Category Archive: 6b) Austrian Economics

Debate Brexit

La UE no está ahora mismo en una situación económica fuerte como para poder presionar. Y mucho menos le interesa entrar en disputas con el RU teniendo en cuenta que éste será siempre un socio preferente de los EUUU esté el presidente que esté.

Read More »

Read More »

Dirk Müller – Coronavirus: Achtung, Zensur!

Auszug aus dem Cashkurs.com-Marktupdate vom 31.01.2020. Sehen Sie das komplette Marktupdate auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren “Machtbeben” – Der Bestseller von Dirk Müller – Jetzt handsigniert als Taschenbuch im Cashkurs*Shop: http://bit.ly/MacMachtbeben-Taschenbuch-Signiert Dirk Müller Premium Aktien Fonds – Anlegerkongress...

Read More »

Read More »

Dirk Müller: Falsche Berechnung – Virus-Todesrate liegt deutlich höher

Auszug aus dem Cashkurs.com-Marktupdate vom 31.01.2020. Sichern Sie sich – NUR NOCH HEUTE – die Sonderangebote und sehen Sie das komplette Marktupdate auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren “Machtbeben” – Der Bestseller von Dirk Müller – Jetzt handsigniert als Taschenbuch im Cashkurs*Shop:...

Read More »

Read More »

Dirk Müller – Bullshit, Herr Spahn! Handelt die Regierung fahrlässig?

Auszug aus dem Cashkurs.com-Marktupdate vom 29.01.2020. Sehen Sie das komplette Marktupdate auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren – Sonderangebote noch bis 31.01.2020! “Machtbeben” – Der Bestseller von Dirk Müller – Jetzt auch als handsigniertes Taschenbuch im Cashkurs*Shop: http://bit.ly/MacMachtbeben-Taschenbuch-Signiert Dirk...

Read More »

Read More »

Coronavirus Crisis – Possible Impact On The Economy And Markets

Please subscribe to my channel and leave your comments. Follow my website www.dlacalle.com/en Twitter: @dlacalle_IA

Read More »

Read More »

La Crisis del Coronavirus y su Impacto en los Mercados Globales

Suscríbete a mi canal y deja tus comentarios. Sigue mi página web: dlacalle.com Twitter: @dlacalle

Read More »

Read More »

Doug Casey, Rick Rule, and Jayant Bhandari – Racism in America

Doug Casey, founder of Casey Research, is one of the most sought after speakers. He has written two New York Times bestsellers, including “Crisis Investing,” which was #1 for 19 weeks. He frequently contributes to LewRockwell.com and the Liberty. He has recently co-published two new books: “Drug Lord (High Ground)” and “Speculator (High Ground)”.

Rick Rule is one of the most successful investors anywhere. He started his career working as a...

Read More »

Read More »

Das Internet – die dezentrale (R)Evolution

Menschen werden durch unterschiedliche Motive angetrieben. Die einen sehen das höchste Glück in der Ansammlung von materiellen Werten, und andere sind von geistigen Werten angetrieben. Eine Idee kann genauso wie eine Rolex Glücksgefühle und Ansporn auslösen. Mich persönliche treiben Ideen an.

Read More »

Read More »

Interview mit Claudio Grass – Bitcoin vs Gold

Interview mit Claudio Grass – Bitcoin vs Gold Kontakt Claudio Grass https://claudiograss.ch/ #bitcoin #gold #interview Link des Tages ***************** alle Links des Tages sind auf folgender Seite zu finden: Linksammlung mehr Infos unter: http://www.cryptowelt.ch/ Willst du den Kanal unterstützen? ********************************* Plattformen / Tools Support Cryptowelt Support Paypal https://www.paypal.me/cryptowelt BTC Lightning Network...

Read More »

Read More »

What lies ahead for gold in 2020

Over the last few months, gold’s performance has been remarkable. Many market observers and mainstream analysts have pointed to various geopolitical developments in their efforts to explain away the bullishness as a reaction to whatever happens to be in the headlines at the time.

Read More »

Read More »

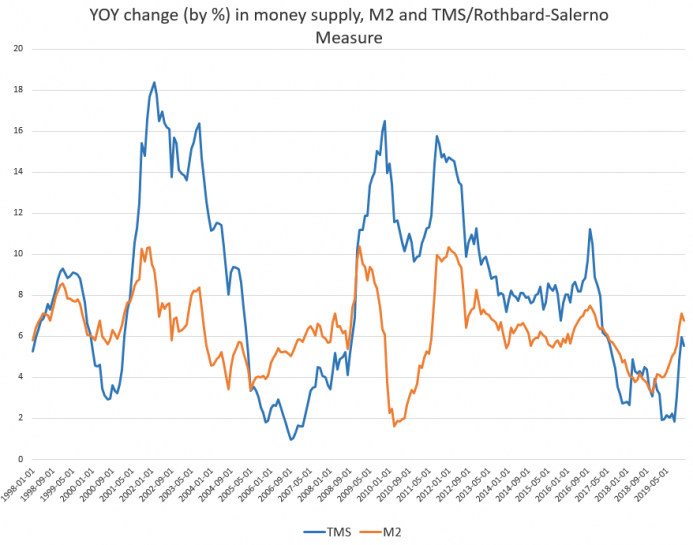

After November Surge, Money Supply Growth Slows in December

The money supply growth rate rose in December slowed after a November surge of nearly six percent. During December 2019, year-over-year growth in the money supply was at 5.53 percent. That's down from November's rate of 5.9 percent, but was up from December 2018's rate of 3.90 percent. The increase in money-supply growth in December continues a sizable reversal of the trend we saw for most of 2019.

Read More »

Read More »

Dirk Müller: Wuhan-Virus – Situation ist kritischer als dargestellt

Das Cashkurs.com-Marktupdate vom 27.01.2020. Aus gegebenem Anlass für alle vollständig zugängig. Sichern Sie sich noch bis zum 31.01.2020 die Jubiläumsangebote auf cashkurs.com: http://bit.ly/ck-registrieren “Machtbeben” – Der Bestseller von Dirk Müller – Jetzt handsigniert im Cashkurs*Shop: http://bit.ly/Machtbeben-Handsigniert Dirk Müller Premium Aktien Fonds – Anlegerkongress 2020 – Jetzt Tickets sichern:...

Read More »

Read More »

Peaceful Market Exchange—Not Politics—Harnesses the Value of Diversity

That there are inherent benefits in diversity is a common article of faith in our democratic/populist times. We hear it in and about universities, businesses, politics, entertainment, etc. Typically, though, we hear about it in terms of forcing more diversity on those whose diversity in a particular dimension doesn’t measure up to someone else’s arbitrary standard.

Read More »

Read More »

Jeff Deist: The Tom Woods Interview

TOM WOODS: This is the Tom Woods Show, and today I welcome Jeff Deist. Everybody wants to know the sheer nuts and bolts of how somebody becomes Ron Paul’s chief of staff. I’ll tell a little story most people don’t know. About ten years ago, Dr. Paul was approached about doing an autobiography; he would have gotten a huge advance. There was big demand for it!

Read More »

Read More »

Why “One Man, One Vote” Doesn’t Work

The US Senate is increasingly targeted by left-wing think tanks and legislators for the fact it is based on "voter inequality." According to critics, the Senate ensures small states are "overrepresented,"and the body favors voters in smaller and more sparsely populated states. In contrast, reformers hold up the concept of "one man, one vote" as an ideal and a solution.

Read More »

Read More »

Outlook on the Global Economy, the Phase One Trade Deal and Brexit EkoTurk TV Interview (English)

Please subscribe to my channel and place your comments below. Follow my website to read all my articles: www.dlacalle.com/en Twitter: @dlacalle_IA

Read More »

Read More »

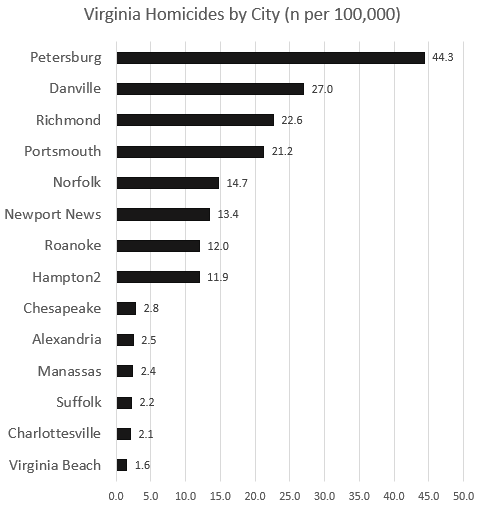

The Majority of Virginia Homicides Come from only Two Metro Areas

In most times and places, crime tends to be a highly localized phenomenon. I have covered this for Mises.org at the national level, pointing out that homicide rates in, say, the Mountain West and New England are far lower than homicide rates in the Great Lakes region or the South. Gun-control laws clearly don't explain these differences, since many places with rock-bottom homicide rates such as Idaho and Maine also have few controls on private gun...

Read More »

Read More »

Negative interest rates have cost Swiss banks CHF8 billion

Swiss banks have been forced to fork out CHF8 billion ($8.3 billion) in negative interest fees since the Swiss National Bank (SNB) imposed its policy in 2015. Last year saw the heftiest annual bill of CHF2 billion, according to research from German company Deposit Solutions.

Read More »

Read More »

Money, Inflation, and Business Cycles: The Cantillon Effect and the Economy

Abstract: Austrian economists hold that money matters a great deal in concrete terms in the immediate short run and has permanent long-run effects. Sierońs book investigates the Cantillon effect, which indicates that money is not neutral because inevitabily it is injected unevenly, creating economic distortions. These distortions are important to the long run and the Austrian theory of the business cycle.

Read More »

Read More »