Category Archive: 6b) Austrian Economics

Diese neue Agenda bringt nichts Gutes! Jetzt Handeln!

Markus Krall spricht darüber, dass wir heute schon die massivste Bankenrettung im Umfang von tausenden von Milliarden haben. Die Kernfrage lautet also nicht waren die Bilanzen der Banken ausgehöhlt, sondern die Kernfrage lautet, wann es sichtbar wird.

Read More »

Read More »

NEGATIVE RATES Coming To The US and UK – How To Protect Your Savings

Please subscribe to my channel and leave your comments below:

☑ Twitter - https://twitter.com/dlacalle_IA

☑ Website - https://www.dlacalle.com/en

☑ My books at Amazon - https://www.amazon.com/Daniel-Lacalle/e/B00P2I78OG

Kind regards!

Read More »

Read More »

Tesla kauft für 1,5 Mrd. Dollar BITCOIN! (Gamechanger)

Er hat es gemacht: Elon Musk hat mit seiner Firma Tesla 1,5 Milliarden Dollar in Bitcoin investiert. Was das für Bitcoin und die Tesla Aktie bedeutet heute im Video.

SEC Tesla: http://bit.ly/3cU89Do

► Vorbestellung

Du möchtest mein neues Buch vorbestellen?

Entweder über Amazon: https://amzn.to/3bfKWdN

oder mit Signatur über folgende E-Mail: [email protected]

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

ORO Y PLATA: Invertir Por Fundamentales, No Por Tendencia

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales / Please subscribe to my channel and leave your comments below:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Website - https://www.dlacalle.com/en

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

☑ My...

Read More »

Read More »

„Hayek und die Pandemie“: Das irreführende Narrativ des Neo-Keynesianismus in der F.A.Z.

Was sagt Hayeks Liberalismus dazu? Am 5. Februar 2021 hat der Ökonom Arash Molavi Vasséi den Aufsatz „Hayek und die Pandemie“ in der F.A.Z. veröffentlicht. Er will darin aufzeigen, wie seiner Meinung nach Friedrich August von Hayek (1899–1992) die Politiken, zu denen die Staaten in der Coronavirus-Pandemie greifen, vor dem Hintergrund „liberaler Prinzipien“ beurteilen würde.

Read More »

Read More »

Dr. Markus Krall extrem schockiert – Das GROßE FINALE…Wir erleben es jetzt!!! Bist du VORBEREITET?

Bitte unterstützt unseren Kanal damit wir auch in Zukunft hochwertige Videos für Euch produzieren können. Vielen Dank

Read More »

Read More »

Did You Make Janet Yellen Rich?

The Stress of Losing Billions. Up until the WallStreetBets crowd short squeezed Melvin Capital for a $7 billion loss, Robinhood had it made. But losing billions is stressful. And when your product blows up your customer the clucking that follows comes hot and heavy.

Read More »

Read More »

James Rickards: Die neue große Depression kommt – was Sie jetzt tun müssen! (Ep.11)

James Rickards ist ein renommierter Ökonom und Kritiker des Systems. Er hat nach der Finanzkrise die US-Regierung beraten und ist Autor mehrerer Bestseller. Heute sprechen wir über sein aktuelles Buch und die neue große Depression die Rickards erwartet, sowie wie man sich finanziell aufstellen muss.

James Rickards Buch: https://amzn.to/3q0ELyM

James Rickards Twitter: https://twitter.com/jamesgrickards

► Vorbestellung

Du möchtest mein neues Buch...

Read More »

Read More »

RUINA – Pymes, Autónomos, Hostelería: Abandonados Por Decisión Política

Lectura adicional: https://www.elespanol.com/invertia/opinion/20210206/empresas-no-piden-ayuda-expolio-decision-politica/556824314_13.html

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales / Please subscribe to my channel and leave your comments below:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑...

Read More »

Read More »

Title IX Will Become a Vehicle of More Injustice

President Joe Biden vowed to put a “quick end” to the Trump administration’s Title IX regulations and return to Obama-era ones at universities. If this happens, the sexual misconduct hearings will be deeply impacted.

Read More »

Read More »

Sehen wir den Totalausfall in 2021?

Markus Krall spricht darüber, dass wenn Sie jemanden fragen müssen, um etwas zu produzieren, dann wissen Sie, dass die Gesellschaft vor dem Untergang steht. Und das ist unser Grundproblem, weil wir uns als freie Menschen in Abhängigkeit begeben haben. Wir befinden uns laut Markus Krall in einem System wo inkompetente Menschen, die niemals in Lage wären etwas zu produzieren, darüber bestimmen, was wir tun dürfen.

Read More »

Read More »

Modern Society To Collapse, Survivors To Live Off Land (Without Tools Or Know-How)

The wild action in the markets and the economic devastation on Main Street may have the spotlight for now, but with the current trajectory we’re on, modern industrial technological civilization will shut down...

Read More »

Read More »

Ernst Wolff, Markus Krall oder Robert Kiyosaki. Zeitschriften Time, The Economist. Thema Great Reset

Aktueller Preis vom Bitcoin. Empfehlung von mir zum Great Reset. Ernst Wolff (Experte über Geld), Dr. Markus Krall (Experte über Finanzen) oder Robert Kiyosaki (Millionär; seine Aussage zu Gold》Gold ist Geld Gottes)

Read More »

Read More »

A Penchant for Controlling Others

We all want freedom for ourselves, but many people have doubts about the way others might use their own freedom. Under these conditions, the state is there to help. Get enough people to favor enough restriction, and the state is good to go, administering every aspect of life from its smallest to its largest detail.

Read More »

Read More »

Impfchaos: In Deutschland dominiert mehr und mehr planwirtschaftliches Denken

Zwei mögliche Kanzlerkandidaten wetteifern darum, wer am lautesten nach einer Planwirtschaft ruft, die das Impfchaos beseitigen soll.

Read More »

Read More »

Markus Krall – Ausbeutung und Umverteilung es wird alles übersteigen, was wir je gesehen haben!!!

⭐Ausbeutung und Umverteilung es wird alles übersteigen, was wir je gesehen haben, dr. Markus Krall!

Read More »

Read More »

Investieren in Bitcoin – so gehts! (Anleitung)

Wie kannst du in Bitcoin investieren? Was ist ratsam? Über Börsen, Apps, ETFs oder in Form von Aktien? Welche Plattformen sind empfehlenswert? Was ist bei der Lagerung zu beachten? Auch Tesla Chef Elon Musk hat wohl in Bitcoin investiert. MicroStrategy kauft hingegen weiter Bitcoin hinzu auch bei Preisen von über 30.000 $. Indien hingegen will Bitcoin verbieten und eine eigene digitale Währung kreieren.

- Bitcoin

Wo seriös BITCOIN kaufen und...

Read More »

Read More »

BIDEN’S ENERGY PLAN: Risk Of An Expensive Cost And Higher Bills

Read:

https://www.dlacalle.com/en/why-europes-misguided-energy-policy-must-change/

https://mises.org/wire/europe-tried-its-own-green-new-deal-it-was-disaster

Please subscribe to my channel and leave your comments below:

☑ Twitter - https://twitter.com/dlacalle_IA

☑ Website - https://www.dlacalle.com/en

☑ My books at Amazon - https://www.amazon.com/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo! / Kind regards!

Read More »

Read More »

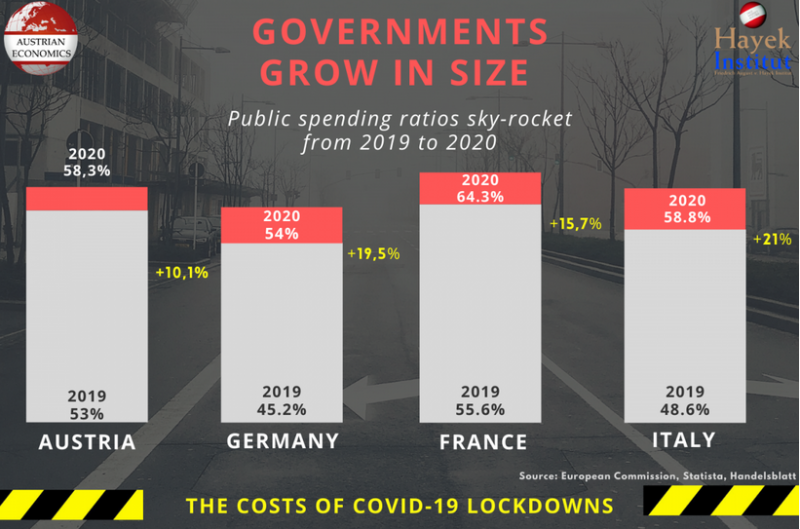

Governments Grow in Size

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

There’s Nothing Wrong with Short Selling

The recent GameStop short-squeeze drama has riveted financial markets. Given the historic unpopularity of short sellers (e.g., Holman Jenkins has written that “short-selling is…widely unpopular with everyone who has a stake in seeing stock prices go up”), the resulting heightened invective against them is not a surprise.

Read More »

Read More »