Category Archive: 4.) Marc to Market

Week Ahead: State of Dollar’s Correction to be Determined

The US dollar rose against the G10 currencies and most emerging market currencies last week. But to the extent the upside correction this month has been spurred by a backing up of US rates, its recovery may be over or nearly so. The US two-year yield settled lower on the week and the 10-year yield … Continue reading...

Read More »

Read More »

Waller may be Alone in Advocating July Rate Cut, but it Weighs on the Greenback

Overview: The US dollar is trading softer against most G10 and emerging market currencies today. The dollar seemed to lose its bid late yesterday after Federal Reserve Governor Waller argued in favor a rate cut at this month's meeting, despite the TIC data that showed foreign investors bought more US securities in May than they …

Read More »

Read More »

Trial Balloon to Fire Powell went over like a Lead Zeppelin

Overview: A natural experiment of sorts unfolded yesterday. Heightened speculation, fanned in part by the White House itself, that after several threats, President Trump was going to fire Fed Chair Powell. Short-term rates fell but the curve steepened, the greenback sold off sharply, and stocks skidded lower. The main narrative is that seeing the carnage, …

Read More »

Read More »

USD Steadies after Yesterday’s Surge, but Does it have Legs?

Overview: The dollar has steadied today after yesterday's jump. Asia and Europe do not seem to be as enthusiastic about the dollar as North America seemed to be yesterday. President Trump indicated that sectoral tariffs on semiconductor chips and pharmaceuticals could be announced as early as August 1. He also said that there will be …

Read More »

Read More »

Greenback Slips Ahead of June CPI

Overview: The US dollar is trading somewhat heavier against the G10 currencies but the Scandis today, ahead of the US CPI report. Most emerging market currencies are also firmer. The last few CPI readings were softer than expected, but economists continue to look for firmer price pressures. Late yesterday, the US announced a 17% tariff …

Read More »

Read More »

Market Recognizes US Tariff Threats as Negotiation Tactics and Sees Through New Front in Criticism of Powell

Overview: The market has taken the US threat of 30% tariffs on the EU and Mexico in stride. Both currencies wobbled a little but are little changed as the North American session is about to start. Participants seem to recognize the threat as a tactic meant to increase the pressure to negotiate (i.e., make new …

Read More »

Read More »

Week Ahead: US CPI and Import Prices may keep Fed’s Stand Pat Decision Unanimous amid Threats of a Higher Universal Tariff

The dollar rose against most of the G10 currencies last week. The Australian dollar and Swedish krona were the exceptions. The Aussie was helped by the central bank's surprise decision not to cut rates. The krona may have been helped by stronger than expected June inflation, with the key measure jumping to 3.3% from 2.5%), …

Read More »

Read More »

US Tariffs Unsettle the Markets while the UK’s May GDP Unexpectedly Contracted

Overview: The US 35% tariff on Canada and President Trump's threat to have a 15%-20% universal tariff rather than 10% provides today's disruption. A tariff letter for the EU is awaited but seeing how the US treated Canada and Brazil (with whom the US has a trade surplus) warns of the risk to Europe. That …

Read More »

Read More »

The Dollar’s Upside Correction Stalls

Overview: The continued release of US tariff announcements shapes the near-term considerations. Of the surprises, the 50% tariff on Brazil (10% on April's "Liberation Day") is among the most egregious. The US has a trade surplus with it and the letter made clear a personal animosity over the treatment of former President Bolsonaro. After having …

Read More »

Read More »

Capital Markets Take US Tariffs and Threats in Stride

Overview: The US tariff saga continues. Yesterday, President Trump announced a 50% tariff copper, sending the red metal screaming higher (13%+), and threatening 200% tariffs on pharma. Other sectoral investigations are expected to wrap up toward the end of the month. There is a vigorous effort to check "transshipments," but it is not clear how …

Read More »

Read More »

US Tariffs Stall the Greenback’s Upside Correction. RBA Surprises with Stand Pat Decision

Overview: The capricious nature of the US tariffs, the tone in which they were announced, while still allowing time (August 1) to negotiate is the main talk. More tariff announcements are expected today. The dollar's upside correction was cut short, and it is weaker against nearly all the world's currencies. The jump in long-end Japanese …

Read More »

Read More »

US Dollar Extends Recovery; Tariffs Loom but now August 1

Overview: After last week's US jobs data and anticipation of a firm CPI reading next week, US interest rates have firmed, and the dollar begins the new week on a firm note. Meanwhile, US tariff letters from the White House may begin being delivered today. Initially, it was signaled that some letter would go out …

Read More »

Read More »

Week Ahead: US Liberation Day Redux after Jobs Data Reinforce Fed’s Patience, and RBA to Cut

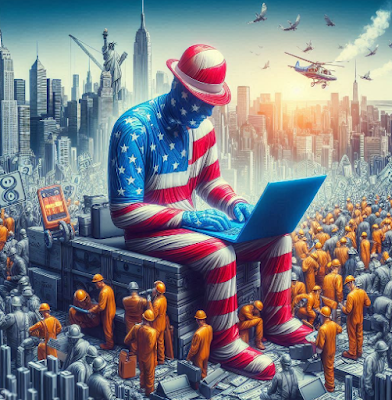

Fresh off the passage of the the budget, judicial victories, and achieving a cease fire between Israel and Iran, the Trump administration is on the verge of closing its initial chapter in its dramatic changes of America's foreign economic policy. The 90-day hiatus since Liberation Day comes to an end in the week ahead. Ahead …

Read More »

Read More »

USD is Mostly Firmer Ahead of Jobs Report for which the Market is on Notice for Downside Risks

Overview: The US dollar is firm. The only G10 currency that is stronger today is sterling, which is recovering from yesterday's sharp losses and the UK's drama eased following Prime Minister Starmer's support for Chancellor Reeves. Of note most of the final June PMI readings were revised higher from the initial estimates. The US struck …

Read More »

Read More »

Dollar Bears Taking the Day Off?

Overview: The dollar's latest leg down began with the President Trump's heightened attacks on the Federal Reserve's conduct of US monetary policy on June 23. That move may be over. Perhaps helped by stronger than expected data yesterday and the rise in US rates. US rates have edged up further today, and the greenback is … Continue reading...

Read More »

Read More »

Dollar Drop Gains Momentum and US Rates Extend Decline

Overview: An accelerated run on the US dollar continues. The euro, sterling, Australian and New Zealand dollars have risen to new highs. The greenback has dropped to new lows since 2015 against the Swiss franc. Japan's efforts to protect its rice farmers triggered the ire of President Trump. The "reciprocal tariffs," which could come back …

Read More »

Read More »

The Greenback is Finishing the Month Quietly, while PBOC Fixes the Dollar at New Lows for the Year

Overview: The US dollar is consolidating in mostly narrow ranges against the G10 currencies. It is trading mostly softer against emerging markets currencies. The news stream features further progress of the US budget bill, which dropped the onerous "revenge tax" (Section 899), and there is talk of as many as a dozen trade framework agreements …

Read More »

Read More »

July 2025 Monthly

The second half of 2025 begins not with optimism, but with fatigue. The global economy is not collapsing, but it is clearly bending under strain—economic, geopolitical, and institutional. What is taking shape is not a soft landing, but something more sobering: a slower, structurally weaker cycle in a more dangerous and fragile world.Three developments define …

Read More »

Read More »

Dollar Stabilizes after Yesterday’s Shellacking but Finds Little Traction

The US dollar has steadied today after yesterday's shellacking that saw it fall to new multiyear lows against the euro and sterling and 10-year lows against the Swiss franc. The news stream is somewhat more supportive today, with trade deals said to be in the works, in addition to the confirmation/clarification of an agreement with China.

Read More »

Read More »

Dollar Pummeled on Risk to Fed’s Independence

The US dollar was weak yesterday, but it has been pummeled today. It is down against the G10 currencies and all but the Russian ruble and Turkish lira among emerging market currencies. The proximate trigger of today's sell-off were news reports that a successor to Fed Chair Powell could be announced in a few months.

Read More »

Read More »