Category Archive: 4.) Forex Live

AUDUSD buyers run into a cluster of resistance. Seeing some corrective selling.

AUDUSD trades above and below 0.6500 after testing cluster of resistance between 0.6500 to 0.6521

Read More »

Read More »

USDCAD rebounds helped by weaker Ivy PMI and higher US rates. What next?

The US rates are higher today and acting as a tail wind for the USD including the USDCAD. Having said that, there is work to do to give the buyers additional confidence after the sharp falls from last week.

Read More »

Read More »

The USDCHF broke lower on Friday and moved below key 200 day and 100 bar MA on 4H chart.

Bearish break on Friday in the USDCHF below the 200 day MA at 0.9002 and the 100 bar MA on the 4-hour chart at 0.8997. Stay below is more bearish going forward.

Read More »

Read More »

Kickstart your FX trading for November 6 with technical look at EURUSD, USDJPY and GBPUSD

In this morning video on November 6, 2023, I kickstart the Forex trading day with a technical look at the EURUSD, USDJPY and GBPUSD. What are the biases, the risks, the targets for those three major currency pairs?

Read More »

Read More »

S&P 500 Technical Analysis

Here's a quick technical analysis on the S&P 500 with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

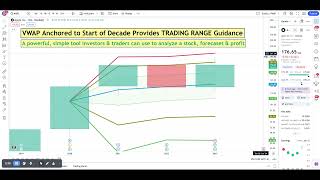

Apple stock long term price analysis, forecast & trading range

Dive into the depths of Apple stock's trading strategy with our latest ? analysis! Anchoring the mighty VWAP from the start of 2020, we're giving you the insider's edge on long-term trading ranges and price forecasting. ?

? In this video, we break down the powerful Volume Weighted Average Price (VWAP) and its role in defining Apple's stock journey. Whether you're a seasoned trader or just starting out, understanding the VWAP's signals is crucial...

Read More »

Read More »

USDJPY Technical Analysis

Here's a quick technical analysis on the USDJPY pair with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Kickstart your FX trading for Nov 3, 2023. A technical look at EURUSD, USDJPY and GBPUSD.

Kickstart your FX trading for November 3, 2023 with technical look at EURUSD, USDJPY and GBPUSD

Read More »

Read More »

S&P 500 Technical Analysis

Here's a quick technical analysis on the S&P 500 with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Kickstart your FX trading for Nov 2, 2023. A technical look at EURUSD, USDJPY and GBPUSD.

Kickstart your FX trading for November 2, 2023 with technical look at EURUSD, USDJPY and GBPUSD

Read More »

Read More »

USDJPY Technical Analysis

Here's a quick technical analysis on the USDJPY pair with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

AUDUSD sellers push the price below the 100/200 hour MA. Ups and downs continue for the pair.

AUDUSD trades below 100/200 hour MAs near 0.6374. Can the sellers keep the pressure on the pair?

Read More »

Read More »

Kickstart your FX trading for October 31 with technical look at EURUSD, USDJPY and GBPUSD

Kickstart your FX trading for October 31 with technical look at EURUSD, USDJPY and GBPUSD

Read More »

Read More »

USDCAD Technical Analysis

Here's a quick technical analysis on the USDCAD pair with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Gold Technical Analysis

Here's a quick technical analysis on Gold with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »