Category Archive: 4.) Marc to Market

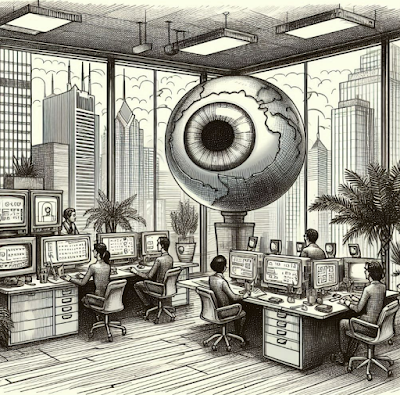

Allow Chinese Companies to Build Locally and Sell Locally or Face Dire Consequences

If trade imbalances truly drive protectionist backlash, as many claim, we should have witnessed comparable anti-trade sentiment during the 1980s when America's deficit with Japan reached historic proportions. Yet history reveals a critical distinction: Japan was offered—and wisely seized—an economic escape valve that today's geopolitical climate threatens to deny China. This asymmetry not only betrays …

Read More »

Read More »

US-China Trade Talks this Weekend Help Stabilize the Greenback ahead of FOMC

Overview: There are five developments to note. First, the US and China will have initial trade talks this weekend in Switzerland. Second, the PBOC cut its key rate by 10 bp and cut reserve requirements by 0.5%. It also announced several other measures to boost lending/relending. Third, German factory orders were stronger than expected, perhaps …

Read More »

Read More »

PBOC Returns and Helps Stabilize Local FX

Overview: China's mainland markets re-opened after the extended holiday, and the by setting the dollar's reference rate little changed from its last fix helped inject a note of stability into the local Asian currencies. Indeed, most of them pulled back today, including the Taiwan dollar and the Malaysian ringgit. The yuan and yen are firmer. …

Read More »

Read More »

US Dollar Remains Under Pressure, while Asia Pacific Currencies Lead the Charge

Overview: The dollar has begun the new week under pressure, though many financial centers are closed today. The upside pressure on Asia Pacific currencies remains notable. The offshore yuan, the Taiwanese dollar, and Malaysian ringgit, the Japanese yen, and Australian dollar are among the strongest currencies today. The ostensible trigger is speculation of US semiconductor …

Read More »

Read More »

Week Ahead: FOMC in No Hurry to Cut Rates while BOE Easing set to Accelerate

President Trump says there are trade talks with China. Beijing denies it. Around the time the US reports that the world's largest economy contracted slightly in Q1 (0.3% annualized), US Treasury Secretary Bessent said that the effective embargo was shutting down the China's economy. The week ended with China's Commerce Ministry statement that it was …

Read More »

Read More »

China’s Feint Weighs on the Greenback Ahead of Today’s Employment Report

Overview: Ideas that the US economy is not doing as poorly as many feared after the Q1 GDP contraction was dissected helped the dollar appear to confirm a bottoming pattern yesterday. However, indications that China is considering the US request for trade talks have bolstered risk-appetites today, ahead of the US jobs report and dragged …

Read More »

Read More »

May Day: Dovish Hold by BOJ and Broadly Firmer Dollar

Overview: The US dollar is mostly firmer in thin May Day turnover. The Japanese yen is the weakest of the G10 currencies following what is seen as a dovish hold by the Bank of Japan, which cut growth forecasts, shaved inflation projections, and delayed reaching its inflation target on a sustained basis. The market downgraded …

Read More »

Read More »

Weak US Survey Data to Begin being Evident in Real Sector Reports

Overview: The foreign exchange market is quiet. The dollar is mostly little changed against the G10 currencies, mostly in the ranges that have been carved in recent days. The dollar-bloc currencies are mostly flat to firmer. The others are softer, led by the yen's almost 0.5% loss and sterling's 0.35% decline. Among emerging market currencies, …

Read More »

Read More »

US Dollar Comes Back a Little Firmer

Overview: The US dollar has come back better bid today. It is firmer against all the G10 currencies. The proximate cause has been reports that as early as today, the 100th day of President Trump's second-term, he will announce another retreat pivot: imported auto parts for vehicles made in the US may be waived or … Continue reading...

Read More »

Read More »

Calm before the Storm?

Overview: The US dollar is trading quietly in a mixed fashion, mostly confined to the ranges seen at the end of last week. This could prove to be a pivotal week. The weakness in the US survey data may become evident in the real sector data, with a dismal Q1 GDP reading that may show … Continue reading »

Read More »

Read More »

Markets Remain Unsettled Despite the US Postponement of the Reciprocal Tariffs

Overview: A couple of hours before the US announced a postponement in the reciprocal tariffs on everyone but China, President Trump sent social media message encouraging people to buy stocks. And the postponement sent US equities soaring, but it does not set right with many observers. In fact, the US hiked the tariff on China further, and the net result is that the average effective tariff in the US is now 24% rather than 27% as it would have been...

Read More »

Read More »

Fragile Calm in the Capital Markets

(traveling; no commentary tomorrow)Overview: The dramatic price action in throughout the capital markets after last week's US tariff announcements, China's retaliation, and yesterday's US threat of another 50% tariff on China has calmed today, in a nervous way. Indeed, the calm could be shattered by one comment or social media post by the US President. Japan pushed back against some of "facts" the US cited, like the tariff Japan puts on...

Read More »

Read More »

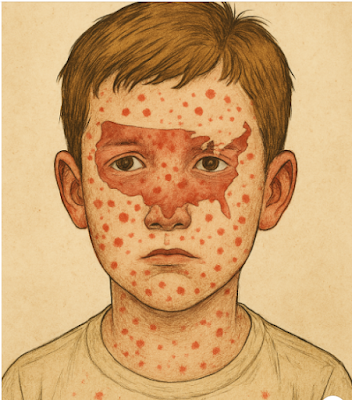

Shades of Smoot-Hawley: Depression Feared

Overview: At the end of last week, there was much talk about Black Monday and today it is here. Various circuit breakers kicked in as stocks plummeted. The Nikkei 225 fell 7.8%, and while China's CSI 300 fell 7.05%, the index of mainland shares that trading in Hong Kong dropped 13.75%. The Hang Seng itself was down 13.2%. Europe's Stoxx 600 fell 5.1% before the weekend and is off another 5.8% today. US index futures settled on their lows before...

Read More »

Read More »

The Week Ahead: Trade War and Price Action are More Important than US and China’s CPI

April 2, what President Trump called, "Liberation Day" will indeed go down in history. The markets quaked. A trade war with China escalated as Beijing took strong retaliatory measures, with not only a sharp rise in its tariff on US imports but imposed (more) restrictions on rare earth exports. Canada and Mexico were spared the "reciprocal tariffs,” but both made clear declarations of intent to diversify their trade and economic...

Read More »

Read More »

Friday: Tariffs, US Jobs, Powell, and Melting Equities

Overview: There appear to be two-forces at work that has helped the US dollar recover. First, as the market continues to debate whether the reciprocal tariffs are a negotiating ploy and in this tug-of-war of sorts, President Trump's declaration that he is open to "phenomenal offers" plays into that view. Still, the fact that Israel got rid of all of its tariffs on the US and still was hit with a 17% levy is notable. Second, there may be...

Read More »

Read More »

The Day After

Overview: Little would one know from looking at the US economic outperformance and the record-high household net worth, but the US President said that global trade has “looted, pillaged, raped, and plundered” the US economy. Rather than some sophisticated analysis to measure trade and non-trade barriers as the President Trump suggested, the so-called "kind reciprocity," appears to be a simple function of US imports as a percentage of the...

Read More »

Read More »

Liberation Day from the Multilateral World Our Parents, Grandparents, and Great Grandparents Created

Overview: The trepidation over today's US tariff announcement has been underscored by reports that even as late as yesterday, a final decision had not been made. Given the complexity of different tariff schedule formulations, and the desire to implement the new regime immediately seem to favor a simply across the board levy or maybe two categories, a high one and low one. In terms of allocation of power, Treasury Secretary Bessent and his...

Read More »

Read More »

Dollar Consolidates, Bonds Rally, Stocks Recover, and Gold Extends Gains Ahead of Tomorrow’s US Tariff Announcement

Overview: Ahead of tomorrow's US tariff announcement, which reports suggest the administration is still debating key elements, the US dollar is mostly consolidating inside yesterday's ranges. The news stream has been limited to the largely as expected Japanese Tankan survey, which did not appear to impact BOJ expectations and the unsurprising decision by the Reserve Bank of Australia to stand pat after initiating an easing cycle at its last...

Read More »

Read More »

Equities and Rates: Look Out Below

Overview: The US dollar begins the new week mostly firmer. The dollar-bloc currencies and Scandis are the weakest. Sterling and the euro are little changed, while the continued drop in the US 10-year yield has helped lift the yen by nearly 0.5%. Emerging market currencies are mixed as well. A handful of Asian currencies, including the Chinese yuan, are higher. The Turkish lira is also firmer, after falling nearly 4% over the past two weeks....

Read More »

Read More »

April 2025 Monthly

The world is different. After a four-year restoration of the traditional globalist US elite, a majority of the American electorate seems to have rejected it. President Trump is indeed a transformational president, and his reversal of many traditional elements of US domestic and foreign policy are triggering dramatic action in other parts of the world. Many Americans and European had been critical of Germany's self-imposed fiscal strait jacket In...

Read More »

Read More »