Category Archive: 4) FX Trends

CNY7.20 Gives Way as Strong Greenback Proves Too Much

Overview: The dollar's post-FOMC sell-off has

been completely reversed and the greenback has reached new highs for the week

against most of the G10 currencies. Heightened intervention fears and softer US

yields has helped steady the yen, which near unchanged now, and is the best

performer. The Scandis and Antipodeans are the heaviest, off 0.65%-0.90%. For

the first time since last November, the US dollar has risen above CNY7.20 and

continued to...

Read More »

Read More »

USDJPY Technical Analysis – WATCH OUT for a key breakout

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:45 Technical Analysis with Optimal Entries....

Read More »

Read More »

GBPUSD Technical Update: Stepping though technical levels on way to key day MAs

The 100-day MA in the GBPUSD at 1.2625 and the 200-day MA at 1.2593 are the next key targets

Read More »

Read More »

The USDCAD chart is sloppy as the ups and downs continue.

The price of the USDCAD is trading within the cluster of MAs but above 100 and 200-day MAs.

Read More »

Read More »

The SNB surprised with a cut today. What are the chart saying for USDCHF and EURCHF now?

The USDCHF and EURCHF move higher after the surprise cut in interest rates by the SNB. What next from a technical perspective.

Read More »

Read More »

Market Hears a Dovish Fed and Sells the Greenback

Overview: The Federal Reserve triggered a dollar

sell-off yesterday and follow-through selling was seen in Asia before

profit-taking emerged. That created a new dollar selling opportunity in early European

turnover. The FOMC revised up this year's growth forecast, shaved the

unemployment projection, and while maintaining the PCE deflator forecast, and

the median dot remained for three cuts this year. The soft-landing scenario was

underscored and...

Read More »

Read More »

Gold Technical Analysis – Dip-buying opportunity following the FOMC decision

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:38 Technical Analysis with Optimal Entries.

2:05 Upcoming Economic Data....

Read More »

Read More »

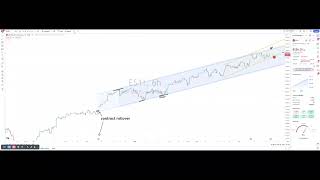

What did the volatility from the FOMC decision do to the technicals in the USDJPY?

This video outlines the technicals in play for the USDJPY and explains why the levels in play are SO IMPORTANT.

Read More »

Read More »

NZDUSD trades to new 2024 lows today and maintains a bearish bias. What shift the bias?

A technical look at the NZDUSD as we head toward the US Fed decision at 2 PM ET. What levels are in play? What would shift the bias back to the upside? What key targets loom on more downside momentum today?

Read More »

Read More »

AUDUSD traders stall the rise today against a key MA and keep the sellers in control

The technical roadmap for the AUDUSD ahead of the Fed rate decision is explained in full.

Read More »

Read More »

USDCAD bounces higher today but finds sellers near swing area resistance. What next?

It is Fed Day. What technical levels are in play for the USDCAD through the FOMC rate decision

Read More »

Read More »

USDCHF extends above key retracement target. Trades at highest since November 14

The price of the USDCHF moves above its 61.8% retracement at 0.88957.. What is driving the pair technically.

Read More »

Read More »

Dollar Extends Gains Against the Yen but Broadly Firmer Ahead of the FOMC

Overview: The US dollar remains bid ahead of the outcome of today's

FOMC meeting. No change in policy is expected, but the forward guidance, partly

delivered in the updated projections, is the focus. In the last iteration

(December), the Fed "dot" was for three rate cuts this year. Japanese

markets were closed for a national holiday today but dollar's gains against the

yen have been extended and the greenback is nearing the peak seen in...

Read More »

Read More »

Navigating US OIL PRICE trends | Market Outlook with Exness

Curious about the recent behavior of the US oil price? You're not alone. Many traders are keeping a keen eye on the US oil price chart, trying to decipher where the US oil market is heading next. Something interesting is brewing this week with US oil trading. Could there be a lucrative opportunity as the price potentially dips to the $76 mark and then aims for a retest at $78?

Is it time to consider trading US oil?

In this Market Outlook with...

Read More »

Read More »

WTI Crude Oil Technical Analysis – Watch what happens at this key resistance zone

#crudeoil #futures #technicalanalysis

In this video you will learn about the latest fundamental developments for WTI Crude Oil. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:40 Technical Analysis with Optimal Entries.

2:13 Upcoming Economic Data....

Read More »

Read More »