Category Archive: 6c) Crypto Currencies English

BitGo and 21Shares Expand Partnership Across US and Europe for Crypto ETPs

BitGo and 21Shares, a global issuer of cryptocurrency exchange traded products (ETPs), have agreed to expand their partnership across the US and Europe.

The collaboration will deepen across staking and custody services to support 21Shares’ growing suite of crypto ETP products.

21Shares manages US$5.7bn in assets and offers a broad range of digital asset investment products.

Its institutional approach to product development and operations positions...

Read More »

Read More »

Hong Kong and Switzerland Discuss Fintech, Sustainability and Market Connectivity

The eighth Hong Kong-Switzerland Financial Dialogue took place in Bern, Switzerland, on 29 January.

The Hong Kong Monetary Authority (HKMA) and the State Secretariat for International Finance (SIF) under the Federal Department of Finance of Switzerland co‑organised the event.

The Dialogue aims to support cooperation in financial services between Hong Kong and Switzerland. It also provides a forum for exchanging views on key issues in the global...

Read More »

Read More »

UBS Plans Crypto Trading for Select Private Banking Clients

UBS is planning to make cryptocurrency investing available to some private banking clients, a move that would mark a notable shift into digital assets for one of the world’s largest wealth managers.

The Swiss banking group, which oversaw about US$4.7 trillion in wealth assets as of Sept 30, is in the process of selecting partners for a potential crypto offering, people familiar with the matter told Bloomberg.

Discussions have been ongoing for...

Read More »

Read More »

DZ BANK Granted MiCAR Authorisation for “meinKrypto” Crypto Platform

At the end of December 2025, DZ BANK received MiCAR authorisation from the German Federal Financial Supervisory Authority (BaFin) to operate its cryptocurrency platform, “meinKrypto”.

The platform allows primary institutions of the cooperative financial network to offer retail customers access to crypto trading.

Each Volksbank and Raiffeisenbank must now submit their own MiCAR notification for “meinKrypto” to BaFin.

Once approved and implemented,...

Read More »

Read More »

FINMA Outlines Custody Requirements for Crypto-Based Assets

The Swiss Financial Market Supervisory Authority (FINMA) has published a new supervisory communication outlining how it assesses the risks associated with the custody of crypto-based assets.

The communication sets out the requirements institutions must meet to ensure the secure safekeeping of such assets.

FINMA notes growing interest in crypto-based assets and related services within the Swiss financial market.

An increasing number of customers...

Read More »

Read More »

Top Stablecoin Trends to Watch in 2026

Stablecoins are no longer just for a tool for cryptocurrency traders, and are now increasingly being adopted for real-world payments, especially cross-border transactions, according to an analysis by FXC Intelligence, a financial data company specializing in payments and e-commerce.

The report, released in December 2025, explores the rise of stablecoin in payments, highlighting key market trends, the most prominent players, and ongoing...

Read More »

Read More »

Crypto.com and Stripe Partner to Enable Direct Crypto Payments

Crypto.com and Stripe have announced product updates aimed at making it easier for businesses to accept cryptocurrency payments.

Through an integration with Stripe, businesses using Crypto.com Pay will be able to accept payments directly from customers’ crypto balances.

Crypto.com is the first cryptocurrency platform to be integrated with Stripe for direct balance-based crypto payments.

Customers will be able to check out using their preferred...

Read More »

Read More »

Blockchain Reaches Operational Maturity at Swiss Banks, with Stablecoins Becoming the New Strategic Priority

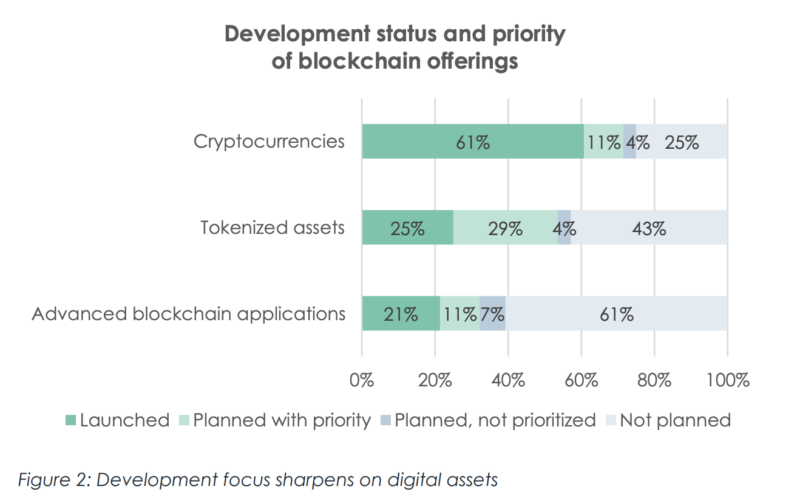

In the Swiss financial services sector, formal blockchain strategies have become standard practice and cryptocurrency services are now live, a new study by the Center for Financial Services Innovation at the University of St. Gallen, ACK, mintminds, PwC and vision&, found.

This underscores the country’s transition from blockchain experimentation to operational maturity.

The study, which polled 28 banks and financial service providers in...

Read More »

Read More »

J.P. Morgan Launches Tokenised Money Market Fund on Ethereum

J.P. Morgan Asset Management has launched its first tokenised money market fund, My OnChain Net Yield Fund (MONY), on the public Ethereum blockchain.

The fund is powered by Kinexys Digital Assets, the firm’s multi-chain asset tokenisation solution.

MONY is a 506(c) private placement fund offering qualified investors the ability to earn US dollar yields by subscribing via Morgan Money, J.P. Morgan’s trading and analytics platform for liquidity...

Read More »

Read More »

Bahamas Still Grapples with the Reputational Fallout of the FTX Collapse

Three years after the collapse of the Bahamas-headquartered cryptocurrency exchange FTX, the country continues to feel the impact and has not yet recovered from the resulting reputational damage, Christina Rolle, Executive Director of the Securities Commission of the Bahamas, said in a recent interview.

This underscores the long-term consequences that such a widespread financial scandal can have on a nation’s credibility.

Speaking to Henri...

Read More »

Read More »

Bitcoin ETFs Become BlackRock’s Most Profitable Products

Bitcoin exchange-traded funds (ETFs) have become BlackRock’s most profitable product line, a development that came as “a big surprise” to the company, Cristiano Castro, director of business development at BlackRock Brazil, tod local media.

At the Blockchain Conference in Sao Paulo, Castro told reporters on the sidelines of the event on November 28, that the performance had surpassed the firm’s expectations.

“We were very optimistic when we...

Read More »

Read More »

Mt Pelerin Introduces Crypto-Linked Personal IBANs

Mt Pelerin, a provider of blockchain and self-custody financial services, has announced the launch of personal crypto IBANs within its service.

The feature allows users to extend the function of their self-custodial wallets by enabling them to send and receive money across both blockchain and traditional banking networks.

Self-custody is a core principle of Bitcoin and other cryptocurrencies, centred on the ability to hold and control one’s own...

Read More »

Read More »

Klarna Launches Stablecoin KlarnaUSD on Tempo Blockchain

Klarna has announced the launch of its first stablecoin, KlarnaUSD, marking a notable development for the company, whose CEO was previously sceptical about cryptocurrency.

The stablecoin will be issued on Tempo, a new independent blockchain developed by Stripe and Paradigm, which is specifically designed for payments.

Klarna is the first bank to launch a stablecoin on Tempo.

KlarnaUSD aims to streamline cross-border payments, which currently incur...

Read More »

Read More »

Kraken Launches Krak Card with 1% Cashback in UK and EU

Kraken, one of the world’s longest-standing crypto platforms, has announced the phased rollout of the Krak Card, offering 1% cash back on all purchases, along with new features including salary deposits and expanded wealth-building options.

The Krak Card will first be available to users in the UK and EU, with additional markets to follow.

Offered in physical and virtual formats, the card allows instant spending using multiple balances with no...

Read More »

Read More »

Prediction Markets Set to Surge, Fueled by Clearer Regulations, Sector Expansion, and Blockchain Integration

Prediction markets have grown rapidly, driven by regulation, a dynamic fundraising landscape, and rising mainstream adoption, especially in sports.

That momentum is projected to continue as major financial institutions enter the space, and as new markets and decentralized finance (DeFi) technologies push the sector to new heights, according to a new report by Sporting Crypto, a sports and blockchain media and intelligence company.

Prediction...

Read More »

Read More »

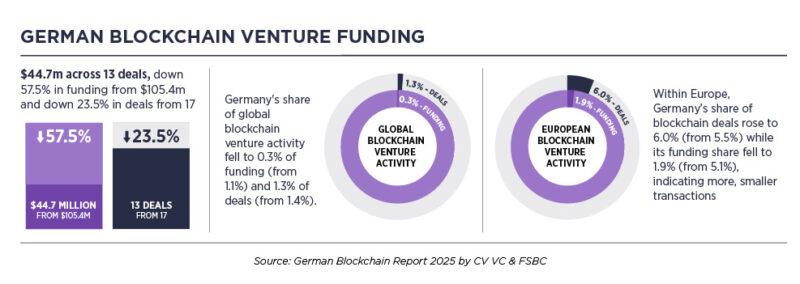

German Blockchain Funding Falls to Four-Year Low Despite $9.3B Venture Growth

CV VC, together with the Frankfurt School Blockchain Center, has released the German Blockchain Report 2025, analysing venture capital activity in Germany’s blockchain sector from Q3 2024 to Q2 2025.

While overall German venture funding rose, blockchain-specific investment declined, representing the lowest share of national venture activity in four years.

Globally, venture funding reached US$411.9 billion across 21,872 deals, up 19.5% year-on-year,...

Read More »

Read More »

Societe Generale Completes First US Digital Bond Using Broadridge Tokenisation

Broadridge has announced that Societe Generale has completed its first digital bond issuance in the US using Broadridge’s tokenisation capability.

The bonds were issued by Societe Generale-FORGE, the bank’s subsidiary focused on digital assets.

The transaction demonstrates how institutions can use tokenisation and permissioned blockchain technology to enable instant settlement and greater transparency while remaining compliant with traditional...

Read More »

Read More »

Lithuania: the Digital Euro Is Already Treated as Infrastructure

For many people in the euro area, the “digital euro” still sounds like a distant central-bank experiment. In Lithuania, it is increasingly treated as something much more concrete: a piece of future-critical infrastructure that needs to work when other systems fail. The difference is partly geography and history. Lithuania is a small euro-area country …

Read More »

Read More »

OSL Teams Up with Bank Frick for Fiat Gateway Integration

OSL Group, a stablecoin trading and payment infrastructure provider in Asia, has entered a strategic cooperation with Bank Frick.

The partnership gives OSL access to on/off-ramp services for multiple fiat currencies, allowing regulated exchanges between fiat and digital assets for OSL and its institutional clients.

As part of the cooperation, OSL is integrated into Bank Frick’s xPULSE network, a system that facilitates instant fiat transfers with...

Read More »

Read More »

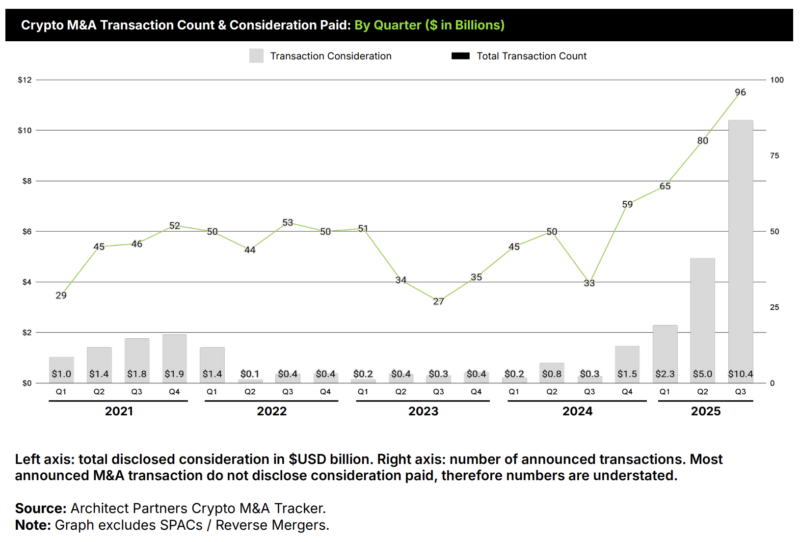

Crypto M&A Reaches New Record with Total Value Surging More Than 34-Fold YoY

Mergers and acquisitions (M&A) activity in the cryptocurrency sector has surged in 2025, reaching record levels amid accelerating industry consolidation, deeper convergence between traditional finance and digital assets, and a more supportive regulatory landscape.

In Q3 2025 alone, the sector recorded 96 announced M&A transactions, totaling US$10.4 billion, according to new data from Architect Partners, a M&A and strategic financing...

Read More »

Read More »