Category Archive: 6b) Austrian Economics

The Economics and Ethics of Government Default, Part II

The economic analysis of repudiation applies to the debt of all levels of government and to all countries. The central question is not how big the government is or how much it owes, but rather whether the debt is funded by taxes.

Read More »

Read More »

WICHTIGE WORTE AN ALLE! MARKUS KRALL PROGNOSE & ANALYSE & UBER GELD & WIRTSCHAFT

Wir freuen uns sehr, wenn du ebenfalls deine Meinung, Handlungsempfehlungen oder deine eigenen Prognosen in den Kommentaren postest. Das würde uns und der Community sehr viel bedeuten.

Read More »

Read More »

Trading, Ideas De Inversión Y Riesgo En Tiempos De Crisis

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Wie DU vom Vermögenstransfer profitierst (Goldene Zwanziger)

2020 ist ein Wendepunkt in der Geschichte. Im gleichen Jahr habe ich in Berlin dazu einen Vortrag gehalten. Wieso der Paradigmenwechsel stattfindet, bis wann er beendet ist, wie man sich darauf vorbereitet und warum wir ein neues politisches System brauchen. Das Versagen der Politik in den letzten Monaten bestätigen diesen Vortrag nur.

Sie wollen Marc Friedrich für einen Vortrag engagieren - online oder live? Schicken Sie eine email mit Ihrer...

Read More »

Read More »

Die ökonomischen Effekte der Pandemie: Eine Österreichische Analyse

5. März 2021 – Nachfolgend finden Sie die Einleitung des Aufsatzes „Die ökonomischen Effekte der Pandemie: Eine Österreichische Analyse“ von Jesús Huerta de Soto. Den Text in voller Länge können Sie hier herunterladen.

Read More »

Read More »

Markus Krall: Schuldenorgie und Geldflut, der Kollaps des Fiat-Geldsystems!

MARKUS KRALL: Schuldenorgie und Geldflut, der Kollaps des Fiat-Geldsystems! Wir befinden uns bereits in einer Krise, nur ist sie fein getarnt!

Read More »

Read More »

Playing Games with Stocks

The GameStop saga—can we call it an insurrection?—wants easy heroes and villains. Both are available. The populist version of the story goes like this: a few thousand angry gamers, colluding via the now infamous WallStreetBets subreddit, brought at least one powerful hedge fund to its knees.

Read More »

Read More »

EXPROPIACIÓN, CLIENTELISMO Y PARO – El Plan de Sánchez e Iglesias

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

FLS: Andrew Moran performing Dreams at Dubrek Studio’s

Andrew Moran performing a cover of Dreams by Fleetwood Mac at our new live sessions for 2021 at Dubrek Studio's in Derby. In collaboration with Derby Sound Community Radio

Organized by Fusion#

Filmed by Oolay Photography

Recorded by Saffell Records

Read More »

Read More »

FLS: Andrew Moran performing I Want You at Dubrek Studio’s

Andrew Moran performing I Want You at our new live sessions for 2021 at Dubrek Studio's in Derby. In collaboration with Derby Sound Community Radio.

Organized by Fusion#

Filmed by Oolay Photography

Recorded by Saffell Records

Read More »

Read More »

MARKUS KRALL: Jetzt VORKEHRUNGEN treffen, Dieser GEHEIME Plan wird kommen !!!

Markus Krall (* 10. Oktober 1962) ist ein deutscher Volkswirt, Unternehmensberater und Autor. Seit September 2019 ist Krall Mitglied und Sprecher der Geschäftsführung der Degussa Goldhandel GmbH. Er steht der Österreichischen Schule nahe.

Read More »

Read More »

Kennedy’s Policy Toward Third World Nations

Last night, we had the first presentation in our online conference “The National Security State and the Kennedy Assassination.” Our first speaker was James DiEugenio, who has been the leading figure in the JFK assassination research community highlighting how President Kennedy’s policy toward independence movements in Third World countries was contrary to the policy held by the U.S. national-security establishment, namely the Pentagon and the...

Read More »

Read More »

Rothbard Week: 5 Great Things About Murray

Ryan McMaken and Tho Bishop discuss five reasons why Rothbard's work is so memorable. From his fearlessness in the face of opposition, to his commitment to peace and decency, Rothbard provides us with a model of principled scholarship.

Read More »

Read More »

EINFACH NUR TRAURIG! MARKUS KRALL PROGNOSE & ANALYSE ÜBER GELD & WIRTSCHAFT

Wir wollen Deutschlands aktivste Finanzcommunity sein. Das schaffen wir nur mit deiner Unterstützung. Jedes Teilen, jedes Kommentieren und Liken bedeutet uns sehr viel und ermöglicht es uns, noch mehr spannende Finanzvideos auf diesem Kanal für die Community bereitzustellen.

Read More »

Read More »

Public Schools Refuse to Open. Give the Taxpayers Their Money Back

In many school districts across the nation, public school teachers still don’t want to go back to work. Private sector workers have long been hard at work in kitchens, at construction sites, and in hardware and grocery stores. Meanwhile, from Seattle, to Los Angeles, and to Berkeley, California, Teachers' Union representatives insist they simply can’t be expected to perform the on-site work in the expensive facilities that the taxpayers have long...

Read More »

Read More »

Was kann der PCR Test? (Lockdown 3.0)

Der PCR Test ist die Grundlage für die Lockdowns seit einem Jahr. Der Test wurde im Schnellverfahren durchgewunken. 22 Wissenschaftler bezweifeln, dass der PCR Test hierfür geeignet ist. Sie haben in einem Papier ihre Argumente aufgeführt.

Einen dieser Wissenschaftler spreche ich heute: Dr. Bruno Dalle-Carbonare. Wir sprechen über das Papier, wie solide der PCR Test ist? Was er kann und was er nicht kann.

Der Report:...

Read More »

Read More »

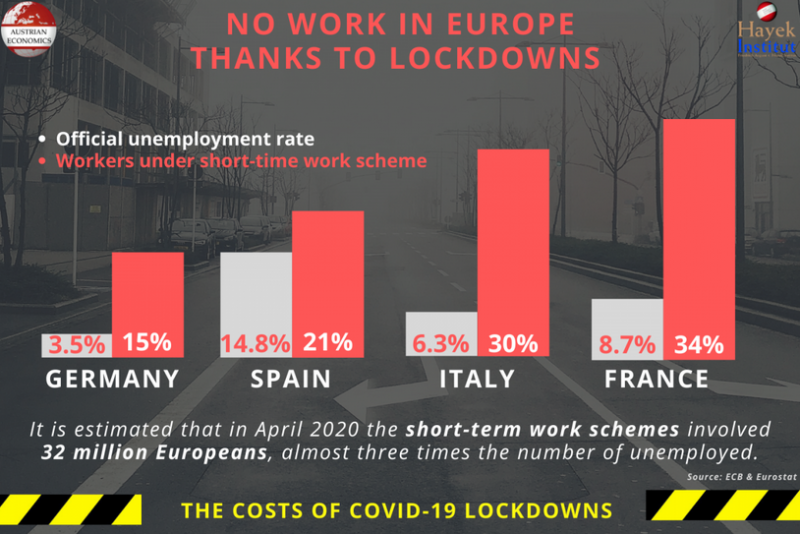

No Work in Europe Thanks to Lockdowns

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

Panel and Q&A Session w/ Murray N. Rothbard and Joseph T. Salerno

From the very beginning of the US, there were battles over central banking—with Thomas Jefferson leading the pro-gold standard, anti-central banking forces, and Alexander Hamilton championing easy money and an early version of the Federal Reserve. Under President Andrew Jackson, central banking was uprooted. lt wasn't until 1913 that a coalition of bankers and politicians were able to establish the Federal Reserve System.

Read More »

Read More »

GELDSPIEL GEHT IN ENDPHASE & UBER! MARKUS KRALL PROGNOSE & ANALYSE &UBER GELD

Markus Krall Analyse & Prognose - Markus Krall über die Wirtschaft, das Geldsystem & die Zentralbanken

Read More »

Read More »

Stagflation Cometh

A gentleman who does work for us sent me a text recently saying the price of his supplies has increased 20 percent, so he wants to increase his monthly fee 10 percent. It was a nice way to ask, and I said sure, especially given that he’s willing to take a haircut on his labor to make the increase more palatable.

Read More »

Read More »