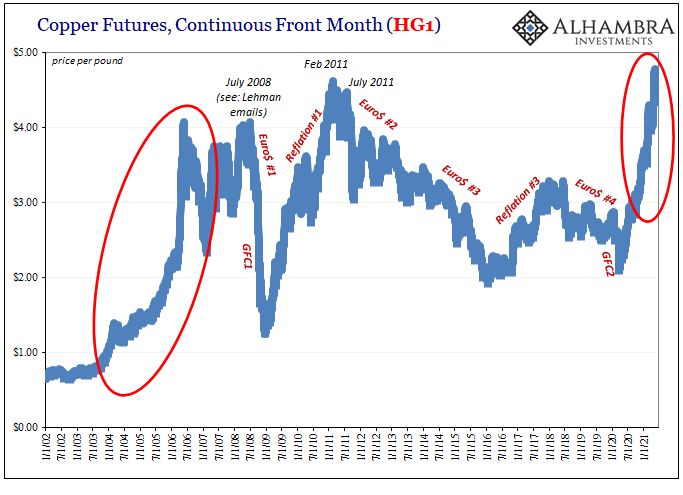

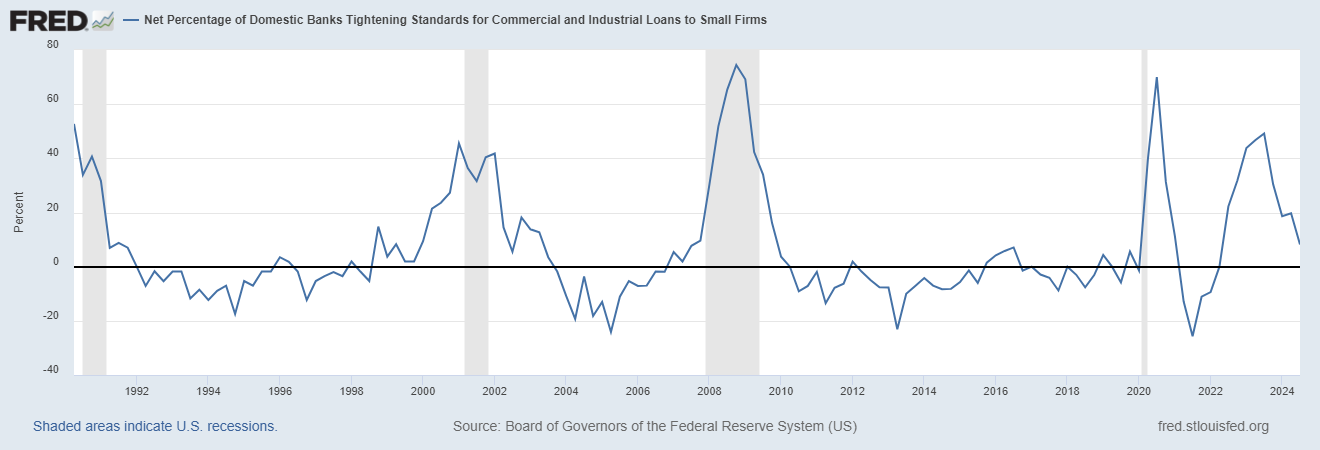

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs.

Read More »

Read More »

And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene.

Read More »

Read More »

Third CPI In A Row, Yet All Eyes On That 30s Auction

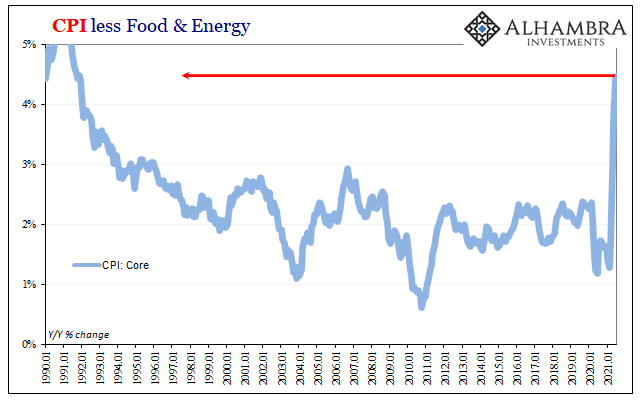

Three in a row, huge CPI gains. According to the BLS, headline consumer price inflation surged 5.39% (unadjusted) year-over-year during June 2021. This was another month at the highest since July 2008 (the last transitory inflationary episode). The core CPI rate gained 4.47% last month over June last year, the biggest since November 1991.

Read More »

Read More »

Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »

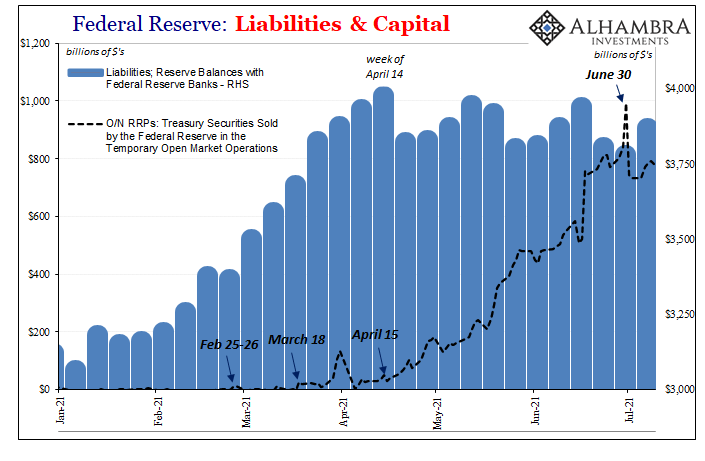

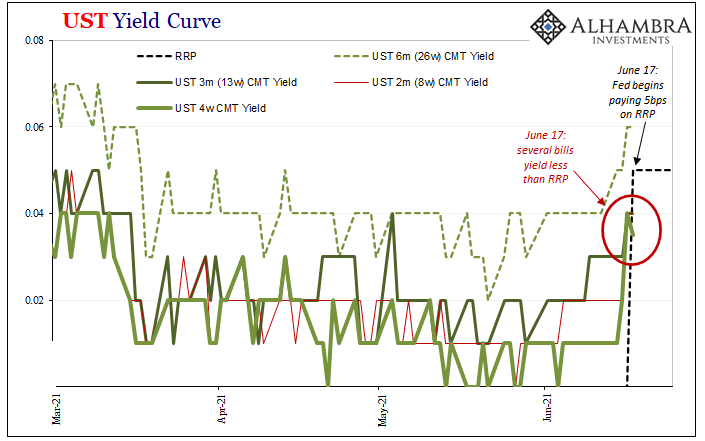

RRP No Collateral Coincidences As Bills Quirk, Too

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big.

Read More »

Read More »

Jeff Snider On Shadow Money, History, Eurodollar System, Central Banks, Repo, Collateral (RCS 117)

Topics- Were the Dot-Com Bubble and the Housing Bubble caused by the exponential growth of shadow money since the late 80s? Risk, liquidity, Credit Bubble of ’95, China, Eurodollar System. Rehypothecation and how it works: return, leveraging assets, Repo Market, treasuries, repledging, collateral, derivatives. Central Banks, Global Monetary System, Salomon Brothers. Collateral shortage: is that the problem?

Read More »

Read More »

Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change.

Read More »

Read More »

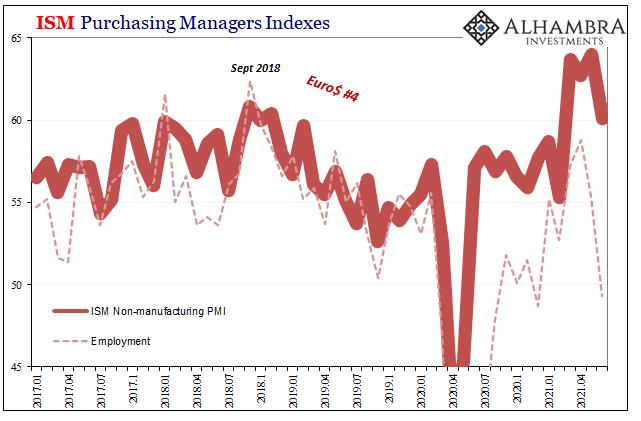

ISM’s Nasty Little Surprise Isn’t Actually A Surprise

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Read More »

Read More »

Anyone Remember That Whole SLR Cliff?

Does anyone remember the SLR “cliff?” Of course you don’t, because in the end it didn’t seem to make any difference. For a few weeks, it was kind of ubiquitous if only in the sense that it was another one of those deep plumbing issues no one seems able to understand (forcing all the “experts” to run to Investopedia in order write something up about it).

Read More »

Read More »

A Clear Balance of Global Inflation Factors

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years.

Read More »

Read More »

Inflation Isn’t Just The Outlier, The Inflation In It Is, Too

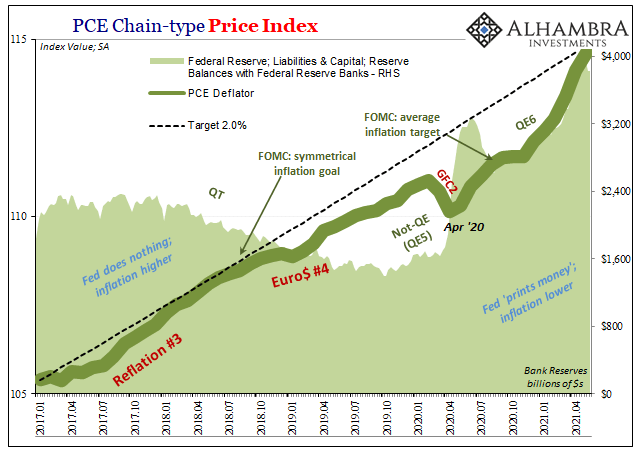

Following the same recent pattern as the BLS and its CPI, the Bureau of Economic Analysis’s (BEA) PCE Deflator ran up hotter in May 2021 than its already high increase during April. The latter’s headline consumer basket rose 3.91% year-over-year, its fastest pace since August 2008.

Read More »

Read More »

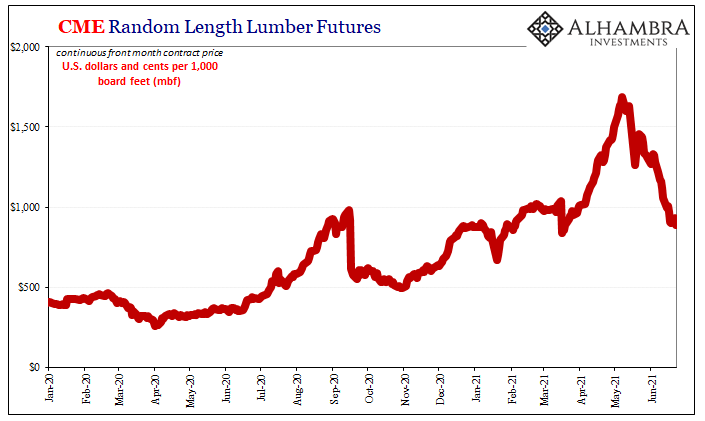

Sure Looks Like Supply Factors

If it walks like a duck and quacks like a duck, then it must be inflationary overheating. Or not? As more time passes and the situation further evolves, the more these recent price deviations conform to the supply shock scenario rather than a truly robust economy showing no signs of slowing down.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Weekly Market Pulse on June 21, where we look at significant things from last week's events with Joe Calhoun.

Read More »

Read More »

The FOMC Accidentally Exposes Itself (Reverse Repo-style)

Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely.

Read More »

Read More »

Copper Corroding PPI

Yesterday, lumber. Today, copper. The “doctor” has been in reverse for better than two months now, with trading in the current session pounding the commodity to a new multi-month low. Down almost $0.19 for the day, an unusual and eye-opening loss, this brings the cumulative decline to 9.2% since the peak way back on May 11.

Read More »

Read More »

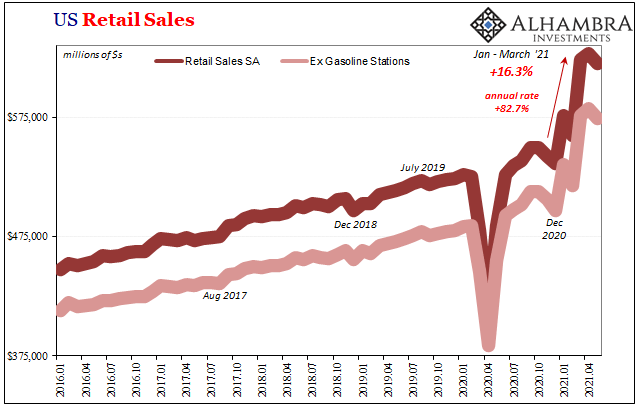

Another Round of Transitory: US Retail Sales & (revised) IP

Same stuff, different month. We can basically reprint both what was described yesterday about supply curves not keeping up with exaggerated demand as well as the past two months of commentary on Retail Sales plus Industrial Production each for the US. Quite on the nose, US demand for goods, anyway, is eroding if still artificially very high.

Read More »

Read More »

The Inflation Emotion(s)

Inflation is more than just any old touchy subject in an age overflowing with crude, visceral debates up and down the spectrum reaching into every corner of life. It is about life itself, and not just quality. When the prices of the goods (or services) you absolutely depend upon go up, your entire world becomes that much more difficult.

Read More »

Read More »