Category Archive: 4) FX Trends

Gold Technical Analysis – The price is at a key resistance zone

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:42 Technical Analysis with Optimal Entries.

2:09 Upcoming Economic Data....

Read More »

Read More »

March 2024 Monthly

Rarely are officials able to achieve the proverbial economic soft-landing when higher interest rates help cool price pressures without triggering a significant rise in unemployment or a contraction.

Read More »

Read More »

Ueda’s Comments Knock the Yen Back, while the Euro Flirts with $1.08

Overview: The US dollar is mixed today. The dollar-bloc currencies and the Scandis are enjoying a slightly firmer tone, while the euro and sterling are edging higher in European turnover.

Read More »

Read More »

EURUSD Technical Analysis – The price is at a key support zone

#eurusd #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the EURUSD pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:11 Technical Analysis with Optimal Entries.

2:24 Upcoming Economic Data....

Read More »

Read More »

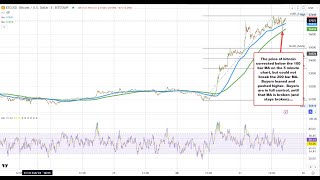

The USDCAD moves lower and toward key support near 100 day MA and key swing area.

The 100 day MA comes in at 1.35457, and the 50% of the move down from the October high at 1.35378. That area is key support.

Read More »

Read More »

The USDCAD moves lower and toward key support near 100 day MA and key swing area.

The USDCAD 100 day MA comes in at 1.35457, and the 50% of the move down from the October high at 1.35378. That area is key support.

Read More »

Read More »

Kickstart your FX trading for Feb. 29 with technical look at the EURUSD, USDJPY and GBPUSD

What are the technicals in the EURUSD, USDJPY and GBPUSD saying after the as expected US PCE data.

Read More »

Read More »

Yen Pops on BOJ Comments on Inflation, but the Dollar holds Most of Yesterday’s Gains against the other G10 Currencies

The dollar is mixed as the market awaits the US personal consumption expenditure deflator, which is the measure of inflation the Fed targets. While there is headline risk, we argue that the signal has already been generated by the CPI and PPI releases.

Read More »

Read More »

Gold Technical Analysis

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:34 Technical Analysis with Optimal Entries.

1:39 Upcoming Economic Data....

Read More »

Read More »

USDJPY continues its push against the 2024 high at 150.87. Can the ceiling be broken?

The USDJPY based at the 100-hour MA earlier today. Gave the buyers the go-ahead to push back to the upside technically.

Read More »

Read More »

NZDUSD runs lower after more dovish RBNZ rate decision. What are the technicals saying?

The NZDUSD races lower after the more dovish rate decision by the RBNZ. In the US session, the price has breached the 100-day moving average of 0.60917 in the 200 day moving average looms below at 0.60757.

Read More »

Read More »

Kickstart your FX trading for February 28 with a technical look at 3 (no 4) major pairs

A technical look at the EURUSD, USDJPY , GBPUSD and as a bonus the NZDUSD after the RBNZ rate decision.

Read More »

Read More »

Dollar Jumps

Overview: A less hawkish Reserve Bank of New Zealand and a slightly softer than expected January CPI from Australia appears to have sparked a broad US dollar rally.

Read More »

Read More »

WTI CRUDE OIL TECHNICAL ANALYSIS

#crudeoil #futures #technicalanalysis

In this video you will learn about the latest fundamental developments for WTI Crude Oil. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:58 Technical Analysis with Optimal Entries.

2:25 Upcoming Economic Data....

Read More »

Read More »

AUDUSD consolidates within a narrow range with key technical targets. Market waits.

The AUDUSD consolidates above the 100 bar MA on the 4-hour chart and key swing area, and below the 200-day MA and 200 bar MA on 4-hour chart.

Read More »

Read More »

NZDUSD traders set up for RBNZ rate decision in the new trading day

The RBNZ will announce their rate decision at 8 PM ET later today. What technical levels are in play through the rate decision?.

Read More »

Read More »