Category Archive: 4) FX Trends

USDCHF continues to struggle below key ceiling resistance. Sellers remain in control.

USDCHF remains under pressure as sellers control the market. Buyers need to break above the swing area at 0.87704 to reverse the trend. However, the 100-hour moving average is providing some support for now.

Read More »

Read More »

BOC rate decision ahead: Technical barometers for USDCAD revealed in this video preview

In this video, I take a look at the technical indicators to watch for in the USDCAD pair during the Bank of Canada interest rate decision. Discover key levels that could impact price action and potential trends.

Read More »

Read More »

Kickstart the trading day:Technical analysis unveils opportunities in top currency pairs

Discover key support and resistance levels in EURUSD, USDJPY, and GBPUSD. See where price movements are headed and the potential for upside and downside momentum.

Read More »

Read More »

Markets Catch Collective Breath

Overview: The US dollar is mixed today. The dollar-bloc currencies are firmer, while the euro and yen are softer. We had anticipated a recovery of the dollar on ideas that the market has too aggressively pushed down US rates, and pricing in more Fed easing with higher confidence than seems to be warranted by the recent data. However, US rates have not recovered, but the dollar has. Partly, this reflects that rates have fallen as faster if not...

Read More »

Read More »

The bitcoin analysis you didn’t see, getting close to the value area high

Https://www.forexlive.com/technical-analysis/the-ultimate-bitcoin-price-forecast-revealed-watch-the-video-20231206/

Welcome to the ForexLive.com deep dive into Bitcoin's current market trends and future key price points! This video is a must-watch for anyone interested in understandingwhere Bitcoin's price may well be going next. Here's what we cover:

? Key Technical Indicators Explained:

Value Area High (VAH) Analysis:

Discover the...

Read More »

Read More »

WTI Crude Oil Technical Analysis

Here's a quick technical analysis on WTI Crude Oil with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

NZDUSD tests support at swing level. Traders await price reversal or breakout

NZDUSD falls to test support swing level near 0.6117, while traders contemplate whether to push the price higher or break below the 200-hour moving average at 0.60893 for further clues on the next bias.

Read More »

Read More »

EURUSD falls towards key swing area as London/European traders look toward the exits.

European and London traders' exit prompts EURUSD to approach crucial swing area between 1.0765 and 1.0783. ECB's indication of potential rate easing contributes to the consecutive 5-day decline.

Read More »

Read More »

USDJPY roller coaster ride: Ups and downs persist as traders await next shove.

The USDJPY pair continues its volatile journey as sellers turn buyers, pushing the price back up to resistance levels. Traders eagerly anticipate a breakout from the current support and resistance levels.

Read More »

Read More »

USDCAD steps below key levels, bearish momentum builds

The USDCAD moved higher before sellers took control, testing key resistance levels. Breaking below key support levels could signal a downward trend and a short-term high.

Read More »

Read More »

RBA keeps rates unchanged. A dovish slant spurs on a AUDUSD drop.

The Reserve Bank of Australia's decision to maintain interest rates at 4.35% was seen as a dovish move, causing the AUDUSD to decline. Technical analysis reveals a breakdown below key moving averages, signaling potential further selling.

Read More »

Read More »

Forex Kickstart: Technical Analysis of EURUSD, GBPUSD, and USDJPY for December 5.

Get the latest technical analysis and insights on the major currency pairs EURUSD, GBPUSD, and USDJPY. Find out the key levels to watch and potential trading opportunities for both buyers and sellers.

Read More »

Read More »

Don’t Miss the Next Chinese Bull Run: Seizing Opportunities in the Chinese Stock Market Rebound

Embark on a comprehensive journey into the world of technical analysis with our latest video, focused on capturing the burgeoning opportunities in the rebounding Chinese stock market. Centered around the MCHI ETF, a key instrument for tapping into China's vast equity market, this video is a treasure trove for investors and traders aiming to leverage the immense potential of one of the world's foremost economies.

As we navigate through the...

Read More »

Read More »

Softer Tokyo CPI Buys BOJ Time while Moody’s Cuts the Outlook for China’s Debt following Fiscal Stimulus and the Continued Property Slump

Overview: Outside of the Australian dollar, which

has fallen by around 0.6% following the RBA meeting and the softer final PMI,

which may have dragged the New Zealand dollar a lower by around 0.25%, the

other G10 currencies trading little changed ahead of the start of the North

American session. The eurozone and UK final PMIs were revised higher. Central

European currencies lead the emerging market currencies. China reported better

than expected...

Read More »

Read More »

Comprehensive Analysis of American Express (AXP) Stock: Navigating Through 2020-2029

? Decoding American Express's Long Term Market Trends and Projections

Embark on an insightful journey with us as we analyze American Express (AXP) stock, covering the critical developments from the onset of 2020 to the current day. This video is tailored for investors and traders who are eager to grasp the pivotal factors influencing AXP stock, focusing on vital price levels, Volume Weighted Average Price (VWAP), and volume profile insights. Our...

Read More »

Read More »

Axon (AXON) Stock Analysis: Unveiling Key Trends and Predictions (2020-2029)

? Navigating the Future of Axon: A Strategic Stock Analysis

Join us as we embark on a detailed exploration of Axon's (formerly known as Taser) stock journey from the beginning of 2020 to today. In this video, we focus on deciphering the critical price points, the Volume Weighted Average Price (VWAP), and volume profile specific to AXON stock. This analysis is meticulously designed for investors and traders who are keen on understanding the nuances...

Read More »

Read More »

In-Depth Analysis of Amazon (AMZN) Stock: Key Levels, Volume Analysis & Future Outlook (2020-2029)

? Exploring Amazon's Stock Journey: A Comprehensive Technical Perspective

Join us in this detailed exploration of Amazon (AMZN) stock's performance, tracing its path from the dawn of the 2020 decade to today. Our focus is on critical price levels, the Volume Weighted Average Price (VWAP), and volume profile analysis. This video is crafted for both traders and investors aiming to grasp potential pivotal price points that may be vital for future...

Read More »

Read More »

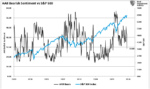

AMD LONG TERM TECHNICAL ANALYSISINCLUDING KEY PRICE LEVELS

AMD Long-Term Technical Analysis: Key Price Levels, VWAP & Volume Profile (2020-2029)

In this video, we're taking an extensive look at AMD's stock performance from the beginning of the 2020 decade to the present, focusing on key price levels, VWAP (Volume Weighted Average Price), and the volume profile. Whether you're an investor or a trader, this analysis is designed to highlight potential key price points that could be crucial in the...

Read More »

Read More »

USDJPY Technical Analysis

Here's a quick technical analysis USDJPY with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »