Category Archive: 4.) Forex Live

TRANSITION: The weekend forex technical report (and more) for the week of Jan 9, 2023

There are a lot of transitions that are going on from a fundamental and technical perspective.

In this weekend video, Greg Michalowski of Forexlive, talks about the transitions that are occurring in the economy, politics and in the markets in his weekend Forex technical report.

Set yourself up to understand the dynamics in play and how you might benefit in your trading this week.

Read More »

Read More »

Accessing Paper Trading in TradingView

Paper trade futures with a trial account: It's the most critical component of your essay and procedure. Most brokerage companies provide free demo accounts so you may practice trading without risking your money. Before trading with real money, use this opportunity to test your trading technique and learn the market.

You may also try TradingView's fantastic and straightforward paper trading, as seen here.

Now some traders claim: Live trading...

Read More »

Read More »

The morning forex technical report. The USD moves lower after the US jobs reportt

The USD moved higher in anticipation of the US jobs report. That report showed wages were less of a concern with an increase of 0.3% versus 0.4% MoM. Moreover the prior month was revised lower from 0.6% to 0.4%. Good news. The not so good news for a rate perspective is the unemployment rate ticked down to 3.5% from 3.6% (revised from 3.7%). That puts the unemployment rate near full employment which has potential for what wage gains down the road....

Read More »

Read More »

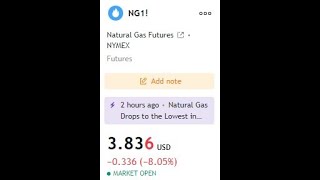

Natural Gas technical analysis: Go Long, go big!

An excelland spot to go Long (at your own discretion) at this amazing technical junction.

Read More »

Read More »

The morning Forex technical report for January 5, 2023

A technical look at some of the major currency pairs with the US dollar

Click on the above video to watch the morning Forex technical report for January 5, 2023. IN the reported take a look at the lows and play for some of the major currency pairs versus US dollar including the EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD.

Read More »

Read More »

The morning forex technical report for January 4, 2022

A look from a technical perspective at some of the major currency pairs vs the USD. The USD is lower in trading today, reversing some of the price action seen yesterday.

Read More »

Read More »

VIDEO: A technical look at the EURUSD, USDJPY and GBPUSD to start the trading day

The USD rose vs the EUR and GBP but is dipping in early NY trading. Meanwhile the USD fell and is now rising vs the JPY.

It is the start of the new year and that has the markets a little more awake with some active trading ranges in some of the major currency pairs.

The EUR and the GBP moved lower vs the USD in early European trading helped by some weaker inflation data and warmer weather perhaps which has some inflation fears abating. However,...

Read More »

Read More »

A broad look of the EURUSD going into 2023

The EURUSD is starting the trading year with more upside momentum and in the process retraced some of the declines from the EURUSD's decline in 2022.

The pip trading range for the 2022 year was about 2000 pips which is near the extreme of the low to high trading range over the last 12 or so years.

What will 2023 bring us, if we anticipate a more normal range of about 1400-1600 pips and the rallies are to be sold in the EURUSD?

IN this video,...

Read More »

Read More »

2023 investing outlook

Adam Button from ForexLive talks about 4 Themes for 2023:

1) Give China a KISS

2) Europe is a weather trade

3) One data point to the next

4) The biggest danger to Canadian housing is the US consumer

Adam expanded on the themes he is expecting: https://www.forexlive.com/news/4-trading-themes-for-2023-1-never-underestimate-the-spending-power-of-the-us-consumer-20230101/

Read More »

Read More »

A happy new year (2023) with this Bitcoin analysis from ForexLive.com

Bitcoin may be making a very early comeback. This technical analysis shows what are the bullish and bearish prices that provide a higher level of confirmation.

Visit ForexLive.com for more technical analysis.

Read More »

Read More »

S&P 500 technical analysis: A bull climbing out of a hole.

Last day of trading for year 2022. On the back of the unemployment data yesterday, we had a big bullsih day as price breaks out of the yellow bull channel. A big and clear breakout that gets the bull out of the hole but price now needs to clear the next red channel as it eyes 3900, afterwards.

Trade the S&P 500 at your own risk and visit ForexLive.com for additional perspectives.

Read More »

Read More »

Nasdaq futures technical analysis: An important junction!

Price can go either way, the game is open. Watch the next 4 hour candles at the brink of this channel. We are open to either direction but a Long would be more interesting in terms of a reward vs risk ratio of the Nasdaq futures.

Will the bulls make an elegant comeback here?

Trade at your own risk and visit https://www.forexlive.com/technical-analysis for additional persepctives.

Read More »

Read More »

A simple Dow Jones technical analysis by ForexLive.com

This is one of the most simple technical analysis, and guide (bullish or bearish) that you will probably see. It shows swing traders and buy and holders (or those seeking to sell some of their holdings) exact prices of when the market is in the favor of bulls or bears, and why. It is a simple map that can provide you with directional clearance, based on a simple and known pattern called a 'bull flag' (channel) and previous pivot points, as well as...

Read More »

Read More »

2022 End of Year Videos: The strongest to the weakest of the 2022 major currencies

What was the strongest of the major currencies in 2022? What was the weakest?

Between now and the end of the year (and into the start of the New Year), Greg Michalowski of Forexlive.com will be producing some video that take a look back at 2022 and then a look forward into 2023.

He will start with more of a look back at the moves in the major currencies and a ranking of the strongest to the weakest of the those currencies in 2022.

Read More »

Read More »

Tesla stock technical analysis: Where is the bottom?

This is an update on where the head and shoulders at TSLA may end. Its measured move is at $91. If and when it gets close to there, buyers and algos are expected to step in, significantly.

Trade TSLA stock at your own risk and visit ForexLive.com for more insights.

Read More »

Read More »

Stock market end of 2022: Watch these critical price levels.

How will the stock market, as represented by the Nasdaq in this technical analysis, end the year? Watch the critical price levels on the short and long term. The way that market participants (buyers and sellers) react to them will be key.

Visit https://www.forexlive.com/technical-analysis for additional technical analysis perspectives on the markets.

Read More »

Read More »

Nasdaq futures technical analysis

Seems that there reward vs. risk potential, at the potential breakout up of this bull channel on the hourly timeframe, supports going for a Long.

Read More »

Read More »

Tesla stock technical analysis A contrarian buy of TSLA!

This is in relation to a head and shoulders possibly being complete for TSLA stock as shown here https://www.forexlive.com/Education/the-head-and-shoulders-pattern-20221209/

So it's time to scale in a buy. Scaling in means not to go all in on the buy and keep ammunition for possibly lower prices. To enter at 10% to 20% of the Long position.

Read More »

Read More »

The US morning forex technical report for December 22, 2022

What levels are in play and why....

It is important to know the traders roadmap. Where we have been? Where we are going? What risk defining levels are on ahead? And most importantly, why those levels are important to you and I. In this report, Greg Michalowski of Forexlive.com looks at the key levels in play, the technical biases and the risks and tells you why.

Read More »

Read More »