Category Archive: 6b) Austrian Economics

Klima Sozialismus stürzt uns ins Chao Teil 1

Dr. Markus Krall: Warum soll ausgerechnet der Sozialismus das Klima retten, wo sozialistische Länder dir größten Klimakiller sind.

Read More »

Read More »

Milliardär WARNT: Die grösste Spekulationsblase aller Zeiten! Was tun? (Inflation wird krass)

Milliardär und Investorenlegende Stanley Druckenmiller prognostiziert das Ende des US-Dollars in spätestens 15 Jahren. Was die Gründe hierfür sind, wie er sich jetzt aufstellt und investiert und was meine Prognose ist erfahrt ihr heute im Video!

Paul Tudor Interview: https://twitter.com/Blockworks_/status/1404421229956718595

► Mein neues Buch

Du möchtest "Die größte Chance aller Zeiten" bestellen?

Amazon: https://amzn.to/3bfKWdN

►...

Read More »

Read More »

The G7’s Reckless Commitment To Mounting Debt

Historically, meetings of the largest economies in the world have been essential to reach essential agreements that would incentivize prosperity and growth. This was not the case this time. The G7 meeting agreements were light on detailed economic decisions, except on the most damaging of them all. A minimum global corporate tax

Read More »

Read More »

SCHOCKT : DAS UNVERMEINDLICHE KOMMT – ABERTAUSENDE BANK FILIALIEN SCHLIEßEN !!!

Filialbanken sind Kreditinstitute, die ein Netz von Filialen unterhalten. Gegensatz sind die Direktbanken. Filialen, Zweigstellen oder Niederlassungen sind vom Sitz örtlich getrennte, rechtlich und wirtschaftlich jedoch unselbständige Vermögensbestandteile eines Unternehmens.

Read More »

Read More »

WARUM Bitcoin jetzt Geld ist – der Vulkan explodiert! (Politik in Angst und Panik)

Die letzte Woche war eine historische Woche! El Salvador hat als erstes Land der Welt Bitcoin als offizielles Zahlungsmittel eingeführt. Welche Länder folgen als nächstes? Die Politik im Ausland und der IWF sind in Panik und greifen das Land an. Was droht nun dem Land in Mittel Amerika? Was hat dies für Auswirkungen auf Bitcoin und den Preis. Zudem ging durch die Presse die Fake News, dass das FBI Bitcoin gehackt hat.

Ross Ulbricht Interview:...

Read More »

Read More »

Indultos, secesionismo y volver a la ilusión en Cataluña – ALEJANDRO FERNANDEZ con Daniel Lacalle

Alejandro Fernández, presidente del PP de Cataluña.

Sigue a Alejandro aquí: @alejandroTGN

@PPCatalunya

Artículo mencionado: https://www.abc.es/opinion/abci-mutacion-constitucional-viene-202001210015_noticia.html

Lectura adicional: https://www.dlacalle.com/contra-la-secesion/

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter -...

Read More »

Read More »

Kamala Harris and the Same Old Immigration Nonsense

Vice-President Kamala Harris got jeered in Guatemala, and deservedly so, after telling the Guatemalan people, “Do not come. The United States will continue to enforce our laws and secure our border.” At the same time, the Biden administration is promising $4 billion in foreign aid to the Guatemalan government.

Read More »

Read More »

#FragMarc – Du fragst ich antworte!

Ihr habt Fragen? Super, denn diese könnt ihr mir heute Abend live im Livestream-Format #FragMarc stellen und ich beantworte sie. Egal ob über Bitcoin, Geld, Wirtschaft, Politik... seid kreativ!

Read More »

Read More »

Why Monetary “Stimulus” Won’t Prevent an Economic Bust

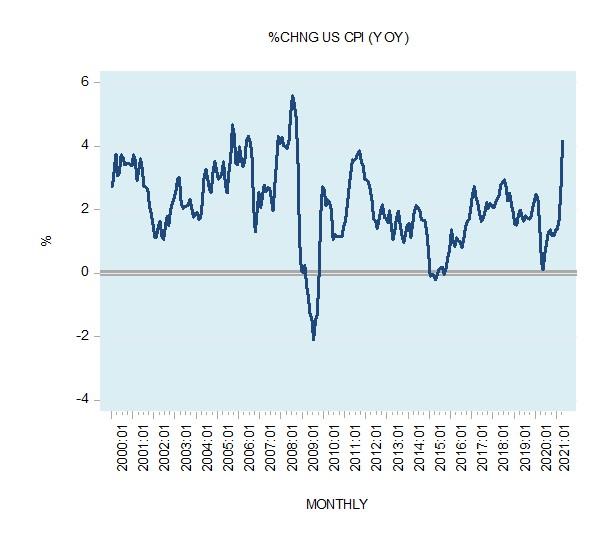

The increase in the growth rate of the Consumer Price Index (CPI) has fueled concerns that if the rising trend were to continue the Fed is likely to tighten its interest rate stance. Observe that the yearly growth rate in the CPI climbed to 4.2 percent in April from 2.6 percent in March and 0.3 percent in April 2020.

Read More »

Read More »

Das wollen SIE MIT UNS MACHEN! HÖR dir das AN! TRIFF deine VORKEHRUNGEN!

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung,

Read More »

Read More »

[MorMor] Jim Moriarty Sebastian Moran | On Raglan Road

/That I had loved not as I should a creature made of clay/

/When the angel woos the clay he'd lose his wings at the dawn of day/

•••••••••••••••••••••••••••••••••••••••••••••

I want to make an edit of Sebastian listening to Jim sing, but then of course On Raglan Road is so very much Sebastian POV. It becomes quite cruel and prophetic, as if Jim intentionally sings it to Sebastian.

I've been looking forever for a scene from Paul (or Fassy) to...

Read More »

Read More »

¿QUÉ ES LA ESTANFLACIÓN? – Un Riesgo No Previsto

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Dirk Müller – Steuer-Posse: US-Billionäre verhöhnen die Bevölkerung

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 09.06.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher...

Read More »

Read More »

Markus Krall: Wollen Zentralbanken eigene Kryptowährungen?

Unter Weltwirtschaft oder Welthandel wird die Gesamtheit der Wirtschaftsbeziehungen der Welt verstanden, die alle staatlichen Volkswirtschaften umfasst. Das ihr zugerechnete nominale Weltsozialprodukt betrug im Jahr 2017 rund 80 Billionen US-Dollar.

Read More »

Read More »

Die grösste Blase aller Zeiten – erklärt in 3 einfachen Schritten (George Gammon) mit Untertitel

Premiere! For the first time George Gammon is on a german channel.

George is a successful entrepreneur and real estate Investor and furthermore a brillant explainer of macroeconomic topics. His YT Channel is quite famous and absolutely a must watch. We picked his mind about the central banks, where to live and how he invests right now. Buckle up and share widely this interesting interview with George.

George Twitter:...

Read More »

Read More »

Livestream mit Peter Boehringer ,MdB und Dirk Brandes

In diesem Livestream spricht Dirk Brandes mit Peter Boehringer, MdB und Vorsitzender des Haushaltsausschusses im Deutschen Bundestag, über den Bundeshaushalt.

Weitere interessante Themen werden sein, Bitcoin, Gold, Währung sowie der EU-Corona Hilfsfond.

Viele spannende Fragen beantwortet Peter Boehringer.

#PeterBoehringer #DirkBrandes #AfDHannover #Deutschlandabernormal

Read More »

Read More »

Cashkurs*Trends Webinar zu CD Projekt, Coupang und iRobot

Erfahren auch Sie die künftigen Börsentrends vor der breiten Masse…jetzt CK-Trends-Mitglied werden: http://bit.ly/CashkursTrends

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Cashkurs.com – Ihr unabhängiges Nachrichtenportal: http://bit.ly/ck-registrieren

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher

Cashkurs*Trends -...

Read More »

Read More »

BITCOIN wird offizielles Zahlungsmittel in El Salvador! (Historisch)

Bitcoin schreibt ein weiteres Mal Geschichte. Bitcoin reift, wächst und die Adaption schreitet voran. Bitcoin wird trotz aller Unkenrufe Geld. Erstmals wird Bitcoin als offizielles Zahlungsmittel in einem Land eingeführt (El Salvador). Wie es dazu kam, was dies bedeutet, was die Auswirkungen sind und warum Elon Musk immer mehr Reputation verliert.

► Telegram: https://t.me/friedrichpartner

► Mein Hörbuch: https://amzn.to/2RjAavI

► Unser Bitcoin...

Read More »

Read More »