Category Archive: 6b) Austrian Economics

Post-Covid China

The world should take a lesson from how East Asia ran itself in 2020. Japan had no lockdown. None. With an aging population, its death rate has been creeping up for many years. In 2020, it fell by 0.7%, as if Covid-19 was a life-saver.

Read More »

Read More »

Marin Katusa: Wieso ich so BULLISH auf den US-Dollar bin!

Marin Katusa ist Buchautor und einer der erfolgreichsten Mineninvestoren der Welt. Er wird gar häufig als Warren Buffet der Minenaktien betitelt. Heute sprechen wir über Gold, Silber, Minenaktien, Rohstoffe, warum er keine Angst vor Inflation hat und warum er positiv für den US-Dollar gestimmt ist.

Marins Twitter: https://twitter.com/marinkatusa

Marins Website https://katusaresearch.com/

Marins Buch: https://amzn.to/3hxNi9F

► Mein neues Buch

Du...

Read More »

Read More »

BRUTAL SÁNCHEZ LANZA HACHAZO A PENSIONES – Más Impuestos, Menos Pensión

LECTURA ADICIONAL: https://www.elespanol.com/invertia/opinion/20210703/parche-pensiones/593570650_13.html

https://www.elindependiente.com/economia/2021/07/02/9-millones-de-espanoles-se-veran-afectados-por-el-recorte-de-pensiones-de-escriva/

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Inflation Is a Form of Embezzlement

Monetary inflation is just a type of embezzlement. Historically, inflation originated when a country’s ruler such as king would force his citizens to give him all their gold coins under the pretext that a new gold coin was going to replace the old one. In the process of minting new coins, the king would lower the amount of gold contained in each coin and return lighter gold coins to citizens.

Read More »

Read More »

Ley Trans, derechos humanos y lucha contra la trata – CRUZ SÁNCHEZ DE LARA charla con DANIEL LACALLE

Sigue a Cruz Sánchez de Lara:

Su currículum: https://www.linkedin.com/in/cruz-s%C3%A1nchez-de-lara-sorzano-a379191b/?originalSubdomain=es

Tribune for Human Rights: https://thribune.org/

Sámchez de Lara abogados: https://sanchezdelaraabogados.wordpress.com/

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter -...

Read More »

Read More »

Death and Libertarianism

Whenever a government program or policy produces deaths of innocent people, the way I figure it is that that makes it incumbent on libertarians to take a firm stand against such programs and policies. We all know that there are all sorts of government regulations that deprive people of liberty that we libertarians need to oppose.

Read More »

Read More »

Von aktuellen Messermorden über Regenbogenflaggen bis zu Währung, Schulden, BitCoin, Gold

Peter Boehringer im Gespräch mit Dirk Brandes, live übertragen am 28.06.2021

0:45 Vorstellung

1:12 Regenbogenflaggen

5:54 Messermorde von Würzburg

9:52 Schulden wegen Corona-Maßnahmen

38:30 Schulden der EU

40:36 EU-Steuern durch EU-Schulden?

42:07 Schuldgeldsystem & Digitaler Euro

45:36 Gold

59:27 Monetäre Transformation

1:06:32 BitCoin

1:16:24 Ewigkeitskredite

Quelle/Erstveröffentlichung: _ak

Mehr von Peter Boehringer hier:

✅...

Read More »

Read More »

Ich habe 100.000 Euro verloren! Vermeide diese 3 Fehler bei der Anlage

3 Learnings und diese Fehler haben mit ca. 100.000 Euro gekostet.

Geldsicherheit LIVE: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Diese 3 Fehler haben mich ca. 100 Tsd Euro gekostet

Ich werde ab und zu gefragt, ob ich denn schon selbst Lehrgeld zahlen musste. Die Antwort ist einfach:

Natürlich. So wie jeder erfolgreiche Investor und jeder Mensch durch die Schule...

Read More »

Read More »

The Tyranny of the Covid-19 Eviction Moratorium

The U.S. Supreme Court recently permitted the eviction moratorium established by the Centers for Disease Control to continue, at least until July 31, when the CDC plans to lift it. The Court wrongly decided the matter. It should have immediately lifted the moratorium.

Read More »

Read More »

Kinderarzt warnt: Unsere Kinder werden lange unter den Folgen leiden! (Corona Maßnahmen)

Ich spreche mit Dr. Steffen Rabe über die Corona Maßnahmen und die Auswirkungen auf Kinder, Schulschließungen, Lockdown, Masken- und Impfpflicht. Aber auch ob Kinder Superspreader sind, was zu beachten ist und wie man den Kindern in diesen Zeiten helfen kann. Ein extrem wichtiges Video - bitte kräftig verteilen und weiter empfehlen. Dr. Steffen Rabe ist seit mehr als 20 Jahren Kinderarzt, er hat sich intensiv mit dem Thema impfen beschäftigt und...

Read More »

Read More »

Dr. Markus Krall schockiert – Es ist einfach nur noch geisteskrank!!!

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland

Read More »

Read More »

The Fed’s Power over Inflation and Interest Rates Has Been Greatly Exaggerated

It is widely held that the central bank is a key factor in the determination of interest rates. By popular thinking, the Fed influences the short-term interest rates by influencing monetary liquidity in the markets. Through the injection of liquidity, the Fed pushes short-term interest rates lower. Conversely, by withdrawing liquidity, the Fed exerts an upward pressure on the short-term interest rates.

Read More »

Read More »

CRISIS DE DEUDA: Qué Es Y Por Qué Puede Ocurrir En Cualquier Momento

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

REBOTAR NO ES CRECER – Ojo Con La “EUFORIA” De 2021

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

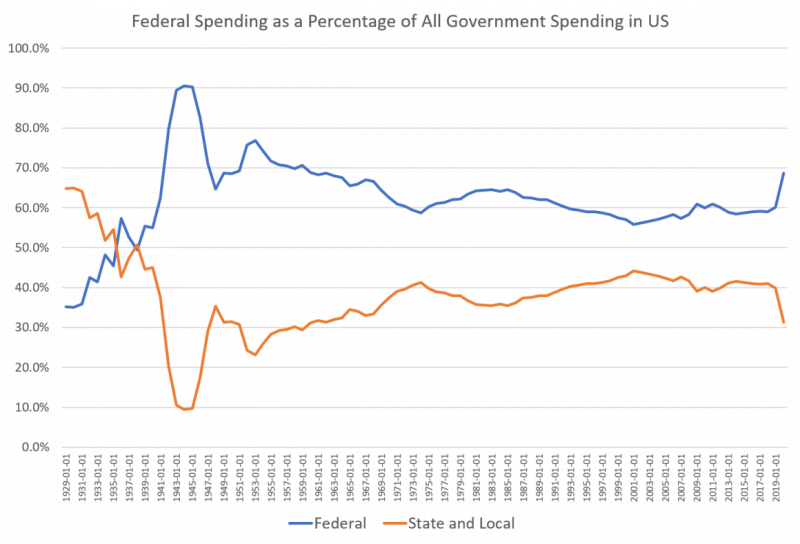

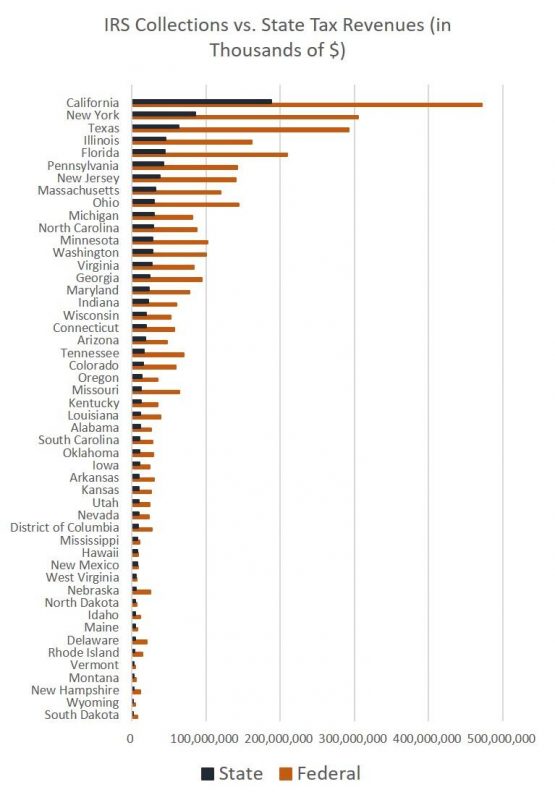

The Fed: Why Federal Spending Soared in 2020 but State and Local Spending Flatlined

In the wake of the Covid Recession and the drive to pour ever larger amounts of “stimulus” into the US economy, the Federal Government in 2020 spent more than double—as a percentage of all government spending—of what all state and local governments spent in 2020, combined.

Read More »

Read More »

Auf was man JETZT achten muss! (Bitcoin)

Die Entscheidung rückt näher. Wo geht es mit Bitcoin hin? Bleibt der Bullenmarkt intakt oder kommt der Bärenmarkt. Auf welche Marken muss man jetzt achten und wie handeln? Zudem gehe ich auf die Minerschließungen in China ein und weitere Neuigkeiten.

► Telegram Gruppe: https://t.me/friedrichpartner

► Videos als Podcast: https://anchor.fm/marcfriedrich7

► Genanntes Interview:

► Mein neues Buch

Du möchtest "Die größte Chance aller...

Read More »

Read More »

La Jungla: Recordando La Locura De Los 80 y 90 – José Antonio Abellán charla con Daniel Lacalle

Sigue a José Antonio Abellán: @jaabellan

https://lajunglaradio.com/

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

Andrew Moran Evadé d’un tribunal anglais, arrêté en Espagne.

#Replay #Reportage #ReplayTv #belgium

#Police_Belge #Belgique #policebelges #France

#gendarmesfrançais #Gendarmes_français #Police

#100_jours avec #la_police #reportage,#reportage2021,#reportage_choc,#reportagem,#reportage_francais,

#reportage_complet,#reportage_comique,#reportage_documentaire,#documentaire,

#documentaire_français, #documentaire_politique, #reportage#complet_en_francais,

#reportage_complet_fr 2021...

Read More »

Read More »

The Feds Collect Most of the Taxes in America—So They Have Most of the Power

In 2021, it's clear Americans now have thrown off any notions of subsidiarity and instead embraced the idea that the federal government should be called upon to fund pretty much anything and everything. From "stimulus checks" to "paycheck protection," it's assumed an entire national workforce can be propped up by federal spending.

Read More »

Read More »

Dirk Müller – Goldverbot wegen Klimaschutz voraus?

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 24.06.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher...

Read More »

Read More »