Category Archive: 4.) Forex Live

What to look for on a technical break in your forex trading

What to look for in breaks and what to look for in failed breaks. The GBPJPY is making a bearish break today. Not only have we made a break below a prior resistance/support line but also below the 200 day MA. The question traders need to ask now is “Will the break keep the momentum … Continue reading...

Read More »

Read More »

When your forex trading risk is really low, reward does not really matter

Risk a little to make more than a little… There are times when a forex technical level is important enough to just focus on the risk, and forget about the reward. In other words, if you trade at a key level where risk is only 5 pips, you only have to see the market move … Continue reading...

Read More »

Read More »

VIDEO: USDJPY bangs against lower support as market prepares for US employment

January 5, 2017. US employment report up tomorrow The USDJPY has moved lower in trading today and tests a support area defined by some key swing levels going back two years ago. That area comes in between 115.96 and 116.09. Below that is the 61.8% of the move down from the 2015 high at the …

Read More »

Read More »

Forex technical analysis: EURUSD higher but stalling at resistance

100 and 200 hour MAs, 38.2% and 2015 low keeping a lid on the pair The EURUSD is trading higher on the day but is running into resistance against MA, retracement and an old low from 2015. What needs to happen to turn the bias more bullish? Greg Michalowski of ForexLive takes a technical look … Continue...

Read More »

Read More »

What’s next for gold after the Italian referendum

Adam Button from ForexLive speaks to Kitco about the outlook for gold and why the Italian referendum probably won’t matter.

Read More »

Read More »

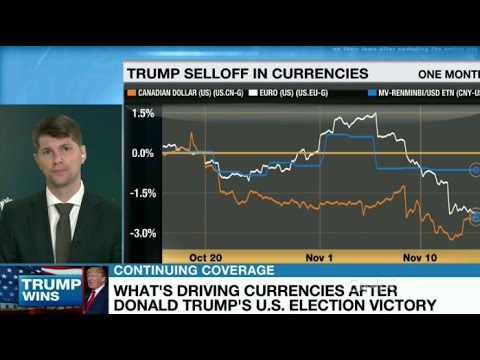

Adam Button at the London Stock Exchange

Adam Button from ForexLive talks about the outlook for currencies after Donald Trump won the US election. What to watch for from the US dollar and why the forex market was caught off guard.

Read More »

Read More »

The finer points of trading forex on US election night

A minute-by-minute preview of how to trade the US election. Adam Button from ForexLive breaks down when results will be released and how to interpret them. Adam looks at the different outcomes and what to watch for and how to trade the US dollar and other markets in the aftermath.

Read More »

Read More »

Forex trading can be like football. You win some. You lose some.

Sometimes risking a little more, works out for you too In the US, the college football season is getting underway on Saturday. Yippee. A comment from an Attacking Currency Trend trader reminded me of conversations I have had with my son, a college football coach. The comment was about a trade that got stopped out …

Read More »

Read More »

Video of the purported Yemen attack on a Saudi oil facility

This video was originally posted to Facebook with the caption: By the grace of Allah, Just about an hour ago, a video from inside Najran city for #Aramco oil company burning by a Yemeni ballistic missile “Zelzal-3″, Friday 26-8-2016. The video shows a huge fire on the oil tanks .. Note the oil tanks at …

Read More »

Read More »

The five smartest words retail forex traders say

Greg Michalowski, Author Attacking Currency Trends. Director of Client Education and Technical Analysis at ForexLive.com. I am more of technical forex trader, but that bias comes with some important reasons, especially for retail traders. Fundamental analysis is important, but it does not do a good job with defining and limiting risk…especially when traders are wrong. …

Read More »

Read More »

How to trade the August BOE interest rate decision

On August 4th, the BOE will announce there interest rate decision. The expectations is for a cut of 25 basis points to 0.25%. What do they say in the statement? Do they do more QE? Do they surprise and say they don’t have enough information yet? The pair has rallied over the last few days … Continue reading...

Read More »

Read More »

The BOJ is about to go big

Preview of the Bank of Japan decision for July 28, 2016. This is a highly-anticipated central bank announcement and Adam Button from ForexLive breaks down what to watch out for and how to be ready for the BOJ.

Read More »

Read More »

Federal Reserve preview for July 27 2016

What to expect from the July 27 Federal Reserve interest rate decision. Some trade ideas for the FOMC from Adam Button ahead of the 2 pm ET decision. What to look for from Janet Yellen and the Fed and what it will mean in the forex and stock market.

Read More »

Read More »

Three trade ideas to end the week

A look at the EURUSD, AUDUSD and the USDJPY The EURUSD, the AUDUSD and the USDJPY are all trading around some technical levels that could set up some low risk trading opportunities. The EURUSD is trading in the most narrow trading range for a week since end of 2014 with one day to go. Will … Continue reading »

Read More »

Read More »

Three ways Donald Trump could roil markets at the Republican National Convention

Adam Button looks at the potential impacts of Donald Trump at the 2016 Republican National Convention. What impacts will the RNC have in the foreign exchange market, stocks and for the economy. Donald Trump’s speech is the key point for the 2016 RNC but there are other drivers and things to watch as well. Visit …

Read More »

Read More »

The technicals are talking to us in the EURUSD. What are they saying?

The EURUSD is trading in a narrow trading range on the daily and the hourly chart. What does that tell us about the pair and what we can expect in trading in the new future?

Read More »

Read More »

Plan your trade: A look at the key levels for the EURUSD through US employment report

The June US employment report will be released tomorrow at 8:30 AM ET. The expectations are around 180K. The unemployment rate is expected to tick up to 4.8% from 4.7%. I don’t look to go into a high risk event with a position. There are better times to trade, but after the news is known, …

Read More »

Read More »

Forex trading video: EURUSD falls below 200 day MA.What next?

The EURUSD has fallen below the 200 day MA in trading today. That is nothing new if you look at recent history. The price has been trading above and below the MA line as traders ponder “Which way next” for the pair… Now yesterday the MA did hold. Today…not so lucky. In fact, the correction …

Read More »

Read More »

Forex technical analysis: USDJPY finishes a fairly quiet week near 100 hour MA

The USDJPY is finishing the trading week near the 100 hour MA at 102.56. The pair spent the last two trading days mostly between the 100 hour and 200 hour MAs. Those levels will define the close range in trading in the early week. Look for the break and run.

Read More »

Read More »