Category Archive: 6b) Austrian Economics

Wo geht der Goldpreis hin? | Eine Frage noch … mit Ronald Stöferle

Eine Frage noch … – mit Ronald Peter Stöferle, dem bekanntesten Goldexperten im deutschsprachigen Raum. Warum sind die Österreicher so besessen vom gelben Metall? Wann glänzt das Asset besonders? Was unterscheidet Gold von Aktien und Währungen? Und warum stieg der Preis zuletzt so stark an? Nikolaus Jilch und Ronald Stöferle fördern alle relevanten Fakten zu …

Read More »

Read More »

The “Market Monetarists” and NGDP Targeting

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] In addition to the Keynesian perspective (covered in chapter 14), a relatively new challenge to the Austrian framework comes from the “market monetarists” and their endorsement of a central bank policy of “level targeting” of nominal gross domestic product (sometimes abbreviated as NGDPLT1).

Read More »

Read More »

Dirk Müller: Es rollt ein Tsunami auf uns zu – Vergessen Sie alle Bilanzzahlen!

Auszug aus dem Cashkurs.com-Marktupdate vom 11.03.2020. Sehen Sie das komplette Marktupdate auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren Dirk Müller Premium Aktien Fonds – Anlegerkongress 2020 – Jetzt Tickets sichern: http://bit.ly/Anlegerkongress2020 Weitere Produkte von und mit Dirk Müller: Bücher von Dirk Müller:...

Read More »

Read More »

GRETA THUNBERG 355 Deutschlandzerstörer Markus Krall Sahra Wagenknecht AfD Charles Krüger FRIDAYS FF

2. Scientists for Future II : https://www.ratderweisen.net Greta Thunberg Fridays for Future Parents for Future https://www.instagram.com/newsundtalksfuergebildete/ https://www.instagram.com/news_und_talks/ – Original stammt vom Video-Verteiler der 2.Scientists for Future II – COOPERATION mit 2.Scientists for Future II ist Eure und unsere allereinzige Chance !!! Jede Ausgabe setzt die Kenntnis aller anderen voraus, mindestens der Nr....

Read More »

Read More »

GRETA THUNBERG 354 Deutschlandzerstörer Markus Krall Hayek KenFM Christian Felber FRIDAYS FOR FUTURE

2. Scientists for Future II : https://www.ratderweisen.net Greta Thunberg Fridays for Future Parents for Future https://www.instagram.com/newsundtalksfuergebildete/ https://www.instagram.com/news_und_talks/ – Original stammt vom Video-Verteiler der 2.Scientists for Future II – COOPERATION mit 2.Scientists for Future II ist Eure und unsere allereinzige Chance !!! Jede Ausgabe setzt die Kenntnis aller anderen voraus, mindestens der Nr....

Read More »

Read More »

Los Bonos Basura Y El Riesgo Desproporcionado

Lee el artículo completo, suscríbete a mi canal y deja tus comentarios. https://www.elespanol.com/invertia/opinion/20200311/bonos-basura-riesgo-desproporcionado/473832616_13.html

Read More »

Read More »

If China Is the Problem, Can’t We At Least Have Free Trade with Everyone Else?

It remains unclear how much the stock market implosion of recent days will affect the larger economy. As David Stockman has noted often, the Wall Street economy is not synonymous with the Main Street economy, contrary to what the advocates of rampant bank bailouts and financialization would have us believe.

Read More »

Read More »

CORONA ist der AUSLÖSER nicht der GRUND (Ausgangssperre bald in Deutschland?)

Der Crash ist da! Das Coronavirus stürzt die Börsen in den Abgrund und die Welt in die Rezession. Daraus wird wahrscheinlich sogar eine globale Depression. Die nächsten Wochen sind entscheidend und werden zeigen wohin die Reise geht. Was Sie jetzt schon machen können um sich mental, gesundheitlich und finanziell vorzubereiten erklärt Ihnen heute Marc Friedrich. …

Read More »

Read More »

More Rate Cuts And Quantitative Easing Coming, Careful What You Wish For.

Please subscribe to my channel and leave your comments below. My website with all my articles is www.dlacalle.com/en Twitter: @dlacalle_IA

Read More »

Read More »

GRETA THUNBERG 353 Irrwege Markus Krall FRIEDRICH MERZ Rainer Mausfeld CorPrepper FRIDAYS FOR FUTURE

2. Scientists for Future II : https://www.ratderweisen.net Greta Thunberg Fridays for Future Parents for Future https://www.instagram.com/newsundtalksfuergebildete/ https://www.instagram.com/news_und_talks/ – Original stammt vom Video-Verteiler der 2.Scientists for Future II – COOPERATION mit 2.Scientists for Future II ist Eure und unsere allereinzige Chance !!! Jede Ausgabe setzt die Kenntnis aller anderen voraus, mindestens der Nr....

Read More »

Read More »

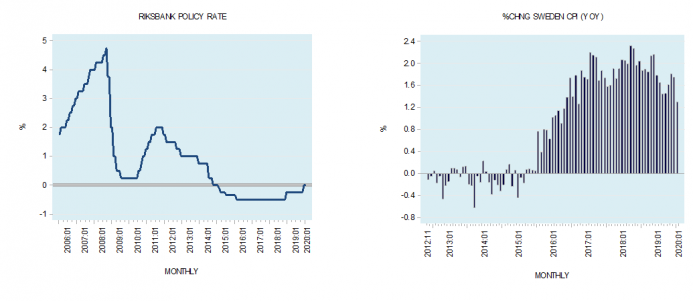

Why Sweden’s Negative Interest Rate Experiment Is a Failure

According to the Financial Times's February 20 article “Why Sweden Ditched Its Negative Rate Experiment,” economists are pondering whether Sweden’s central bank experiment with negative interest rate was a success. Sweden’s Riksbank, the world’s oldest central bank, introduced negative interest rates in early 2015.

Read More »

Read More »

“Coronavirus & India/China Gold Consumption” with Jayant Bhandari

We speak with Jayant on the impact of Chinese & Indian gold consumption given the recent COVID-19 virus, the recent gold discovery in India and is it really that big or small? We also find out from Jayant where he is putting his money in the mining sector.

Jayant is constantly traveling the world to look for investment opportunities, particularly in the natural resource sector. He advises institutional investors about his finds. Earlier, he...

Read More »

Read More »

Petróleo En Caída Libre – ¿Qué Ocurre?

Suscríbete a mi canal y deja tus comentarios. Todos mis artículos están en mi página web: www.dlacalle.com Twitter: @dlacalle

Read More »

Read More »

Oil In Free Fall What Is Happening?

Please subscribe to my channel and leave your comments below. All my articles are in my website: dlacalle.com/en Twitter: @dlacalle_IA

Read More »

Read More »

Global Market Collapse and the Self-Fulfilling Prophecy

Please subscribe to my channel and leave your comments below. All my articles expanding on these subjects are at www.dlacalle.com/en Twitter: @dlacalle_IA

Read More »

Read More »